What is Memorandum of Association?

Memorandum of Association is a document which sets out the constitution of a company and is, therefore, the foundation on which the structure of the company is built. It defines the scope of the company’s activities and its relations with the outside world.

Table of Content

The first step in the formation of a company is to prepare a document called the memorandum of association. In fact memorandum is one of the most essential pre-requisites for incorporating any form of company under the Companies Act, 2013 ( hereinafter referred to as ‘Act”).

This is evidenced in Section 3 of the Act, which provides the mode of incorporation of a company and states that a company may be formed for any lawful purpose by seven or more persons,

- where the company to be formed is a public company; two or more persons,

- where the company to be formed is a private company; or one person,

- where the company to be formed is a One Person Company by subscribing their names or his name to a memorandum and complying with the requirements of this Act in respect of its registration.

To subscribe means to append one’s signature or mark a document as an approval or attestation of its contents.

Memorandum Meaning

According to Section 2(56) of the Act “memorandum” means the memorandum of association of a company as originally framed and altered, from time to time, in pursuance of any previous company law or this Act.

Section 4 of the Act specifies in clear terms the contents of this important document which is the charter of the company.

The memorandum of association of a company contains the objects of the company which it shall pursue. It not only shows the objects of formation of the company but also determines the scope of its operations beyond which its actions cannot go.

“THE MEMORANDUM OF ASSOCIATION”, as observed by Palmer, “is a document of great importance in relation to the proposed company”.

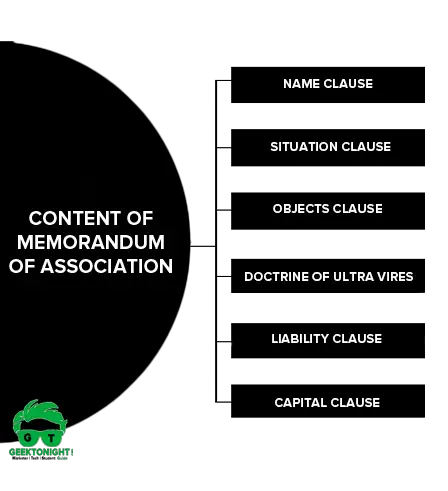

Content of Memorandum of Association

Name Clause

Name of the company should indicate whether the company is private or public. No undesirable name as specified in Rule 8 of Companies (Incorporation) Rules, 2014 No identical name that resembles the name of an existing company.

A company being a legal entity must have a name of its own to establish its separate identity. The name of the company is a symbol of its independent corporate existence. The first clause in the memorandum of association of the company states the name by which a company is to be known. The company may adopt any suitable name provided it is not undesirable.

According to section 4(2), the name stated in the memorandum shall not:

- be identical with or resemble too nearly to the name of an existing company registered under this Act or any previous company law; or

- be such that its use by the company:

- will constitute an offence under any law for the time being in force;

- is undesirable in the opinion of the Central Government.

Section 4(3) provides that without prejudice to the provisions of section 4(2), a company shall not be registered with a name which contains:

- any word or expression which is likely to give the impression that the company is in any way connected with, or having the patronage of, the Central Government, any State Government, or any local authority, corporation or body constituted by the Central Government or any State Government under any law for the time being in force; or

- such word or expression, as may be prescribed, (See annexure 3.1 of Chapter 3) unless the previous approval of the Central Government has been obtained for the use of any such word or expression.

As per section 4(4) a person may make an application, in form (e-Form INC1) accompanied by prescribed fee to the Registrar for the reservation of a name set out in the application as

- the name of the proposed company; or

- the name to which the company proposes to change its name.

Section 4(5)(i) lays down that upon receipt of an application under subsection (4), the Registrar may, on the basis of information and documents furnished along with the application, reserve the name for a period of 60 days from the date of the application.

The Central Government under Section 16 is empowered to direct a company, at any point of time to rectify its name if by inadvertence it has been registered with a name which is identical to or too nearly resembles the name of an existing company whether registered under this Act or the previous company law.

The company shall change its name within a period of 3 months from the issue of the above direction after passing an ordinary resolution for the purpose.

This section also gives enhanced power to the Central Government to order rectification of name where such name in its opinion constitutes an infringement of a registered trademark.

The proprietor of the registered trade mark may make an application to the Central Government for an order for rectification of name of the company because it is identical to or too nearly resembles the applicant’s registered trademarks.

Such application must be made within three years from the date of incorporation or the registration or change of name whether under this Act or previous company law.

In such a case the Central Government may direct the company to change its name and the company shall change its name, within a period of six months from the issue of such direction, after passing an ordinary resolution for the purpose.

Where a company changes its name or obtains a new name, it shall within a period of fifteen days from the date of such change, give notice of the change to the Registrar along with the order of the Central Government, who shall carry out necessary changes in the certificate of incorporation and the memorandum.

Situation Clause

Situation Clause The name of the State in which the registered office of the company is to be situated must be given in the memorandum. But the exact address of the registered office is not required to be stated therein.

According to section 12 of the Act within 15 days of company’s incorporation, and at all times thereafter, the company must have a registered office to which all communications and notices may be sent.

The company must also furnish to the Registrar verification of its registered office within a period of thirty days of its incorporation in such manner as may be prescribed. ( e-form INC-22)

Publication of Name and Address of the Company

According to Section 12(3) every company is required to display its name and address in legible letters in conspicuous position and in all its business letters, bill heads, letter papers. Accordingly, the company shall:

- paint or affix its name, and the address of its registered office, and keep the same painted or affixed, on the outside of every office or place in which its business is carried on, in a conspicuous position, in legible letters, and if the characters employed therefor are not those of the language or of one of the languages in general use in that locality, also in the characters of that language or of one of those languages;

- in case the company has adopted common seal then the name shall be engraved in legible characters on its seal;

- get its name, address of its registered office and the Corporate Identity Number along with telephone number, fax number, if any, e-mail and website addresses, if any, printed in all its business letters, billheads, letter papers and in all its notices and other official publications; and

- have its name printed on negotiable instruments such as hundies, promissory notes, bills of exchange.

However, where a company has changed its name or names during the last two years, it shall paint or affix or print, as the case may be, along with its name, the former name or names so changed during the last two years.

Further in case of One Person Company, the words ”One Person Company” shall be mentioned in brackets below the name of such company, wherever its name is printed, affixed or engraved.

Ministry of Corporate Affairs (MCA) has clarified that display of its name in English in addition to the display in the local language will be a sufficient compliance with the requirements of the section.

The MCA has also clarified that a share certificate is not an official publication of a company within the meaning of Section 147 of the Companies Act, 1956 [This corresponds to Section 12 of the Companies Act, 2013] [Circular No. 3/73/8/10(147)/ 72-CC-V dated 3.2.1973].

Objects Clause

The third compulsory clause in the memorandum sets out the objects for which the company has been formed. Under section 4(1)(c) of the Act, all companies must state in their memorandum the objects for which the company is proposed to be incorporated and any matter considered necessary in furtherance thereof.

The objects clause is of great importance because it determines the purpose and the capacity of the company. It indicates the purpose for which the company has been set up and its actual capability, besides its sphere of activities.

It states affirmatively the ambit and extent of powers of the company and, stated negatively, that nothing should be done beyond that ambit and that no attempt shall be made to use the company for any other purpose than that which is specified.

The purpose of the objects clause is to enable the persons dealing with the company to know its permitted range of activities. The acts beyond this ambit are ultra vires and hence void. Even the entire body of shareholders cannot ratify such acts.

The company shall furnish to the Registrar of Companies, the verification of its registered office within 30 days of incorporation in Form INC 22.

Although express powers are necessary, a company may do anything which is incidental to and consequential upon the powers specified, and the act will not be ultra vires. Thus, a trading company has an implied power to borrow money, draw and accept bills of exchange in the ordinary form, but a railway company cannot issue bills although it may borrow money.

The subscribers to the memorandum of association enjoy almost unrestricted freedom to choose the objects. The only restriction is that objects should not be illegal and against the provisions of the Companies Act, 2013.

The memorandum of association of a company is its charter defining the objects of its existence and operations. The objects clause or clauses in the memorandum are to be so construed as to confer on the company all powers reasonably required to the attainment of the objects.’ “A memorandum of association like any other document must be read fairly and its importance derived from a reasonable interpretation of the language which it employs”

Doctrine of Ultra Vires

In the case of a company whatever is not stated in the memorandum as the objects or powers is prohibited by the doctrine of ultra vires. As a result, an act which is ultra vires is void, and does not bind the company.

Neither the company nor the contracting party can sue on it. Also, as stated earlier, the company cannot make it valid, even if every member assents to it.

The general rule is that an act which is ultra vires the company is incapable of ratification. An act which is intra vires the company but outside the authority of the directors may be ratified by the company in proper form.

The rule is meant to protect shareholders and the creditors of the company. If the act is ultra vires (beyond the powers of) the directors only, the shareholders can ratify it. If it is ultra vires the articles of association, the company can alter its articles in the proper way.

Liability Clause

Section 4 sub-section 1(d) of the Act, states that the liability of members of the company is to be specifically mentioned in the MoA. It is provided that the liability of member may either be limited or unlimited, further it shall also state that:

- in the case of a company limited by shares, the liability of its members is limited to the amount unpaid, if any, on the shares held by them; and

- in the case of a company limited by guarantee, the amount up to which each member undertakes to contribute:

- to the assets of the company in the event of its being wound-up while he is a member or within one year after he ceases to be a member, for payment of the debts and liabilities of the company or of such debts and liabilities as may have been contracted before he ceases to be a member, as the case may be; and

- to the costs, charges and expenses of winding-up and for adjustment of the rights of the contributories among themselves;

- to the assets of the company in the event of its being wound-up while he is a member or within one year after he ceases to be a member, for payment of the debts and liabilities of the company or of such debts and liabilities as may have been contracted before he ceases to be a member, as the case may be; and

Capital Clause

This clause shall state the amount of the capital with which the company is registered. The shares into which the capital is divided must be of fixed value, which is commonly known as the nominal value of the share.

The capital is variously described as “nominal”, “authorised” or “registered”. The amount of nominal capital is determined having regard to the present as well as future requirements of the company with reference to its objects. The usual way to state the capital in the memorandum is:

“The capital of the company is Rs. 10,00,000 divided into 1,00,000 equity shares of ` 10 each”. This amount lays down the maximum limit beyond which the company cannot issue shares without altering the memorandum as provided by Section 61 of the Companies Act, 2013.

If there are both equity and preference shares, then the division of the capital is to be shown under these two heads. A company is not authorised to issue capital beyond its authorised/nominal/registered capital. If it receives applications for shares beyond the shares covered by the authorised capital, the amount received on excess number of shares should be returned.

Out of the issued capital, the total amount actually subscribed or agreed to be subscribed is known as subscribed capital, and this subscribed capital again may be wholly paid or partly paid, in which latter case the balance would be payable on future calls when made. The amount actually paid by the shareholders is called the paid-up capital.

According to Section 60 of the Act, if the amount of the authorised capital (nominal capital), of the company is stated in any notice, advertisement, official publication, business letter, bill head or letter paper, it shall also contain a statement in an equally prominent position and in equally conspicuous terms the amount of capital which has been subscribed and the amount paid-up.

Business Law Notes

(Click on Topic to Read)

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Memorandum of Association | Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

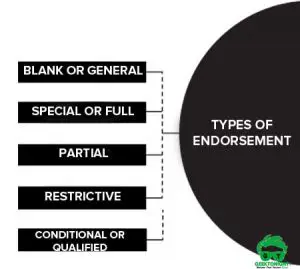

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India