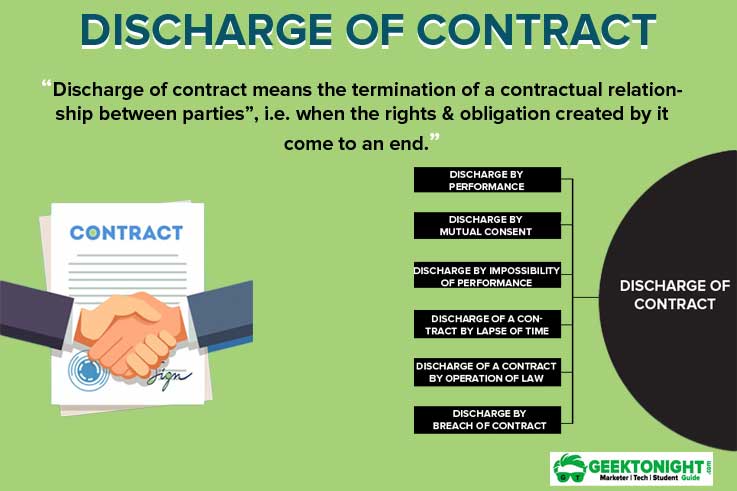

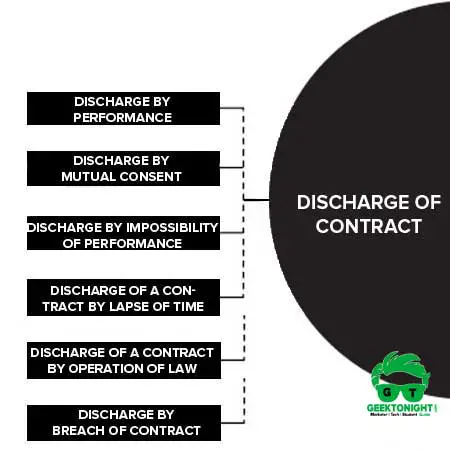

What is Discharge of Contract?

Discharge of contract means the termination of a contractual relationship between parties. A contract is said to be discharged when it ceases to operate, i.e. when the rights & obligations created by it come to an end.

Table of Content

- 1 What is Discharge of Contract?

- 2 Discharge of Contract Meaning

- 3 Modes of Discharge of Contract

- 4 Business Law Notes

- 5 Business Law Book References

Discharge of Contract Meaning

Discharge of a contract means termination of contractual relation between the parties to a contract.

Modes of Discharge of Contract

The contract may be discharged in the following six modes of discharge of contract discussed as follows:

- Discharge by performance

- Discharge by mutual consent or agreement

- Discharge by impossibility of performance

- Discharge of a contract by lapse of time

- Discharge of a contract by operation of law

- Discharge by breach of contract

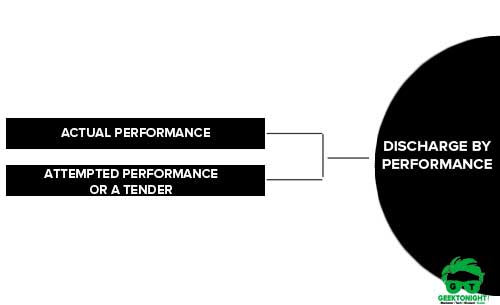

Discharge by performance

Performance of a contract is the principal and most usual mode of discharge of a contract.

Discharge by performance may be:

Actual Performance

Actual performance means the parties to a contract have performed their respective promises under the contract.

Attempted Performance or a Tender

Attempted performance or a tender means the promisor has made an

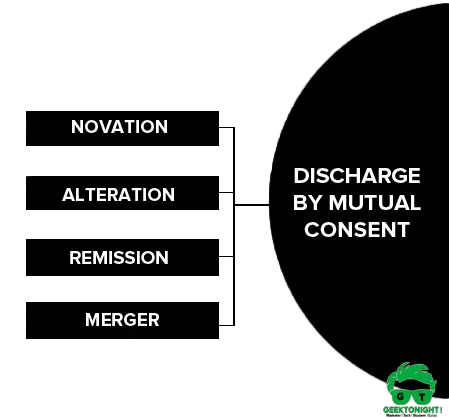

Discharge by Mutual Consent or agreement

A contract can be discharged by mutual agreement in any of the following ways.

Novation

The term novation implies the substitution of a new contract for the original one.

Example: A owed Rs 100 to B, under contract. B owned Rs 100 to C. It was agreed among A, B and C that A would pay Rs 100 to C.

Alteration

It refers to a change in one or more of the terms of a contract with the consent of all the contracting parties.

Example: A agreed with B to supply 100 TV sets at a certain price by the end of October. Subsequently, ‘A’ and ‘B’ mutually agree that the supply can be made by the end of November. This is an alteration in the terms of the contract by consent of both the parties.

Remission

Remission means the acceptance (by the promisee) of a lesser sum than what was contracted for, or a lesser fulfilment of the promise made.

Example: A owes B Rs 5,000. A pays Rs 2,000 to B and B accepts the amount in satisfaction of the whole debt. The whole debt is discharged.

Merger

The conversion of the inferior right into the superior right is called a merger. It is also called as the vesting of rights and liabilities in the same person.

Example: A person holds property under lease, purchases the property. On purchase, his lease agreement is discharged.

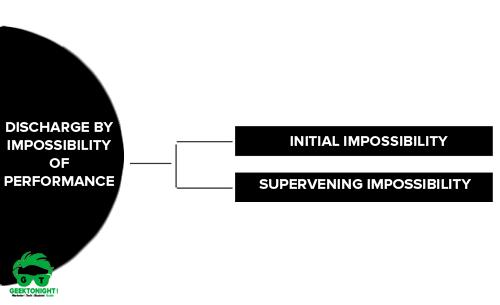

Discharge by Impossibility of Performance

Sometimes after a contract has been established, something might occur, though not at the fault of either party, which can render the contract impossible to perform, or illegal, or radically different from that originally undertaken, which leads to discharge of contract.

The impossibility of performance may be of two:

Initial impossibility

Initial impossibility or Pre-contractual impossibility: It means impossibility exists at the time of making a contract.

The initial impossibility may be:

- Known or

- Unknown to the parties at the time of making the agreement.

Supervening impossibility

Supervening impossibility or Post-contractual impossibility: The contract becomes void on account of the subsequent impossibility only if the following conditions are satisfied:

- The act should have become impossible after the formation of the contract.

- The impossibility should have been caused by a reason of some event which was beyond the control of the promissory.

- The impossibility must not be the result of some act or negligence of the promisor himself.

Discharge of a contract by lapse of time

Every contract and promise under the contract should be performed within a time limit. The contract is discharged if it is not performed or enforced within a specified period called the period of limitation.

Example: The period of limitation for recovering the debt is 3 years and 12 years for the recovery of immovable property.

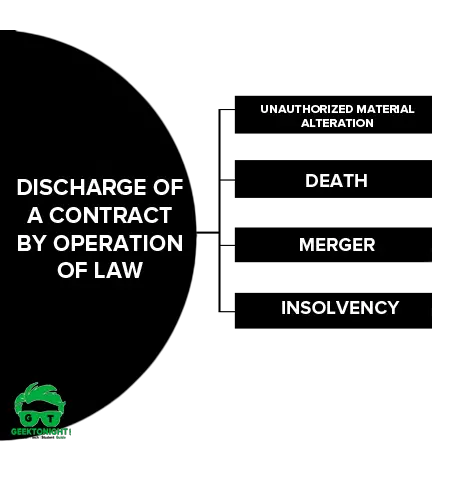

Discharge of a contract by operation of law

In the following circumstances, the discharge of contract by the operation of law.

A party can treat a contract discharged (i.e., from his side) if the other party alters a term (such as quantity or price) of the contract without seeking the consent of the former.

Death

The contract that requires personal skill is discharged on the death of the promisors. However, any benefit received before the performance shall be returned by the legal representative of the deceased party.

Merger

The conversion of the inferior right into the superior right is called a merger. It is also called as the vesting of rights and liabilities in the same person.

Insolvency

The insolvent is discharged from all the liabilities on all the contracts, entered into, up to the date of insolvency.

Discharge by breach of contract

Breach occurs where one party to a contract fails to perform its contractual obligations, or the performance is defective, which leads to a discharge of contract.

A Breach may be:

Anticipatory

Anticipatory is also known as ‘breach by repudiation’. Where a person repudiates a contract before the stipulated due date.

For instance, A, after agreeing to sell his car to B on a fixed date, sells it to C. This is an anticipatory breach.

Actual breach

Actual breach refers to the failure to perform contractual obligations when performance is due.

Business Law Notes

(Click on Topic to Read)

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

FAQ

Business Law is also known as Commercial law or corporate law, is the body of law that applies to the rights, relations, and conduct of persons and businesses engaged in commerce, merchandising, trade, and sales.

The Indian Contract Act is divisible into two parts.

The first part (Section 1-75) deals with the general principles of the law of contract and therefore applies to all contracts irrespective of their nature.

The second part (Sections 124-238) deals with certain special kinds of contracts, namely contracts of Indemnity and Guarantee, Bailment, Pledge, and Agency.

It is the duty of the seller to deliver the goods and of the buyer to accept and pay for them, in accordance with the terms of the contract of sale.

– Sec. 31, The Sale of Goods Act, 1930.

Sales of Goods Act 1930 came into force on 1st July 1930. It extends to the whole of India. It does not affect rights, interests, obligations and titles acquired before the commencement of the Act. The Act deals with the sale but not with mortgage or pledge of the goods.

The Sale of Goods Act, identifies the terms, “Conditions and Warranties” as being of a prime significance in a contract of sale.

Negotiable Instruments Act 1881

Negotiation of an instrument is the process by which the ownership of an instrument is transferred from one person to another.

The crossing of Cheque means that the specific cheque can only be deposited straightway into a bank account and cannot be instantly cashed by a bank or any credit institution.

Promissory Note, on the other hand, is a promise to pay a certain amount of money within a stipulated period of time. And the promissory note is issued by the debtor.

Bill of exchange is an instrument ordering the debtor to pay a certain amount within a stipulated period of time. Bill of exchange needs to be accepted in order to call it valid or applicable. And the bill of exchange is issued by the creditor.

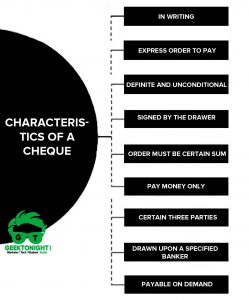

A cheque is a bill of exchange, drawn on a specified banker and it includes ‘the electronic image of truncated cheque’ and ‘a cheque in electronic form’.

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Discharge of Contract | What, Modes, Meaning Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

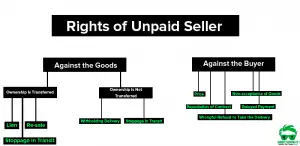

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India