What is Market Structures?

Market structure can be defined as a group of industries characterised by a number of buyers and sellers in the market, level and type of competition, degree of differentiation in products and entry and exit of organisations from the market.

Table of Content

The study of market structure helps organisations in understanding the functioning of different firms under different circumstances. Based on the study, organisations can make effective business decisions.

Also Read: Elasticity of Demand

Types of Market Structures

Pure Competition

Pure competition exists in a market when there is large number of sellers offering homogenous products to equal population of buyers. Due to presence of high population of producers, price does not get affected so as to cause inflation.

Thus, buyers can purchase products from any seller as there is no difference in the price and quality of products of different sellers. This is because the market sets the price for the market, making sellers as price takers.

Moreover, in a purely competitive market, all the products are considered as substitutes of one another. Therefore, if there is a rise in the price of a product from one producer, buyers can easily purchase the similar product from the other seller.

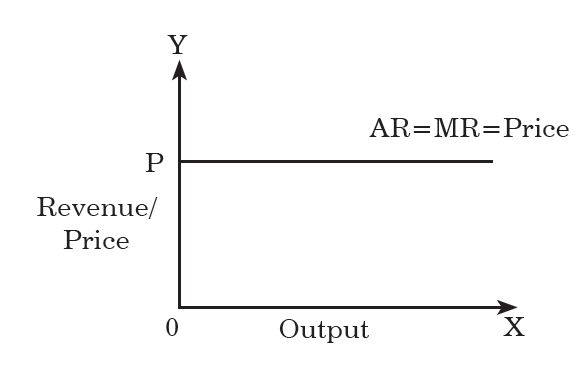

In a purely competitive market, due to the absence of legal, technological, financial or other barriers, it is easy for a new organisation to enter or exit the market. However, the existence of pure competition is not possible in the real world. In pure competition, the homogeneity of the products with a fixed market price is shown by the average revenue curve or the demand curve as a horizontal straight line.

In Figure, OP is the price level at which a seller can sell any quantity of products.

Perfect Competition

Perfect competition is a market in which there are many firms selling identical products with no firm large enough relative to the entire market to be able to influence the market price. Perfect competition is a type of market structures which is extension of pure market subject to a wider scope.

Perfect Competition Characteristics

The main perfect competition characteristics are discussed below:

- Large number of buyers and sellers

- Homogenous product

- Ease of entry and exit from the market

- Perfect knowledge

- No transportation costs

Large number of buyers and sellers

In perfect competition, a large number of buyers and sellers exist. However, the high population of buyers and sellers fails to affect the prices, and the output produced by a seller or purchases made by a buyer are very less in comparison to the total output or total purchase in an economy.

Homogenous product

Another important characteristic of perfect competition is the existence of homogenous product for buying and selling. This makes it possible for buyers to choose the product from any seller in the market. Due to the presence of large number of sellers, the market price remains same throughout the market.

Ease of entry and exit from the market

In perfect competition, there are hardly any barriers, such as government regulations and policies, to enter or exit the market. Consequently, firms find it easy to enter the markets as all the organisations earn normal profits. Similarly, organisations also easily exit the market as they are not bound by any rules and regulations.

Perfect knowledge

In the perfectly competitive scenario, both buyers and sellers are completely aware of the product price prevailing in the market. Thus, no seller would try to sell the product at a higher price. However, this also leaves no scope for bargaining for buyers too.

No transportation costs

In perfect competition, the existence of the same price is because of zero transportation costs. Due to the absence of transportation costs, there is no scope of price variation in all sectors of the market.

Also Read: What Market Failure?

Imperfect Competition

Imperfect competition is a competitive market where a large number of sellers are engaged in selling heterogeneous (dissimilar) goods as opposed to the perfectly competitive market.

The concept of imperfect competition was first explained by an English economist, Joan Robinson. Under imperfect competition, both buyers and sellers are unaware of the prices. Therefore, producers can influence the price of the product they are offering for sale.

Types of Imperfect Competition

There are 3 types of Imperfect competition:

Monopolistic competition

Monopolistic competition is a type of market structures where there are a large number of small sellers, selling differentiated, but close substitute products.

Monopolistic competition is a type of imperfect competition, wherein a large number of sellers are engaged in offering heterogeneous products for sale to buyers.

The term monopolistic competition was given by Prof. Edward H. Chamberlin of Harvard University in 1933 in his book, Theory of Monopolistic Competition. Monopolistic competition is the most realistic situation that exists in the market.

Monopolistic Competition Characteristics

The main monopolistic competition characteristics are discussed below in details:

- Large number of sellers and buyers: The presence of large number of sellers offering different products to equal number of buyers is a primary characteristic of monopolistic competition.

- Product differentiation: Another important characteristic of monopolistic competition is product differentiation; wherein products that are sold in the market vary in style, quality standards, trademarks and brands.

This helps buyers in differentiating among the available products in more than one way. However, under monopolistic competition, products are close substitutes of each other. - Ease of entry and exit: Similar to perfect competition, under monopolistic competition, organisations are free to enter or exit the market due to the limited number of restrictions imposed by the government.

- Restricted mobility: Dissimilar to perfect competition, the factors of production are not perfectly mobile in monopolistic competition. This is due to organisation’s willingness to pay heavy transportation costs to move the factors of production or goods and services. This results in difference in the prices of products of organisations.

- Price control policy: Under monopolistic competition, organisations do not have much control over the price of the product. If the prices of products are higher, then the buyers would switch to other sellers due to close substitutability of products.

Therefore, the price policy of competitors greatly influences the price policy of an organisation.

Oligopoly

Oligopoly is a market situation in which a firm determines its marketing policies on the basis of the expected behaviour of close competitors. Oligopoly is a type of imperfect competition, wherein there are few sellers dealing either in homogenous or differentiated products.

The term oligopoly has been derived from the two Greek words, oligoi means few and poly means control. Thus, it means the control of the few organisations in the market.

Example, oligopoly in India exists in the aviation industry where there are just few players, such as Kingfisher, Air India, Spice JetIndigo, etc. All these airlines depend on each other for setting their pricing policies. This is because the prices are affected by the prices of the competitors’ products.

Oligopoly characteristics

- Existence of few sellers: One of the primary features of oligopoly is the existence of a few sellers who dominate the entire industry and influence the prices of each other, greatly. In addition, the number of buyers is also large. Moreover, in oligopoly, there are a large number of buyers.

- Identical or differentiated products: An important characteristic of oligopoly is the production of identical products or differentiated products.

This implies that organisations may either produce homogenous products, such as cement, asphalt, concrete and bricks, or differentiated products, such as an automobile. If organisations produce homogenous products, it is said to be pure oligopoly. - Impediments in entry: Another important characteristic of oligopolistic competition is that organisations cannot easily enter the market; nor can they make an exit from the market.

The reasons for difficult entry in the market are various legal, social and technological barriers. This also implies that the existing organisations have a complete control over the market. - Enhanced role of government: Under oligopolistic market structure, the government has a greater role as it acts as a guard to anti-competitive behaviours of oligopolists. It is often observed that oligopolists may engage in the illegal practice of collusion, where they together make production and pricing decisions.

Oligopolists may start acting as a single organisation and further increase prices and profits. Thus in such an environment, the government requires to keep a watch on such activities to curb the illegal practices. - Mutual interdependence: Under oligopoly market structure, mutual interdependence refers to the influence that organisations create on each other’s decisions, such as pricing and output decisions. In oligopoly, a few numbers of sellers compete with each other.

Therefore, the sale of an organisation is dependent on its own price of products, as well as the price of its competitor’s products. Thus, in oligopoly, no organisation can make an independent decision. - Existence of price rigidity: Under oligopolistic market, organisations do not prefer to change the prices of their products as this can adversely affect the profits of the organisation.

For instance, if an organisation reduces its price, its competitors may reduce the prices too, which would bring a reduction in the profits of the organisation. On the other hand, the increase in prices by an organisation will lead to loss of buyers.

Monopoly

Monopoly can be defined as a type of market structures, wherein a single producer or seller has a control on the entire market.

The term monopoly has been derived from a Greek word Monopolian, which means a single seller. Thus, in monopoly, a single seller deals in the products that have no close substitutes in the market.

Monopoly characteristics

- Existence of a single seller: Under the monopoly type of market structure, there is always a single seller producing large quantities of the products. Due to the availability of only one seller, buyers are forced to purchase from the only seller. This results in total control on the supply of products by the seller in the market. Moreover, the seller has complete power to decide the price of products.

- Absence of substitutes: Another important characteristic of a monopoly is the absence of substitutes of the products in the market. In addition, differentiated products are absent in the case of a monopoly market.

- Barriers to entry: The reason behind the existence of monopoly is the various barriers that restrict the entry of new organisations in the market. These barriers can be in the form of exclusive resource ownership, copyrights, high initial investment and other restrictions by the government.

- Limited information: Under monopoly, information cannot be disseminated in the market and is restricted to the organisation and its employees. Such information is not easily available to public or other organisations. This type of information generally comes in the form of patents, copyrights or trademarks.

Price Discrimination Under Monopoly

Price Discrimination Under Monopoly is generally observed that different prices are charged from various users by a monopolist to achieve more profits. This policy of charging different prices by a monopolist is known as price discrimination.

Three types of Price discrimination under monopoly are discussed below:

- Geographical price discrimination: In this type of price discrimination, a monopolist charges different prices for the products in different areas. Generally, if the demand of a product is inelastic in an area, the monopolist charges higher price and vice versa.

For example, rice is sold at different prices by Food Corporation of India in Kashmir and Himachal Pradesh. - Personal price discrimination: In this type of price discrimination, a monopolist charges different prices from different users or buyers. Personal price discrimination occurs mainly due to ignorance among buyers related to the prices of the products.

For example, a grocery seller may charge different prices for similar vegetables from different customers depending on the negotiation power of customers. If a customer is aware of the prices and is able to bargain, the seller may become willing to sell the product at a lower price. On the other hand, the seller may sell the same product at a higher price if the customer is ignorant and unaware of prevailing prices in the market. - Utility based price discrimination: In this type of price discrimination, the seller charges different prices from buyers in accordance with the use of the products.

For example, the price of electricity differs on the basis of consumption, i.e., rate per unit for commercial use is higher than that for the domestic use.

Also Read: What is Market Power?

Business Economics Tutorial

(Click on Topic to Read)

Go On, Share article with Friends

Did we miss something in Business Economics Tutorial? Come on! Tell us what you think about our article on Types of Market Structures | Business Economics in the comments section.

Business Economics Tutorial

(Click on Topic to Read)