What is Corporate Governance?

Corporate Governance refers to the system of rules, practices, and processes that an organization follows to control and manage its operations. It is a framework of procedures and policies that defines the way a company is directed, controlled, and held accountable to its stakeholders, including shareholders, customers, employees, suppliers, and the wider community.

Good corporate governance ensures that a company operates in a transparent, ethical, and accountable manner, which helps to build trust with stakeholders and maintain the company’s reputation.

It involves the management of the company’s relationships with its shareholders, board of directors, executives, employees, and other stakeholders, and it encompasses a wide range of issues, such as financial reporting, risk management, compliance with laws and regulations, and ethical conduct.

Table of Content

- 1 What is Corporate Governance?

- 2 How to Improve Corporate Governance

- 2.1 Divorce of Management and Ownership

- 2.2 Role and Powers of the Board

- 2.3 Legislation

- 2.4 Code of Conduct

- 2.5 Board Independence

- 2.6 Board Skills

- 2.7 Management Environment

- 2.8 Board Appointments

- 2.9 Board Induction and Training

- 2.10 Board Meetings

- 2.11 Strategy Setting

- 2.12 Business and Community Obligations

- 2.13 Financial and Operational Reporting

- 2.14 Monitoring the Board Performance

- 2.15 Audit Committee

- 2.16 Risk Management

- 3 Corporate Governance Definition

- 4 Objectives and Goals of Corporate Governance

- 5 Dimensions of Corporate Governance

- 6 Benefits of Corporate Governance

- 7 Efforts to Improve Corporate Governance

- 8 Corporate Governance and CSR

- 9 Corporate Disclosure and Investor Protection in India

- 10 Models of Corporate Governance

- 11 OECD Principles of Corporate Governance

- 12 Theories Underlying Corporate Governance

- 13 Differences Between the Agency Theory and Stewardship Theory

- 14 Corporate Governance as a Systemic Process

- 15 Ethics and Corporate Governance

- 16 Corporate Social Responsibility and Corporate Governance

How to Improve Corporate Governance

Quality of corporate governance primarily depends on the following factors, namely: integrity of the management; ability of the Board; adequacy of the processes; commitment level of individual Board members; quality of corporate reporting; participation of stakeholders in the management; etc.

- Divorce of Management and Ownership

- Role and Powers of the Board

- Legislation

- Code of Conduct

- Board Independence

- Board Skills

- Management Environment

- Board Appointments

- Board Induction and Training

- Board Meetings

- Strategy Setting

- Business and Community Obligations

- Financial and Operational Reporting

- Monitoring the Board Performance

- Audit Committee

- Risk Management

Since, this is an important element affecting the long-term financial health of companies, good governance framework also calls for effective legal and institutional environment, business ethics and awareness of the environmental and societal interests.

The main constituents of good corporate governance listed below have to be incorporated by each company to improve its credibility in the market.

Divorce of Management and Ownership

Ownership refers to the legal custodian of the business. Management of the business requires professional skills and a degree of autonomy to the managers, agreed upon consensually between the owners and managers.

Role and Powers of the Board

The foremost requirement of good corporate governance is the clear identification of powers, roles, responsibilities and accountability of the Board, CEO and the Chairman of the Board.

Legislation

Understanding the legislative and regulatory framework is fundamental to effective corporate governance.

Code of Conduct

It is essential that an organisation’s explicitly prescribed code of conduct is communicated to all stakeholders and is clearly understood by them. There should be some system in place to periodically measure and evaluate the adherence to such code of conduct by each member of the organisation.

Board Independence

An independent board is essential for sound corporate governance. It means that the board is capable of assessing the performance of managers with an objective perspective. Hence, the majority of board members should be independent of both the management team and any commercial dealings with the company.

Such independence ensures the effectiveness of the board in supervising the activities of management as well as making sure that there are no actual or perceived conflicts of interests.

Board Skills

In order to be able to undertake its functions effectively, the board must possess the necessary blend of qualities, skills, knowledge and experience so as to make quality contribution. This includes operational or technical expertise, financial skills, legal skills as well as knowledge of government and regulatory requirements.

Management Environment

This includes setting up of clear objectives and appropriate ethical framework, establishing due processes, providing for transparency and clear enunciation of responsibility and accountability, implementing sound business planning, encouraging business risk assessment, having right people and right skill for jobs, establishing clear boundaries for acceptable behaviour, establishing performance evaluation measures and evaluating performance and sufficiently recognising individual and group contribution.

Board Appointments

To ensure that the most competent people are appointed on the board, the board positions must be filled through the process of extensive search. A well defined and open procedure must be in place for reappointments as well as for appointment of new directors.

Board Induction and Training

It is essential to ensure that directors remain abreast of all development, which impact or, may impact corporate governance and other related issues.

Board Meetings

These are the forums for board decision making. Such meetings enable directors to discharge their responsibilities. The effectiveness of board meetings is dependent on carefully planned agendas and provision of relevant papers and materials to directors sufficiently prior to board meetings.

Strategy Setting

The objective of the company must be clearly documented with a long term corporate strategy including an annual business plan together with achievable and measurable performance targets and milestones.

Business and Community Obligations

Though the basic activity of a business entity is inherently commercial, yet it must also take care of the community’s obligations. The stakeholders must be informed about the approval by the proposed and on going initiatives taken to meet the community obligations.

Financial and Operational Reporting

The board requires comprehensive, regular, reliable, timely, correct and relevant information in a proper format and of a quality that is appropriate to discharge its function of monitoring corporate performance.

Monitoring the Board Performance

The board must monitor and evaluate its combined performance and also that of individual directors at periodic intervals, using key performance indicators besides peer review.

Audit Committee

It is inter alia responsible for liaison with management, internal and statutory auditors, reviewing the adequacy of internal control and compliance with significant policies and procedures, reporting to the board on key issues.

Risk Management

Risk is an important element of corporate functioning and governance. There should be a clearly established process of identifying, analysing and treating risks, which could prevent the company from effectively achieving its objectives.

The board has the ultimate responsibility for identifying major risks to the organisation, setting acceptable levels of risks, and ensuring that senior management takes steps to detect, monitor, and control these risks.

The mandatory and non-mandatory requirements of Clause 49 to be complied with for improving corporate governance are listed at the end of the chapter in the Annexure. [Refer Annexure I, IA, IB, IC, ID]

Corporate Governance Definition

According to Gabrielle O’Donovan, corporate governance is an internal system encompassing policies, processes and people, which serve the needs of shareholders and other stakeholders, by directing and controlling management activities with good business savvy, objectivity, accountability and integrity. Sound corporate governance is reliant on external marketplace commitment and legislation, plus a healthy board culture which safeguards policies and processes.

Security and Exchange Board of India (SEBI) defines corporate governance as the acceptance by management of the inalienable rights of shareholders as the true owners of the corporation and of their own role as trustees on behalf of the shareholders. It is about commitment to values, about ethical business conduct and about making a distinction between personal and corporate funds in the management of a company.

According to Sir Adrian Cadbury, corporate governance is concerned with holding the balance between economic and social goals and between individual and communal goals. The corporate governance framework is there to encourage the efficient use of resources and equally to require accountability for the stewardship of those resources. The aim is to align as nearly as possible the interests of individuals, corporations and society.

According to the International Chamber of Commerce, corporate governance is the relationship between corporate managers, directors and the providers of equity, people and institutions who save and invest their capital to earn a return. It ensures that the board of directors is accountable for the pursuit of corporate objectives and that the corporation itself conforms to the law and regulations.

In simple words, we can conclude that corporate governance refers to a system of rules, regulations and processes that helps a company in directing and controlling the functioning of a company.

Objectives and Goals of Corporate Governance

Corporate governance is essential because it focuses on building a long-term shareholders’ value. In addition, it is needed to gain the trust and confidence of domestic and foreign investors. Corporate governance also assumes that proper functioning of the financial markets helps in various corporate and societal concerns, including labour welfare and environmental protection.

- Creating Competitive Advantage

- Preventing Fraud and Malpractices

- To Bring in Transparency

- Adhering to Legal Compliance

An effective corporate governance system is needed to curb or minimise corporate failure, corporate malice and unethical behaviour present in organisations. The incidents of corporate scandals, such as misuse of organisation’s financial resources for personal benefits or not following the code of conduct, damage its goodwill.

Good corporate governance is responsible for the growth and development of organisations. Amidst increasing competition, liberalisation and globalisation, an organisation is required to retain the trust of stakeholders as well as attract new ones.

The objectives and goals of corporate governance are as follows:

Creating Competitive Advantage

It refers to building a core competency that works as an edge over the rivals of a particular organisation. Competitive advantage comes into being only when the organisation supports value creation. An example of value creation would be Sony, which has the competitive advantage of creating small-sized products that are more effective and of better quality.

Preventing Fraud and Malpractices

It refers to precluding misconducts and fraudulent practices so as to ensure sound and trustworthy corporate environment. Small frauds can lead to big financial crisis; therefore, such frauds should be prevented at the nascent stage only.

To Bring in Transparency

It refers to meeting the investor’s expectations by creating an open system that aims at providing accountability and transparency in all organisational operations. This further leads to value enhancement and provides scope for effective implementation of corporate standards.

Adhering to Legal Compliance

It refers to adhering to the laws and regulations as per the legal framework of a country. Compliance to laws enables an organisation to survive in the long term and builds a good code of conduct. Moreover, jurisdiction also helps in protecting the rights of investors.

Dimensions of Corporate Governance

Corporate governance is a set of rules that directs, regulates, governs and controls business organisations. These rules are basically the guidelines to run organisations and operate businesses. Corporate governance enables organisations to achieve their objectives within the government and industrial frameworks.

Moreover, corporate governance aims at adding value to the business which results into numerous benefits retrieved by an organisation and its various stakeholders such as suppliers, employees and customers.

There are mainly two dimensions of corporate governance, namely, internal corporate governance and external corporate governance. These are explained as follows:

Internal Corporate Governance

It involves the controlling mechanism among various players within an organisation, such as Board of Directors, top management like CEO and MD, and shareholders. It aims at ensuring methodical strategy implementation, optimum management of risks, efficient processes and regulatory compliance within the organisation.

External Corporate Governance

This comprises the forces that impact an organisation from outside, such as legal entities, government, industry norms, regulatory authorities, market, service providers (auditors, consultants and financial institutions) and media. It plays a key role in ensuring appropriate corporate governance practices and mechanism in an organisation.

Benefits of Corporate Governance

In today’s globalised world, corporations need to access global pools of capital as well as attract and retain the best human capital from various parts of the world. Instances of financial crisis like Subprime crisis, Madoff Investment Securities scam, Satyam scam, have brought the subject of corporate governance to the surface.

This is because financial and non-financial disclosures made by any firm are only as good and honest as the people behind them. Under such a scenario, unless a corporation embraces and demonstrates ethical conduct, it will not be able to succeed. Several studies in India and abroad have indicated that markets and investors take notice of the credibility offered by good corporate governance procedures designed by the company and helps them to take long term investment decisions.

The corporation being a congregation of various stakeholders, its growth is directly dependent on the cooperation rendered by all the stakeholders. Hence, there is a need to shift the emphasis on compliance of corporate governance with substance, rather than form, and develop intellectual honesty and integrity.

Effectiveness of corporate governance system cannot merely be legislated by law; neither can any system of corporate governance be static. As competition increases, the environment in which firms operate changes and in such a dynamic environment the systems of corporate governance also need to evolve. Companies like Infosys and Wipro have demonstrated that adoption of good corporate governance practices provides stability and growth to the enterprise.

Efforts to Improve Corporate Governance

A National Foundation for Corporate Governance (NFCG) is set up in association with the CII, ICAI and ICSI to provide a platform to deliberate on issues relating to good corporate governance, to sensitise corporate leaders on the importance of good corporate governance practices as well as to facilitate exchange of experiences and ideas amongst corporate leaders, policy makers, regulators, law enforcing agencies and non-government organisations.

Good corporate governance recognises the diverse interests of shareholders, lenders, employees, government, etc.

For effective corporate governance there is a need of selecting meritorious, diverse, ethical and socially oriented executives. Boards of directors cannot function effectively if they do not have the “right people” as members and the “right chairman” as leader.

Moreover, they must also be supported by the “right” attitudes on the part of management, the external auditor and other advisors. Sound, effective corporate governance must include a Board of Directors independent from management but accountable to the company and its shareholders.

It is also important to understand that diversity and independence are important because the best collective decisions are the product of disagreement and contest, not consensus or compromise. All board members need to have knowledge and experience that allows them to demonstrate results orientation, strategic orientation and at the same time, be both independent and collaborative.

With ethical intellectual capital governing new companies like Wipro, Dr. Reddy’s Lab and Infosys who have a large global workforce, they have developed a “no tolerance” policy towards any kind of fraud. Wipro has developed a code of business conduct that defines dos and don’ts and tolerance levels in the company.

Even proxy bribing by vendors or partners is not permitted. Recently Wipro terminated 100 employees after it was discovered that these employees had furnished fake resumes in connivance with the external hiring agency. Similarly, a senior employee, who had wrongfully claimed medical reimbursement for a corrective eye surgery, too was forced to resign. Wipro values its policies above everything else. The penalty is the same across the company and penal policies are the same.

Corporate Governance and CSR

Good corporate governance is the foundation of CSR. Systemic organisational failures and negative social consequences are created by corporate governance structures and processes, which impact stakeholder relationships and are risks for business. Viewed from this context, CSR is a risk management strategy for business.

Example: Violation of market place, work place, or environmental frame-works can impact the profitability of business and reputation.

To overcome these risks, businesses need risk management strategy which can be designed by formulating and implementing CSR strategy and preparing triple bottom line reports.

As CSR is fundamentally concerned with transparency, accountability and performance, it is important for the CSR decision-making structure to be an integral component of the corporate governance system. For developing ethical business standards within the organisation there are several options for board participation in CSR activities.

Example: A board member could be tasked with a broad responsibility for CSR activities; a new member who has specific CSR expertise could be appointed; CSR responsibilities could be added to the work of existing board committees; a new CSR board committee could be formed; or the entire board could be involved in CSR decisions.

Recognising the fact that businesses are vital partners in development, the governance standards and the stakeholder social responsibility practices adopted by the companies need to be strategically aligned to achieve both business and social goals. Corporate Governance & CSR are crucial elements to foster sustainability of businesses and society.

Corporate Disclosure and Investor Protection in India

Corporate disclosure means the act of releasing all the necessary relevant information of a company that may influence an investment decision.

It includes disclosure about companies’ objectives, financial details, operating profit, governance structure and policies, details of the board of directors, etc. If the rights of minority shareholders in firms are poorly protected, those who control the firms can more easily use its resources to pursue their own objectives. Therefore investor’s protection is important.

Investor’s protection in India is needed because of the following reasons:

- Corporate scams and accounting scandals

- Insider trading

- Non disclosure of material facts

- Vanishing companies who disappears after taking money of the investors.

- Money Laundering

- Terrorist Funding

SEBI was established as a measure for investor protection in India in 1992. The SEBI has introduced an automated complaints handling system to deal with investors’ complaints. For this SEBI issues fortnightly press releases disclosing names to the companies against whom maximum number of complaints have been received.

A representative of SEBI supervises the allotment of share process. Besides many other measures it also issues advertisements frequently to make investor aware of various issues to the securities market and of their rights and remedies.

Classification of Complaints

The complaints received by the SEBI are categorised in five types:

Type I: Non-receipts of refund orders/allotment letters/stock investment.

Type II: Non-receipt of dividend.

Type III: Non-receipt of share certificates/bonus shares.

Type IV: Non-receipt of debentures certificate/interest on debentures/ redemption amount of debentures/interest on delayed payment of interest.

Type V: Non-receipt of annual reports, right issue forms/interest on delayed receipt of refund orders/dividends.

The following measures were initiated by the SEBI:

- Vetting offer documents and prospectus of the scheme launched by the companies

- Advertising codes for issue

- IPO Grading

- Improves functioning of Stock exchanges in India

- Securities Appellate Tribunal

- Disclosure of NAV of Mutual Funds daily

- Publications/Awareness Programmes

- Stringent requisites for an intermediary

Consequences of Investor’s Protection

There are two broad areas in which investor protection has an impact which are as follows:

- Financial Markets

- Real Consequences

Financial Markets

Investor protection has encouraged the development of capital market because when they are protected from expropriation they are ready to pay for more for securities thereby making it more attractive for entrepreneurs to issue more securities.

Real Consequences

Investor protection influences the real economy through its effect on financial markets. Financial development can accelerate economic growth in three ways:

- Enhance savings

- It can channel these savings into real investment and thereby foster capital accumulation.

- To the extent that the financiers exercise some control over the investment decisions ofthe entrepreneurs, financial development improves the efficiency of resource allocation, as capital flows toward the more productive uses. All three channels can in principle have large effects on economic growth.

Models of Corporate Governance

An organisation always follows a hierarchy where authority flows upwards and accountability is delegated downwards. For example, in a marketing department, the marketing manager holds the authority to give directions; whereas, the marketing executive is accountable to abide by those directions.

The Board of Directors forms the management of the organisation, which works as a team for reaching consensus on matters related to corporate governance. The practices of corporate governance, as followed across various organisational hierarchies, can be explained with the help of various models.

Let us explain these models of corporate governance in the following sub-sections.

Anglo-American Model

The Anglo-American model, also known as the Anglo-Saxon approach, of corporate governance follows a shareholder-oriented approach. It highlights the fundamentals of corporate governance practices in America, Britain, Canada, Australia and other countries following the common wealth law.

The major features of the Anglo-American model are as follows:

- Providing equal ownership of the organisation to both institutional and individual shareholders

- Making directors and managers interdependent

- Separating the ownership and management functions

- Making disclosure norms concise and comprehensive

- Penalising insider trading and framing strict rules against the manipulations of organisational code of conduct

- Protecting the interest of small shareholders

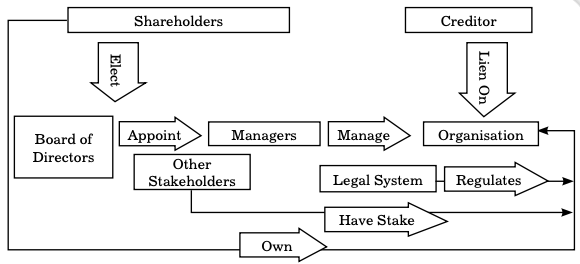

Figure shows the Anglo-American model of corporate governance:

As shown in Figure, in the Anglo-American model, shareholders elect the Board of Directors. The Board of Directors appoints the managers to manage the organisation.

In addition, this model shows a legal system that regulates the organisation, which is owned by the shareholders. The organisation has an obligation towards the creditors and other stakeholders who have contributed it financially and/ or non-financially.

German Model

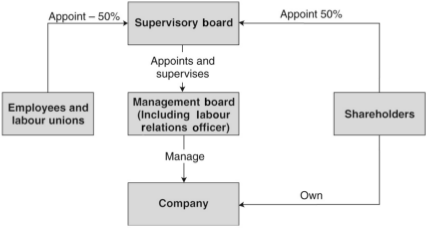

The German model of corporate governance comprises two boards, namely supervisory board and management board. This model is also known as two-tier board model as well as Continental European model as it has been adopted in Germany, Holland and France.

It adopts a societal orientation and states that the employees of an organisation have a voting right to elect the Board of Directors. Figure illustrates the German model of corporate governance:

As per Figure, half of the supervisory board is elected by employees and labour union of the organisation; while the other half is elected by the shareholders.

The supervisory board thereafter supervises the management board that comprises executive managers. The management board is responsible for managing the overall organisational affairs.

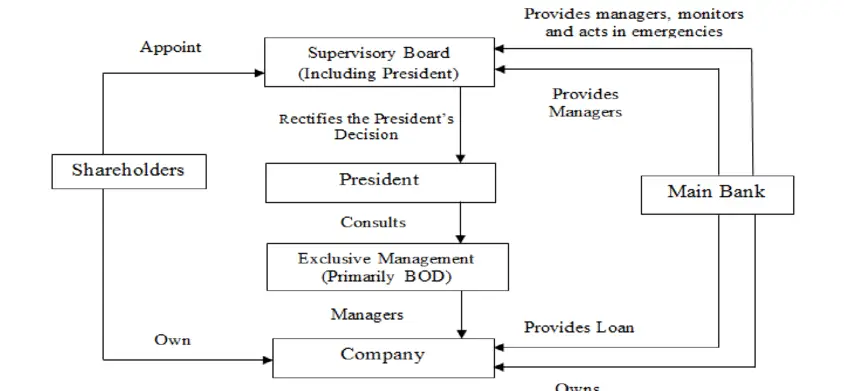

Japanese Model

The Japanese model of corporate governance is called the business network model. It is also known as Keiretsu in Japanese, which means system and row. It considers financial institutions as an important part of corporate governance.

The features of the Japanese model are as follows:

- Including the president in the model and assigning him the function of consulting both supervisory and executive boards

- Outlining the importance of lending banks

Figure represents the Japanese model of corporate governance:

As shown in Figure, in the Japanese model of corporate governance, shareholders appoint the advisory board, which ratifies the decisions taken from the board. The executive management works as a consultant for the organisation’s president. The banks are required to finance the organisation that is owned by shareholders.

Similarities Between German and Japanese Models of Corporate Governance

- Integrated financial system

- Maintain long-term investor relations

- Follow flexible norms and do not have a stringent regulatory force that can minimise insider trading

- Lack a proper control system regarding mergers and acquisitions

Indian Model

The Indian corporate houses are governed by the Company’s Act of 1956 that is influenced by the model followed by the United Kingdom. It also uses recommendations given by the German and Japanese models of corporate governance.

The legal corporate governance system of India is based on the recommendations of three committees: Kumar Mangalam Birla Committee, Narayana Murthy Committee and Naresh Chandra Committee. Some experts have also pointed out that the Indian model of corporate governance takes most of the features of the Anglo-American model. Therefore, it can be said that the Indian corporate governance model is influenced by corporate governance practices prevailing worldwide. Figure illustrates the Indian model of corporate governance:

As shown in Figure, the Indian model of corporate governance depicts the external and internal organisational environments, which influences the organisational functioning. The model also depicts the output of corporate governance in the form of investor protection, ethics, long-term shareholder value and transparency as well as accountability.

OECD Principles of Corporate Governance

For stimulating the economic progress and international trade, the Organisation for Economic Cooperation and Development (OECD) was founded in 1961 as an international economic organisation.

It refers to a forum of countries coming together and describing their commitment towards the democracy and the market economy. It basically got established with an objective of maintaining good practices and coordinating among the countries across the globe.

OECD promotes policies designed:

- to achieve the highest sustainable economic growth and employment and a rising standard of living in member countries, while maintaining financial stability, and thus to contribute to the development of the world economy;

- to contribute to sound economic expansion in member as well as non-member countries in the process of economic development; and

- to contribute to the expansion of world trade on a multilateral, non-discriminatory basis in accordance with international obligations

OECD is a non-governmental organisation that has a goal to achieve long-term value for shareholders. The principles provided by OECD play a significant role in improving the structure of corporate governance and are applicable universally.

These principles are given as follows:

- Protecting the shareholders’ rights

- Bringing transparency in the standards of corporate governance

- Balancing the conflict of interest and discouraging insider trading through discussions

- Including independent directors on audit committees

- Conducting the internal audit of the organisation separately from the external audit

- Creating and protecting property rights

As per the notification made by the OECD:

- The corporate governance framework should be developed with a view to its impact on overall economic performance, market integrity and the incentives it creates for market participants and the promotion of transparent and efficient markets

- The division of responsibilities among different authorities in a jurisdiction should be clearly articulated and ensure that the public interest is served.

- Supervisory, regulatory and enforcement authorities should have the authority, integrity and resources to fulfil their duties in a professional and objective manner. Moreover, their rulings should be timely, transparent and fully explained.

Theories Underlying Corporate Governance

The organisation can act as a separate entity distinct from its members. However, the members of the organisation give it a form or structure on the basis of their strategic thinking and business plans.

There are some basic theories, such as stakeholder theory, stewardship theory and agency theory, which influence the corporate governance practices in an organisation. These theories are explained in the next sub-sections.

Stakeholder Theory

The stakeholder theory was developed in 1930s. It supports the view that an organisation should maximise stakeholders’ benefits and follow an ethical code of conduct. It has been drawn on the basis of various theories, including the social contract theory, communitarian ethics and ethics of care.

There are many problems that arise while enforcing the stakeholder theory in an organisation. These problems include identifying genuine stakeholders and determining the shareholders’ benefits. An organisation has many stakeholders.

Therefore, some management experts have suggested dividing stakeholders into primary and secondary shareholders. Primary shareholders refer to those shareholders who directly purchase shares from the organisation; whereas, secondary shareholders purchase shares from the stock exchange.

The stakeholder theory of corporate governance has been accused of creating chaos in the organisation as it diverts the managers from the goal of profit maximisation.

Stewardship Theory

The stewardship theory nullifies the possible conflicts between the managers and shareholders that have been presumed by the agency theory. It supports the view that the managers are considerate about their personal reputation and value their integrity.

There is a high demand for managers who have a strong sense of dignity for their personal reputation. Consequently, managers with high ethical and moral values are being offered higher remuneration in their respective industries as compared to others.

The stewardship theory focuses on the trustworthiness of managers and is based on the following points:

- Motivating managers to ensure that they not only look after personal goals, but also align these personal goals with the organisational objectives

- Controlling managers with excessive modes can actually demotivate them. So, it is important to ensure that the control measures do not hamper the productivity of the managers.

Agency Theory

The agency theory is built upon the presumption that the interests of managers often clash or are divergent from that of the shareholders. The shareholders select the managers, who are called agents, for the long-term wealth maximisation and smooth functioning of the organisation.

However, the managers focus on their personal benefits and short-term profit maximisation rather than long-term wealth maximisation of the organisation. This conflict of interest between managers and shareholders gives rise to a problem, known as the agency problem.

The role of corporate governance comes into picture for addressing the agency problem by bringing transparency and aligning the objectives of the organisation with its associated parties.

The agency problem can be solved by providing incentives, personal recognition and monetary and non-monetary rewards to managers to motivate them to achieve wealth maximisation. In addition, the organisation tries to establish a link between executive remuneration and shareholder benefits to address the agency problem.

It is not possible for an organisation to completely eradicate the conflict of interest between shareholders and managers. However, this conflict of interest can be minimised by implementing the following effective corporate governance practices:

Correct Full Disclosures

It implies that all documents pertaining to the financial and operational framework of a company should represent its true and fair picture to its shareholders and investors.

Effective Board of Directors

It refers to an efficient board of directors that should be independent and neutral enough to deal with managers as well as shareholders. The board should also ensure proper implementation of legal regulations. The directors are responsible for the rights of shareholders. Therefore, they should aim towards long-term value maximisation.

Differences Between the Agency Theory and Stewardship Theory

The differences between agency theory and stewardship theory are as follows:

Behavioural Differences

It refers to the difference in the attitude and behaviour of managers. The agency theory follows the materialistic approach, whereas the stewardship theory supports the socialistic approach.

Besides, the agency theory prompts managers to take the role of agents where they have to control and supervise the managerial functioning. On the other hand, the stewardship theory aims at empowering the managers.

Need Hierarchy Differences

It refers to the needs (as per the Maslow’s Hierarchy of Needs Theory) of managers fulfilled by these two theories. The two theories satisfy different levels of needs of the managers.

The agency theory satisfies the lower level needs of the managers that are also known as extrinsic needs. On the other hand, the stewardship theory aims at fulfilling the intrinsic or higher level needs of the managers.

Orientation Differences

It refers to the differences in approach followed by these two theories. The agency theory aims at building a control and authority-oriented management, whereas the stewardship theory focuses on participative management.

Corporate Governance as a Systemic Process

Corporate governance can be defined as a systemic process that helps companies in enhancing their wealth-generating capacity by using managerial activities like direction and control.

As large organisations use a substantial number of societal resources, corporate governance must ensure the proper utilisation of these resources in order to meet the requirements and expectations of their stakeholders.

Thus, there is a need of structured corporate governance, based on strong ethics and principles. Corporate governance structure is primarily based on two core principles, which are as follows:

- The administrative and decision-making freedom to the management to take the organisation forward without any unnecessary limitations.

- The freedom must have the effective accountability of performing individual duties.

The systemic process of corporate governance must have the structured and well-defined roles of the organisation, which also includes the role of every individual associated with the organisation, especially at middle, senior and higher level of management.

Well-defined roles based on core principles further elucidate the philosophy of an organisation. The governance philosophy includes transparency, empowerment and accountability, which are explained as follows:

Transparency

This means the clarity of policies and procedures of an organisation to the associated stakeholders to whom it owns the responsibility, such as customer (or client), supplier (or service provider), regulatory authorities, government and society. Thus, transparency must ensure the proper disclosure of the policies and procedures without jeopardising the key strategies of the organisation.

Empowerment

It can be defined as a process to unleash creativity and innovation throughout an organisation by encouraging decision making at various levels of hierarchy in order to realise the actual potential of its employees. In turn, empowerment helps the organisation to grow and succeed.

Accountability

Accountability refers to the responsibility. There is a direct relationship between the power and accountability. The high level of power comes with the high level of accountability.

Thus, it is of paramount importance for an organisation to allow the access of relevant information, policies and procedures to all the employees. Appropriate transparency and empowerment enhances the accountability.

Ethics and Corporate Governance

Nowadays, many Indian organisations have acknowledged the significance of incorporating ethical values, such as integrity, transparency and healthy communication in their corporate governance system. They believe that the goodwill generated by implementing business ethics helps to gain their monetary and non-monetary benefits in the long run.

Every organisation deals with many stakeholders that include shareholders, employees, customers, vendors and communities. For attaining a healthy growth rate, an organisation needs to build healthy relations with all these stakeholders.

For example, an organisation ensures the payment of decent dividend to its shareholders, good working conditions to employees, reliable products for consumers and responsible relations with the community. Business ethics is a system of moral principles applied in a business environment.

It has the following purposes:

- Providing tools to individuals so that they can deal with moral complexity in business

- Ensuring that business decisions cover ethical framework

- Evaluating ethical implications before taking any decisions

Corporate governance elaborates the corporate pursuit of economic objectives related to a number of wider ethical and societal considerations. It can be understood as an application of best management practices associated with compliance of law in true spirit and adherence to ethical framework.

The concept of corporate governance deals with the following questions:

- Who should derive benefits from corporate decisions?

The enhanced level of awareness among stakeholders and consumers leads to the identification of the existence of unethical practices in the organisation. Such practices include financial frauds, tax evasion, bad quality products and services, indifference towards environmental concerns and hazardous working conditions.

Nowadays, investors make sure that the organisations in which they invest are managed properly and possess a proper corporate governance structure. The organisations consider corporate governance as an important control mechanism.

This mechanism makes the optimum use of the human, financial and physical resources of organisations. Thus, organisations focus to ingrain ethics into their culture and concentrate on implementing appropriate corporate governance practices.

Corporate governance represents the various frameworks that are associated with the functioning of an organisation. It includes moral framework, ethical framework and the value framework. To survive in the market in the long run by creating reputation and strong goodwill, an organisation needs to develop a systematic approach towards the corporate governance.

Corporate governance and corporate social responsibility are quite different business concepts. However, their association is becoming much familiar due to increased focus of corporate houses on balancing business profits with responsible operations.

Corporate governance is traditionally defined as a mechanism used by an organisation to ensure that organisational functioning is optimised to produce the best financial results for shareholders. The top management develops and oversees the governing systems that facilitate the application of the various rules and regulations pertaining to the corporate governance mechanism.

In the current and dynamic scenario that asks for the high level of the accountability from the corporate houses, it has become essential for them to treat all the stakeholders with balanced approach. The increased public demands have made it compulsory for the corporate houses to incorporate social and environmental responsibilities into corporate guidelines.

There has been an ongoing debate on the involvement of other stakeholders’ interests within the corporate governance system. Some companies still consider the maximisation of shareholders as their main agenda, whereas others believe that a balanced approach towards the corporate and societal issues provides them long-term viability and proves as a competitive advantage.

Corporate Social Responsibility (CSR) has evolved from basic standards of business ethics. It comprises honesty and transparency.

According to Hopkins (2007), CSR is defined as continuing commitment by business to behave ethically and contribute to economic development while improving the quality of life of the workforce and their families, as well as of the local community and society at large.

The outcome of the common convergence of corporate governance and corporate social responsibility is not easy to measure for a corporate house. According to Forbes Magazine, company leaders should not expect to see tangible profits from responsible behaviour. Instead, companies should include responsible behaviour in its corporate governance to do the right thing and to experience long-term indirect benefits of better community relations and the avoidance of public backlash.

Business Ethics

(Click on Topic to Read)

- What is Ethics?

- What is Business Ethics?

- Values, Norms, Beliefs and Standards in Business Ethics

- Indian Ethos in Management

- Ethical Issues in Marketing

- Ethical Issues in HRM

- Ethical Issues in IT

- Ethical Issues in Production and Operations Management

- Ethical Issues in Finance and Accounting

- What is Corporate Governance?

- What is Ownership Concentration?

- What is Ownership Composition?

- Types of Companies in India

- Internal Corporate Governance

- External Corporate Governance

- Corporate Governance in India

- What is Enterprise Risk Management (ERM)?

- What is Assessment of Risk?

- What is Risk Register?

- Risk Management Committee

Corporate social responsibility (CSR)

Lean Six Sigma

- Project Decomposition in Six Sigma

- Critical to Quality (CTQ) Six Sigma

- Process Mapping Six Sigma

- Flowchart and SIPOC

- Gage Repeatability and Reproducibility

- Statistical Diagram

- Lean Techniques for Optimisation Flow

- Failure Modes and Effects Analysis (FMEA)

- What is Process Audits?

- Six Sigma Implementation at Ford

- IBM Uses Six Sigma to Drive Behaviour Change

Research Methodology

Management

Operations Research

Operation Management

- What is Strategy?

- What is Operations Strategy?

- Operations Competitive Dimensions

- Operations Strategy Formulation Process

- What is Strategic Fit?

- Strategic Design Process

- Focused Operations Strategy

- Corporate Level Strategy

- Expansion Strategies

- Stability Strategies

- Retrenchment Strategies

- Competitive Advantage

- Strategic Choice and Strategic Alternatives

- What is Production Process?

- What is Process Technology?

- What is Process Improvement?

- Strategic Capacity Management

- Production and Logistics Strategy

- Taxonomy of Supply Chain Strategies

- Factors Considered in Supply Chain Planning

- Operational and Strategic Issues in Global Logistics

- Logistics Outsourcing Strategy

- What is Supply Chain Mapping?

- Supply Chain Process Restructuring

- Points of Differentiation

- Re-engineering Improvement in SCM

- What is Supply Chain Drivers?

- Supply Chain Operations Reference (SCOR) Model

- Customer Service and Cost Trade Off

- Internal and External Performance Measures

- Linking Supply Chain and Business Performance

- Netflix’s Niche Focused Strategy

- Disney and Pixar Merger

- Process Planning at Mcdonald’s

Service Operations Management

Procurement Management

- What is Procurement Management?

- Procurement Negotiation

- Types of Requisition

- RFX in Procurement

- What is Purchasing Cycle?

- Vendor Managed Inventory

- Internal Conflict During Purchasing Operation

- Spend Analysis in Procurement

- Sourcing in Procurement

- Supplier Evaluation and Selection in Procurement

- Blacklisting of Suppliers in Procurement

- Total Cost of Ownership in Procurement

- Incoterms in Procurement

- Documents Used in International Procurement

- Transportation and Logistics Strategy

- What is Capital Equipment?

- Procurement Process of Capital Equipment

- Acquisition of Technology in Procurement

- What is E-Procurement?

- E-marketplace and Online Catalogues

- Fixed Price and Cost Reimbursement Contracts

- Contract Cancellation in Procurement

- Ethics in Procurement

- Legal Aspects of Procurement

- Global Sourcing in Procurement

- Intermediaries and Countertrade in Procurement

Strategic Management

- What is Strategic Management?

- What is Value Chain Analysis?

- Mission Statement

- Business Level Strategy

- What is SWOT Analysis?

- What is Competitive Advantage?

- What is Vision?

- What is Ansoff Matrix?

- Prahalad and Gary Hammel

- Strategic Management In Global Environment

- Competitor Analysis Framework

- Competitive Rivalry Analysis

- Competitive Dynamics

- What is Competitive Rivalry?

- Five Competitive Forces That Shape Strategy

- What is PESTLE Analysis?

- Fragmentation and Consolidation Of Industries

- What is Technology Life Cycle?

- What is Diversification Strategy?

- What is Corporate Restructuring Strategy?

- Resources and Capabilities of Organization

- Role of Leaders In Functional-Level Strategic Management

- Functional Structure In Functional Level Strategy Formulation

- Information And Control System

- What is Strategy Gap Analysis?

- Issues In Strategy Implementation

- Matrix Organizational Structure

- What is Strategic Management Process?

Supply Chain