What is Credit Rating?

Credit rating involves analysis and assessment of companies and government that issues securities for raising finance from various markets.

The credit rating agencies collects the data from various sources about the issuer of securities, the market in which issuer operates, the overall economy etc. and provides guidance to the investors in matter of credit risk associated with the securities so that the investor can take informed decisions.

Therefore, credit rating agencies are specialized institutions that evaluate the issuer of securities for raising funds and assign a rating or grade according to creditworthiness of the issuer.

Table of Content

Credit rating expresses the rating agency’s opinion about the ability and willingness of an issuer (borrower), such as a corporation or government, to meet its financial obligations when due.

These credit ratings are provided by organizations such as Standard & Poor’s, Moody’s, ICRA, CRISIL and CARE etc. commonly called credit rating agencies, which specialize in evaluating credit risk of the issuer of the securities.

Each agency applies its own methodology/framework in measuring creditworthiness of the issuer and uses a specific rating scale to publish its ratings opinions about the borrower. Normally, these ratings are expressed as letter grades that range, for example, from ‘AAA’ to ‘D’ to communicate the agency’s opinion of relative level of credit risk associated with a particular security issued by an issuer.

The need for credit rating arises because of difference in the information available to issuer of securities (the borrower of funds) and the investor (the lender of funds) about the creditworthiness of the borrower. The difference of information between borrower and lender is also called information asymmetry. It arises because of non-availability or partial availability of information to the investors about the securities or borrower of funds.

Factors Affecting Credit Rating

Credit rating depends on the various factors as various agencies use different formulas to calculate a credit rating but most are based on the following factors:

- Payment history: Payment history indicates how company has managed various payments in the past. How timely payments are made to the lender, creditor and other suppliers. Records of late payments on current and past credit accounts will lower company’s credit rating.

- Public records: Public records about the events such as bankruptcies, negative judgments from legal authorities can lower the credit rating of company.

- Duration of credit history: Longer credit history is better for the company and it result into better credit rating.

- New accounts: In general, opening of multiple new accounts in a short period may lower the credit rating of company.

Functons of Credit Rating Agencies

Credit rating agencies (CRAs) helps the investors to take more informed decision by providing assessment about the company. However, credit rating is not a recommendation on whether or not to buy a debt instrument. Credit rating is a powerful tool to assist the investor in arriving at a decision about the worth of a company proposing to offer a debt instrument. The main functions of credit rating agencies are as follows:

- Credit rating agencies credit awareness about the issuing company’s debt instrument to prospective investors.

- Providing key inputs helpful in taking investment decision.

- CRAs services as a guide about the company coming out with the issue.

- It provides a performance benchmark independent evaluation of the business and financial performance of a company.

- It provides user- friendly symbols instead of complex financial structures.

- It monitors and disseminates credit opinions on the rated companies/ securities in a timely and efficient manner.

- CRAs bridge the information gap between issuer and investors.

Types of Credit Rating

A credit rating reflects current opinion on the relative likelihood of timely payment of interest and principal on the rated obligation. It is an unbiased, objective, and independent opinion as to the issuer’s capacity to meet its financial obligations.

The following are the common types of credit rating:

- Sovereign credit rating: It is credit rating of a sovereign entity, i.e., government. The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors looking to invest abroad.

- Credit Rating of Real Estate Builders and Developers: Housing and real estate form the backbone of the country’s infrastructure, and are critical drivers of economic development. With government policies emphasising faster economic growth, the real estate sector is attracting large investments from both domestic and foreign investors.

Investors and customers, however, need to exercise caution in their exposure, as the sector is largely unorganized. Recently, credit rating agencies have started assigning rating to the builders and developers with the objective of helping and guiding prospective real estate buyers.

National developers rating and Real estate rating are example of credit rating provided by CRISIL. - Corporate Debt credit rating: The credit rating of a corporation is a financial indicator to potential investors of debt securities such as bonds. Credit rating is usually of a financial instrument such as a bond, secured debt, debentures and rather than the whole corporation.

- Equity rating or IPO grading: Equity grading is the grade assigned by a Credit Rating Agency (CRAs) registered with SEBI, to the initial public offering (IPO) of equity shares or any other security which may be converted into or exchanged with equity shares at a later date.

The grade represents a relative assessment of the fundamentals of that issue in relation to the other listed equity securities in India.

Such grading is generally assigned on a five point scale with a higher score indicating stronger fundamentals and vice versa as below:- IPO grade 1 Poor fundamentals

- IPO grade 2 Below Average fundamentals

- IPO grade 3 Average fundamentals

- IPO grade 4 Above average fundamentals

- IPO grade 5 Strong fundamentals

Credit Rating Process

Credit rating process starts with the receipt of formal request from a company desirous of having its issue obligations rated by credit rating agency. Rating agency regularly monitors all ratings with reference to new political, economic and financial developments and industry trends.

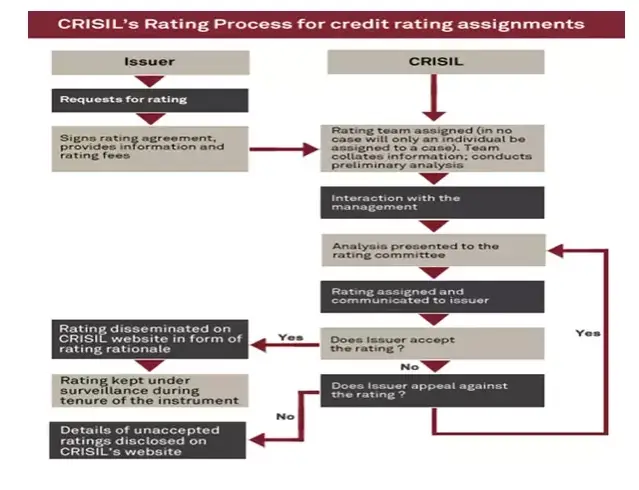

Figure depicts the credit rating procedure followed by CRISIL India. The process/ procedure followed by all the major credit rating agencies in India are almost similar and usually comprises of the following steps.

- Receipt of the request: The rating process begins, with the receipt of formal request for rating from a company desirous of having its issue obligations under proposed instrument rated by credit rating agencies.

An agreement is entered into between the rating agency and the issuer company. The agreement spells out the terms of the rating assignment and covers the following aspects: - Assignment to analytical team: On receipt of the above request, the rating agency assigns the job to an analytical team. The team usually comprises of two members/analysts who have expertise in the relevant business area and are responsible for carrying out the rating assignments.

- Obtaining information: The analytical team obtains the requisite information from the client company. Issuers are usually provided a list of information requirements and broad framework for discussions.

These requirements are derived from the experience of the issuers business and broadly confirms to all the aspects which have a bearing on the rating. The analytical team analyses the information\ relating to its financial statements, cash flow projections and other relevant information. - Plant visits and meeting with management: To obtain classification and better understanding of the client’s operations, the team visits and interacts with the company’s executives. Plants visits facilitate understanding of the production process, assess the state of equipment and main facilities, evaluate the quality of technical personnel and form an opinion on the key variables that influence level, quality and cost of production.

A direct dialogue is maintained with the issuer company as this enables the rating agencies to incorporate non-public information in a rating decision and also enables the rating’ to be forward looking.

Meting typically cover information about competitive position, strategies, financial policies, historical performance, risk profile and strategies in addition to reviewing financial data. - Presentation of findings: After completing the analysis, the findings are discussed at length in the internal committee, comprising senior analysts of the credit rating agency. All the issue having a bearing on rating are identified. An opinion on the rating is also formed. The findings of the team are finally presented to Rating Committee.

- Rating committee meeting: This is the final authority for assigning ratings. The rating committee meeting is the only aspect of the process in which the issuer does not participate directly. The rating is arrived at after composite assessment of all the factors concerning the issuer, with the key issues getting greater attention.

- Communication of decision: The assigned rating grade is communicated finally to the issuer along with reasons or rationale supporting the rating.

The ratings which are not accepted are either rejected or reviewed in the light of additional facts provided by the issuer. The rejected ratings are not disclosed and complete confidentiality is maintained. - Dissemination to the public: Once the issuer accepts the rating, the credit rating agencies disseminate it through printed reports to the public.

- Monitoring for possible change: Once the company has decided to use the rating, CRAs are obliged to monitor the accepted ratings over the life of the instrument. The CRA constantly monitors all ratings with reference to new political, economic and financial developments and industry trends.

All this information is reviewed regularly to find companies for, major rating changes. Any changes in the rating are made public through published reports by CRAs.

Source: https://www.crisil.com/ratings/rating-process.html

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting