Application of Payment of Wages Act 1936

The Act will apply to persons employed in any factory or employed (otherwise than in a factory) upon any railway by a railway administration or, either directly or through a sub-contractor, by a person fulfilling a contract with a railway administration, and to persons employed in an industrial or other establishments.

Here “factory” means a factory as defined in section 2(m) of the Factories Act, 1948 (63 of 1948) and includes any place to which the provisions of that Act have been applied under section 85(1) thereof.

Table of Content

This Act applies to wages payable to an employed person in respect of a wage period if such wages for that wage period do not exceed Rs 6500/- per month or such other higher sum which, on the basis of figures of the Consumer Expenditure Survey published by the National Sample Survey Organisation, the Central Government may, after every five years, by notification in the Official Gazette, specify”.

Meaning of wages

“Wages” means all remuneration (whether by way of salary, allowances, or otherwise) expressed in terms of money or capable of being so expressed which would, if the terms of employment, express or implied, were fulfilled, be payable to a person employed in respect of his employment or of work done in such employment, and includes:

- Any remuneration payable under any award or settlement between the parties or order of a court;

- Any remuneration to which the person employed is entitled in respect of overtime work or holidays or any leave period;

- Any additional remuneration payable under the terms of employment (whether called a bonus or by any other name);

- Any sum which by reason of the termination of employment of the person employed is payable under any law, contract or instrument which provides for the payment of such sum, whether with or without deductions, but does not provide for the time within which the payment is to be made;

- Any sum to which the person employed is entitled under any scheme framed under any law for the time being in force, But does not include106.

Responsibility for Payment of wages

Every employer shall be responsible for the payment of all wages required to be paid under this Act to persons employed by him and in case of persons employed:

- In factories, if a person has been named as the manager of the factory under clause (f) of subsection (1) of section 7 of the Factories Act, 1948 (63 of 1948);

- In industrial or other establishments, if there is a person responsible to the employer for the supervision and control of the industrial or other establishments;

- Upon railways (other than in factories), if the employer is the railway administration and the railway administration has nominated a person in this behalf for the local area concerned;

- In the case of contractor, a person designated by such contractor who is directly under his charge;

Wage period for payment of wages

The person responsible for payment of wages shall decide the wage period. But the period shall not exceed one month.

The wages of every person employed upon or in any railway, factory or industrial or other establishment upon or in which less than 1000 persons are employed, shall be paid before the expiry of the 7th day after the last day of the wage-period in respect of which the wages are payable Any other railway, factory or industrial or other establishment that is where more than 1000 people are employed, shall be paid before the expiry of the 10th day, after the last day of the wage-period in respect of which the wages are payable.

In the case of persons employed on a dock, wharf or jetty or in a mine, the balance of wages found due on completion of the final tonnage account of the ship or wagons loaded or unloaded, as the case may be, shall be paid before the expiry of the 7th day from the day of such completion.

Where the employment of any person is terminated by or on behalf of the employer, the wages, earned by him shall be paid before the expiry of the 2nd working day from the day on which his employment is terminated.

But where the employment of any person in an establishment is terminated due to the closure of the establishment for any reason other than a weekly or other recognized holiday, the wages earned by him shall be paid before the expiry of the 2nd day from the day on which his employment is so terminated.

Maintenance of registers and records

It is the responsibility of the employer to maintain such registers and records giving particulars of persons employed by him, the work performed by them, the wages paid to them, the deductions made from their wages and such other particulars. Every record and register maintained shall be preserved for a period of 3 years after the date of last entry made therein.

Penalties

- Whoever being required under this Act to maintain any records or registers or to furnish any information or return

- Fails to maintain such register or record; or

- Willfully refuses or without lawful excuse neglects to furnish such information or return; or

- Willfully furnishes or causes to be furnished any information or return which he knows to be false; or

- refuses to answer or willfully gives a false answer to any question necessary for obtaining any information required to be furnished under this Act, shall, for each such offence, be punishable with fine which shall not be less than Rs 1500/- one but which may extend to Rs 7500/-.

2. Whoever-

- Willfully obstructs an Inspector in the discharge of his duties under this Act; or

- refuses or willfully neglects to afford an Inspector any reasonable facility for making any entry, inspection, examination, supervision, or inquiry authorized by or under this Act in relation to any railway, factory or industrial or other establishment; or

- Willfully refuses to produce on the demand of an Inspector any register or other document kept in pursuance of this Act; or

- prevents or attempts to prevent or does anything which he has any reason to believe is likely to prevent any person from appearing before or being examined by an Inspector acting in pursuance of his duties under this Act; shall be punishable with fine which shall not be less than Rs 1500/-one but which may extend to Rs. 7500/

3. If any person who has been convicted of any offence punishable under this Act is again guilty of an offence involving contravention of the same provision, he shall be punishable on a subsequent conviction with imprisonment for a term which shall not be less than one month but which may extend to six months and with fine which shall not be less than Rs 3750/- but which may extend to Rs 22500/-.

4. If any person fails or willfully neglects to pay the wages of any employed person by the date fixed by the authority in this behalf, he shall, without prejudice to any other action that may be taken against him, be punishable with an additional fine which may extend to Rs 750/- for each day for which such failure or neglect continues.

Payment in case of death of the employed person whose wages are not disbursed

Where the amount payable to an employed person as wages could not be paid on account of his death before payment or on account of his whereabouts not being known;

Be paid to the person nominated by him in this behalf. 2. Where no such nomination has been made or where for any reasons such amount cannot be aid to the person nominated, be deposited with the prescribed authority.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

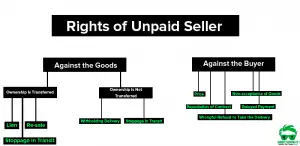

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

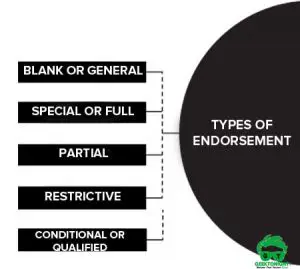

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

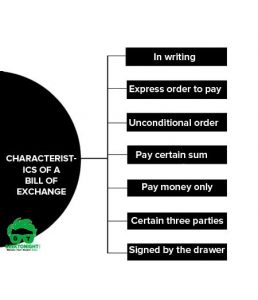

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India