Technology Life Cycle

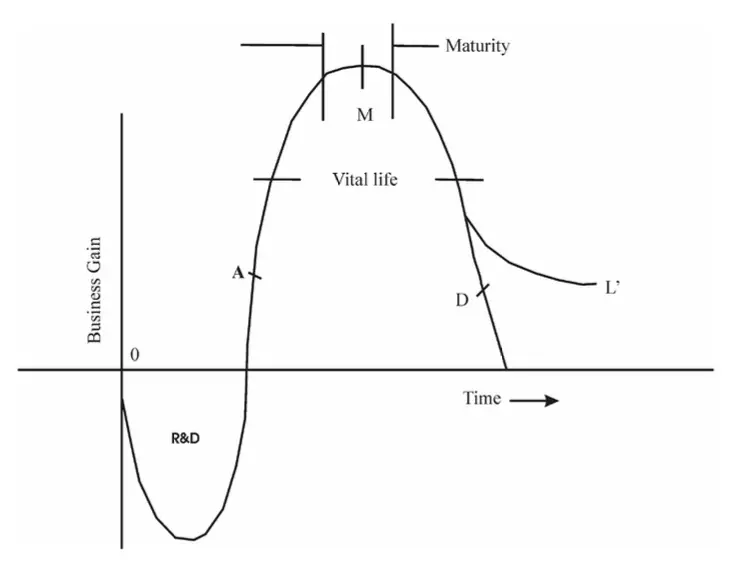

The Technology Life Cycle (TLC) describes the commercial gain of a product through the expense of the research and development phase, and the financial return during its “vital life”. Some technologies, such as steel, paper, or cement manufacturing, have a long lifespan (with minor variations in technology incorporated with time) whilst in other cases, such as electronic or pharmaceutical products, the lifespan may be quite short.

Table of Content

The Technology Life Cycle associated with a product or technological service is different from Product Life Cycle (PLC) dealt with in Product Life Cycle Management. The latter is concerned with the life of a product in the marketplace in respect of the timing of introduction, marketing measures, and business costs. The technology underlying the product (such as that of a uniquely flavored tea) may be quite marginal but the process of creating and managing its life as a branded product will be very different.

The technology life cycle is related to the time and cost of developing the technology, the timeline of recovering cost, and modes of making the technology yield a profit proportionate to the costs and risks involved. The Technology Life Cycle may, further, be protected during its cycle with patents and trademarks seeking to lengthen the cycle and to maximize the profit from it.

The development of a competitive product or process can have a major impact on the lifespan of the technology, making it shorter. Equally, the loss of patent rights through litigation, or loss of its secret elements (if any) through leakages also works to reduce its lifespan. Thus, it is apparent that the ‘management’ of the Technology Life Cycle is an important aspect of technology development.

In the simplest formulation, innovation can be thought of as being composed of research, development, demonstration, and deployment.

Four Phases of the Technology Life Cycle

The Technology Life Cycle may be seen as composed of four phases:

- The research and development (R&D) phase (sometimes called the “bleeding edge”) is when incomes from inputs are negative and where the prospects of failure are high.

- The ascent phase is when out-of-pocket costs have been recovered and the technology begins to gather strength by going beyond some Point A on the Technology Life Cycle (sometimes called the “leading edge”).

- In the maturity phase when the gain is high and stable, the region goes into saturation, marked by M.

- The decline (or decay phase), after Point D, of reducing the fortunes and utility of the technology.

Licensing Options

In the modern world’s business trends, with Technology Life Cycles shortening due to competition and rapid innovation, a technology becomes technically licensable at all points of the Technology Life Cycle, whereas earlier, it was licensed only when it was passed through its stage of maturity.

Large corporations develop technology for their advantage and not with the objective of licensing. The tendency to license out technology only appears when there is a threat to the life of the Technology Life Cycle (business gain) as discussed later.

Licensing in the R&D Phase

There are always smaller firms (SMEs) that are improperly situated to finance the development of innovative Research and Development in the post-research and early technology phases. By sharing incipient technology under certain conditions, substantial risk financing can come from third parties. This is a form of quasi-licensing that takes various formats.

Even the big corporate houses may not wish to bear all costs of development in areas of crucial and high risk (such as aircraft development) and may seek means of spreading it to the stage where proof-of-concept is obtained.

In the case of small and medium firms, entities such as venture capitalists can enter the scene and help to materialize technologies. Venture capitalists accept both the costs and uncertainties of Research & Development and that of market acceptance, in reward for high returns when the technology proves itself. Apart from finance, they may provide networking, management, and marketing support. Venture capital connotes financial as well as human capital.

Large firms may opt for Joint Research and Development or work in a consortium for the early phase of development. Such vehicles are called strategic alliances – strategic partnerships.

With both venture capital funding and strategic (research) alliances, when business gains begin to neutralize development costs (the Technology Life Cycle crosses the X-axis), the ownership of the technology starts to change.

In the case of smaller firms, venture capitalists help clients enter the stock market for obtaining substantially larger funds for development, maturation of technology, product promotion and to meet marketing costs.

Example: A major way is through Initial Public Offering (IPO) which invites risk funding by the public for potential high gain. At the same time, the IPOs enable venture capitalists to attempt to recover expenditures already incurred by them through the part sale of the stock pre-allotted to them (after the listing of the stock on the stock exchange). When the IPO is fully subscribed, the assisted enterprise becomes a corporation and can more easily obtain bank loans, etc if required.

Strategic alliance partners, allied on research, pursue separate paths of development with the incipient technology of common origin but pool their accomplishments through instruments such as ‘cross-licensing’. Generally, contractual provisions among the members of the consortium allow a member to exercise the option of independent pursuit after joint consultation; in which case the opted owns all subsequent development.

Licensing in the Ascent Phase

The ascent stage of the technology usually refers to some point above Point A in the Technology Life Cycle diagram but actually, it commences when the Research and Development portion of the Technology Life Cycle curve inflects (only that the cash-flow is negative and unremunerative to Point A). The ascent is the strongest phase of the Technology Life Cycle because it is here that the technology is superior to alternatives and can command premium profit or gain.

The slope and duration of the ascent depend on competing technologies entering the domain, although they may not be as successful in that period. Strongly patented technology extends the duration period.

The Technology Life Cycle begins to flatten out (the region shown as M) when equivalent or challenging technologies come into the competitive space and begin to eat away market share.

Till this stage is reached, the technology-owning firm would tend to exclusively enjoy its profitability, preferring not to license it. If an overseas opportunity does present itself, the firm would prefer to set up a controlled subsidiary rather than license a third party.

Licensing in the Maturity Phase

The maturity phase of the technology is a period of stable and remunerative income but its competitive viability can persist over the larger timeframe marked by its ‘vital life’. However, there may be a tendency to license out the technology to a third-parties during this stage to lower the risk of decline in profitability (or competitively) and to expand financial opportunity.

The exercise of this option is, generally, inferior to seeking participatory exploitation; in other words, engagement in the joint venture, typically in regions where the technology would be in the ascent phase, as say, a developing country. In addition to providing financial opportunity, it allows the technology owner a degree of control over its use. Gain flows from the two streams of investment-based and royalty incomes. Further, the vital life of the technology is enhanced in such a strategy.

Licensing in the Decline Phase

After reaching a point such as D in Figure 5.3, the earnings from the technology begin to decline rather rapidly. To prolong the life cycle, owners of technology might try to license it out at some point L when it can still be attractive to firms in other markets. This, then, traces the lengthening path, LL’. Further, since the decline is the result of competing rising technologies in this space, licenses may be attracted to the generally lower cost of the older technology (than what prevailed during its vital life).

Licenses obtained in this phase are ‘straight licenses’. They are free of direct control from the owner of the technology (as would otherwise apply, say, in the case of a joint venture). Further, there may be fewer restrictions placed on the licensee in the employment of the technology.

The utility, viability, and thus the cost of straight licenses depend on the estimated ‘balance life’ of the technology. For instance, should the key patent on the technology have expired, or would expire in a short while, the residual viability of the technology may be limited, although balance life may be governed by other criteria viz. know-how which could have a longer life if properly protected.

It is important to note that the license has no way of knowing the stage at which the prime, and competing technologies, are on their TLCs. It would, of course, be evident to competing licensor firms, and to the originator, from the growth, saturation, or decline of the profitability of their operations.

The license may, however, be able to approximate the stage by vigorously negotiating with the licensor and competitors to determine costs and licensing terms. A lower cost, or easier terms, may imply a declining technology.

In any case, access to technology in the decline phase is a large risk that the licensee accepts. (In a joint venture this risk is substantially reduced by licensor sharing it). Sometimes, financial guarantees from the licensor may work to reduce such risk and can be negotiated.

There are instances when, even though the technology declines to become a technique, it may still contain important knowledge or experience which the licensee firm cannot learn of without help from the originator. This is often the form that technical service and technical assistance contracts take (encountered often in developing country contracts). Alternatively, consulting agencies may fill this role.

Business Ethics

(Click on Topic to Read)

- What is Ethics?

- What is Business Ethics?

- Values, Norms, Beliefs and Standards in Business Ethics

- Indian Ethos in Management

- Ethical Issues in Marketing

- Ethical Issues in HRM

- Ethical Issues in IT

- Ethical Issues in Production and Operations Management

- Ethical Issues in Finance and Accounting

- What is Corporate Governance?

- What is Ownership Concentration?

- What is Ownership Composition?

- Types of Companies in India

- Internal Corporate Governance

- External Corporate Governance

- Corporate Governance in India

- What is Enterprise Risk Management (ERM)?

- What is Assessment of Risk?

- What is Risk Register?

- Risk Management Committee

Corporate social responsibility (CSR)

Lean Six Sigma

- Project Decomposition in Six Sigma

- Critical to Quality (CTQ) Six Sigma

- Process Mapping Six Sigma

- Flowchart and SIPOC

- Gage Repeatability and Reproducibility

- Statistical Diagram

- Lean Techniques for Optimisation Flow

- Failure Modes and Effects Analysis (FMEA)

- What is Process Audits?

- Six Sigma Implementation at Ford

- IBM Uses Six Sigma to Drive Behaviour Change

Research Methodology

Management

Operations Research

Operation Management

- What is Strategy?

- What is Operations Strategy?

- Operations Competitive Dimensions

- Operations Strategy Formulation Process

- What is Strategic Fit?

- Strategic Design Process

- Focused Operations Strategy

- Corporate Level Strategy

- Expansion Strategies

- Stability Strategies

- Retrenchment Strategies

- Competitive Advantage

- Strategic Choice and Strategic Alternatives

- What is Production Process?

- What is Process Technology?

- What is Process Improvement?

- Strategic Capacity Management

- Production and Logistics Strategy

- Taxonomy of Supply Chain Strategies

- Factors Considered in Supply Chain Planning

- Operational and Strategic Issues in Global Logistics

- Logistics Outsourcing Strategy

- What is Supply Chain Mapping?

- Supply Chain Process Restructuring

- Points of Differentiation

- Re-engineering Improvement in SCM

- What is Supply Chain Drivers?

- Supply Chain Operations Reference (SCOR) Model

- Customer Service and Cost Trade Off

- Internal and External Performance Measures

- Linking Supply Chain and Business Performance

- Netflix’s Niche Focused Strategy

- Disney and Pixar Merger

- Process Planning at Mcdonald’s

Service Operations Management

Procurement Management

- What is Procurement Management?

- Procurement Negotiation

- Types of Requisition

- RFX in Procurement

- What is Purchasing Cycle?

- Vendor Managed Inventory

- Internal Conflict During Purchasing Operation

- Spend Analysis in Procurement

- Sourcing in Procurement

- Supplier Evaluation and Selection in Procurement

- Blacklisting of Suppliers in Procurement

- Total Cost of Ownership in Procurement

- Incoterms in Procurement

- Documents Used in International Procurement

- Transportation and Logistics Strategy

- What is Capital Equipment?

- Procurement Process of Capital Equipment

- Acquisition of Technology in Procurement

- What is E-Procurement?

- E-marketplace and Online Catalogues

- Fixed Price and Cost Reimbursement Contracts

- Contract Cancellation in Procurement

- Ethics in Procurement

- Legal Aspects of Procurement

- Global Sourcing in Procurement

- Intermediaries and Countertrade in Procurement

Strategic Management

- What is Strategic Management?

- What is Value Chain Analysis?

- Mission Statement

- Business Level Strategy

- What is SWOT Analysis?

- What is Competitive Advantage?

- What is Vision?

- What is Ansoff Matrix?

- Prahalad and Gary Hammel

- Strategic Management In Global Environment

- Competitor Analysis Framework

- Competitive Rivalry Analysis

- Competitive Dynamics

- What is Competitive Rivalry?

- Five Competitive Forces That Shape Strategy

- What is PESTLE Analysis?

- Fragmentation and Consolidation Of Industries

- What is Technology Life Cycle?

- What is Diversification Strategy?

- What is Corporate Restructuring Strategy?

- Resources and Capabilities of Organization

- Role of Leaders In Functional-Level Strategic Management

- Functional Structure In Functional Level Strategy Formulation

- Information And Control System

- What is Strategy Gap Analysis?

- Issues In Strategy Implementation

- Matrix Organizational Structure

- What is Strategic Management Process?

Supply Chain