Employee State Insurance Act

The Employee State Insurance Act, [ESIC] 1948, is a piece of social welfare legislation enacted primarily with the object of providing certain benefits to employees in case of sickness, maternity and employment injury and also to make provision for certain others matters incidental thereto.

The Act in fact tries to attain the goal of socio-economic justice enshrined in the Directive principles of state policy under part 4 of our constitution, in particular articles 41, 42 and 43 which enjoin the state to make effective provision for securing, the right to work, to education and public assistance in cases of unemployment, old age, sickness and disablement.

Table of Content

Origin of Employee State Insurance Act

The Employee State Insurance act was promulgated by the Parliament of India in the year 1948.To begin with the ESIC scheme was initially launched on 2nd February 1952 at just two industrial centers in the country namely Kanpur and Delhi with a total coverage of about 1.20 lakh workers.

There after the scheme was implemented in a phased manner across the country with the active involvement of the state governments.

Objectives of Employee State Insurance Act

The ESI Act is a social welfare legislation enacted with the object of providing certain benefits to employees in case of sickness, maternity and employment injury. Under the Act, employees will receive medical relief, cash benefits, maternity benefits, pension to dependents of deceased workers and compensation for fatal or other injuries and diseases.

Definitions

According to Section 2 (m) of Factories Act, 1948, Factory means any premises including the precints thereof

- whereon ten or more persons are employed or were employed for wages on any day of the preceding twelve months, and in any part of which a manufacturing process is being carried on with the aid of power or is ordinarily so carried on, or

- whereon twenty or more persons are employed or were employed for wages on any day of the preceding twelve months, and in any part of which a manufacturing process is being carried on without the aid of power or is ordinarily so carried on.

According to Section 2 (k) of Factories Act, “manufacturing process” means any process for

- making, altering, repairing, ornamenting, finishing, packing, oiling, washing, cleaning, breaking up, demolishing, or otherwise treating or adapting any article or substance with a view to its use, sale, transport, delivery or disposal, or

- pumping oil, water, sewage or any other substance; or;

- generating, transforming or transmitting power; or 38

- composing types for printing, printing by letter press, lithography, photogravure or other similar process or book binding; lra-6 ] [ lra-7 or lra-7 ]

- constructing, reconstructing, repairing, refitting, finishing or breaking up ships or vessels;

- preserving or storing any article in cold storage;

Applicability

The ESI Act extends to the whole of India

- It applies to all the factories including Government factories (excluding seasonal factories), which employ 10 or more employees and carry on a manufacturing process with the aid of power and 20 employees where manufacturing process is carried out without the aid of power.

- The act also applies to shops and establishments. Generally, shops and establishments employing more than 20 employees are covered by the Act.

- • The act does not apply to any member of Indian Naval, Military or Air Forces.

- All employees including casual, temporary or contract employees drawing wages less than Rs 10,000 per month are covered. The ceiling limit has been raised from Rs.7500 to Rs.10000 with effect from 01.10.06.

- Apprentices covered under the Apprenticeship Act are not covered under this Act. According to Apprenticeship Act 1961, “apprentice” means a person who is undergoing apprenticeship training in pursuance of a contract of apprenticeship.

- Where a workman is covered under the ESI scheme,

- Compensation under the Workmen’s Compensation Act cannot be claimed in respect of employment injury.

- No benefits can be claimed under the Maternity Benefits Act.

Areas Covered

The ESI Scheme is being implemented area-wise by stages. The Scheme is being implemented in almost all union territories and states except Nagaland, Manipur, Tripura, Sikkim, Arunachal Pradesh and Mizoram.

Administration of the Act

The provisions of the Act are administered by the Employees State Insurance Corporation. It comprises members representing employees, employers, the central and state government, besides, representatives of parliament and medical profession.

A standing committee constituted from amongst the members of the corporation, acts as an executive body. The medical benefit council, constituted by the central government, is another statutory body that advises the corporation on matters regarding administration of medical benefit, the certification for purposes of the grant of benefits and other connected matters.

Benefits under the Scheme

Employees covered under the scheme are entitled to medical facilities for self and dependants. They are also entitled to cash benefits in the event of specified contingencies resulting in loss of wages or earning capacity. The insured women are entitled to maternity benefit for confinement.

Where death of an insured employee occurs due to employment injury or occupational disease, the dependants are entitled to family pension. Various benefits that the insured employees and their dependants are entitled to, the duration of benefits and contributory conditions thereof are as under:

Medical benefits

- From day one of entering insurable employment for self and dependants such as spouse, parents and children own or adopted.

- For self and spouse on superannuation subject to having completed five years in insurable employment on superannuation or in case of having suffered permanent physical disablement during the course of insurable employment.

Sickness benefits

- Sickness benefit is payable to an insured person in cash, in the event of sickness resulting in absence from work and duly certified by an authorised insurable medical officer/ practitioner.

- The benefit becomes admissible only after an insured has paid contribution for at least 78 days in a contribution period of 6 months.

- Sickness benefit is payable for a maximum of 91 days in two consecutive contribution period.

Maternity benefit

- Maternity benefit is payable to insured women in case of confinement

- Miscarriage or sickness related thereto.

- For claiming this an insured woman should have paid for at least 70 days in 2.

- • consecutive contribution periods i.e. 1 year. • The benefit is normally payable for 12 weeks, which can be further extended up to • 16 weeks on medical grounds. • The rate of payment of the benefit is equal to wage or double the standard sickness • benefit rate. • The benefit is payable within 14 days of duly authenticated claim papers.

Disablement benefit

- Disablement benefit is payable to insured employees suffering from physical

- disablement due to employment injury or occupation disease.

Obligations of Employers

- The employer should get his factory or establishments registered with the E.S.I. Corporation within 15 days after the Act becomes applicable to it, and obtain the employers Code Number.

- The employer should obtain the declaration form from the employees covered under the Act and submit the same along with the return of declaration forms, to the E.S.I. office. He should arrange for the allotment of Insurance Numbers to the employees and their Identity Cards.

- The employer should deposit the employees’ and his own contributions to the E.S.I. Account in the prescribed manner, whether he has sufficient resources or not, his liability under the Act cannot be disputed.

Business Law Notes

(Click on Topic to Read)

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Employee State Insurance Act 1948 | Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

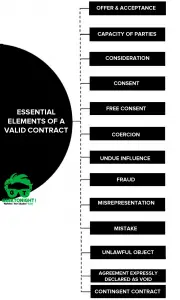

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

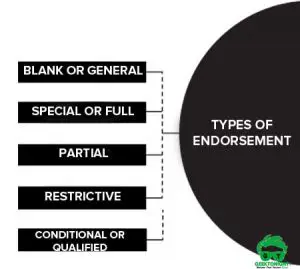

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India