Sale of Goods Act, 1930

In trade and commerce, sales and purchase of goods are very common transactions. Originally, the transactions related to sale and purchase of goods was regulated by Chapter VII (Sections 76 to 123) of the Indian Contract Act 1872 – which was broadly based on English common law.

A separate act, the Sales of Goods Act 1930 came into force on 1st July 1930. It extends to the whole of India. It does not affect rights, interests, obligations and titles acquired before the commencement of the Act. The Act deals with the sale but not with mortgage or pledge of the goods.

Contract of Sale

A contract of sale of goods is a contract whereby the seller transfers or agrees to transfer the property in goods to the buyer for a price [Sec.4]. A contract of sale may be absolute or conditional.

Table of Content

- 1 Sale of Goods Act, 1930

- 2 Contract of Sale

- 3 Definitions

- 3.1 Buyer – Sec 2 (1)

- 3.2 Delivery- Sec 2 (2)

- 3.3 Deliverable state- Sec 2 (3)

- 3.4 Document of Title- Sec 2 (4)

- 3.5 Fault – Sec 2 (5)

- 3.6 Future goods- Sec 2 (6)

- 3.7 Goods- Sec 2 (7)

- 3.8 Insolvent- Section 2 (8)

- 3.9 Mercantile agent- Section 2 (9)

- 3.10 Price – Section 2(10)

- 3.11 Property- Section 2(11)

- 3.12 Seller- Section 2 (13)

- 3.13 Specific goods- Section 2(14)

- 4 Elements of Contract of Sale

- 5 How the Contract of Sale Comes About

- 6 Difference Between Sale And Agreement To Sell

- 7 Difference Between Sale and a Hire Purchase

- 8 Difference Between Sale and a Bailment

- 9 Business Law Notes

- 10 Business Law Book References

Definitions

Buyer – Sec 2 (1)

Buyer means a person who buys or agrees to buy goods.

Delivery- Sec 2 (2)

Delivery means voluntary transfer of the possession from one person to another.

Deliverable state- Sec 2 (3)

Goods are said to be in a “deliverable state” when they are in such state that the buyer would under the contract be bound to take delivery of them.

Document of Title- Sec 2 (4)

A document of the title to goods may be described as any document used as proof of the possession or control of goods, authorizing or purporting to authorize, either by endorsement or by delivery, the possessor of the document to transfer or receive goods thereby represented.

Fault – Sec 2 (5)

Fault means wrongful act or default.

Future goods- Sec 2 (6)

Future goods mean goods to be manufactured or produced or acquired by the seller after the making of the contract of sale.

Goods- Sec 2 (7)

Goods mean every kind of movable property other than actionable claims and money; and includes stock and shares, growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale.

Insolvent- Section 2 (8)

A person is said to be “insolvent” who has ceased to pay his debts in the ordinary course of business or cannot pay his debts as they become due, whether he has committed an act of insolvency or not.

Mercantile agent- Section 2 (9)

Mercantile agent means a mercantile agent having in the customary course of business as such agent authority either to sell goods, or to consign goods for the purposes of sale, or to buy goods, or to raise money on the security of goods.

Price – Section 2(10)

Price means the money consideration for a sale of goods.

Property- Section 2(11)

Property means the general property in goods and not merely a special property.

Seller- Section 2 (13)

Seller means a person who sells or agrees to sell goods.

Specific goods- Section 2(14)

Specific goods mean goods identified and agreed upon at the time a contract of sale is made.

Elements of Contract of Sale

The five essentials of valid sales act of sale are as discussed below:

You may form a mental model of the formation of contract. In other words, you will deal with four main concepts of the formation of a contract.

| FEATURES | EXPLANATION | EXAMPLE |

|---|---|---|

| Two parties | There must by two parties, buyer and seller, to contract. | You go to a dealer and buy a computer and pay for it. The dealer is the seller and you are the buyer. |

| Movable Goods | Any goods that are movable and the ownership is transferred. (Immovable property does not come under the Sales of Goods Act.) | When you fly, the airline sells you the service to take you from one place to another; it does not sell you the aircraft. So also when you buy grain, you only buy grain and not the land of the farmer. |

| Price | Sale is about exchange goods for money. Under Contract Act it is termed as consideration, but this consideration must be only in money. Exchange of goods for goods is barter and not sale. | You buy a computer and pay money for it as the price for the value you |

| Transfer of General Property | Property is distinguished as general property and special property. General property consists of as goods owned and special property as goods under possession. | You own a clock. It is a general property. You pledge the clock to a pawn shop—the shop owner is in possession of your property which is owned by you; it is a special property for the shop owner. |

| Valid Contract | The principles of valid contract are applicable to sale of contract. | The principles of contract that are enshrined in the Contract Act: offer, acceptance, consideration, communication, and competency to contract. |

Two parties

There must be a seller as well as a buyer. ‘Buyer’ means a person who buys or agrees to buy goods [Section 2 (1)]. ‘Seller’ means a person who sells or agrees to sell goods [Section 2(13)]. A person cannot be a seller as well as a buyer as a person cannot buy his own goods.

Goods

There must be some goods. ‘Goods’ means every kind of movable property other than actionable claims and money and includes stock and shares, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale [Sale 2(7)]. Contracts relating to actionable claims, immovable property and services are not covered by this Act.

- The ‘actionable claims’ mean a claim which can be enforced through the courts of law. Eg., a due from one person to another is an actionable claim.

- The ‘money’ here means the legal tender (i.e., currency of the country) and not old coins.

Transfer of Property

Property means the general property in goods, and not merely a special property [Section 2(11)]. General property in goods means ownership of the goods. Special property in goods means possession of goods.

Thus, there must be either a transfer of ownership of goods or an agreement to transfer the ownership of goods. The ownership may transfer either immediately on completion of sale or sometime in future in agreement to sell.

Price

There must be a price. Price here means the money consideration for a sale of goods. When the consideration is only goods, it amounts to a ‘barter’ and not sale.

When there is no consideration, it amounts to gift and not sale. However, the consideration may be partly in money and partly in goods because the law does not prohibit as such.

How the Contract of Sale Comes About

As you have learnt in the Contract Act, no particular form is necessary to constitute a contract of sale.

There are offer and acceptance, the communication may be formal, informal, or implied. The sale and transfer may occur immediately before, after simultaneous, or payment in instalments.

In order to understand exactly how the contract of sale comes about, you must learn some fundamental distinctions. Table: distinguishes between each of the following:

- Sale and agreement to sell

- Sale and hire-purchase

- Agreement to sell and hire-purchase

- Sale and bailment

- Sale and contract for work and materials

The table is a logical consequence of the principles of contract that you studied in Contract Act Chapter which covered the Contract Act, 1872.

It goes to prove that both the Contract Act and Sale of Goods Act are complementary and both are based fundamentally on the same principles.

Difference Between Sale And Agreement To Sell

A contract of sale is a generic term and includes both an actual sale and an agreement to sell. Section 4 provides that if the property in goods is transferred from the seller to the buyer under a contract, the contract is called a sale.

Where the transfer of the property in the goods will take place at a future time or is subject to some condition which has to be fulfilled, the contract is called an agreement to sell.

Such an agreement to sell becomes a sale when the prescribed time lapses or the conditions are fulfilled.

| Basis of distinction | Sale | Agreement to sell |

|---|---|---|

| Meaning | When in a contract of sale, the exchange of goods for money consideration takes place immediately, it is known as Sale. | When in a contract of sale the parties to contract agree to exchange the goods for a price at a future specified date is known as an Agreement to Sell. |

| Nature | Absolute | Conditional |

| Type of Contract | Executed Contract | Executory Contract |

| Transfer of risk | Yes | No |

| Title | In sale, the title of goods transfers to the buyer with the transfer of goods. | In an agreement to sell, the title of goods remains with the seller as there is no transfer of goods. |

| Right to sell | Buyer | Seller |

| Consequences of subsequent loss or damage to the goods | Responsibility of buyer | Responsibility of Seller |

| Tax | VAT is charged at the time of sale. | No tax is levied. |

| Suit for breach of contract by the seller | The buyer can claim damages from the seller and proprietary remedy from the party to whom the goods are sold. | Here the buyer has the right to claim damages only. |

| Right of unpaid seller | Right to sue for the price. | Right to sue for damages |

Difference Between Sale and a Hire Purchase

A Hire purchase agreement is an agreement for hire of goods where the person who hires the goods has an option to purchase the goods at the end. The possession of the goods is delivered to such a hirer and he has to pay via instalments. The property in the goods passes to the hirer on the payment of the last instalments.

| Basis of distinction | Sale | Hire-Purchase |

|---|---|---|

| Law | A contract of sale is governed by the Sale of Goods Act, 1930. | They are governed by Hire Purchase Act, 1972 |

| Nature of Contract | It may be written, oral or implied. | It is an agreement to hire and an agreement to sell. It has to be in writing. |

| Possession | Possession may or may not transfer immediately. | Possession passes immediately |

| Transfer of ownership | The ownership of goods is transferred immediately. | It transferred only when the option to purchase is exercised and the last payment is made. |

| Buyer | The buyer becomes the full owner of the goods | The hirer is a bailee, and not the owner until he pays all the instalments of the price in full or exercises the option to purchase. |

| Transfer to third parties | The buyer can transfer a good title to third parties because ownership of goods has been transferred. | The hirer cannot transfer a good title to a third party as ownership has not been transferred. |

| Right to repossess | The seller can sue for price but he cannot repossess the goods. | The hire vendor has a right to repossess the goods if the hirer defaults in the payments. |

| Right to terminate | In a sale, there is no option to the buyer to return the goods bought. | The hirer can terminate the agreement before the ownership is transferred. |

| Sales tax | In case of sale of taxable goods, sales tax is levied. | Even if taxable goods are hired, sales tax is not levied. |

Difference Between Sale and a Bailment

Sale and Bailment are two different types of contracts. A contract of sale is a straight forward contract where a person may buy goods, services or property from a seller in exchange for remuneration, usually in the form of money. Essentially, in a bailment contract, the bailor gives the goods, assets or property to the bailee for a specific amount of time. However, the goods, assets or property still belongs to the bailor.

| Basis of distinction | Sale | Bailment |

|---|---|---|

| Act | Sale is defined under Sec. 4(3) of the Sale of Goods Act, 1930. | Bailment is defined under Sec. 148 of the Indian Contract Act, 1872. |

| Ownership of Goods | The buyer becomes the owner of goods. | The bailee does not become the owner of goods. |

| Use of Goods | In a sale, the buyer may use the goods in any way he likes. | In bailment, the bailee can use the goods only accordingly to the direction of the bailor. |

| Consideration | In a sale, the consideration is always in terms of money. | In a Bailment, the consideration need not be money as it may be the understanding to return the goods bailed on accomplishment of the purpose. |

| Return of goods | In a sale, there is no return of goods from the buyer to the seller, unless there is a breach. | In a bailment, the goods are necessarily returned after the specified time or accomplishment of the purpose. |

Business Law Notes

(Click on Topic to Read)

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Sales of Goods Act 1930 | Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

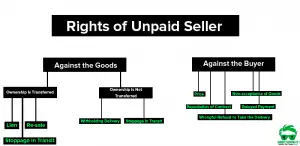

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

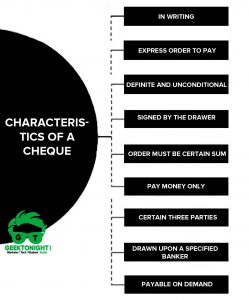

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India