Goods – The Subject Matter of Contract of Sale

- The goods which form the subject of a contract of sale may be either existing goods, owned or possessed by the seller, or future goods.

- There may be a contract for the sale of goods the acquisition of which by the seller depends upon a contingency which may or may not happen.

- Where by a contract of sale the seller purports to effect a present sale of future goods, the contract operates as an agreement to sell the goods.

– Sec. 6, The Sale of Goods Act, 1930

Table of Content

- 1 Goods – The Subject Matter of Contract of Sale

- 2 What is Goods?

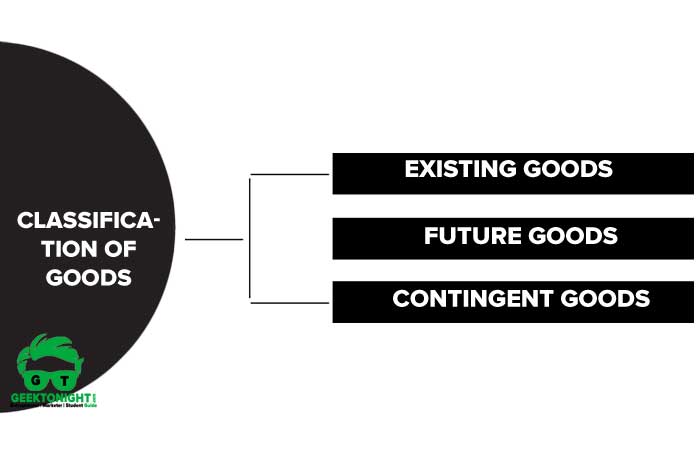

- 3 Classification of Goods

- 4 Effects of Destruction of Goods

- 5 Document of Title to Goods

- 6 Price

- 7 Business Law Notes

- 8 Business Law Book References

What is Goods?

Every kind of movable property is goods: shares, stocks, crops, trees, goodwill, patents, trade marks, electricity, water, gas, etc.—all that can be exchanged for money

What they are not

Money and actionable claims are excluded from the claim of goods.

- By money, the lawgiver understands that which a legal tender, the currency.

It considers old coins and also foreign currency as goods that can be bought and sold. - The actionable claim implies any debt or beneficial interest in a movable property not in possession, which can be recovered by means of a suit or an action. It is something which is enforceable by the court of law but which cannot be sold as goods.

It must be noted carefully that although it would logically seem stocks and shares too are actionable claims, yet the Act specifically considers them as goods.

Classification of Goods

Sec. 6 of the Sale of Goods Act classifies ‘goods’ under the following categories:

Existing goods

These are the goods which are owned or possessed by the seller at the time of sale.

Specific goods

Specific goods are identified and agreed upon at the time of sale.

Example: A contract to sell a Nokia cell phone of a particular model is a contract to sell a specific good. In this case, the sale is for a specific good, as the phone has been identified.

Unascertained goods

Unascertained goods are the goods that are not specifically agreed upon at the time of entering into the contract.

Example: 100 leather jackets are lying in the godown out of this lot of 100 jackets 10 jackets are to be bought by X, this is a contract for the sale of unascertained goods made by the leather jacket manufacturer.

Ascertained goods

An ascertained good is a part of the goods that are available in bulk are specially meant for sale.

Example: X owns 20 Maruti Cars. Y enters into a contract with X to buy one car out of those 20 cars. After the contract one car is given to X and this car will then be an ascertained good.

Future goods

These are not possessed by the seller at the time of the contract but which will be produced, procured, and supplied by him in the future. It is similar to the goods in an agreement to sell.

Example: X agrees to sell to Y the entire crop of sugarcane to be grown at her farm in Uttar Pradesh for an amount of Rs. 2,00,000. Such type of agreement is not a sale but an agreement to sell future goods.

Contingent goods

Section 6(2) has defined ‘contingent goods’ as the goods “the acquisition of which by the seller depends upon a contingency which may or may not happen“.

Such goods are therefore dependent upon an event or an occurrence which may or may not happen.

Example: X agreed to sell 100 cotton shirts he was importing from China provided his ship arrived safely in time. In this example, the cotton shirts are contingent goods as their sale is dependent upon the safe and timely arrival of the ship.

Effects of Destruction of Goods

You know that there are various kinds of goods and equally various ways to deliver them.

But goods can age, depreciate, perish, or be damaged. So what is the fate of the contract in such cases?

We may consider it in two ways.

Goods perishing before the contract

In the case of a contract for the sale of specific goods, that have been damaged or perished without the knowledge of the seller the contract is null and void. The reason for this being impossibility of performance. The subject matter of the contract is perished or no more there; the contract cannot be carried out.

Example A trader in cement sells 100 bags of the product. He is, however, unaware that due to extreme moisture in the warehouse the cement is hardened and is of no use for construction. The merchandise has lost its commercial value. The contract does not stand.

Criteria

- Specific or ascertained goods.

- Goods must have perished before the contract is made.

- The seller has no knowledge of the perished goods at the time of contract.

Goods perishing after the contract but before the sale

In an agreement to sell specific goods, if subsequently, the goods perish without the fault of the seller and before the ownership of the goods is transferred, the agreement is void. If the ownership or the title is already passed to the buyer then it becomes his liability.

Example: You go to the dealer to buy a car and make an agreement for sale. You have been notified that your desired car has arrived. In the meantime, someone takes it for a trial drive and crashes it. You know naturally that that particular car is not yours.

Criteria

- It must be an agreement to sell and not an actual sale.

- Goods must be specific.

- Goods must have been damaged or perished beyond the recognition of the contract.

- The destruction must take place without the fault of either party. Document of

Document of Title to Goods

In the ordinary course of business, you may receive a voucher, bill, document, receipt, cash memo, bill of lading, lorry receipt, railway receipt, dock warrant, and several such acknowledgements with which you can prove—and prove so well in a court of law—that you, and you alone, are the owner of such goods. With these you have a title to goods.

Examples with explanation

- Bill of loading: Acknowledgement receipt of goods on board of a ship which is signed by the captain of the ship or his authorized representative.

- Dock warrant: Document issued by the dock owner.

- Warehouse-keeper’s or wharfinger’s certificate: Document issued by warehouse keeper.

- Railway receipt: Document issued by railways acknowledging receipt of goods.

- Delivery order: Document of the owner of the goods to the holder of the goods asking the latter to deliver the goods to the person named in the document.

Criteria

- Must be used in the ordinary course of business.

- The undertaking to deliver the goods to the possessor of the document should be unconditional.

- The possessor of a document, by virtue of holding such a document, must be entitled to receive the goods unconditionally.

Price

- The price in a contract of sale may be fixed by the contract or maybe left to be fixed in manner thereby agreed or may be determined by the course of dealing between the parties.

- Where the price is not determined in accordance with the foregoing provisions, the buyer shall pay the seller a reasonable price. What is a reasonable price is a question of fact dependent on the circumstances of each particular case.

– Sec. 9, The Sale of Goods Act, 1930

Price is what you pay for the value of goods; what you have seen in the Contract Act as consideration.

- It is the consideration for the transfer or agreement to transfer the property in goods from the seller to the buyer.

- It is not essential that it should be fixed at the time of sale, but you know that it is always payable.

Modes of Fixing the Price

The price may be fixed in the following ways:

- Price may be fixed in contract

- When the price is not fixed by any of the above ways

- Price to be fixed by a third party

Price may be fixed in contract

The price may be fixed in contract [Section 9]: this is the usual way of fixing the price.

- The way the prices fixed may have been agreed upon in the contract of sale [Section 9 (1)].

- The price may be decided by a course of dealings between the parties [Section 9 (1)].

When the price is not fixed by any of the above ways

When the price is not fixed by any of the above ways. [Section 9 (2)]: When the price is not being fixed through an agreement of both the parties then a reasonable price is taken as the price of the contract, depending upon the prevailing circumstances of the case.

Price to be fixed by a third party

Price to be fixed by a third party [Section 10 (1)]: When a third party is brought in to fix the price and such a third party is not able to do so, then the situation will be handled depending on the reasons for which the third party has not been able to fix the price.

- If it is so, a contract shall specify the name of the third party.

- If the third party fails to specify, the contract is void but if goods are delivered to the buyer and used by him, he is required to pay a reasonable price.

- If the third party is prevented from fixing the price, a defaulting party is liable for the damages.

Precaution at Price Fixing

There are often disputes based on price. To avoid these following precautions could help:

Price escalation clause

Due to inflation, sellers often demand in their contract for a clause on price escalation. Thus the seller will be able to charge a price not at the time of contract but of the time of delivery of goods.

- Real estate dealers very often adopt this cause to offset their escalating costs.

Earnest money or security deposit

At times the buyer is asked to pay a part of the payment in advance. This works as a security for the performance of the contract.

- If the buyer fails to execute the deed, he forfeits his claim on the earnest money

- If the seller fails to deliver he would have to return the money.

Time stipulation

Time of payment is very important; it may be paid before, during, or after a contract; but it is always determined when.

Mode of payment

Any of the negotiable instruments such as cash money, cheque, or draft may be utilized for a mode of payments.

Business Law Notes

(Click on Topic to Read)

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Goods & Price: The Subject Matter of Contract of Sale | Sales of Goods Act 1930 | Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

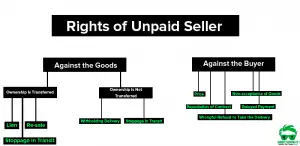

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

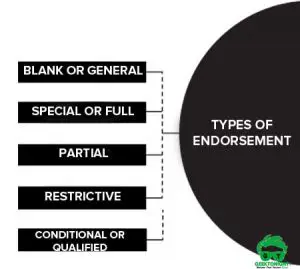

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

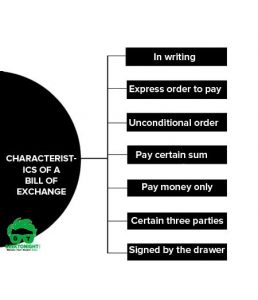

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India