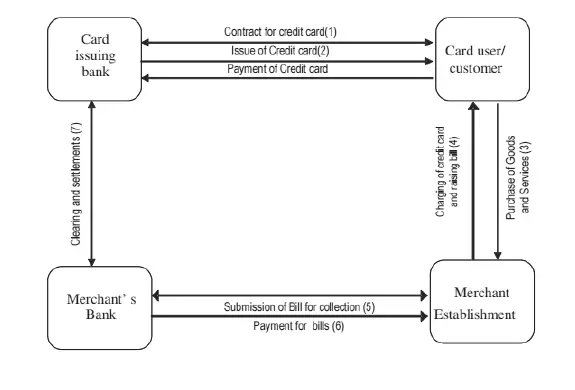

Credit Card Life Cycle

The credit card operation comprises the following steps as follows:

- Credit purchases: A Cardholder purchases goods/services and gives the credit card.

- Processing of credit card: A Merchant establishment delivers goods after taking an authenticated credit card and noting the number and taking signatures on certain forms.

- Raising of bill: The Merchant establishment raises the bill for the purchase and sends it to the credit card issuing bank for payment.

- Marking payment: The issuing bank pays the amount to the merchant establishment.

- Bill to cardholder: The issuing bank raises bill on the credit cardholder and sends it for payment.

- Card Payment: The credit cardholder makes the payment to the issuing bank.

Credit Card Transaction

The flow of information and money between these parties in the credit cards always through the card associations is known as the interchange, and it consists of the following steps.

Authorization

The cardholder pays for the purchase and the merchant submits the transaction to the acquirer (acquiring bank). The acquirer verifies the credit card number, the transaction type and the amount with the issuer (Card-issuing bank) and reserves that amount of the cardholder’s credit limit for the merchant.

An authorization will generate an approval code, which the merchant stores with the transaction. Batching: Authorized transactions are stored in “batches”, which are sent to the acquirer. Batches are typically submitted once per day at the end of the business day.

If a transaction is not submitted in the batch, the authorization will stay valid for a period determined by the issuer, after which the held amount will be returned to the cardholder’s available credit ( authorization hold).

Clearing and settlement

The acquirer sends the batch transactions through the credit card association, which debits the issuers for payment and credits the acquirer. Essentially, the issuer pays the acquirer for the transaction.

Funding

Once the acquirer has been paid, the acquirer pays the merchant, the merchants receives the amount totaling the funds in the batch minus the “discount rate,” which is the fee the merchant pays the acquirer for processing the transactions.

Charge backs

A chargeback is an event in which money in a merchant account is held due to a dispute relating to the transaction. Charge backs are typically initiated by cardholders. In the event of a chargeback, the issuer returns the transaction to the acquirer for resolution.

The acquirer then forwards the chargeback to the merchant, who must either accept the chargeback or contest it.

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting