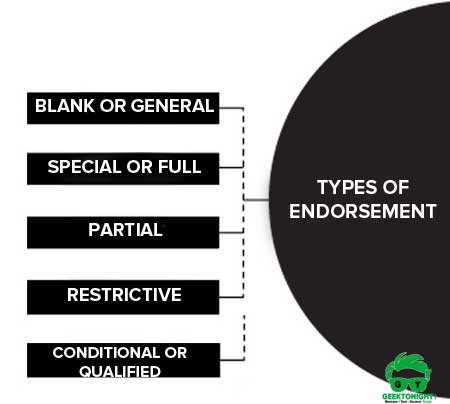

Types of Endorsements

- Blank or General Endorsement

- Special or Full Endorsement

- Partial Endorsement

- Restrictive Endorsement

- Conditional or Qualified Endorsement

What is Endorsement?

Endorsement means, “the writing of one’s name on the back of the instrument or any paper attached to it with the intention of transferring the rights therein“. – Negotiable Instruments Act

Thus, an endorsement is signing a negotiable instrument for the purpose of negotiation.

- Person who effects an endorsement is called an “endorser”

- Person to whom the negotiable instrument is transferred by endorsement is called the “endorsed”

Table of Content

Endorsement Meaning

Signing

- on the face or back of negotiable instrument; or

- on a slip of paper annexed to the negotiable instrument

By

- the holder of negotiable instrument

For the purpose of

- negotiating such negotiable instrument

Types of Endorsement

5 different types of endorsement are discussed below:

- Blank or general endorsement

- Special or full endorsement [Sec. 16]

- Partial endorsement [Sec. 56]

- Restrictive endorsement [Sec. 50]

- Conditional or qualified endorsement

• Sans recourse

• Facultative

• Contingent

Blank or General Endorsement

It is a type of endorsement when the endorser just signs on the instrument without mentioning the name of the person in whose favour the endorsement is made.

Endorsement in blank specifies no endorsee. It simply consists of the signature of the endorser on the endorsement.

Example: A bill is payable to X. X endorses the bill by simply affixing his signature. This is an endorsement in blank by X. In this case the bill becomes payable to bearer.

There is no difference between a bill or note endorsed in blank and one payable to bearer. They can both be negotiated by delivery.

Special or Full Endorsement

In this type of endorsement contains not only the signature of the endorser but also the name of the person in whose favour the endorsement is made, then it is an endorsement in full.

In Special or Full Endorsement an endorsement, it is only the endorsee who can transfer the instrument.

Example: A is the holder of a bill endorsed by B in the blank. A writes over B’s signature the words “Pay to C or order.” A is not liable as an endorser but the writing operates as an endorsement in full from B to C.

Partial Endorsement

A partial endorsement is a type of endorsement in which purports to transfer to the endorsee a part only of the amount payable on the instrument. Such an endorsement does not operate as a negotiation of the instrument.

Example: A is the holder of a bill for Rs.1000. He endorses it “pay to B or order Rs.500.” This is a partial endorsement and invalid for the purpose of negotiation.

Restrictive Endorsement

A restrictive endorsement is one which either by express words restricts or prohibits the further negotiation of a bill or which expresses that it is not a complete and unconditional transfer of the instrument but is a mere authority to the endorsee to deal with bill as directed by such endorsement.

Example: “Pay C,“ “Pay C for my use,“ “Pay C for the account of B“ are instances of restrictive endorsement. The endorsee under a restrictive endorsement acquires all the rights of the endorser except the right of negotiation.

Conditional or Qualified Endorsement

A type of endorsement where the endorsee limits or negatives his liability by putting some condition in the instrument is called a conditional endorsement.

A conditional endorsement, unlike the restrictive endorsement, does not affect the negotiability of the instrument. It is also sometimes called a qualified endorsement.

Sans recourse

Endorser relieves himself from the liability to all subsequent endorsees.

Facultative

The endorser waives any of his rights

Contingent

The endorser makes his liability dependent upon happening of some event.

Example: The holder of bill endorse it- ‘pay A or order on his marrying B’. In such case, the endorser will not be liable until A marry to B.

Business Law Notes

(Click on Topic to Read)

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

FAQ

Business Law is also known as Commercial law or corporate law, is the body of law that applies to the rights, relations, and conduct of persons and businesses engaged in commerce, merchandising, trade, and sales.

Also Read:

1. Business Law Definition

2. Business Law Meaning

3. Business Law of India

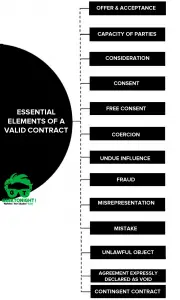

The Indian Contract Act is divisible into two parts.

The first part (Section 1-75) deals with the general principles of the law of contract and therefore applies to all contracts irrespective of their nature.

The second part (Sections 124-238) deals with certain special kinds of contracts, namely contracts of Indemnity and Guarantee, Bailment, Pledge, and Agency.

Also Read:

1. Essential Elements of a Valid Contract

Sales of Goods Act 1930 came into force on 1st July 1930. It extends to the whole of India. It does not affect rights, interests, obligations and titles acquired before the commencement of the Act. The Act deals with the sale but not with mortgage or pledge of the goods.

Read Complete:

1. Essentials of Valid Sales

2. How the Contract of Sale Comes About

3. Difference Between Sale And Agreement To Sell

Negotiable Instruments Act 1881

Negotiation of an instrument is the process by which the ownership of an instrument is transferred from one person to another.

Read Complete:

1. Methods of the negotiation of instrument

2. Definition of Negotiable Instrument

3. Meaning of Negotiable Instrument

4. Characteristics of a Negotiable Instrument

5. Presumptions as to Negotiable Instruments

6. Classification of Negotiable Instruments

7. Types of Negotiable Instruments

Also Read:

Types of Endorsement

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Types of Endorsement | Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

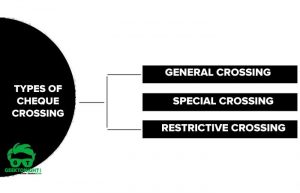

- What is Crossing of Cheque?

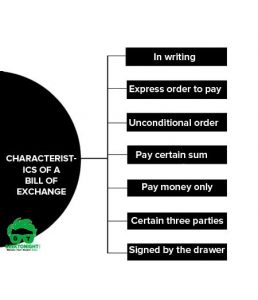

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India