What is Capital Budgeting?

Capital budgeting (or investment appraisal) is the planning process used to determine whether an organization’s long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are worth pursuing.

Table of Content

Capital budgeting is concerned with planning significant outlays that have long-run implications, such as acquiring new equipment and the introduction of new products. Most companies have many more potential projects than can actually be funded.

Hence, managers must carefully select those projects that promise the greatest future return. The ability of the managers’ makes capital budgeting decisions a critical factor in the long run profitability and survival of the company.

Capital Budgeting Decision may be defined as the “firm’s decision to invest its current fund more efficiently in the long term assets in anticipation of an expected flow of benefits over a series of years”(Bhat 2012).

The long-term assets are those that affect the firm’s operations beyond the one year period. The firm’s investment decisions would generally include expansion, acquisition, modernisation and replacement of the long-term asset. Thus, it may be pointed out that capital budgeting decisions affect the firm’s value in long run. The value will increase if the investments are profitable and add to the shareholders’ wealth.

Thus, capital budgeting is a measurable way for organizations to determine the long-term economic and financial profitability of any investment project.

Importance of Capital Budgeting

Capital budgeting is important because it creates accountability and measurability. Any business that seeks to invest its resources in a project, without understanding the risks and returns involved, would be held as irresponsible by its owners or shareholders. Businesses (aside from non-profits) exist to earn profits.

Capital budgeting is also vital to a business because it creates of the following reasons:

- Develop and formulate long-term strategic goals: Capital budgeting involves investment in funds that have long term implications on the firm’s future. Capital budgeting helps in developing and formulating long term strategic goals. The ability to appraise/value investment projects via capital budgeting creates a framework for businesses to plan out future long-term direction.

- Seek out new investment projects: knowing how to evaluate investment projects gives a business the model to seek and evaluate new projects, an important function for all businesses as they seek to compete and profit in their industry.

- Estimate and forecast future cash flows: future cash flows are what create value for businesses overtime. Capital budgeting enables executives to take a potential project and estimate its future cash flows (both inflows and outflows), which then helps determine if such a project should be accepted.

- Facilitate the transfer of information: from the time that a project starts in form of an idea to the time it is accepted or rejected, numerous decisions have to be made at various levels of authority. The capital budgeting process facilitates the transfer of information to the appropriate decision-makers within a company to enable better decision making.

- Monitoring and Control of Expenditures: Capital budgeting identifies the necessary expenditures required for an investment project. Since a good project can turn bad if expenditures aren’t carefully controlled or monitored, this step is a crucial benefit of the capital budgeting process.

- Help in creating decision rule: when a capital budgeting process is in place, a company is then able to create a set of decision rules that can categorize which projects are acceptable and which projects are unacceptable.

The result is a more efficiently run business that is better equipped to quickly ascertain whether or not to proceed further with a project or shut it down early in the process, thereby saving a company.

Capital Budgeting Decision Techniques

After determination of relevant cash flows, the next step in capital budgeting is to analyse them to assess whether a project is acceptable or not. A number of techniques are available for performing such analyses.

These capital budgeting techniques are divided into two groups:

- Non-discounting Cash Flows techniques (NCDF)

- Discounting Cash Flows (DCF)

A brief description of all these methods is given below.

Non-discounting Cash Flow Techniques (NDCF)

Non-discounting cash flow techniques do not adjust the various cash flows for their respective time value. In such evaluation techniques, we assume that there exists no opportunity to reinvest the money generated by the project proposals. There are mainly two types of methods under this:

- Payback Period (PB) Method

- Accounting Rate of Return (ARR) Method

Payback Period (PB) Method

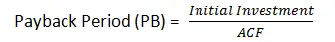

The Payback period are commonly used to evaluate proposed investments. It is defined as “the amount of time required by the firm to recover its initial investment in a project, as calculated from cash flows”.

In case of an annuity, the payback period can be found by dividing the initial investment by annual cash inflow. For a mixed stream of cash inflows, the yearly cash inflows must be accumulated until the initial investment is recovered.

The basic concept behind the payback method (PB) is that one must get the recovery of one’s investment at the earliest. The earlier the company gets its money out of the project; the lower is the risk involved.

In case the investment recovery arise late then uncertainty and unpredictability regarding future increases. The payback (PB) of any project can be computed by using following formula:

Where:

ACF = Constant Annual Inflow from project

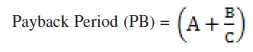

Sometime if cash inflows are uneven during the life of project, we need to calculate the cumulative net cash flow for each period and then use the following formula for payback period:

Where:

A is the last period with a negative cumulative cash flow;

B is the absolute value of cumulative cash flow at the end of the period A;

C is the total cash flow during the period after A

Decision Rule

The PB can be used as a decision criterion to select investment proposal. In order to arrive at a decision rule using PB criteria, firms compare the project’s payback with a predetermined standard payback. The predetermined standard payback is decided by the management. The following acceptance rule is applied

- If the PB is less than the standard payback period, accept the project.

- If the PB is greater than the standard payback period, reject the project.

- If the PB is equal to the standard payback period, may or may not accept the project.

Accounting Rate of Return (ARR) Method

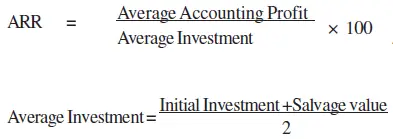

The accounting rate of return is also known as average rate of return of return on capital employed. The ARR is the ratio of the average after tax profit divided by the average investment. There are a number of alternative methods for calculating ARR. The most common method of computing ARR is using the following formula:

The average profits after taxes are determined by adding up the PAT for each year and dividing the result by the number of years. Similarly, average investment is calculated taking into consideration initial investment and salvage value.

Decision Rule

The ARR method is based on accounting information and in order to select or reject any project using ARR method, the ARR of any project is compared with the rate of return established by management.

In other words, accept or reject criterion, under this method is as follow

- Accept all those projects whose ARR is higher than the minimum rate established the management.

- Reject those projects which have ARR less than minimum rate established by management.

- May accept or reject those projects which have ARR is equal to minimum rate established by management.

This method would rank a project number one if it has highest ARR and lowest rank would be assigned to the project with lowest ARR.

Discounting Cash Flow Techniques (DCF)

On the other hand, discounting cash flows techniques discount the future expected cash flows by the relevant discount factor to arrive at its present value. We can say under DCF techniques, the expected future cash flows are adjusted for the time value of money to get a clear picture of the real benefits arising from the project.

There are mainly five types of methods under this:

- Net Present Value (NPV) Method

- Internal Rate of Return (IRR) Method

- Profitability Index (PI) Method

- Discounted Payback Period (DPB) Method

Net Present Value (NPV) Method

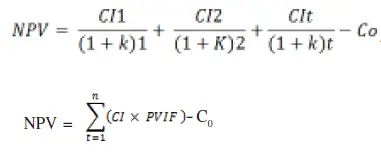

The net present value is one of the discounted cash flow or time-adjusted technique. It recognizes that cash flow streams at different time period differs in value and can be computed only when they are expressed in terms of common denominator i.e. present value.

The NPV is the difference between the present value of future cash inflows and the present value of the initial outlay, discounted at the firm’s cost of capital. The procedure for determining the present values consists of two stages. The first stage involves determination of an appropriate discount rate. With the discount rate so selected, the cash flow streams are converted into present values in the second stage.

Calculation of Net Present Value (NPV)

The important steps for calculating NPV are given below:

- Cash flows of the investment project should be forecasted based on realistic assumptions. These cash flows are the incremental cash inflows after taxes and are inclusive of depreciation (CFAT) which is assumed to be received at the end of each year. CFAT should take into account salvage value and working capital released at the end.

- Appropriate discount rate should be identified to discount the forecasted cash flows. The appropriate discount rate is the firm’s opportunity cost of capital which is equal to the required rate of return expected by investors on investments of equivalent risk.

- The Present value (PV) of cash flows should be calculated using opportunity cost of capital as the discount rate.

- The NPV should be found out by subtracting present value of cash outflows from present value of cash inflows. The project should be accepted if NPV is positive (i.e. NPV >0). The NPV can be calculated with the help of equation:

NPV = Present Value of Cash Inflows – Initial investment

Where,

CI = cash flows at time t

C0 = Initial investment

K = cost of capital

PVIF = present value interest factor

Decision Rule

The present value (PV) method can be used as an accept-reject criterion. The present value of the future cash streams or inflows would be compared with present value of outlays. The present value outlays are the same as the initial investment.

• If the NPV is greater than zero, accept the project.

• If the NPV is less than zero, reject the project.

Symbolically, accept-reject criterion can be shown as below:

PV > Co Accept [NPV > 0]

PV < Co Reject [NPV < 0]

Where, PV is present value of inflows and C is the outlays. This method can be used to select between mutually exclusive projects also. Using NPV the project with the highest positive NPV would be ranked first and that project would be selected. The market value of the firm’s share would increase if projects with positive NPVs are accepted.

Internal Rate of Return (IRR) Method

This technique is also known as yield on investment, marginal productivity of capital, marginal efficiency of capital, rate of return, and time-adjusted rate of return and so on. It also considers the time value of money by discounting the cash flow streams, like NPV technique. While computing the required rate of return and to find out the present value of cash flows is not considered.

But the IRR depends entirely on the initial outlay and the cash proceeds of the projects which are being evaluated for acceptance or rejection. It is, therefore, appropriately referred to as internal rate of return. The IRR is usually the rate of return that a project earns.

The internal rate of return (IRR) is the discount rate that equates the NPV of an investment opportunity with Rs.0 (because the present value of cash inflows equals the initial investment).

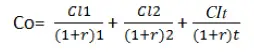

It is the compound annual rate of return that the firm will earn if it invests in the project and receives the given cash inflows. Mathematically, IRR can be determined by solving following equation for r:

CIt = Cash Flows at time t

Co = Cash outflow

Where,

IRR = r = required rate of return or discount rate

Decision Rule

To evaluate a project using IRR method, manager compare the IRR of any project with the required rate of capital as decided by the management. The required rate of return is also known as cost of capital, cut-off rate or hurdle rate.

When IRR is used to make accept-reject decisions, the decision criteria are as follows:

- If the project IRR is greater than project cost of capital, accept the project. (r >k)

- If the project IRR is less than project cost of capital, reject the project. (r<k)

- If the IRR is equal to project cost of capital, may or may not accept the project (r=k)

Profitability Index (PI) Method

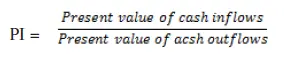

Profitability Index (PI) or Benefit-cost ratio (B/C) is similar to the NPV approach. This approach measures the present value of returns per rupee invested. It is observed in shortcoming of NPV that, being an absolute measure, it is not a reliable method to evaluate projects requiring different initial investments.

The PI method provides solution to this kind of problem. PI method is a relative measure and can be defined as the ratio which is obtained by dividing the present value of future cash inflows by the present value of cash outlays.

Decision Rule

Using the PI method

• Accept the project when PI>1

• Reject the project when PI<1

• May or may not accept when PI=1, the firm is indifferent to the project.

Discounted Payback Period (DPB) Method

The Discount pay back (DPB) method is almost the same as payback method. The only difference between simple payback and discounted payback is that the cash flows involved in a project are discounted back to the present value term.

The cash flows are then directly compared to the original investment in order to identify the period taken to payback the original investment in present values terms.

Key Points

- Accounting Rate of Return (ARR): The amount of profit, or return, that an individual can expect based on an investment made. Accounting rate of return divides the average profit by the initial investment in order to get the ratio or return that can be expected.

- Annuity: series of equal periodic payments or receipts. Examples of an annuity are semi-annual interest receipts from a bond investment and cash dividends from a preferred stock.

- Budget: estimate of revenue and expenditure for a specified period.

- Capital Budget: (1) The amount of money set aside for the purchase of fixed assets (e.g., equipment, buildings, etc.). Also, (2) a request for authorization to purchase new fixed assets.

- Cash flow: cash receipts minus cash disbursements from a given operation or asset for a given period. Cash flow and cash inflow are often used interchangeably. In capital budgeting, monetary value of the expected benefits and costs of a project.

- Discounted cash flow: value of future expected cash receipts and expenditures at a common date, which is calculated using Net or Internal Rate of Return.

- Discounted payback: A capital budgeting method that generates decision rules and associated metrics that choose projects based on how quickly they return their initial investment plus interest.

- Future Value: The value of an asset or cash at a specified date in the future that is equivalent in value to a specified sum today.

- Initial Investment: The present value of all cash outflows associated with the project. More generally, we think of this as the total cost of the project.

- Internal Rate of Return (IRR): A capital budgeting method that generates decision rules and associated metrics for choosing projects based on an implicit expected geometric average of a project’s rate of return.

- Modified IRR: A capital budgeting technique method that converts a project’s cash flows using a more consistent reinvestment rate prior to applying the IRR decision rule.

- Net Present Value (NPV): A capital budgeting technique that generates decision rules and associated metrics for choosing projects based on the total discounted value of their cash flows.

- NPV profile: A graph of a project’s NPV as a function of the cost of capital.

- Payback: A capital budgeting method that generates decision rules and associated metrics for choosing projects based on how quickly they return their investment.

- Present value: The current worth of a future sum of money or stream of cash flows given a specified rate of return. Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the future cash flows.

- Salvage Value: The estimated value that an asset will realize upon its sale at the end of its useful life. The value is used in accounting to determine depreciation amounts and in the tax system to determine deductions.

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting