What is Hire Purchase?

Hire purchase is a type of instalment credit under which the hire purchaser, called the hirer, agrees to take the goods on hire at a predetermined rental, which is inclusive of the repayment of principal as well as interest, with an option to purchase.

Under this transaction, the hire purchaser acquires the property (goods) immediately on signing the hire purchase agreement but the ownership or title of the same is transferred only when the last instalment is paid to the owner (hiree). The hirer has the right to terminate the agreement at any time before the transfer of ownership of the asset.

In other words, the hirer has the option to purchase the asset. In case hirer decide to terminate the agreement, the hirer has to either

- return the asset and avoid payment of instalment due thereafter

- pay the future instalments either fully or at a discount as mutually agreed and take ownership of the asset.

The hire purchase system is regulated by the Hire Purchase Act 1972.

This Act defines a hire purchase as “an agreement under which goods are let on hire and under which the hirer has an option to purchase them in accordance with the terms of the agreement and includes an agreement under which:

- The owner delivers possession of goods thereof to a person on condition that such person pays the agreed amount in periodic instalments.

- The property in the goods is to pass to such person on the payment of the last of such instalments, and

- such person has a right to terminate the agreement at any time before the property so passes”.

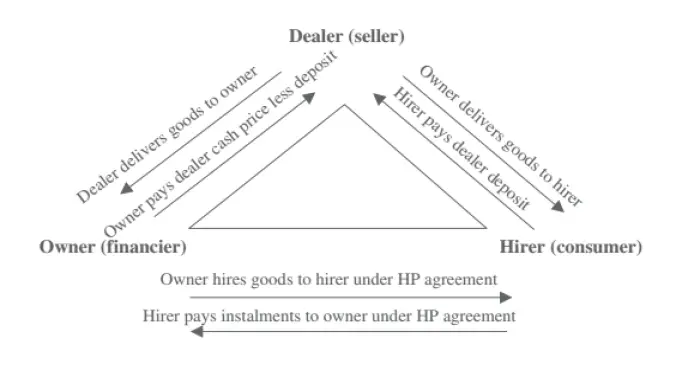

Hire purchase should be distinguished from instalment sale wherein ownership of the property passes to the purchaser with the payment of the first instalment. But in case of Hire purchase ownership remains with the seller until the last instalment is paid buyer gets ownership after paying the last instalment. The figure depicts a typical hire-purchase transaction between the parties.

Features of Hire Purchase Agreement

Hire purchase (as per Hire Purchase Act 1972, India) is a typical transaction in which the assets are allowed to be hired and the hirer is provided an option to later purchase the same assets. Following are the features of a regular hire purchase transaction:

- The person who has hire the goods will give regular installment or rent to the owner of the good which will include some portion of principal amount and some portion of interest as agreed by both the parties.

- The ownership of good passes only when the person has paid the last installment of the goods which he or she has hired.

- In case of hire purchase the person who has taken the good on hire cannot transfer the goods to a third party as he or she does not have the ownership of the goods.

- Every installment is treated as hire charge for using the asset.

- The hire vendor has the right to repossess the asset in case of difficulties in obtaining the payment of installment.

- If the hirer does not want to own the asset, he can return the assets any time and is not required to pay any installment that falls due after the return.

However, once the hirer returns the assets, he cannot claim back any payments already paid as they are the charges towards the hire and use of the assets.

Advantages of Hire Purchase

Advantages of Hire Purchase system are:

- The buyer is greatly benefited as he has to make the payment in instalments. This system is greatly advantageous to the people having limited income.

- It encourages thrift among the buyers who are forced to save some portion of their income for the payment of the instalments. This inculcates the habit to save among the people.

- The buyer need to worry about the asset depreciating quickly in value as there is no obligation to buy the asset in case of Higher Purchase.

- Hire purchasers also enjoy the tax benefit on the interest payable by them

Disadvantages of Hire Purchase

Disadvantages of Hire Purchase System are:

- Total amount paid towards the asset in case of hire purchase system is higher than the cash price of assets.

- Ownership of assets is transferred only at the end of the hire purchase agreement. The hirer cannot sale or transfers the asset till then.

- If the hired asset is no longer needed because of any change in the business strategy, there may be a resulting penalty for seller.

Difference between Leasing and Hire purchase

Essentially, both lease financing and hire purchase are the options of financing the assets. These options vary from each other in many aspects viz. ownership of the asset, depreciation, rental payments, duration, tax impact, repairs and maintenance of the asset and the extent of finance.

These are discussed as follow:

- Ownership of the Asset: In lease, ownership lies with the lessor (owner of asset). The lessee has the right to use the equipment and does not have an option to purchase. Whereas in hire purchase, the hirer has the option to purchase. The hirer becomes the owner of the asset/equipment immediately after the last installment is paid.

- Depreciation: In lease financing, the depreciation is claimed as an expense in the books of lessor. On the other hand, the depreciation claim is allowed to the hirer in case of hire purchase transaction.

- Rental Payments: The lease rentals cover the cost of using an asset. Normally, it is derived with the cost of an asset over the asset life. In case of hire purchase, installment is inclusive of the principal amount and the interest for the time period the asset is utilized.

- Duration: Generally lease agreements are done for longer duration and for bigger assets like land, property etc. Hire Purchase agreements are done mostly for shorter duration and cheaper assets like hiring a car, machinery etc.

- Tax Impact: In lease agreement, the total lease rentals are shown as expenditure by the lessee. In hire purchase, the hirer claims the depreciation of asset as an expense.

- Repairs and Maintenance: Repairs and maintenance of the asset in financial lease is the responsibility of the lessee but in operating lease, it is the responsibility of the lessor. In hire purchase, the responsibility lies with the hirer.

- Extent of Finance: Lease financing can be called the complete financing option in which no down payments are required but in case of hire purchase, the normally 20 to 25 % margin money is required to be paid upfront by the hirer. Therefore, we call it a partial finance like loans etc.

Legal Framework of Hire Purchase

There is no exclusive legislation dealing with hire purchase transaction in India. The Hire purchase Act was passed in 1972. An Amendment bill was introduced in 1989 to amend some of the provisions of the act. However, the act has been enforced so far. The provisions of are not inconsistent with the general law and can be followed as a guideline particularly where no provisions exist in the general laws which, in the absence of any specific law, govern the hire purchase transactions. The act contains provisions for regulating:

• The format / contents of the hire-purchase agreement

• Warrants and the conditions underlying the hire-purchase agreement,

• Ceiling on hire-purchase charges,

• Rights and obligations of the hirer and the owner.

In absence of any specific law, the hire purchase transactions are governed by the provisions of the Indian Contract Act and the Sale of Goods Act.

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting