What is the Business Cycle?

Business Cycle, also known as the economic cycle or trade cycle, is the fluctuations in economic activities or rise and fall movement of gross domestic product (GDP) around its long-term growth trend.

No era can stay forever. The economy too does not enjoy same periods all the time. Due to its dynamic nature, it moves through various phases.

Table of Content

The change in business activities due to fluctuations in economic activities over a period of time is known as a business cycle. Business cycle are also called trade cycle or economic cycle. Business Cycle can also help you make better financial decisions.

The economic activities of a country include total output, income level, prices of products and services, employment, and rate of consumption. All these activities are interrelated; if one activity changes, the rest of them also change.

Also Read: What is Economics?

Business Cycle Definition

Arthur F. Burns and Wesley C. Mitchel defined business cycle definition as

Business cycle are a type of fluctuation found in the aggregate economic activity of nations that organize their work mainly in business enterprises: a cycle consists of expansions occurring at about the same time in many economic activities, followed by similarly general recessions, contractions, and revivals which merge into the expansion phase of the next cycle; in duration, business cycle vary from more than one year to ten or twelve years; they are not divisible into shorter cycle of similar characteristics with amplitudes approximating their own.

Arthur F. Burns & Wesley C. Mitchel

Also Read: What is Demand in Economics

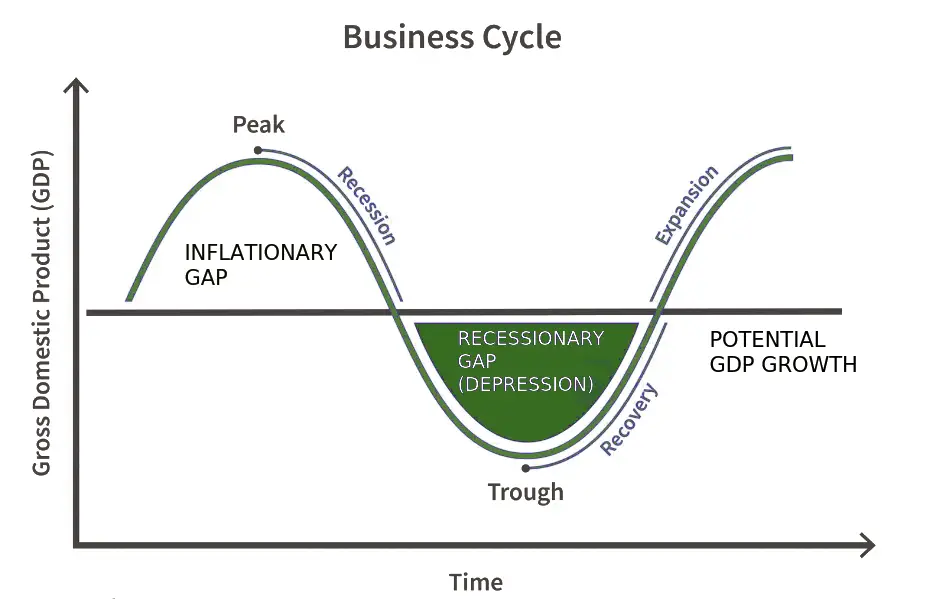

Phases of Business Cycle

4 Phases of Business Cycle are:

Let us discuss 4 phases of business cycle in detail:

Expansion

Expansion is the first phase of a business cycle. It is often referred to as the growth phase.

In the expansion phase, there is an increase in various economic factors, such as production, employment, output, wages, profits, demand and supply of products, and sales. During this phase, the focus of organisations remains on increasing the demand for their products/services in the market.

The expansion phase is characterised by:

- Increase in demand

- Growth in income

- Rise in competition

- Rise in advertising

- Creation of new policies

- Development of brand loyalty

In this phase, debtors are generally in a good financial condition to repay their debts; therefore, creditors lend money at higher interest rates. This leads to an increase in the flow of money.

In the expansion phase, due to increase in investment opportunities, idle funds of organisations or individuals are utilised for various investment purposes. The expansion phase continues till economic conditions are favourable.

Peak

Peak is the next phase after expansion. In this phase, a business reaches at the highest level and the profits are stable. Moreover, organisations make plans for further expansion.

Peak phase is marked by the following features:

- High demand and supply

- High revenue and market share

- Reduced advertising

- Strong brand image

In the peak phase, the economic factors, such as production, profit, sales, and employment, are higher but do not increase further.

Contraction

An organisation after being at the peak for a period of time begins to decline and enters the phase of contraction. This phase is also known as a recession.

An organisation can be in this phase due to various reasons, such as a change in government policies, rise in the level of competition, unfavourable economic conditions, and labour problems. Due to these problems, the organisation begins to experience a loss of market share.

The important features of the contraction phase are:

- Reduced demand

- Loss in sales and revenue

- Reduced market share

- Increased competition

Trough

In Trough phase, an organisation suffers heavy losses and falls at the lowest point. At this stage, both profits and demand reduce. The organisation also loses its competitive position.

The main features of this phase are:

- Lowest income

- Loss of customers

- Adoption of measures for cost-cutting and reduction

- Heavy fall in market share

In this phase, the growth rate of an economy becomes negative. In addition, in trough phase, there is a rapid decline in national income and expenditure.

After studying the business cycle, it is important to study the nature of business cycle.

Read: Difference Between Micro and Macro Economics

Nature of Business Cycle

The nature of business cycle helps the organisation to be prepared for facing uncertainties of the business environment.

Let us discuss the nature of business cycle in detail.

Cyclical nature

This is the periodic nature of a business cycle. Periodicity signifies the occurrence of business cycle at regular intervals of time. However, periods of intervals are different for different business cycle. There is a general consensus that a normal business cycle can take 7 to 10 years to complete.

General nature

The general nature of a business cycle states that any change in an organisation affects all other organisations too in the industry. Thus, general nature regards the business world as a single economic unit.

For example, depression moves from one organisation to the other and spread throughout the industry. The general nature is also known as synchronism.

Read: What is Business Economics?

Types of Business Cycle

Following the writings of Prof .James Arthur and Schumpeter, we can classify business cycle into three types based on the underlying time period of existence of the cycle as follows:

- Short Kitchin Cycle

- Longer Juglar cycle

- Very long Kondratieff Wave

Short Kitchin Cycle (very short or minor period of the cycle, approximately 40 months duration)

Longer Juglar cycle (major cycles, composed of three minor cycles and of the duration of 10 years or so)

Very long Kondratieff Wave (very long waves of cycle, made up of six major cycles and takes more than 60 years to run its course of duration)

Also Read: Scope of Economics

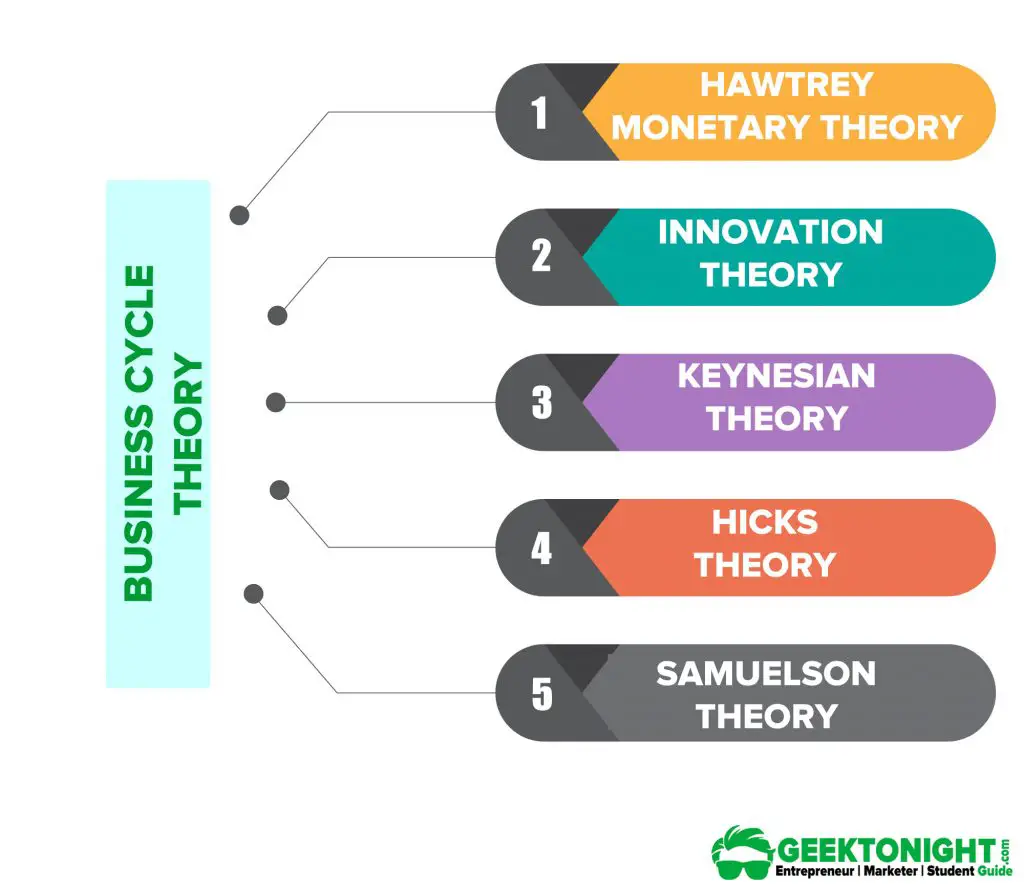

Business Cycle Theory

A business cycle is a complex phenomenon which is common to every economic system. Several theories of business cycle have been propounded from time to time to explain the causes of business cycle.

Hawtrey Monetary Theory

Hawtray was of opinion that in depression monetary factors play a critical role. The main factor affecting the flow of money and money supply is the credit position by the bank. He made the classical quantity theory of money as the basis of his trade cycle theory.

According to him, both monetary and non-monetary factors also affect trade. His theory is basically the product of the supply of money and expansion of credit. This expansion of credit and other money supply instrument create a cumulative process of expansion which in return increase aggregate demand.

According to this theory the only cause of fluctuations in business is due to instability of bank credit. So it can be concluded that Hawtray’s theory of business cycle is basically depend upon the money supply, bank credits and rate of interests.

Criticism of this Business Cycle theory

- Hawtray neglected the role of non-monetary factors like prosperous agriculture, inventions, rate of profit and stock of capital.

- It only concentrates on the supply of money.

- Increase in interest rates is not only due to economic prosperity but also due to other factors.

- Over-emphasis on the role of wholesalers.

- Too much confidence in monetary policy. vi. Neglect the role of expectations. vii. Incomplete theory of trade cycles.

Innovation Theory

The innovation theory of business cycle is invented by an American Economist Joseph Schumpeter. According to this theory, the main causes of business cycle are over-innovations.

He takes the meaning of innovation as the introduction and application of such techniques which can help in increasing production by exploiting the existing resources, not by discoveries or inventions. Innovations are always inspired by profits. Whenever innovations are introduced it results into profitability then shared by other producers and result in a decline in profitability.

Criticism of this Business Cycle theory

- Innovation fails to explain the period of boom and depression.

- Innovation may be major factor of investment and economic activities but not the complete process of trade cycle.

- This theory is based on the assumption that every new innovation is financed by the banks and other credit institutions but this cannot be taken as granted because banks finance only short term loans and investments.

Keynesian Theory

The theory suggests that fluctuations in business cycle can be explained by the perceptions on expected rate of profit of the investors. In other words, the downswing in business cycle is caused by the collapse in the marginal efficiency of capital, while revival of the economy is attributed to the optimistic perceptions on the expected rate of profit.

Moreover, Keynesian multiplier theory establishes linkages between change in investment and change in income and employment. However, the theory fails to explain the cumulative character both in the upswing and downswing phases of business cycle and cyclical fluctuations in economic activity with the passage of time.

Hicks Theory

Hicks extended the earlier multiplier-accelerator interaction theory by considering real world situation. In reality, income and output do not tend to explode; rather they are located at a range specified by the upper ceiling and lower floor determined by the autonomous investment.

In the theory, it is assumed that autonomous investment tends to grow at a constant percentage rate over the long run, the acceleration co-efficient and multiplier co-efficient remain constant throughout the different phases of the trade cycle, saving and investment co-efficient are such that upward movements take away from equilibrium.

The actual output fails to adjust with the equilibrium growth path overtime. In fact it has a tendency to run above it and then below it, and thereby, constitute cyclical fluctuations overtime. This basic intuition can be shown with the help of the following figure.

Criticism of this Business Cycle theory

- Wrong assumption of constant multiplier and acceleration co-efficient.

- Highly mechanical and mathematical device.

- Wrong assumption of no-excess capacity.

- Full-employment ceiling is not independent

Samuelson theory

According to this theory process of multiplier starts working when autonomous investment takes place in the economy. With the autonomous investment income of the people rises and there is increase in the demand of consumer goods. It directly affected the marginal propensity to consume.

If there is no excess production capacity in the existing industry then existing stock of capital would not be adequate to produce consumer goods to meet the rising demand. Now in order to meet the consumer’s requirements, producers will make new investment which is derived investment and the process of acceleration principle comes into operation.

Then there is rise in income again which in the same manner continue the process of income propagation. So in this way multiplier and acceleration interact and make the income grow at faster rate than expected. After reaching its peak, income comes down to bottom and again start rising.

Autonomous investment is incurred by the government with the objective of social welfare. It is also called public investment. The autonomous investment is the investment which is done for the sake of new inventions in techniques of production.

Derived investment is the investment undertaken in capital equipment which is induced by increase in consumption.

Criticism of this Business Cycle theory

- This model only concentrates on the impact of the multiplier and acceleration and it ignored the role of producer’s expectations, changing business requirements and consumers preferences etc.

- It is not practically possible to compute the fact of multiplier and acceleration principle.

- It has wrong assumption of constant capital output ratio.

Also Read: What is Law of Supply?

Business Economics Tutorial

(Click on Topic to Read)

Go On, Share article with Friends

Did we miss something in Business Economics Tutorial? Come on! Tell us what you think about our article on Business Cycle | Business Economics in the comments section.

Business Economics Tutorial

(Click on Topic to Read)