What is Project Selection?

Project Selection is the process of choosing a project rationally in the light of objectives and inherent constraints on the basis of appraisal.

Identification of a new project is a complex problem. The project selection process starts with the generation of project ideas. In order to select the most promising project, the entrepreneur needs to generate a few ideas about the possible project one can undertake.

Table of Content

The project ideas as a process of identification of a project begin with an analytical survey of the economy (also known as pre-investment surveys). The surveys and studies will give us ideas.

Project Selection Criteria

Project manager should select only those projects that ensure returns in the near future. This is because it helps in allocating the resources that aim at ensuring better returns. Therefore, proper decision-making process is essential for the selection of the project.

While selecting a project, the following project selection criteria should be kept in mind:

- Realism: The project selection model should consider all the risk factors such as the cost and time that influence the decisions of a project manager. The model should also explain the objectives of the project manager and the firm.

- Capability: The selection model should help the project manager take appropriate decisions by considering the risk and constraints involved in the project. The selection model should be capable of evaluating the future project proposals on the basis of the expected returns of the project.

- Cost: The various costs associated with the right project selection model should be kept at the minimum level. The costs incurred in designing a project selection model consists of data generation, processing and storage expenses. The objective here is to identify the best project selection model.

- Flexibility: The project selection model provides the desired results within the stated conditions of the firm. The model should be flexible enough to adjust with the environmental changes of the firm.

- Easy usage: The project selection model is convenient enough to implement inside the firm.

Project Selection Process

The process of project selection consists of the following stages:

- Pre-Screening

- Individual Project Evaluation

- Screening

- Portfolio Selection

- Portfolio Balancing and Adjustment

- Model Selection and Development

Pre-Screening

In this stage, all infeasible projects are eliminated from funding eligibility. Projects that fail to deliver overall country development goal or goal of the development programme’s and restricted by regulations are eliminated first.

Pre-screening targets to minimise the workload or information overload for later stages. Duplicate projects competing for same funds are normally eliminated if it coincides with existing projects‘ benefit.

Individual Project Evaluation

During this stage, all input from a common form of all projects under contention after pre-screening is taken for further analysis. Based on chosen method the inputs would be analysed against cost and return at each phase or along with risk factors.

Quantitative techniques like Net Present Value (NPV), Payback period, Internal Rate of Return (IRR), Expected Commercial Value (ECV), etc are more often used in this stage and qualitative inputs are considered under a common scale (e.g. satisfactory or dissatisfactory).

Screening

If there is any pre-set economic criteria in the guidelines form of the programme’s those are considered in this stage. The results found in previous stage are considered for each project and any non-mandatory projects failing to meet pre-set economic criteria are taken out.

Portfolio Selection

This stage tries to combine the results of earlier stage and makes a portfolio of project that satisfies the programme’s development goals best. Based on the objectives of the programme’s a ranking of the projects is made by the selection committee and resources are allocated to the maximum available.

Portfolio Balancing and Adjustment

Decision makers apply judgement to adjust the mix of projects in the portfolio to get highest benefit from the overall set of projects. Interactions among the projects such as interdependence and mutual exclusivity are taken into account.

Model Selection and Development

According to Archer & Ghasemzadeh (1996) cited in Dye & Pennypacker (1999), this would normally be a onetime process for the organisations with minor and infrequent adjustments.

During the life span of the programme, management tries to have a set procedure, models based on the organisation‘s culture, experience and availability of the information needed for using specific techniques. Several recommended tools, which can best fit certain selection stages.

Project Selection Models

Project selection models help the project manager in selecting a project. There are two types of project selection models are:

Numeric Models

These models use numbers as input for selecting a project. Numeric models are of two types:

Profit or profitability

These models consider monetary and non-monetary factors. The biggest advantage of the profitability model is that it is easy to understand and use. Following are the types of profitability models:

- Payback period

- Average Rate of Return (ARR)

- Net present value Method

- Internal Rate of Return Method

- Profitability index

Payback period: This is the easiest way of analyzing project ideas. The payback period represents the time the project takes to return the money spent on the project.

The payback period is calculated from the following formula:

Cost of the project / Annual cash inflow from the project

Average Rate of Return (ARR): The project manager selects the project that provides a reasonable return against the investment made. ARR is the simplest way of calculating the return on investment.

Following is the formula of ARR:

(Annual cash Inflows – Depreciation) / Initial Investment

In the above formula, depreciation is calculated by using the straight-line method,

(Cost – SalvageValue) / Useful Life

Net present value Method: (or discounted cash flow technique) The net present values of all cash inflows and an outflow occurring during the entire life of the project is determined separately for each year by discounting these flows by a pre-determined rate.

NPV ═ Total present value of cash Inflows – Present value of initial investment

Internal Rate of Return Method: The IRR of an investment is the discount rate at which the net present value of costs (negative cash flows) of the investment equals the net present value of the benefits (positive cash flows) of the investment.

Under this method, the cash flows of a project are discounted at a suitable rate by hit and trial method, which equates the net present value so calculated to the amount of the investment.

C = A1/(1+r)b + A2/(1+r)b + An/(1+r)n

Profitability index (PI): also known as profit investment ratio (PIR) and value investment ratio (VIR), is the ratio of present value of cash inflows to initial investment of a proposed project. It is a useful tool for ranking projects because it allows you to quantify the amount of value created per unit of investment.

Profitability index = PV of future cash flow / Initial Investment

Scoring

These models involve multiple decision criteria for selecting a project. In scoring models, the decisions are taken after discussions between the project team and the top-level management. Following are the types of scoring models:

- Unweighted 0-1 factor: The management lists the factors that are considered in rating a project. Management consists of a team of raters who help selection of the project.

The people involved in the team must be familiar with the organizational goals. In this model, the list of factors is provided to the team of raters and the project is selected on the basis of the score given to it.

The benefit of using this model is that it gives equal importance to the opinions of all raters on the basis of which the final result is obtained. - Unweighted factor scoring: In this model, the raters can select any of the values on a scale of 1 to 5 in which 5 is very good, 4 is good, 3 is fair, 2 is poor and 1 is very poor.

Non-numeric Models

These models use discussions and suggestions as input for selecting a project. These models are constructed on the basis of subjective evaluation of the ideas and opinions of the project manager and the project team.

Following are the types of non-numeric models:

Sacred Cow

These are models in which higher officials such as the CEO of a company supports the project.

Q-Sort

This helps in preparing a list of projects that are on priority. In this technique, the project manager gathers the ideas of the project and then classifies them as good, fair or bad. The classification of the project is done on the basis of the market potential, economic and technical feasibility, risks involved and the level of competition.

Product Line Extension

In this case, a project to develop and distribute new products would be judged on the degree to which it fits the firm’s existing product line, fills a gap, strengthens a weak link, or extends the line in a new, desirable direction.

Comparative Benefit Model

For this situation, assume that an organisation has many projects to consider, perhaps several dozen. Senior management would like to select a subset of the projects that would most benefit the firm, but the projects do not seem to be easily comparable.

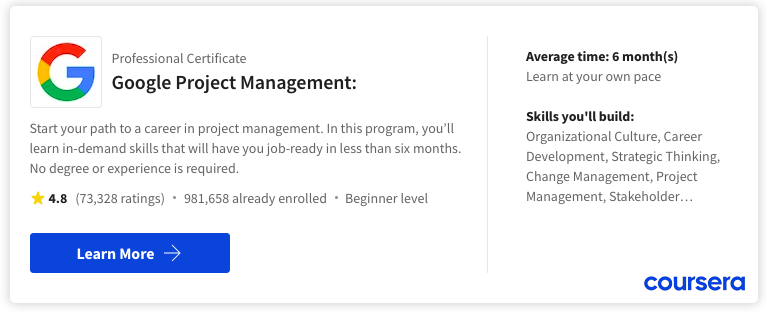

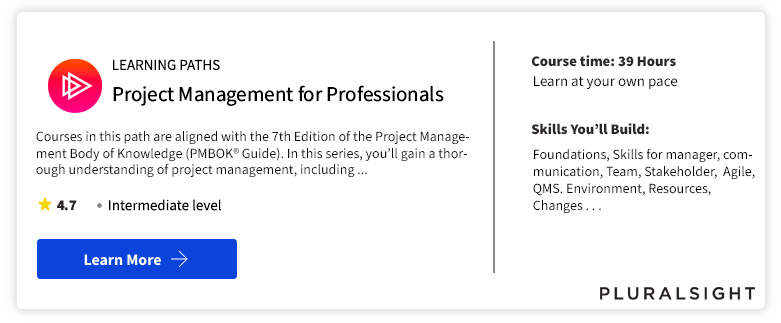

Best Project Management Courses

Project management skills are in demand. If you are ready to get started, consider enrolling in the Google Project Management: Professional Certificate Learn the job-ready essentials of project management in six months or less, such as initiating projects, risk management and change management. Also we have made list of best project management courses as there are a plethora of options available, and it can be challenging to identify the best one.

Best Project Management Tool

Best for:

- Mid & Large Size Team

- Higher Plan

- Standard Feature

- Flexible Database & Stability

Best for:

- Small & Growing Team

- Smaller Plan

- Standout Feature

- Try New Feature

The ideal project management tool selection will eventually rely on the particular requirements of your team. We suggest experimenting with the free versions of various tools to gauge your team’s comfort level and then proceeding accordingly.

Project Management Tutorial

(Click on Topic to Read)

- What is Project Management?

- Functions of Project Management

- What is Project?

- Project Managers

- What is Project Life Cycle?

- Project Feasibility Study

- What is Project Analysis?

- What is Project Planning?

- What is Project Selection?

- What is Project Schedule?

- What is Project Budget?

- What is Project Risk Management?

- What is Project Control?

- Project Management Body of Knowledge (PMBOK)

- Best Project Management Tools

- What is Project Organisation?

- What is Project Contract?

- Types of Cost Estimates

- What is Project Execution Plan?

- Work Breakdown Structure (WBS)

- Project Scope Management

- Project Scheduling Tools and Techniques

- Project Risk Identification

- Risk Monitoring

- Allocating Scarce Resources in IT Project

- Goldratt’s Critical Chain

- Communication in Project Management | Case Study

- Plan Monitor Control Cycle in Project Management

- Reporting in Project Management

- IT Project Quality Plan

- Project Outsourcing of Software Development

- Implementation Plan of Software Project

- What is Project Implementation?

- What is Project Closure?

- What is Project Evaluation?

- Software Project Management Challenges

- What is Project Management Office (PMO)?

- IT Project Team

- Business Case in IT Project Life Cycle

- PMP Study Guide