What is Promissory Note?

A promissory note is an instrument in writing (note being a bank-note or a currency note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money to or to the order of a certain person, or to the bearer of the instruments.

- A promissory note may be payable on demand or after a definite period of time.

- The words “or to the bearer of the instrument” have become inoperative in view of the provision contained in Section 31(2) of the Reserve Bank of India Act, which provides that no person in India other than Reserve Bank of India or the Central Government can make or issue promissory note payable to the bearer of the instrument.

- A bank note or currency note is not a promissory note because it is money itself.

Bill of exchange is an instrument ordering the debtor to pay a certain amount within a stipulated period of time. Bill of exchange needs to be accepted in order to call it valid or applicable. And the bill of exchange is issued by the creditor.

Promissory Note, on the other hand, is a promise to pay a certain amount of money within a stipulated period of time. And the promissory note is issued by the debtor.

Table of Content

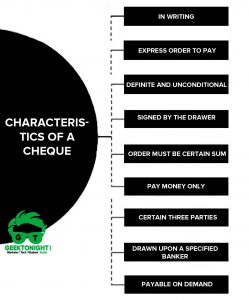

Characteristics of a Promissory Note

To be a promissory note, an instrument must possess the following essentials characteristics of a promissory note:

- Must be in writing

- Must certainly an express promise

- Must be unconditional

- Signed by the maker

- Must be certain sum

- Payee must be certain

- Promise should be to pay money and money only

- Amount should be certain

Must be in writing

A mere verbal promise to pay is not a promissory note. The method of writing (either in ink or pencil or printing, etc.) is unimportant, but it must be in any form that cannot be altered easily.

Example: A promises to pay B a sum of Rs. 500 on telephone. This promise will not make a promissory note because it is not in writing.

Must certainly an express promise or clear understanding to pay

There must be an express undertaking to pay. A mere acknowledgment is not enough. The following are not promissory notes as there is no promise to pay.

Example: State with reasons whether each of the following instruments is a Promissory note or not:

- “Mr B, I owe you Rs 500.”

- “We have received the sum of Rs 500 in cash from Mr B.”

- “We have received the sum of Rs 500 in cash from Mr B. This amount will be repaid on demand”.

- “We promise to pay Mr B a sum of Rs 500”.

Solution: Cases (a) and (b): These instruments are not promissory notes because there is no express promise to pay. These instruments are merely acknowledgements of indebtedness.

Cases (c) and (d): These instruments are promissory notes because there is an express promise to pay.

Must be unconditional

A conditional undertaking destroys the negotiable character of an otherwise negotiable instrument. Therefore, the promise to pay must not depend upon the happening of some outside contingency or event. It must be payable absolutely.

Example: State with reasons whether each of the following instruments is a Promissory Note or not.

- “I promise to pay B Rs 500 seven days after my marriage with Madhuri or Sridevi”.

- “I promise to pay B Rs 500 on D’s death provided D leaves me enough to pay that sum”.

- “I promise to pay Rs 500 on D’s death”.

Solution: Cases (a) and (b): These instruments are not promissory notes because the promise to pay is not unconditional.

In Beardsley vs. Baldwin (1741) 93 IR 1094, a written undertaking to pay a certain amount within a specified time after defendant’s marriage was not recognised as a promissory note because possibly the defendant may never marry and the sum may never become payable.

Case (c): This instrument is a promissory note because the promise to pay is unconditional as it is certain that D will die.

Signed by the maker

The person who promises to pay must sign the instrument even though it might have not been written by the promisor himself. There are no restrictions regarding the form or place of signatures in the instrument. It may be in any part of the instrument. It may be in pencil or ink, a thumb mark or initials.

Must be certain sum

The promise must be to pay a certain sum. Negotiable Instruments are meant for free circulation and if their value is not clearly mentioned on the instruments, their circulation would be materially impeded.

The sum payable is also certain in the following cases:

- Where it is payable along with interest and either the amount of interest itself or the rate of interest is given.

- Where it is payable at a specified rate of exchange.

- Where it is payable by instalments with a provision that a default being made in payment, the unpaid balance shall become due [Section 5].

Example: State with reasons whether each of the following instruments is a Promissory Note or not.

- “I promise to pay 8 Rs 500 and all other sums which shall be due to him.”

- “I promise to pay B Rs 500, first deducting thereout any money which he may owe me”.

- “I promise to pay B Rs 500 along with interest thereon.”

Solution: The aforesaid instruments are not promissory notes because the sum payable is not certain.

The payee must be certain

The instrument must point out with certainty the person to whom the promise has been made. The payee may be ascertained by name or by designation.

The promise should be to pay money and money only

Money means legal tender money and not old and rare coins. A promise to deliver paddy either in the alternative or in addition to money does not constitute a promissory note.

Example: State with reasons whether each of the following instruments is a Promissory note or not:

- “I promise to deliver to B 1000 kg of paddy.”

- “I promise to pay B Rs 500 and deliver 1000 kg of paddy.”

- “I promise to pay B Rs 500 and to deliver to him by black horse on 1st January next”.

Solution: The aforesaid instruments are not promissory notes because the payment is not in money and money only.

The amount should be certain

One of the important characteristics of a promissory note is a certainty- not only regarding the person to whom or by whom payment is to be made but also regarding the amount.

Example: State with reasons whether each of the following instruments is a Promissory Note or not.

- “I promise to pay 8 Rs 500 and all other sums which shall be due to him.”

- “I promise to pay B Rs 500, first deducting thereout any money which he may owe me”.

- “I promise to pay B Rs 500 along with interest thereon.”

Solution: The aforesaid instruments are not promissory notes because the sum payable is not certain.

Bill of Exchange Parties

Drawer

Drawer is a debtor or borrower. The person who makes the promise to another to pay the debt.

Drawee

Drawee is a credit or lender. The person on whom the bill is drawn.

Payee

Payee The person to whom the money is to be paid or a person receiving payment.

Business Law Notes

(Click on Topic to Read)

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

Frequently Asked Questions (FAQs)

Business Law is also known as Commercial law or corporate law, is the body of law that applies to the rights, relations, and conduct of persons and businesses engaged in commerce, merchandising, trade, and sales.

The Indian Contract Act is divisible into two parts.

The first part (Section 1-75) deals with the general principles of the law of contract and therefore applies to all contracts irrespective of their nature.

The second part (Sections 124-238) deals with certain special kinds of contracts, namely contracts of Indemnity and Guarantee, Bailment, Pledge, and Agency.

It is the duty of the seller to deliver the goods and of the buyer to accept and pay for them, in accordance with the terms of the contract of sale.

– Sec. 31, The Sale of Goods Act, 1930

Sales of Goods Act 1930 came into force on 1st July 1930. It extends to the whole of India. It does not affect rights, interests, obligations and titles acquired before the commencement of the Act. The Act deals with the sale but not with mortgage or pledge of the goods.

The Sale of Goods Act, identifies the terms, “Conditions and Warranties” as being of a prime significance in a contract of sale.

Negotiable Instruments Act 1881

Negotiation of an instrument is the process by which the ownership of an instrument is transferred from one person to another.

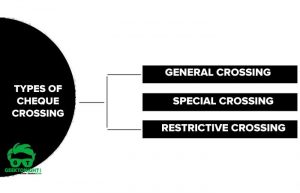

The crossing of Cheque means that the specific cheque can only be deposited straightway into a bank account and cannot be instantly cashed by a bank or any credit institution.

Bill of exchange is an instrument ordering the debtor to pay a certain amount within a stipulated period of time. Bill of exchange needs to be accepted in order to call it valid or applicable. And the bill of exchange is issued by the creditor.

A cheque is a bill of exchange, drawn on a specified banker and it includes ‘the electronic image of truncated cheque’ and ‘a cheque in electronic form’.

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Promissory Note | Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

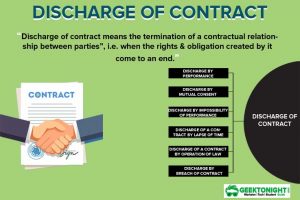

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Thanks for your notes is understandable for any body easily