Definition of Director

Directors are a body to whom the duty of managing the general affairs of the company is delegated. Sec 2(13) of the Companies Act defines Director as “any person occupying the position of director, by whatever name he may be called”.

A director is a person having control over the direction, conduct and management of the affairs of a company. Only an individual can be appointed as a director. The main reason for appointing individuals is that somebody must be held responsible for the acts of the company so that the failure can be justified.

Table of Content

Disqualification of Director

A person shall not be eligible for appointment as a director of a company, if-

- he is of unsound mind and stands so declared by a competent court;

- he is an undischarged insolvent;

- he has applied to be adjudicated as an insolvent and his application is pending;

- a person who has been convicted by a court of any offence, whether involving moral turpitude or otherwise, and sentenced in respect thereof to imprisonment for not less than six months and a period of five years has not elapsed from the date of expiry of the sentence;

- if a person has been convicted of any offence and sentenced in respect thereof to imprisonment for a period of seven years or more, he shall not be eligible to be appointed as a director in any company;

- an order disqualifying him for appointment as a director has been passed by a court or Tribunal and the order is in force;

- a person who has not paid any calls in respect of any shares of the company held by him, whether alone or jointly with others, and six months have elapsed from the last day fixed for the payment of the call;

- a person who has been convicted of the offence dealing with related party transactions under section 188 at any time during the last preceding five years; or

- a person who has not obtained director identification number.

An additional disqualification is provided in sub section (2) of Section 164 relating to consequences of non-filing of financial statements or annual returns.

Any person who is or has been director of any company which has not filed any financial statements and Annual Return for 3 continuous financial year or has defaulted in payment of debentures/deposit/dividend etc., shall also not be eligible for appointment as director of any public company and for re- appointment in the same company for a period of five years from the date on which the said company fails to do so.

Removal of Directors

Directors can be removed by:

Shareholders may pass an ordinary resolution at the general meeting to remove a director before expiry of the period of his office. Shareholders cannot remove a person from directorship when the appointment is by the Central Government or when the company follows the policy of retiring 2/3rd of directors every year.

Central Government

Central Government may remove a person from directorship on recommendation of the Company Law Board. This can be done when the director has been fraudulent, negligent or done business against company policies.

Company Law Board

To prevent mismanagement and oppression, Company Law Board can remove a person from directorship. The person involving in such acts and terminated from directorship for such behaviour cannot sue the company for damages.

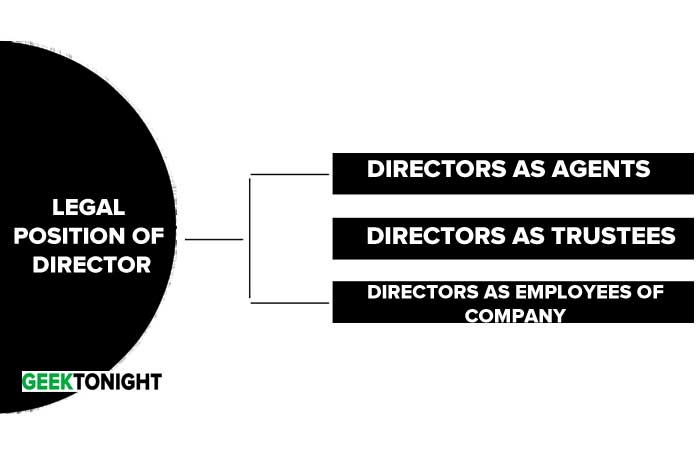

Legal Position of Director

Companies Act does not mention anything on legal position of directors. They have, at various times, been described by judges as agents, trustees or managing partners.

Directors as agents

Directors may correctly be described as agents of the company. The ordinary rules of agency will, therefore, apply to nay contract or transaction made by them on behalf of the company. Thus, where the directors contract in the name and on behalf of the company, it is the company which is liable on it and not the directors.

However, directors incur a personal liability in the following circumstances:

- Where they contract in their own names. Where the chief executive of the company executed a promissory note and borrowed an amount for the company’s sake, it could not be said that amount was borrowed by him, in his personal capacity.

- Where they use the company’s name incorrectly, e.g., by omitting the word ‘Limited’.

- Where the contract is signed in such a way that it is not clear whether it is the principle (the company) or the agent who is signing.

- Where they exceed their authority- Weeks vs Propert (1873)

Directors as trustees

Directors are regarded as trustees of the company’s assets and of the powers that vest in them because they administer those assets and perform duties in the interest of the company and not for their own personal advantage.

Directors as employees of company

Where a director accepts employment under the company under a separate contract of service, in addition to the directorship, he is also treated as an employee or servant of the company.

Duties of Directors

Section 166 of the Companies Act, 2013 prescribes the duties of a director. The duties provided under Section 166 are applicable to all type of companies and to all directors. It includes:

- To act in accordance with the articles of the company.

- To act in good faith in order to promote the objects of the company for the benefit of its members as a whole, and in the best interests of the company, its employees, the shareholders, the community and for the protection of the environment.

- To exercise his duties with due and reasonable care, skill and diligence and shall exercise independent judgment.

- Not to involve in a situation in which he may have a direct or indirect interest that conflicts, or possibly may conflict, with the interest of the company.

- Not to achieve or attempt to achieve any undue gain or advantage either to himself or to his relatives, partners, or associates and if such director is found guilty of making any undue gain, he shall be liable to pay an amount equal to that gain to the company.

- Not to assign his office and any assignment so made shall be void.

If a director of the company contravenes the provisions of this section such director shall be punishable with fine which shall not be less than Rs. 1,00,000 but which may extend to Rs. 5,00,000.

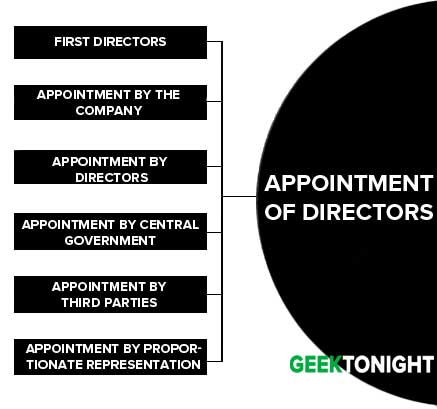

Appointment of Directors

- First Directors

- Appointment by the company

- Appointment by directors

- Appointment by Central government

- Appointment by third parties

- Appointment by proportionate representation

First Directors

Articles of Association of the company usually name the First directors by their respective names. If the Articles do not include such details, the subscribers of the Memorandum of Association become the directors of the company.

Appointment by the company

Directors must be appointed by shareholders in the general meetings. At least 1/3rd of the total number of directors must be permanent directors. The others retire by rotation at every general meeting. This is a statutory requirement which cannot be avoided.

Appointment by directors

In case of a public or a private company which is a subsidiary of a public company, if the office of any director appointed by the company is vacant, the other directors can appoint some individual as a director who shall hold the office till the next general meeting.

Causal vacancies may arise due to death, resignation, disqualification or failure of a person to accept directorship. Sometimes additional directors may be appointed by the existing directors.

The additional directors will hold the post till the next annual general meeting. An alternate director may be appointed to act on behalf of the original director during the original director’s absence.

Appointment by Central government

In order to safeguard the interest of the company/shareholders, the Central government may appoint directors who will hold the post for not more than 3 years.

Appointment by third parties

1/3rd of the total number of directors may be appointed by third parties like banking/financial institution, debenture holders or creditors of the company. Such appointment must be made once in 3 years and the provision should be provided in the Articles.

Appointment by proportionate representation

2/3rd of the directors are appointed by a single vote or cumulative votes and appointment is made once in 3 years. This method of appointment ensures that even minority shareholders are given right to vote on the board.

Business Law Notes

(Click on Topic to Read)

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Director: Definition, Disqualification, Duties, Appointment | Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

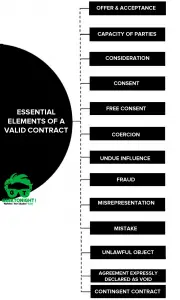

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

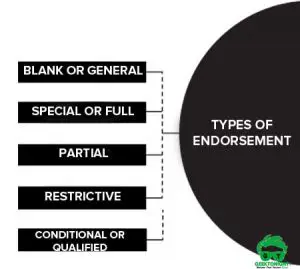

- Types of Endorsement

- What is Promissory Note?

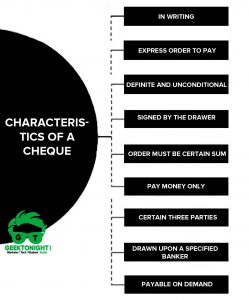

- What is Cheque?

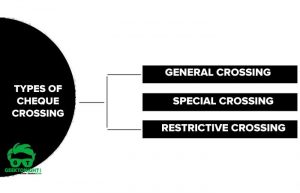

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India