What is Cost of Capital?

Cost of capital is defined “as the minimum rate of return that a firm must earn on its investment so that market value per share remains unchanged”. The minimum rate of return is the compensation expected by the investors from the company for the time and risk taken up by them. The greater the time and the risk involved for particular lending, the greater would be the return required by the investors.

The return to the investor on the invested amount is the cost to the company on the borrowed amount. Suppose the companies get their required funds at a cost (Ko).

This amount is utilized and invested by the company in the various activities that generate a positive return (r) for the company. Now, common sense tells us that r > Ko, i.e. the return on the invested money should be greater than the cost of money.

Table of Content

Thus, the concept of cost of capital helps companies in deciding what should be the return on their investment activities. Therefore, a company should accept an investment proposal whose rate of return is above is above its cost of capital.

Cost of capital acts as a minimum benchmark return, a firm should earn enough profits to meet its cost of capital. The cost of capital concept, thus, helps the company in evaluating its investment decisions, designing its fund structure, deciding its managerial decisions and appraising the financial performance of the firm.

The cost of capital also known as overall cost of capital consists of the following elements

• Cost of Debt, includes both Debentures, Bonds and Term loan (Kd)

• Cost of Preference Capital (Kp)

• Cost of Equity Capital (Ke)

• Cost of Retained Earnings (Kr)

Importance of Cost of Capital

Cost of capital is very important for the management in decision making. It is considered as a standard of comparison for making different decisions.

Cost of capital is significant for the company in the following ways

- Capital budgeting decision

Cost of capital is the minimum rate of return that must be earned by the company to maintain the value of its shares. The firm, naturally, will choose the project which gives a satisfactory return on investment which would in no case be less than the cost of capital incurred for its financing.

In various methods of capital budgeting, cost of capital is the key factor in deciding the project out of various proposals pending before the management. It measures financial performance and determines the acceptability of all investment opportunities. - Designing the corporate financial structure

The cost of capital is significant in designing the firm’s capital structure. The cost of capital is influenced by the chances in capital structure. A manager always keeps an eye on capital market fluctuations and tries to achieve the sound and economical capital structure for the firm.

He may try to substitute the various methods of finance in an attempt to minimise the cost of capital so as to increase the market price and the earning per share. - Deciding about the method of financing

A capable financial executive must have knowledge of the fluctuations in the capital market and should analyse the rate of interest on loans and normal dividend rates in the market from time to time.

Whenever company requires additional finance, he may have a better choice of the source of finance which bears the minimum cost of capital. Although cost of capital is an important factor in such decisions, but equally important are the considerations of relating control and of avoiding risk. - Performance of top management

The cost of capital can be used to evaluate the financial performance of the top executives. Evaluation of the financial performance will involve a comparison of actual profitability of the projects and taken with the projected overall cost of capital and an appraisal of the actual cost incurred in raising the required funds. - Formulating dividend policy

Dividend is that part of the total profit of the firm which is distributed to shareholders. However, the firm can retain all the profit in the business if it has the opportunity of investing in such projects which can provide higher rate of return in comparison of cost of capital.

On the other hand, all the profit can be distributed as a dividend in the firm has no opportunity investing the profit. Therefore, cost of capital plays a key role in formulating the dividend policy.

Concept of Opportunity Cost of Capital

There can be several alternative uses or several investment opportunities of a certain amount of funds. Decision making is a process of selecting among various alternatives. The opportunity cost is the rate of return foregone on the next best alternative investment opportunity of comparable risk.

For example, you may invest your savings of Rs 10,000 either in 8.5 percent in 5 year postal certificates or in 9 percent 5 year fixed deposits in a nationalized bank. In both cases, the government assures the payment; so the investment opportunity reflects equivalent risk.

If you decide to deposit your savings in the postal certificates, you have to forego the opportunity of depositing in bank. You have, thus, incurred an opportunity cost equal to the return on the foregone investment opportunity. It is 9 percent in case of above example. Similarly, the cost of capital is the opportunity cost of capital used by the firm.

Cost of Debt

A company may raise debt in a variety of ways. Debt may be in the form of debentures, bonds, term loans from financial institutions and banks etc. Debentures and bonds are debt instruments issued by the corporations to the public or institutions at a specified interest rate (coupon rates) for a specified period of time, creating creditors to the company.

A debenture or bond may be issued at par or at a discount or premium as compared to its face value. Interest paid on debentures/ bonds is tax deductible. So, form can reduce its taxable income by the amount of money it pays to the bondholders.

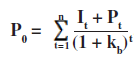

The rate of interest at which debt is issued is the basis of calculating the cost of any type of debt. The explicit cost of debt, i.e., kb is the discount rate which equate the present values of cash flows to the creditors (suppliers of the debt) with the current market price of the new debt issue (before-tax cost of debt).

Where

It = interest payment in period t on the principal

Pt = principal payment in period t

Po = current market price of debt

kb = cost of debt before tax

Before-tax cost of debt (kb) can be determined by simply considering the interest payable as follows:

kb = Interest/Principle

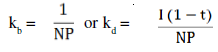

While calculating the cost of debt, we use after tax cost of debt because interest payments are tax deductible for the firm. After-tax cost of debt, which is denoted by kd, can be determined by using following equation:

After-tax cost of debt (kd) = kb (1-tax rate) …………….Eq. 2

It is important to note that in the calculation of average cost of capital, the after-tax cost of capital must be used instead of before-tax cost of debt.

Cost of Perpetual/ Irredeemable Debt

The perpetual debt is the debt that has no maturity value. Such debts do not have any principal repayment during the life of the company. In case of perpetual debt or irredeemable debt, the company continuously pays interest at the given rate per annum forever (because company is a perpetual entity). Cost of perpetual/ irredeemable debt can be calculated by Eq. 3

Where I = Annual interest payments

NP = Net proceeds of issue of debentures, bonds, trem loans etc.

t = tax rate

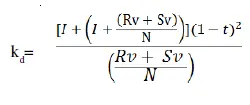

Cost of redeemable debt

Redeemable debt has a maturity value, i.e., these debt are issued for a specific time period say 10 years. Generally redeemable debt is more popular over irredeemable debt because company prefers to repay the debt at some time in the future. Cost of redeemable debt can be calculated by Eq. 4

Where,

kd = cost of debt

I = annual interest payments

Rv = redeemable value of debt at the time of maturity

Sv = sale value less discount and floating expenses

N = number of years to maturity

t = tax rate

Cost of Preference Capital

The cost of preference share capital is the rate of return that must be earned on preference capital financed to keep unchanged the earnings available to the equity shareholders. Like equity, the preference share dividend is paid after the corporate tax has been paid.

Thus, the cost of preference share is not adjusted for tax. The cost of preference share is automatically computed on an after-tax basis. Thus, the past-tax cost of preference dividend is higher than the post-tax cost of debt, even if their return is same.

(a) For the existing share

The cost of irredeemable preference share is:

kp = D/MP …… Eq. 5

Where, kp = cost of irredeemable preference shares

D = preference share dividend

MP = market price of the preference share

(b) For the newly issued preference shares

The cost of irredeemable preference share is:

kp = D/NP …… Eq. 6

Where,

kp = cost of preference shares

D= dividend paid on preference shares

NP = net proceed received from issue of preference shares after deducting

the issue expenses

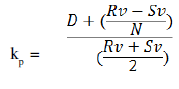

The cost of redeemable preference shares is calculated as shown in Eq. 7

Where,

kp = cost of preference shares

D = constant annual preference dividend payments

Rv = redeemable value of preference shares at the time of redemption

Sv = sale value of preference shares less discount and floating expenses

N = no. of years to redemption

Cost of Equity Capital

Many companies raise equity capital internally by retaining earnings. Alternatively, they distribute the entire earnings to equity shareholders and raise equity capital externally by issuing new shares. Money raised by issuing new equity shares need not to repayable during the life time of the organisation. The equity shareholders are considered to be the owners of the company.

The main objective of the firm is to maximize the wealth of the equity shareholders. The determination of the rate of return required by equity investor is difficult to measure.

The cost of equity may be defined as the “minimum rate of return that a company must earn on the equity share capital financed portion of an investment project so that market price of share remains unchanged”. There are various methods available for calculating the cost of equity.

These methods are discussed in the following section

Dividend Yield (DY) Method

Under this method, cost of equity capital can be defined as “the discount rate that equates the present value of all expected future dividend per share with the net proceeds of the sale (or the current market price) of a share.” The dividend yield method considers dividend per share and market value of shares for calculating the cost of equity capital. This method is based on the following assumption-

The market value of equity shares is directly related to future dividends on those shares. 2. The future dividend per equity share is expected to be constant means no growth rate. But in reality, a shareholder expects the returns from his equity investment to grow over time.

The cost of equity using dividend yield can be calculated by the following formula

ke = D1/P0 …….. Eq. 8

Where,

ke = cost of equity capital

D1 = Annual dividend per share on equity capital in period 1

P0 = Current market price of equity share

Note: In case shares are issued first time, then NP (net proceed from equity share issue) will be used in place of P0 (Current market price of equity share).

Dividend Growth Model

The equity shareholders normally expects dividend to grow year after year and not to remain constant in perpetuity. In dividend growth method the future growth in dividend is added to the current dividend yield. It is recognised that current market price of share reflects expected future dividends.

The Cost of equity share can be calculated by the following formula

ke = D1/P0 + g ……Eq. 9

Where,

ke = Cost of equity capital

D1 = Expected dividend per equity share

P0 = Current market price of equity share

g = growth rate by which dividends are expected to grow per year at a constant compound rate

Price- Earning (P/E) Method

Price- Earning method is based on the earnings per share (EPS) and the market price of the share (MPS). It is based on the assumption the investor capitalise the stream of future earnings of the share and the earnings of the share need not to be in the form of dividend and also it need to be distributed to the shareholders.

Cost of equity using PE method can be determine by the following formula:

ke = EPS/MPS ……. Eq. 11

Where,

ke = cost of equity capital

EPS = earnings per share

MPS = market price per share

Capital Asset Pricing Model (CAPM)

The capital asset pricing model (CAPM) is the most widely used method to calculate the cost of equity. This model divides the cost of equity in two components, the near risk free rate of return available on investing in government securities and an additional risk premium for investing in a particular share or investment. The model also considers to specify the relationship between the market return and the individual equity.

The expected rate of return of an equity share can be calculated by using following equation:

Expected return = Risk free rate + Risk premium ……… Eq. 12

Thus, CAPM requires the following three parameters to estimate a firm’s cost of equity:

- The risk-free rate (R The Cost of Capital f) the yields on the government securities, bank, etc. by all investors.

- The beta coefficient expresses the market risk of the equity stock in relation to the market.

- The market risk premium (Rm – Rb) the market risk premium is measured as the difference between the long-term, historical arithmetic averages of market return, and the risk-free rate.

Cost of Retained Earnings

The part of profit that is not distributed to the shareholders is refereed as retained earnings. It is one of the major sources of finance available for the established companies to finance its expansion and diversification. The cost of retained earnings is the required rate of return on equity. Retained earnings are the earnings left after deducting dividend payments and other provisions from profit after tax.

The cost of retained earnings is similar to the cost of equity. Retained earnings belong shareholders. The shareholders forgo their current income (current dividend) when they allow the company to use the retained earnings in profitable investments.

Generally, cost of retained earnings is slightly less than the cost of equity since no flotation cost is incurred. It is also known as internal equity as it is the amount of earnings not distributed to shareholders and is retained with the firm.

The cost of retained earnings can be calculated using following formula:

kre = ke (1- f) …………………….Eq.11.14

Where:

ke = cost of equity

kre = cost of retained earnings

f = floatation cost

Weighted Average Cost of Capital (WACC)

The capital that a company procures is derived from various sources. A company has different sources of finance, namely common stock, retained earnings, preferred stock and debt. The overall cost of capital is termed as weighted average cost of capital.

The weighted average cost of capital (WACC) is the average after tax cost of all the sources. It is calculated by multiplying the cost of each source of finance by the relevant weight and summing the product of cost of individual source.

Steps in calculation of WACC

The calculation of WACC includes the following steps:

- Determine the cost of all individual components of capital used by the firm like, Debt, preference share capital, equity capital, retained earnings.

- Assign weight to each source of capital. The weight is the proportion of each source of funds in the capital structure. This can be done by dividing the value of the individual component of capital and by the total value of the total capital employed.

- Add all the weighted cost of various components of capital to arrive at the weighted average cost of capital.

The WACC can be calculated by the following formula:

WACC = Wd (kd) + We (ke) + Wp (kp) + Wre (kre) …………….Eq. 15

Where,

Wd = weight of debt

kd = cost of debt

We = weight of equity

ke = cost of equity

Wp = weight of preferred stock

kp = cost of equity

Wre = weight of retained earnings

kre = cost of equity

Determination of Weights

There are two methods by which weights are assigned to the each source of capital for determining the weighted average cost of capital of the firm. These are book value method and market value method.

Book value method

Under this method weights are assigned on the basis of book value. The book value of various type of capital used by the firm can be obtained from its financial statements such as balance sheet. The weights determined by the book value method are based on the accounting procedures that use the par value of the securities to calculate balance sheet values and represent past conditions.

Market Value Method

The market value approach is more realistic compare to book value approach. This method is based on the market value of individual component of capital rather than book value. One drawback of the book value method of assigning weights is that it does not reflect the current market value of debt or equity. For the purpose of valuation, market value weights are used by the firms.

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting