What is Book Building?

SEBI guidelines, 1995 defines book building as “A process undertaken by which a demand for the securities proposed to be issued by a body corporate is elicited and built up and the price for such securities is assessed for the determination of the quantum of such securities to be issued by means of a notice, circular, advertisement, document or information memoranda or offer document.

Book building process is a common practice used in most developed countries for marketing a public offer of equity shares of a company. However, book building is a transparent and flexible price discovery method of initial public offerings (IPOs) in which price of securities is fixed by the issuer company along with the Book Running Lead Manager (BRLM) on the basis of feedback received from investors as well as market intermediaries during a certain period.”

Table of Content

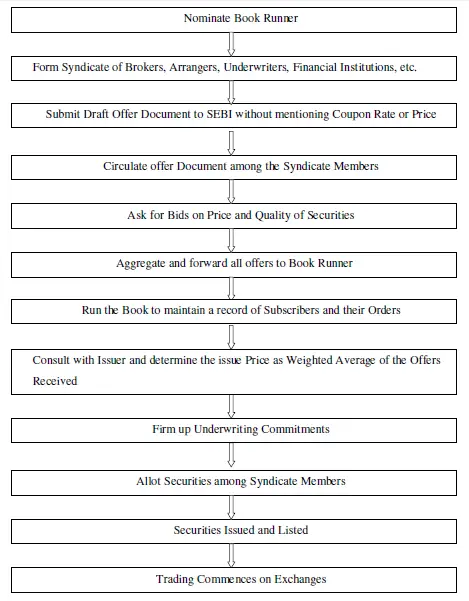

Process of Book Building

A Book Building process involves following steps :

Source: Agarwal, S., Bharat’s Manual of Indian Capital Market, Bharat Law House, New Delhi, 1997, p.578)

Types of Book Building Process

The Companies in India are bound to follow to the SEBI’s guidelines for book building offers in the following manner:

- 75 percent Book-Building Process: Under this process 25 percent of the issue is to be sold at a fixed price and the balance of 75 percent through the Book Building process.

- Offer to public through Book building process: The process specifies that an issuer company may make an issue of securities to the public through prospectus in the following manner:

- 100% of the net offer to the public through book building process, or

- 75% of the net offer to the public through book building process and 25% of the net offer to the public at the price determined through book building process.

- 100% of the net offer to the public through book building process, or

- Pure Auction as an Additional Book building Mechanism: SEBI has decided to introduce an additional method of book building, to start with, for FPOs, in which the issuer would decide on a floor price and may mention the floor price in the red herring prospectus.

If the floor price is not mentioned in the red herring prospectus, the issuer shall announce the floor price at least one working day before opening of the bid in all the newspapers in which the pre-issue advertisement was released.

Benefits of Book Building

There are many benefits associated with book building. These are listed briefly as follow:

- Book building leads to price discovery and helps in finding the intrinsic value of the security being offered.

- The price of a security is determined in a more realistic way by taking into consideration the demand for security.

- The issuer gets the maximum price for the security.

- The issuer company can choose the quality investors.

- There is greater transparency in the allotment of shares to the investors.

- Book building process results in lower costs of issue. Especially, Book building helps the issuer save a lot of money on advertising and brokerage.

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting