What is Long Run Cost?

Long run cost refers to the time period in which all factors of production are variable. Long-run costs are incurred by a firm when production levels change over time.

In the long run, the factors of production may be utilised in changing proportions to produce a higher level of output. In such a case, the firm may not only hire more workers, but also expand its plant size, or set up a new plant to produce the desired output.

Table of Content

Example: downsizing or expanding an organisation, entering or leaving a market, etc., involve long-run costs. To understand the long run cost-output relations, it can be assumed that a long-run cost curve is composed of a series of short-run cost curves.

Also Read: Production in Economics

Type of Long Run Cost

What is Long Run Cost Type? There are basically three types of long run costs:

Long Run Total Cost

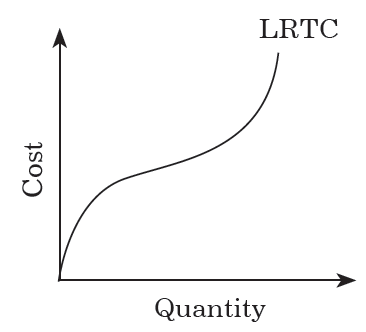

Long-run total cost (LRTC) refers to the total cost incurred by an organisation for the production of a given level of output when all factors of production are variable.

Example: Long run total cost is the per unit cost incurred by a firm when it expands the scale of its operations not just by hiring more workers, but also by building a larger factory or setting up a new plant.

The shape of the long-run total cost curve is S-shaped, much similar to a short-run total cost curve. For relatively small quantities of output, the slope begins to flatten. Then, for larger quantities the slope makes a turn-around and becomes steeper.

The figure depicts the long-run total cost curve of a firm:

Also Read: Types of Cost

Long Run Average Cost

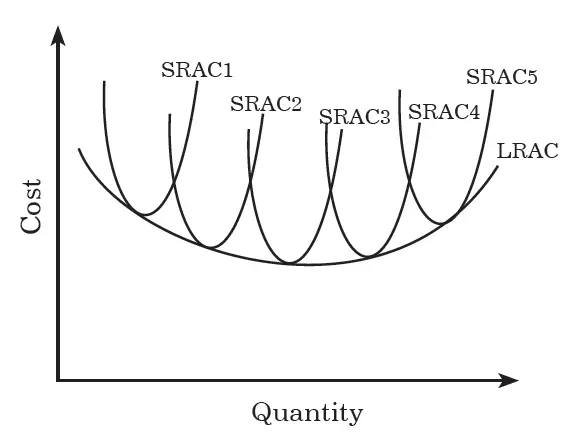

Long-run average cost (LRAC) refers to per unit cost incurred by a firm in the production of a desired level of output when all the inputs are variable.

Example: long-run average cost curve of a firm depicts the minimum average cost at which the firm can produce any given level of output in the long run. The LRAC of a firm can be obtained from its individual short-run average cost curves.

Each SRAC curve represents the firm’s short-run cost of production when different amounts of capital are used. The shape of the LRAC curve is similar to the SRAC curve although the U-shape of the LRAC is not due to increasing, and later diminishing marginal.

The negative slope of the LRAC curve depicts economies of scale and increasing returns to scale. On the other hand, the positive slope of the LRAC curve represents diseconomies of scale or decreasing returns to scale. The economies and diseconomies of scale have been discussed later in the chapter.

Figure depicts the long-run average cost curve of a firm:

In Figure, there are five alternative scales of a plant SRAC1, SRAC2, SRAC3, SRAC4 and SRAC5. However, in the long run, the firm will operate the scale LRAC, which is the most profitable to it.

Also Read: Economies of scale and Diseconomies of Scale

Long Run Marginal Cost

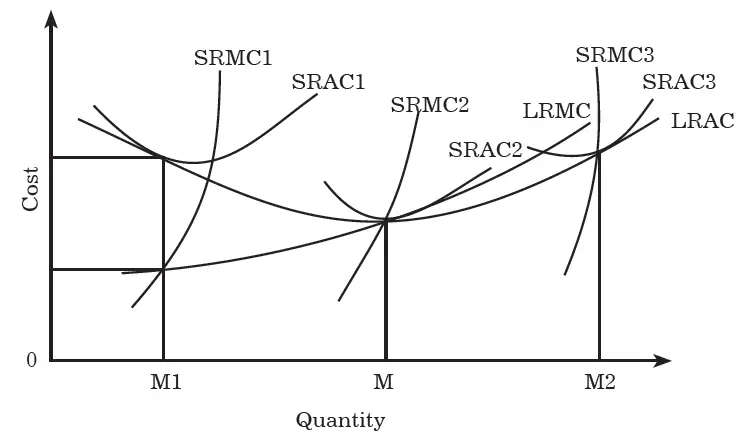

Long-run marginal cost (LRMC) refers to the incremental cost incurred by an organisation for producing a given output level when none of the input is constant.

Example: long-run marginal cost is the additional cost that the firm incurs when it expands the scale of its operations not just by hiring additional workers, but also by increasing the plant capacity.

The LRMC is the slope of the Long run marginal cost curve. The shape of the LRMC curve is similar to the SRMC curve although the U-shape of the LRMC is not due to increasing, and later diminishing marginal.

The negative slope of the LRMC curve depicts economies of scale and increasing returns to scale. On the other hand, the positive slope of the LRMC curve represents diseconomies of scale or decreasing returns to scale.

LRMC curve can be derived from the LRAC curve. In Figure, at output OM1, SRMC1 = LRMC. At SRMC2, LRMC = SRAC2 = LRAC. SRAC1 = LRAC (at tangency) and SRMC1 = LRMC (at intersection).

Also Read: Short Run Cost

Business Economics Tutorial

(Click on Topic to Read)

Go On, Share article with Friends

Did we miss something in Business Economics Tutorial? Come on! Tell us what you think about our article on Long Run Cost | Business Economics in the comments section.

Business Economics Tutorial

(Click on Topic to Read)