What is Mutual Funds?

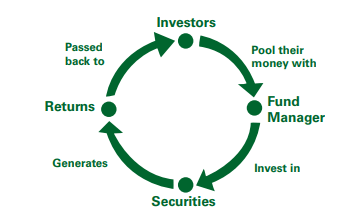

A mutual fund called the financial intermediary serves as a link between the investor and the securities market by mobilizing savings from the small investors and investing them in the securities market as per the scheme or investment objective to generate returns.

In fact, a mutual fund is a professionally managed investment company that combines the funds of many individuals and invests this “pooled” money in a wide variety of different securities as per the stated objective.

Table of Content

Thus, by pooling the money of many individuals mutual funds are able to provide the diversification and professional management to the investors. A fund is “mutual” as all of its returns are shared by the investors of the fund.

These professional managers who run mutual funds invest the collected money in a wide variety of stocks, bonds, government securities such as Treasury Bond etc. depending on the investment objective (scheme objective) of the particular fund. The investment objective of the fund guides the managers in selecting the various securities for a particular fund.

Further, investment objective of the mutual fund also guides the investors on which funds to invest the money. As different investors have different objectives, there are a number of different kinds of mutual funds (growth, balanced, income etc.).

Mutual Funds Definition

From the above definition, the following two important points can be observed as follows:

- A mutual fund can raise money through sale of units to the public;

- A mutual fund can be set up in form of Trust under the Indian Trust Act, 1882.

Thus, a mutual fund is a trust that pools the savings of several investors and then invests these into different kinds of securities (shares, debentures, money market instruments, or a combination of these) in keeping with a pre-stated investment objective.

The income thus generated and the capital appreciation is distributed among mutual fund unit holders in proportion to the number of units held by them. Figure exhibit the working of mutual funds.

Advantages of Mutual Funds

Mutual funds provide many benefits to investors, especially for small investors. These advantages are as follow:

- Professional management

- Portfolio diversification

- Liquidity

- Reduced transaction costs

- Tax benefits

- Transparency

- Good regulation

- Convenient administration

- Return potential

- Flexibility and choice of schemes

- Affordability

Professional management

Mutual funds are managed by professional fund managers, who employ their experience and skills in managing the funds of individuals and institutions that may not have the knowledge, time and skills to cope with the complexities of investment in capital market.

These professionals use their experience and skills to conduct investment research, and to analyse the performance and prospects of various instruments before selecting a particular investment.

The selection of securities for the portfolios is an intellectual exercise comprising a lot of equity research. Thus, by investing in mutual funds, you can avail of the services of professional fund managers, which would otherwise be costly for an individual investor.

Portfolio diversification

Diversification involves the mixing of investments within a portfolio and is used to manage risk. To achieve a truly diversified portfolio, you may have to buy stocks with different capitalizations from different industries and bonds with varying maturities from different issuers.

For the individual investor, this can be quite costly. By purchasing mutual funds, you are provided with the immediate benefit of instant diversification and asset allocation without the large amounts of cash needed to create individual portfolios.

Thus, by investing in mutual funds, an investor can avail of the benefits of diversification and asset allocation, without investing the large amount of money that would be required to create an individual portfolio to reduce market risk.

Liquidity

Mutual funds are typically very liquid investments. Unless they have a pre-specified lock-in, your money will be available to you anytime you want. Typically funds take a couple of days for returning your money to you. Since they are very well integrated with the banking system, most funds can send money directly to your banking account.

Reduced transaction costs

As compared to direct investment in the stock market, investment through the mutual funds is relatively less expensive. This is due to the benefit of economies of scale (larger quantities) associated with the mutual fund which is passed on to the investors.

Since, mutual funds collect money from millions of investors, they achieve economies of scale. The cost of running a mutual fund is divided between a larger pool of money and hence mutual funds are able to offer the investors a lower cost alternative of managing funds.

Tax benefits

The income tax act 1961 provides some tax deductions and exemptions to the mutual funds. The mutual funds can be designed to suit the tax payers’ needs. A large number of mutual funds are offering various schemes to the investor to ensure tax benefits.

Transparency

Mutual funds in India declare their portfolio every month. Thus an investor knows where his/her money is being deployed and in case they are not happy with the portfolio they can withdraw at a short notice as per the scheme invested.

Good regulation

The activities of Mutual funds in India are regulated and monitored by the Securities and Exchange Board of India (SEBI), which strives to protect the interests of investors.

As per SEBI guidelines, mutual funds are required to provide investors with regular information about their investments, in addition to other disclosures like specific investments made by the scheme and the proportion of investment in each asset class. These regulations ensure transparency in the operations of mutual funds in India.

Convenient administration

Investing in a mutual fund reduces paperwork and helps you avoid many problems such as bad deliveries, delayed payments and unnecessary follow up with brokers and companies. Mutual Funds save your time and make investing easy and convenient.

Return potential

Mutual funds are managed by professional fund managers who take right investment decisions as per the market conditions. Thus, over a medium to long term, Mutual funds have the potential to provide a higher return as they invest in a diversified basket of selected securities.

Flexibility and choice of schemes

Mutual funds in India offer a variety of plans, such as regular investment, regular withdrawal and dividend reinvestment plans. Through innovative features such as Systematic Investment Plans (SIP), Systematic Withdrawal Plans (SWP) and dividend reinvestment plans, you can systematically invest or withdraw funds according to your needs and convenience.

By offering innovative funds like Exchange Traded funds (ETF), Gold ETFs and Art funds, mutual fund provide greater flexibility to their investors.

Affordability

As a small investor, you may find that it is not possible to buy shares of larger corporations. Mutual funds generally buy and sell securities in large volumes which allow investors to benefit from lower trading costs.

The smallest investor can get started on mutual funds because of the minimal investment requirements. You can invest with a minimum of Rs.500 in a Systematic Investment Plan on a regular basis.

Structure of Mutual Funds

A mutual fund is set up in the form of a trust, which has sponsor, trustees, asset management company (“AMC”), transfer agent and a custodian. Exhibit 3.4 represents a typical structure of mutual fund India.

Mutual funds have organization structure as per the Security Exchange Board of India’s guidelines. Security Exchange Board of India (SEBI) specified authority and responsibility of different parties of mutual fund.

Following parties are involved in Functioning of Mutual funds.

- Sponsor: The sponsor is like to a promoter of a company as he gets the mutual fund registered with SEBI. The sponsor is defined under SEBI regulations as a person who, acting alone or in combination with another body corporate, establishes a mutual fund. The sponsor forms a trust, appoints the board of trustees, and has the right to appoint the asset management company (AMC) or fund manager.

Under the provisions of the Mutual Fund Regulations by SEBI, the sponsor is required to have a sound track record, a reputation of fairness and integrity in all his business transactions. Further, the sponsor should contribute at least 40% to the net worth of the AMC.

However, if any person holds 40% or more of the net worth of an AMC shall be deemed to be a sponsor and will be required to fulfil the eligibility criteria as specified in the SEBI MF Regulations. - Trustee company/ board of trustee: Every mutual fund is required to have an independent Board of Trustees. In any case, two thirds of the trustees should be independent persons who are not associated with the sponsors in any manner whatsoever.

The mutual fund can be managed by a board of trustees or a trust company. The board of trustees is governed by the Indian Trust Act whereas a trust company is governed by the Companies Act, 1956. The trustees act as a protector of unitholders interests.

In case a company is appointed as a trustee, then its directors can act as trustees of any other trust provided that the object of such other trust is not in conflict with the object of the mutual fund. Trustee or Board of Trustee do not directly manage the portfolio of securities and appoint an Asset Management Company for fund management.

If an AMC wishes to float new schemes, it will need to be approved by the trustees. Trustees play a critical role in ensuring full compliance with regulatory requirements. - Asset management company (AMC): An asset management company is a company registered under the Companies Act, 1956. Also known as fund manager, AMC is appointed by Board of Trustee to manage the investor money or fund corpus.

An AMC functions under the supervision of its own board of directors and also under the directions of trustees along with SEBI. The trustees enter into an agreement with the AMC known as ‘Investment Management Agreement’, which contains all the functions, duties and rights of the AMC as an Investment Manager.

The major obligations of AMC include: ensuring investments in accordance with the trust deed, providing information to unit holders on matters that substantially affect their interests, adhering to risk management guidelines as given by the Association of Mutual Funds in India(AMFI) and SEBI, timely disclosures to unit holders on sale and repurchase, NAV, portfolio details, etc. - Custodian: The fund management includes buying and selling of securities in large volumes. Therefore, keeping a track of such transactions is a specialist function.

The mutual fund is required to appoint a custodian to carry out the custodial services for the mutual fund. Only companies/institutions with substantial organizational strength, service capability in terms of computerization and other infrastructure facilities are approved by SEBI to act as custodians.

The custodian must be totally delinked from the AMC and must be registered with SEBI. The custodian is appointed by trustees for the safekeeping of physical securities while dematerialized securities holdings are held in a depository through a depository participant. The custodian and depositories work under the instructions of the AMC, although under the overall direction of trustees. - Registrar and transfer agents: These are responsible for issuing and redeeming units of the mutual fund as well as providing other related services, such as preparation of transfer documents and updating investor records. A fund can carry out these activities in-house or can outsource them. If it is done internally, the fund may charge the scheme for the service at a competitive market rate.

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting