While computing the total cost of production, there are several types of costs that an organisation needs to consider apart from those involved in the procurement of raw material, labour and capital.

Different circumstances give way to different types of costs. For effective decision making, it is essential to distinguish between and interpret the various cost concepts that affect an organisation’s overall profit.

Table of Content

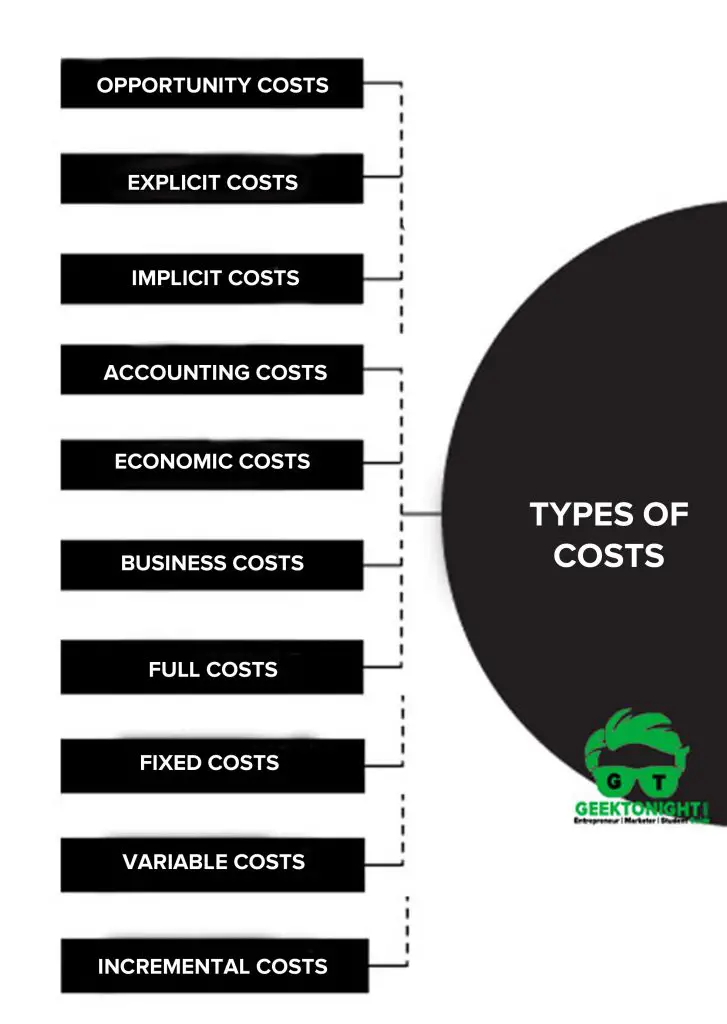

Types of Costs

In Economics there are 10 Types of Costs. These are explained below:

- Opportunity costs

- Explicit costs

- Implicit costs

- Accounting costs

- Economic costs

- Business costs

- Full costs

- Fixed costs

- Variable costs

- Incremental costs

Opportunity Costs

Opportunity cost is also referred to as alternative cost. Organisations tend to utilise their limited resources for the most productive alternative and forgo the income expected from the second-best use of these resources.

Opportunity cost may be defined as the return from the second-best use of the firm’s limited resources, which it forgoes in order to benefit from the best use of these resources.

Example: Let us assume that an organisation has a capital resource of 1,00,000 and two alternative courses to choose from. It can either purchase a printing machine or photo copier, both having a productive life span of 12 years.

The printing machine would yield an income of 30,000 per annum while the photocopier would yield an income of 20, 000 per annum. An organisation that aims to maximise its profit would use the available amount to purchase the printing machine and forgo the income expected from the photo copier. Therefore, the opportunity cost in this case is the income forgone by the organisation, i.e., 20, 000 per annum.

Explicit costs

Explicit costs, also referred to as actual costs, include those payments that the employer makes to purchase or own the factors of production. These costs comprise payments for raw materials, interest paid on loans, rent paid for leased building or machinery and taxes paid to the government.

An explicit cost is one that has occurred and is clearly reported in accounting books as a separate cost.

Example: if an organisation borrows a sum of 70,00,000 at an interest rate of 4% per year, the interest cost of 2,80,000 per year would be an explicit cost for the organisation.

Implicit costs

Unlike explicit costs, there are certain other costs that cannot be reported as cash outlays in accounting books. These costs are referred to as implicit costs. Opportunity costs are examples of implicit cost borne by an organisation.

Example: An employee in an organisation takes a vacation to travel to his relative’s place. In this case, the implicit costs borne by the employee would be the salary that the employee could have earned if he/she had not taken the leave. Implicit costs are added to the explicit cost to establish a true estimate of the cost of production. Implicit costs are also referred to as imputed costs, implied costs or notional costs.

Accounting costs

Accounting costs include the financial expenditure incurred by a firm in acquiring inputs for the production of a commodity. These expenditures include salaries/wages of labour, payment for the purchase of raw materials and machinery, etc.

Accounting costs are recorded in the books of accounts of a firm and appear on the firm’s income statement. Accounting costs include all explicit costs along with certain implicit costs of an organisation.

Example: depreciation expenses (implicit cost) are included in the books of account as a firm’s accounting costs.

Economic costs

Economic costs include the total cost of opting for one alternative over another.

The concept of economic costs is similar that of opportunity costs or implicit costs with the only difference that economic costs include the accounting cost (or explicit cost) as well as the opportunity cost (or implicit cost) incurred to carry out an action over the forgone action.

Example: if the economic cost of the employee in the above example would include his/her week’s pay as well as the expense incurred on the vacation.

Business costs

Business costs include all the expenditures incurred to carry out a business. The concept of business cost is similar to the explicit costs.

Business costs comprise all the payments and contractual obligations made by a business, added to the book cost of depreciation of plant and equipment. These costs are used to calculate the profit or loss made by a business, filing for income tax returns and other legal procedures.

Full costs

The full costs include business costs, opportunity costs, and normal profit. Full costs of an organisation include cost of materials, labour and both variable and fixed manufacturing overheads that are required to produce a commodity.

Fixed costs

Fixed costs refer to the costs borne by a firm that do not change with changes in the output level. Even if the firm does not produce anything, its fixed costs would still remain the same.

Example: depreciation, administrative costs, rent of land and buildings, taxes, etc. are fixed costs of a firm that remain unchanged even though the firm’s output changes. However, if the time period under consideration is long enough to make alterations in the firm’s capacity, the fixed costs may also vary.

Variable costs

Variable costs refer to the costs that are directly dependent on the output level of the firm. In other words, variable costs vary with the changes in the volume or level of output.

Example: if an organisation increases its level of output, it would require more raw materials. Cost of raw material is a variable cost for the firm.

Other examples of variable costs are labour expenses, maintenance costs of fixed assets, routine maintenance expenditure, etc. However, the change in variable costs with changes in output level may not necessarily be in the same proportion.

Incremental costs

Incremental costs involve the additional costs resulting due to a change in the nature of level of business activity.

It characterises the additional cost that would have not been incurred if an additional unit was not produced. As these costs may be avoided by avoiding the possible variation in the production, they are also referred to as avoidable costs or escapable costs.

Example: if a production house has to run for additional two hours, the electricity consumed during the extra hours is an additional cost to the production house. The incremental cost comprises the variable costs.

Infographic of Types of Costs

Also Read: What is Revenue?

Business Economics Tutorial

(Click on Topic to Read)

Go On, Share article with Friends

Did we miss something in Business Economics Tutorial? Come on! Tell us what you think about our article on Types of Cost | Business Economics in the comments section.

Business Economics Tutorial

(Click on Topic to Read)