What is Posting?

Posting means a process in which all information in the journal is transferred to the relevant ledger accounts. There is a specific procedure to transfer these entries. In the preceding section, you studied the format of a ledger. The entries need to be classified systematically and accurately or it may not serve the purpose of the Ledger.

There are two parts in the ledger the debit part and the credit part. The debit part comes first, i.e., at the left-hand side and the credit part comes later which is at the right-hand side. Let us now learn about the rules of posting.

Table of Content

Ledger is the most important book of accounts and is also known as the principal book of accounts. It has accounts of all the heads and gives the summary of each account with the balances and totals at a glance to take business decisions. Therefore, to have this total and accurate information, all journal entries must be recorded in the ledger accounts of different accounts.

The ledger includes all accounts, which are:

- Individual assets accounts, for example, machinery account, furniture account, land and building account if not separable. If separable, then land account different and building account separate, and so on.

- Individual revenue accounts, for example, income from sale of books, income from teaching, income from counselling, and so on

- Individual expense accounts, for example, stationery account, travelling account, office expenses account, salary account, rent account, electricity account, tax account, and so on.

- Individual liabilities account, for example, loan account, each creditors account separate, expenses outstanding not paid, and so on.

- Capital account, for example, in case of proprietorship only one capital account is recorded, but if it is a partnership firm, individual partners or members capital account is recorded. In case of corporates, equity shareholders account, preference shareholders account, etc., are maintained

When all entries are posted from the journal to the ledger, you get the desired information. Therefore, the journal is the original book of entry while the ledger is the final book of entry because it gives us the final position of accounts.

Rules of Posting

A summary of the basic rules for posting in a ledger are as follows:

- A separate account for each head should be maintained in the ledger as per the journal entry. Referring from journal entries in examples given in the preceding sections, Machinery account, Bank account and Depreciation account were created.

Therefore, an individual ledger account has to be created for all these heads. - The ledger should always be marked with the account name followed by marking the debit side as Dr. and credit side as Cr. The account name heading must be in the middle of the ledger. Debit should be in the extreme left and credit should be in the extreme right.

- The posting done on the debit side of the ledger should start with words “To” and all postings done on the credit side of the ledger should start with the words “By”.

- Items on the debit side of the journal entry should be posted on the credit side of the ledger and the items on the credit of the journal entry should be posted on the debit side of the ledger.

- After posting all entries in the ledger, calculate the total of the debit and credit sides.

- If the total debits are more than the credits, the difference amount is written as balance carried down on the credit side of the ledger. Similarly, if the credits are more than the debits, then the difference amount is written as balance carried down (c/d) on the debit side of the ledger.

- In the next accounting period, the same amount which was recorded as balance carried down on the credit side will be recorded as balance brought forward on the debit side to start a fresh period.

Similarly, if some amount was recorded as balance carried down on the debit side, it will be recorded as balance brought forward on the credit side to start a fresh period.

Posting Compound Entry

When in a transaction only two accounts are involved, it is a simple entry. For example, cash received from Maya ₹ 5,000 against the sale of tea of ₹ 5000. Here, only two accounts are affected cash account and sales account to the same extent of amount. Therefore, the entry is:

| Cash A/c | Dr. ₹ 5000 | |

| To Sales A/c (Being sale of tea to Maya) | ₹ 5000 |

But where more than two accounts are involved in one single transaction and there is only one journal entry made, it is said to be a compound entry. There can be two accounts in the debit and one in the credit or one in the debit and two in credit part. However, the rule of posting is the same in this case too, but care should be taken while posting the amounts.

For example, cash received from Maya ₹ 4500 against the sale of tea ₹ 5000 in full settlement.

| Cash A/c | Dr. 4500 | |

| Discount A/c | Dr. 500 | |

| To Sales A/c (Being sale of tea to Maya and account settled after discount) | 5000 |

There are three accounts involved: cash, discount and sale. When you post the amount in the cash account, you will only take the amount of actual cash received, i.e., ₹4,500 and mention sales account. While in the discount account you will take only the amount of the discount ₹500 and mention sales account

In the sales account, you will take the entire amount of sales i.e. ₹5,000 but break it into postings, i.e., one cash A/c ₹4,500 and discount ₹500.

Types of Ledger Posting

Let us now study about these two types of ledger posting.

With Journal Entries

Example 1: The business transactions that occurred for Milky Way are:

- Sale of milk to Manoj for ₹5000

- A motorcycle having book value ₹10000 was sold for ₹8000

- Received ₹4500 from Manoj in full settlement of his account

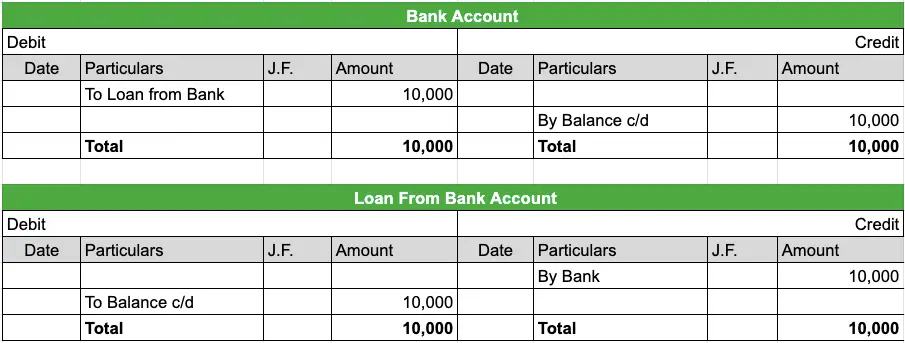

- Taken a loan of ₹10000 from bank

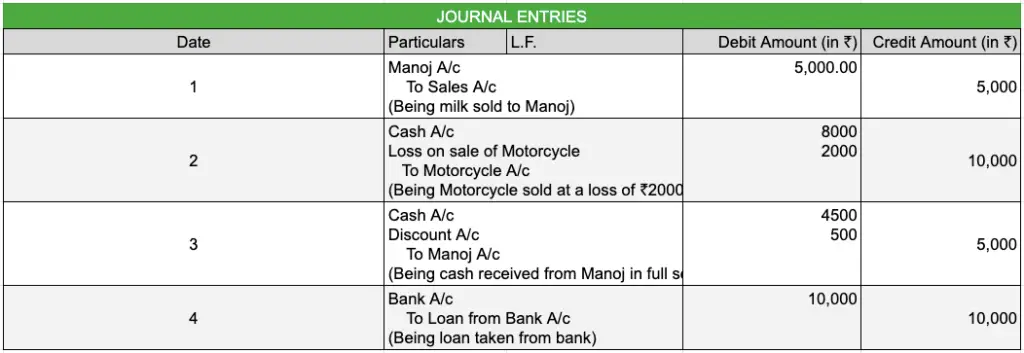

Now, first we make journal entries for each of the above business transactions as shown in Table 5:

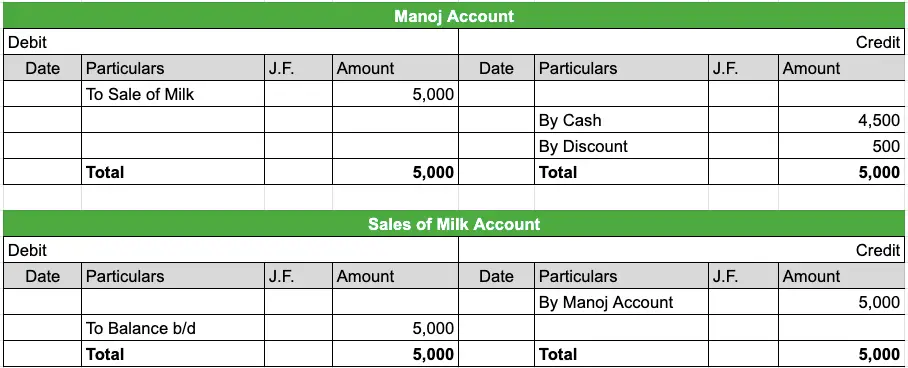

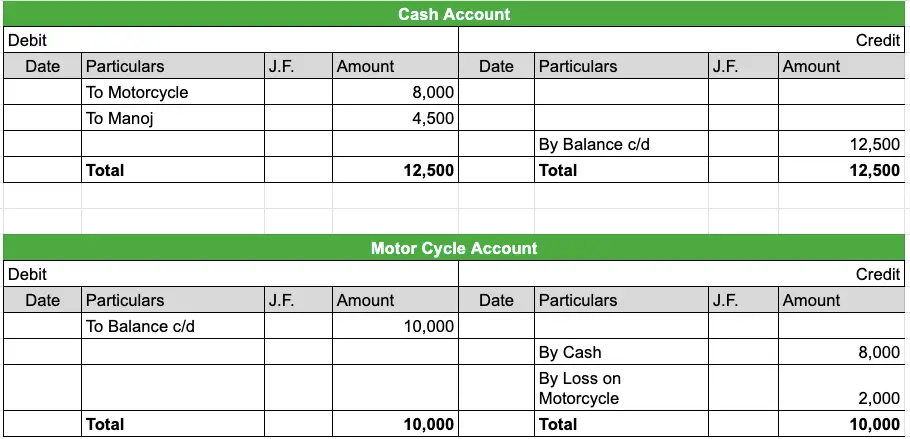

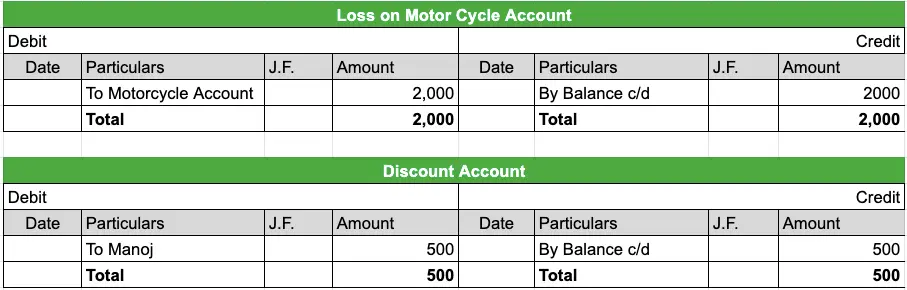

The Ledger Accounts in the books of Milky Way are as follows:

From the above ledger, Milky Way gets information that:

- It has got cash balance of ₹12,500.

- It has a bank balance of ₹ 10,000.

- It has no motorcycle.

- Sales are for ₹ 5000.

- Expenses have loss on motorcycle of ₹ 2000 and discount of ₹ 500 and total ₹ 2500.

- Revenue is ₹ 4500.

- He has a liability of ₹ 10,000.

Without Journal Entries

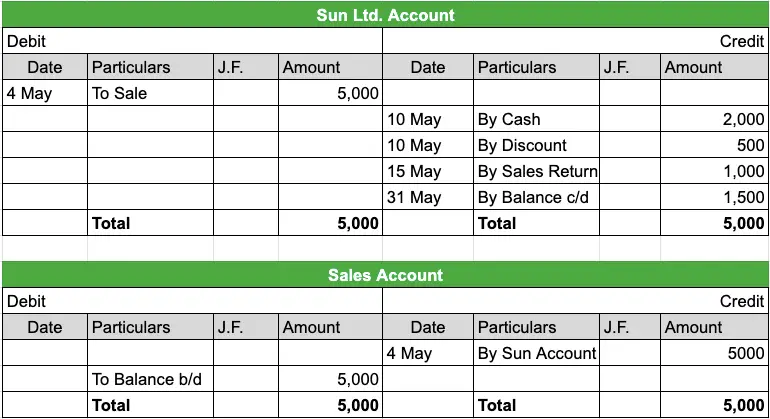

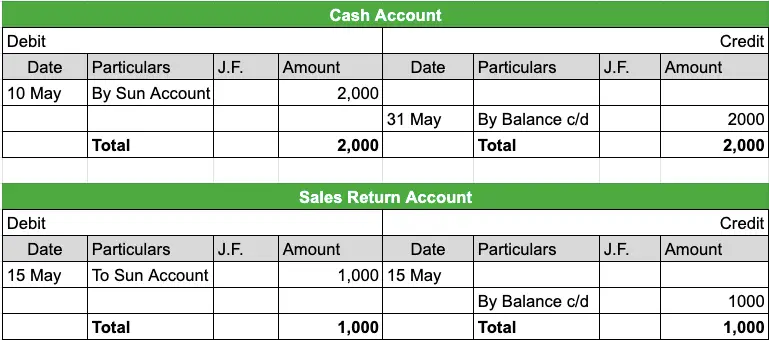

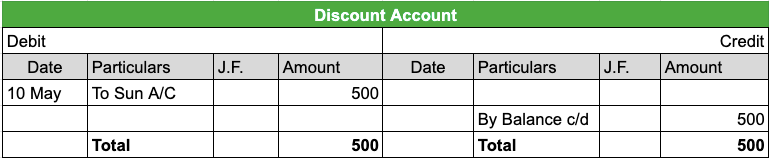

Business transactions in Ted Ltd. are

- 4th May sold goods to Sun Ltd. ₹ 5000

- 10th May Sun Ltd. paid ₹ 2000

- 10th May Ted gave a discount of ₹ 500 to Sun

- 15th May Sun Ltd returned goods of ₹ 1000

Prepare Sun Ltd.’s account in Ted Ltd.’s books of ledger.

Ledger Accounts in the books of Ted Ltd.

Posting an Opening Entry

When we studied about real accounts, you understood that there are some accounts that do not vanish after the accounting period ends. The balances in these accounts are carried forward. The balances of assets and liabilities are carried forward to the next accounting year.

Thus, the balance at which they end at in the previous accounting period is the balance that is carried forward to the next accounting period on the first day. This entering of balance in the next accounting period is called opening entry.

The posting of opening entries is according to the balance of their accounts. In chapter 5, you have studied that all assets have debit balance so the account of each asset opened in the ledger will have the opening balance on the debit side with the words “To balance brought forward”.

In the same way, liabilities and capital accounts have credit balances and so each liability account is opened in the ledger, and at the credit side the balance is transferred with the words “By balance brought forward”. This is how the opening entries are posted. The balance sheet of the previous year is the basis of making opening en- tries of the subsequent year. All other entries are done in the usual way.

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting