Payment of Bonus Act

The payment of Bonus Act provides for payment of bonus to persons employed in certain establishments of the basis of profits or on the basis of production or productivity and for matters connected therewith.

It extends to the whole of India and is applicable to every factory and to every other establishment where 20 or more workmen are employed on any day during an accounting year.

Table of Content

Eligibility for Bonus

Every employee receiving salary or wages up to Rs. 10,000 p.m. and engaged in any kind of work whether skilled, unskilled, managerial, supervisory etc. is entitled to bonus for every accounting year if he has worked for at least 30 working days in that year.

Where an employee has not worked for all the working days in an accounting year, the minimum bonus of one hundred rupees or, as the case may be, of sixty rupees, if such bonus is higher than 8.33 per cent, of his salary or wage for the days he has worked in that accounting year, shall be proportionately reduced.

However employees of L.I.C., Universities and Educational institutions, Hospitals, Chamber of Commerce, R.B.I., IFCI, U.T.I., IDBI, NABARD, SIDBI, Social Welfare institutions are not entitled to bonus under this Act.

Calculation for Working Days in An Accounting Year

An employee shall be deemed to have worked in an establishment in any accounting year also on the days on which:

- he has been laid off under an agreement or as permitted by standing orders under the Industrial Employment (Standing Orders) Act, 1946 (20 of 1946), or under the Industrial Disputes Act, 1947 (14 of 1947), or under any other law applicable to the establishment;

- he has been on leave with salary or wage;

- he has been absent due to temporary disablement caused by accident arising out of and in the course of his employment; and

- the employee has been on maternity leave with salary or wage, during the accounting year.

Disqualification for Bonus

Notwithstanding anything contained in the act, an employee shall be disqualified from receiving bonus, if he is dismissed from service for fraud or riotous or violent behaviour while in the premises of the establishment or theft, misappropriation or sabotage of any property of the establishment.

Minimum and Maximum Bonus Payable

Minimum Bonus

- The minimum bonus which an employer is required to pay even if he suffers losses during the accounting year or there is no allocable surplus is 8.33 % of the salary or wages during the accounting year, or

- Rs. 100 in case of employees above 15 years and Rs 60 in case of employees below 15 years, at the beginning of the accounting year, whichever is higher

Maximum Bonus

If in an accounting year, the allocable surplus, calculated after taking into account the amount ‘set on’ or the amount ‘set of’ exceeds the minimum bonus, the employer should pay bonus in proportion to the salary or wages earned by the employee in that accounting year subject to a maximum of 20% of such salary or wages.

Time Limit for Payment

The bonus should be paid in cash within 8 months from the close of the accounting year or within one month from the date of enforcement of the award or coming into operation of a settlement following an industrial dispute regarding payment of bonus. However if there is sufficient cause extension may be applied for.

Duties/Rights of Employer

Duties

- To calculate and pay the annual bonus as required under the Act To submit an annul return of bonus paid to employees during the year, in Form D, to the Inspector, within 30 days of the expiry of the time limit specified for payment of bonus.

- To co-operate with the Inspector, produce before him the registers/ records maintained, and such other information as may be required by them.

- To get his account audited as per the directions of a Labour Court/ Tribunal or of any such other authority.

Rights

An employer has the following rights:

- Right to forfeit bonus of an employee, who has been dismissed from service for fraud, riotous or violent behaviour, or theft, misappropriation or sabotage of any property of the establishment.

- Right to make permissible deductions from the bonus payable to an employee, such as, festival/interim bonus paid and financial loss caused by misconduct of the employee.

- Right to refer any disputes relating to application or interpretation of any provision of the Act, to the Labour Court or Labour Tribunal

Rights of Employees

- Right to claim bonus payable under the Act and to make an application to the Government, for the recovery of bonus due and unpaid, within one year of its becoming due.

- Right to refer any dispute to the Labour Court/Tribunal Employees, to whom the Payment of Bonus Act does not apply, cannot raise a dispute regarding bonus under the Industrial Disputes Act.

- Right to seek clarification and obtain information, on any item in the accounts of the establishment.

Recovery of Bonus Due

- Where any bonus is due to an employee by way of bonus, employee or any other person authorised by him can make an application to the appropriate government for recovery of the money due.

- If the government is satisfied that money is due to an employee by way of bonus, it shall issue a certificate for that amount to the collector who then recovers the money.

- Such application shall be made within one year from the date on which the money became due to the employee.

- However the application may be entertained after a year if the applicant shows that there was sufficient cause for not making the application within time.

Offences and Penalties

For contravention of the provisions of the Act or rules the penalty is imprisonment upto 6 months or fine up to Rs.1000, or both.

For failure to comply with the directions or requisitions made the penalty is imprisonment upto 6 months or fine up to Rs.1000, or both.

In case of offences by companies, firms, body corporate or association of individuals, its director, partner or a principal officer responsible for the conduct of its business, as the case may be, shall be deemed to be guilty of that offence and punished accordingly, unless the person concerned proves that the offence was committed without his knowledge or that he exercised all due diligence.

The Acts have been amended from time to time. For latest amendment visit the link provided https://labour.gov.in/latest-notificationamendments

Business Law Notes

(Click on Topic to Read)

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Payment of Bonus Act 1965 | Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

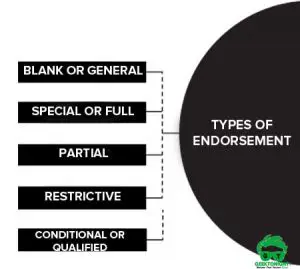

- Types of Endorsement

- What is Promissory Note?

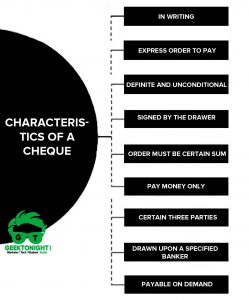

- What is Cheque?

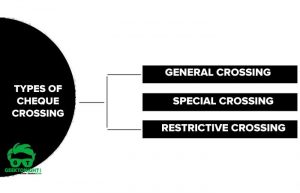

- What is Crossing of Cheque?

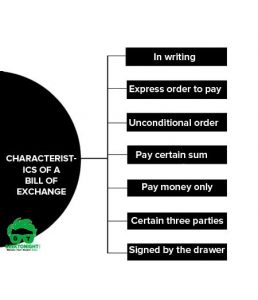

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India