Limited Liability Partnership Act

Limited Liability Partnership (LLP) is an incorporated partnership formed and registered under the Limited Liability Partnership Act 2008 with limited liability and perpetual succession.

The Act came into force, for most part, on 31st March 2009 followed by its Rules on 1st April 2009 and the registration of the first LLP on 2nd April 2009.

LLP is viewed as an alternative corporate business vehicle that provides the benefits of limited liability but allows its partners the flexibility of organizing their internal structure as a partnership based on a mutually arrived agreement.

Table of Content

Features of LLP

The salient features of the Limited Liability Partnership are as follows:

- The LLP is a body corporate and a legal entity separate from its partners.

Any two or more persons, associated for carrying on a lawful business with a view to profit, may by subscribing their names to an incorporation document and filing the same with the Registrar, form a Limited Liability Partnership. - The mutual rights and duties of partners of an LLP inter se and those of the LLP and its partners shall be governed by an agreement between partners or between the LLP and the partners subject to the provisions of the proposed legislation.

- LLP is a separate legal entity, liable to the full extent of its assets, with the liability of the partners being limited to their agreed contribution in the LLP which may be tangible or intangible in nature or both tangible and intangible in nature.

No partner would be liable on account of the independent or un-authorized acts of other partners or their misconduct. - Every LLP shall have at least two partners and shall also have at least two individuals as Designated Partners, of whom at least one shall be resident in India.

- LLP shall maintain annual accounts reflecting true and fair view of its state of affairs. A statement of accounts and solvency shall be filed by every LLP with the Registrar every year.

The accounts of LLPs shall also be audited, subject to any class of LLPs being exempted from this requirement by the Central Government. - The Central Government has the power to investigate the affairs of an LLP, if required, by the appointment of competent inspector for the purpose.

- The Indian Partnership Act, 1932 shall not be applicable to LLPs. A partnership firm, a private company and an unlisted public company may convert themselves to LLP in accordance with provisions of the proposed legislation.

- The Central Government has made rules for carrying out the provisions of the LLP Act.

LLP Agreement

No provision has been made for directors or a board structure on the lines of Company Law. The LLP agreement determines the mutual rights and duties of the partners and their rights and duties in relation to limited liability partnership.

This LLP agreement is required to be filed with the Registrar. It has been provided under Section 23 – Save as otherwise provided by this Act, the mutual rights and duties of the partners of a limited liability partnership, and the mutual rights and duties of a limited liability partnership and its partners, shall be governed by the limited liability partnership agreement between the partners, or between the limited liability partnership and its partners.

- Limited liability partnership agreement should be filed with the Registrar within 30 days of incorporation in form 3.

- A person becomes a Partner by virtue of LLP agreement. This means that the LLP agreement is a must and it serves as a basic document and, to a certain extent, takes the place of MOA and AOA applicable in the case of a company registered under the Companies Act, 1956.

- Any change in the LLP agreement is also required to be notified to the Registrar of Companies. The importance of the said document lies in the fact that it is a public document and it is open to public inspection being on the records of the Registrar.

Incorporation Document

According to section 11 (1) of the Limited Liability Partnership Act, 2008, for a limited liability partnership to be incorporated-

- two or more persons associated for carrying on a lawful business with a view to profit shall subscribe their names to an incorporation document;

- the incorporation document shall be filed in such manner and with such fees, as may be prescribed with the registrar of the state in which the registered office of the limited liability partnership is to be situated; and

- a statement in the prescribed form shall be filed along with the incorporation document, made by either an advocate, or a Company Secretary or a Chartered Accountant or a Cost Accountant, who is engaged in the formation of the limited liability partnership and by anyone who subscribed his name to the incorporation document, that all the requirements of this Act and the rules made thereunder have been complied with, in respect of incorporation and matters precedent and incidental thereto.

The incorporation document shall be in form 2 as per rule 11

- state the name of the LLP;

- state the proposed business of the LLP;

- state the address of the registered office of the LLP;

- state the name and address of each of the persons who are to be partners of the LLP on incorporation;

- state the name and address of the persons who are to be designated partners of the LLP on incorporation;

- contain such other information concerning the proposed LLP as may be prescribed.

If a person makes a statement under clause (c) of Sub-Section (1) which he-

1. knows to be false; or

2. does not believe to be true,

Shall be punishable with imprisonment for a term which may extend to two years and with fine which shall not be less than ten thousand rupees but which may extend to five lakh rupees.

Subject to prior compliance with the requirements of section 11(1) of the Act, section 12 (1) mandates the Registrar to register the incorporation document and issue a certificate of incorporation within 14 days. The certificate of incorporation shall be conclusive evidence that the limited liability partnership is incorporated by the name specified in the incorporation document.

Advantages of LLP

The advantages of a LLP include:

Separate legal entity

A limited liability partnership is a body corporate formed and incorporated under this Act and is a legal entity separate from that of its partners.

Perpetual Succession

A limited liability partnership shall have perpetual succession. In other words, partners may come and partners may go but a LLP will go on till the winding up of its affairs.

Limited Liability

Reduced risk to personal wealth from creditors’ claims. 4. Internal flexibility: Allows for participation in management and maintenance of ethos of partnership.

Disadvantages of LLP

The disadvantages include:

Lack of privacy

Disclosure of financial information required under Section 34.

Requirement of a LLP agreement

An LLP agreement is a necessity so as to avoid the application of default provisions (First Schedule) and to provide for matters not covered in the default provisions.

Legal uncertainty

This being a newly introduced concept in the corporate world, it is yet to prove itself as a commercial entity

Business Law Notes

(Click on Topic to Read)

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

FAQ

Business Law is also known as Commercial law or corporate law, is the body of law that applies to the rights, relations, and conduct of persons and businesses engaged in commerce, merchandising, trade, and sales.

The Indian Contract Act is divisible into two parts.

The first part (Section 1-75) deals with the general principles of the law of contract and therefore applies to all contracts irrespective of their nature.

The second part (Sections 124-238) deals with certain special kinds of contracts, namely contracts of Indemnity and Guarantee, Bailment, Pledge, and Agency.

It is the duty of the seller to deliver the goods and of the buyer to accept and pay for them, in accordance with the terms of the contract of sale.

– Sec. 31, The Sale of Goods Act, 1930.

Sales of Goods Act 1930 came into force on 1st July 1930. It extends to the whole of India. It does not affect rights, interests, obligations and titles acquired before the commencement of the Act. The Act deals with the sale but not with mortgage or pledge of the goods.

The Sale of Goods Act, identifies the terms, “Conditions and Warranties” as being of a prime significance in a contract of sale.

Negotiable Instruments Act 1881

Negotiation of an instrument is the process by which the ownership of an instrument is transferred from one person to another.

The crossing of Cheque means that the specific cheque can only be deposited straightway into a bank account and cannot be instantly cashed by a bank or any credit institution.

Promissory Note, on the other hand, is a promise to pay a certain amount of money within a stipulated period of time. And the promissory note is issued by the debtor.

Read Complete:

1. Characteristics of a Promissory Note

2. Bill of Exchange Parties

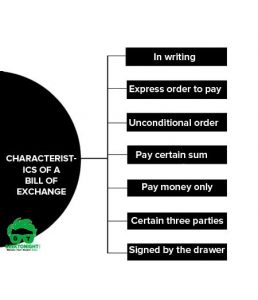

Bill of exchange is an instrument ordering the debtor to pay a certain amount within a stipulated period of time. Bill of exchange needs to be accepted in order to call it valid or applicable. And the bill of exchange is issued by the creditor.

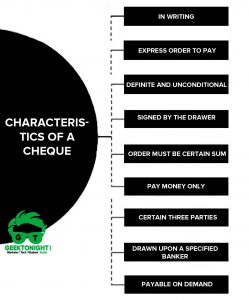

A cheque is a bill of exchange, drawn on a specified banker and it includes ‘the electronic image of truncated cheque’ and ‘a cheque in electronic form’.

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Limited Liability Partnership Act 2008 | Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

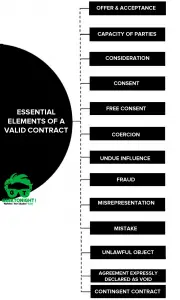

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

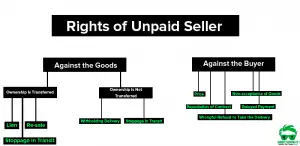

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

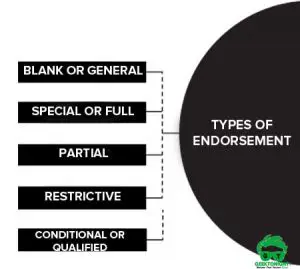

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India