What is Contract Costing?

The term contract costing is used by contractors, builders and engineers, who undertake definite contracts such as building construction, ship building, bridge construction and so on. A contract is usually undertaken for a fixed period and price (called contract price), which is payable either on the completion of the contract or by instalments according to the progress of work done.

Table of Content

Contract Costing Definition

Types of Contract Costing

The contract are generally of three types:

- Fixed Price Contracts

- Contracts with Escalation Clause

- Cost Plus Contracts

Fixed Price Contracts

Under these contracts, a fixed price of contract is agreed upon between the contractor and the contractee. Agreed price is paid by contractee to the contractor. Deductions are made for defective and panalties for delay and extra payment is made for additional work.

Contracts with Escalation Clause

In these cases the contract price is fixed with provision that it will be increased with increase in price of material, wages rates and other major costs, and reduces with the decline in costs. This escalation is implemented according to mutually pre-determined formula.

Cost Plus Contracts

This method is adopted where the probable cost of the contract cannot be ascertained in advance with a reasonable accuracy. In case of these contracts, no fixed price is pre-determined for the contract. Contractee compensates the contractor for all allowable costs actually incurred by him. Over and above of these costs the contractor is paid a fixed percentage of the cost as profit or a lump sum fee of profits.

Also Read: Contract Costing Definition

Difference between Job Costing and Contract Costing

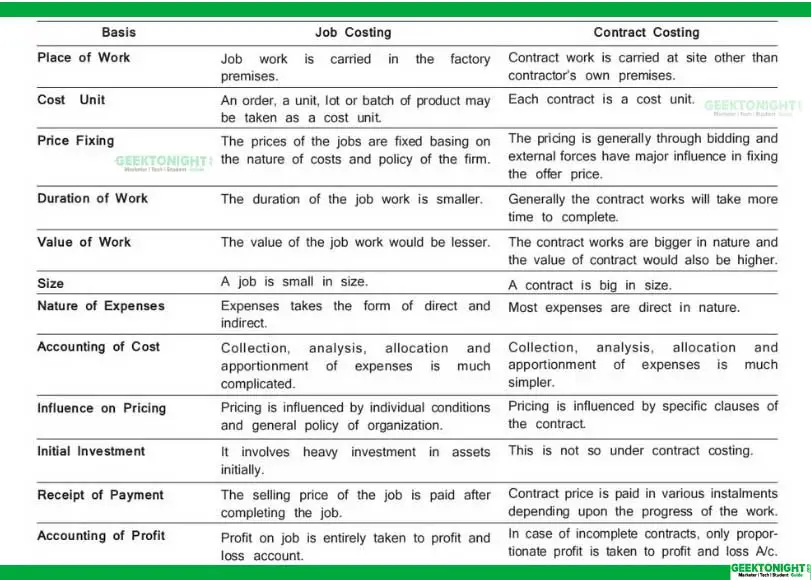

Though contract costing is regarded as a type of job costing, there are some important points of differences between contract costing and job costing:

Features of Contract Costing

The following are the major features of Contract Costing:

- Parties Involved

- Site Work

- Direct Expenses

- Indirect Expenses

- Separate Accounts

- Cost Centre and Cost Unit

- Recognition of Profit

Parties Involved

The parties to a contract are – (a) Contractor – One who undertakes and executes work under a contract, and (b) Contractee – One for whom the work is undertaken.

Site Work

Major part of the work in each contract is generally carried out at the site of the contract.

Direct Expenses

Most of the expenses incurred by the Contractor are directly relatable to the site.

Indirect Expenses

Indirect Expenses, e.g. Administrative Office Expenses and common expenses are apportioned to various contracts on appropriate basis. For example, depreciation of common equipment used on various contracts is apportioned on the basis of the number of days the equipment has been used on various contracts.

Separate Accounts

A separate account is maintained for each contract, to ascertain Profit or Loss.

Cost Centre and Cost Unit

The Cost Centre (place) and Cost Unit (output) in Contract Costing is the Contract itself, e.g. Building Construction.

Recognition of Profit

A contract usually takes long time periods for completion. In certain years, no contract might be completed, while in others, many contracts may be completed. Recognition of Profits after full completion of contract might lead to wide fluctuations in profit every year.

To avoid these fluctuations, profits are generally recognised every year on the basis of percentage of completion and the amount of Notional Profit.

Procedure of Contract Costing

All costs relating to contracts are charged to the respective contract accounts. Accounting of each item of cost in contract accounts is discussed below.

- Material Cost

- Labour cost

- Direct Expenses

- Plant and Machinery

- Sub-contracts

- Contact Price

- Work Certified

- Cost of uncertified work

- Retection Money

- Work-in-progress

Material Cost

As per the nature of contract work materials of different types are required to be used. These can be provided from one or more of the following sources:

- Materials purchased from market and directly delivered at the site.

- Materials suppiled from store room.

- Materials transferred from other contracts.

- Materials supplied by contractee.

Labour cost

Wages of workers employed at site of the contract are recorded as direct wages and charged to the contract account. Salaries of supervisors, engineers and managerial personnel working at the site of the contract are also charged to the contract account as direct wages. Pay roll is prepared for each contract separately so that it becomes easy to calculate and charge the wages to the contract account.

Direct Expenses

Direct expenses incurred for a contract are directly debited to the contract account on the basis of voucher for payments made. These direct expenses are telephone bills paid, electricity bill, item of stationery purchased for the contract, cost of construction maps and plans, expenses of blue-prints, hire charges of plant and special equipment used for the contract, etc.

Plant and Machinery

For contract work a plant and machinery may be used. Depreciation on such plant and machinery used for a contract can be recorded in one of the following ways:

If the plant and machinery is used for the contract for a long period of time, then the particular contract should be debited with the original cost of the plant and the same be credited with the depreciated value at the end of the accounting period.

When a plant and machinery is used for different contracts, the cost of operation (depreciation) of such plant should be determined and be charged to individual contracts based on certain predetermined hourly rate during the period of use.

Sub-contracts

When the contractor give some specialised work of the contract on subcontract basis, the amount paid to the sub-contractor is directly debited to the contract account.

Contact Price

Contact PriceContract price is an amount to be paid by contractee to contractor on satisfactory completion of contract work. Contract price is decided at the time of entering into a contract and agreed upon by both, contractor and contractee.

If it is a small contract which can be completed in a short period, say few months, the contract price is paid to the contractor after deducting a certain agreed percentage of it as retention money on completion of the contract.

Work Certified

When a contract takes more than one year for completion, the contractee has to pay part amount of the contract price on completion of part of the contract work. For this purpose the contractee appoints an architect (or a surveyor) to decide how much of the contract work has been completed by the contractor.

The architect or surveyor does the inspection of work completed by the contractor in respect of quantity as well as quality and issues a certificate stating the value of work completed upto a particular date. This value includes some portion of profit and so it is not the cost amount but a proportionate amount of the contract price. This amount is called value of work certified.

Cost of uncertified work

As stated above the architect issues a certificate for value of work completed in respect of the contract upto a certain date. The contractor does not stop his work on that date but continues his work after that date date upto the close of the period. However, as this work is not inspected by the architect he does not certify it. The cost incurred for this work is called ‘cost of uncertified work’.

Retection Money

A contractee does not make payment to the contractor for full amount of work certified by the architect but deducts a certain percentage of this amount as agreed and pays the net amount to the contractor. This amount deducted and not paid to the contractor is called ‘retention money’.

Work-in-progress

Instead of crediting contract account with the items of value of work certified, cost of uncertified work, plant at site at the time of closing of contract account and materials unused remaining at the site separately, it is possible to record all these items to Work-in-progress account and show work-in-progress as one item on credit side of the contract account.

Work-in-progress account is debited and contract Account is credited with the full amount of the work-in-progress. At the begining of the next year the entry is reversed so that the amount of work-inprogress is shown on the debit side of the contract account and costs incurred during the next year appear below this item of work-in-progress account.

Cost Plus Contract

When it is not possible to estimate the cost of a contract in advance for various reasons, we use the cost plus contract system to determine the cost in advance. This system is used when costs fluctuate over the contract period, as the contract work takes longer time to complete. This system may also be used when a contract is totally new and cost estimation cannot be done with accuracy.

In this contract, the contractor will receive a certain percentage of total cost as profit. The customer often remains suspicious about the cost and needs to monitor the work and cost both closely. Any higher escalation in the cost will be a reward for the contractor and additional cost to the customer. The books of accounts of the contractor need to be properly maintained with all transparency and kept open for auditing and inspection.

The terms and conditions of the contract will have more clarity on different issues. This system of costing is applicable and more suitable to special type of work contracts such as construction of power house, shipyards, dam, etc.

- The contractor has no risk of loss. But the customer has to pay more if the cost escalates, maybe on account of inefficiency.

- The contractor is protected from the increased cost of inputs. However, the customer is not certain about the price of the contract till the end.

- If the price of inputs remains favorable, the contractor does not get benefit. The benefit goes to the customer.

- It is a simplified way to prepare tenders for contractors.

Work Certified

As we understand that construction works usually take a longer period of time for work completion. The customer needs to make payment from time to time depending on the extent of work already completed. This amount is paid on the basis of a certificate issued by an architect or the chartered engi- neer. This is called work certified. This helps to monitor the work progress from time to time and also to estimate and monitor the cost.

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting