The Negotiable Instruments Act was enacted, in India, in 1881. Prior to its enactment, the provision of the English Negotiable Instrument Act was applicable in India, and the present Act is also based on the English Act with certain modifications.

Table of Content

- 1 What is Negotiation of an instrument?

- 2 Definition of Negotiable Instrument

- 3 Meaning of Negotiable Instrument

- 4 Characteristics of a Negotiable Instrument

- 5 Presumptions of Negotiable Instruments

- 6 Promissory Note

- 7 Bill of Exchange

- 8 Cheque

- 9 Classification of Negotiable Instruments

- 10 Types of Negotiable Instruments

- 11 Business Law Notes

- 12 Business Law Book References

What is Negotiation of an instrument?

Negotiation of an instrument is the process by which the ownership of an instrument is transferred from one person to another.

According to Section 14 of the Act, when a note, bill or cheque is transferred to any person, so as to constitute that person the holder thereof, the instrument is said to be negotiated.

Methods of the negotiation of instrument

Two methods of the negotiation of instrument are follows:

- Negotiation by delivery: A bearer instrument may be negotiated by delivery. The delivery must be voluntary.

- Negotiation by endorsement and delivery: An order instrument can be negotiated only by way of endorsement and delivery.

Definition of Negotiable Instrument

Negotiable instrument means a promissory note or bill of exchange or cheque payable either to order or to the bearer.

Meaning of Negotiable Instrument

Negotiable instrument means an Instrument, the property in which is acquired by anyone, who takes it bonafide and for value notwithstanding any defect in the title of any prior party.

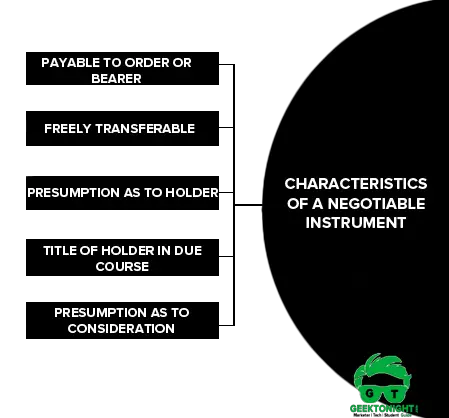

Characteristics of a Negotiable Instrument

The important characteristics of the negotiable instrument are as follows:

- Payable to order or to Bearer: It must be payable either to order or to bearer.

- Freely Transferable: An instrument payable to order is negotiable by endorsement and delivery and an instrument payable to bearer is negotiable by mere delivery.

- Presumption as to Holder: Every holder of a negotiable instrument is presumed to be a holder in due course.

- Title of Holder in due Course Free from all Defects: A holder in due [i.e., the person who became the possessor of a negotiable instrument before maturity, for valuable consideration and in good faith) gets the instrument free from all defects in the title of the transferor.

- Presumption as to Consideration: Every negotiable instrument is presumed to have been made, drawn, accepted, endorsed, negotiated or transferred for consideration.

Presumptions of Negotiable Instruments

These presumptions need not be proved as they are presumed to exist in every negotiable instrument. Until the contrary is proved the following presumptions shall be made in case of all negotiable instruments:

- Of consideration

- as to date

- as to time of acceptance

- as to time of transfer

- as to order of indorsements

- as to stamp

- that holder is a holder in due course

Of consideration

Of consideration that every negotiable instrument was made or drawn for consideration, and that every such instrument, when it has been accepted, endorsed, negotiated or transferred, was accepted, endorsed, negotiated, or transferred for consideration;

as to date

as to date that every negotiable instrument bearing a date was made or drawn on such date;

as to time of acceptance

as to time of acceptance that every accepted bill of exchange was accepted within a reasonable time after its date and before its maturity;

as to time of transfer

as to time of transfer that every transfer of a negotiable instrument was made before its maturity;

as to order of indorsements

as to order of indorsements that the indorsements appearing upon a negotiable instrument were made in the order in which they appear thereon;

as to stamp

as to stamp that a lost promissory note, bill of exchange or cheque was duly stamped;

that holder is a holder in due course

that holder is a holder in due course that the holder of a negotiable instrument is a holder in due course provided that, where the instrument has been obtained from its lawful owner, by means of an offence or fraud, or has been obtained from the maker or acceptor thereof by means of an offence or fraud, or for unlawful consideration, the burden of proving that the holder is a holder in due course lies upon him.

Promissory Note

Promissory Note, on the other hand, is a promise to pay a certain amount of money within a stipulated period of time. And the promissory note is issued by the debtor.

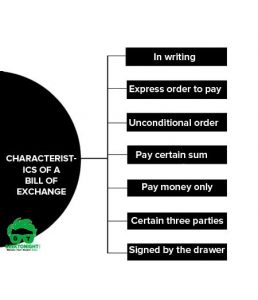

Bill of Exchange

Bill of exchange is an instrument ordering the debtor to pay a certain amount within a stipulated period of time. Bill of exchange needs to be accepted in order to call it valid or applicable. And the bill of exchange is issued by the creditor.

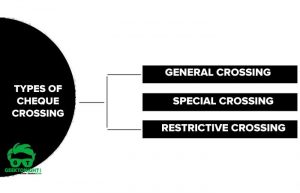

Cheque

A cheque is a bill of exchange, drawn on a specified banker and it includes “the electronic image of a truncated cheque“ and “a cheque in electronic form“.

Classification of Negotiable Instruments

Broadly, Negotiable instruments are classified into 4 types.

- Based on Transfer (Bearer, Order)

- Based on payment (Demand, Time)

- Based on Location (Inland, Foreign)

- Other Instruments (Ambiguous, Inchoate)

Types of Negotiable Instruments

8 major types of negotiable instruments are discussed below:

- Bearer instrument

- Order instrument

- Demand instrument

- Time instrument

- Inland instrument

- Foreign instrument

- Ambiguous instrument

- Inchoate Instrument

Business Law Notes

(Click on Topic to Read)

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Negotiable Instruments Act 1881 | Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India