What is Project Analysis?

Project analysis is the assessment of every expense or problem related to a project, prior to the commencement of work on it. After evaluating the profitability of a project, the selection process is undertaken.

The decisions made during the selection of a project directly affect and frame a project’s requirements analysis. It is a trend that requirements analysis begins once a project has been selected. The mere existence of a market is not enough for a company or a project to succeed.

The company should also be able to sell the product. In this post, we have discussed, different analytical methods used to evaluate a project— market and demand analysis, technical analysis, economic and financial analysis and social cost and benefit analysis— have been discussed.

Stages of Project Analysis

- Project Identification

- Project Formulation

- Market and Demand Analysis

- Technical Analysis

- Economic and Financial Analysis

- Social Cost Benefit Analysis

Project Identification

Project identification is an important rung in project formulation. A project is conceived with the objective of meeting the market demand, exploiting natural resources, creating wealth etc.

Generally, development projects come from national planning. Industrial projects come from identification of commercial prospects and profit potential. Projects are introduced in order to achieve certain objectives. There may be several alternative projects that will meet these objectives.

It is necessary to mention all the other alternatives considered with justification in favour of the specific project proposed for consideration.

Project Formulation

Project formulation involves the following steps, – opportunity studies/ support studies, identification of product/service, pre-feasibility study, feasibility study, project appraised, detailed project report.

An opportunity study identifies investment opportunity. A pre feasibility study is regarded as an intermediate stage between a project opportunity study and a detailed feasibility study. A feasibility study is a means to arrive at an investment decision.

The feasibility studies focus on Market and Demand Analysis, Technical Analysis, Economic and Financial Analysis, Social Cost-Benefit Analysis etc.

Market and Demand Analysis

Market analysis aims at assessing the potential sales revenue from a proposed project. It is also known as market-feasibility study.

The approach for conducting a market-feasibility study would vary depending on the type of proposed product. For instance:

- In case of a novel product idea, a market-feasibility check has to be based on indicators of buyer behaviour (in terms of their response to ‘new’ or ‘dream’ products) for estimating potential demand.

- If a proposed product is new in an economy, but is successfully marketed in some other economy, its market feasibility is assessed through a meaningful comparison of some broad economic and cultural indicators in the two economies.

- Per-capita income, income disparity level, pattern-indicating shift in choice for consumption, literacy level and such other economic factors can indicate the potential of demand for a particular proposed product.

- If the proposed project is for addition in the capacity existing in the economy, the task of market-feasibility study will be historical data analysis and study of factors, which influence consumption trends.

The above discussion is centred around a market-feasibility study for that product which is already selling in the market.

Technical Analysis

While initiating a project, it must be ensured that the required equipment/know-how is available with the entrepreneur. Technical Analysis establishes whether a project is technically feasible or not. Other types of analyses are clearly connected with technical analysis.

There may be two or more alternative technologies available for manufacturing a product/service. For example, soap can be manufactured either by semi-boiled process or by the fully boild process. Similarly, cement can be made either by the dry process or by the wet process.

The choice of technology is governed by a variety of considerations. These are as follows,– plant capacity, principal inputs, investement outlay and production cost, use by other units, product mix, latest developments, case of absorption.

Methods of production which are suitable to local economic, social, and cultural conditions are referred to as appropriate technology.

The propounders of appropriate technology opine that the technology should be evaluated in terms of the following question:

- Whether the technology utilises local row materials?

- Whether the technology utilises local man power?

- Whether the goods and services produced cater to the basic needs?

- Whether the technology protects ecological balance?

- Whether the technology is harmonious with social and cultural conditions?

Satisfactory arrangements must be made to obtain the technical know how needed for the proposed manufacturing process.

Economic and Financial Analysis

Before any financial analysis is carried out, four basic decisions must be in place. These basic decisions are briefly explained as follows:

Period of analysis

- Usually, the period of forecast is a matter of the company’s policy based on the considerations of factors like product life cycle, business cycle, rate of change in technology, and taste, managerial ability to foresee in the future and database available to support the forecast.

- Information technology projects typically can be planned for about three years due to the technological development rate, short product life cycle and uncertainty caused by low entry barrier.

- Project report for the purpose of loans will be prepared for the period of the loan. This limits the life of a forecast.

- Time-value based evaluation techniques are sensitive to the cut-off rate and length of time and their results become less relevant for decision-making with the increasing span of time in analysis, especially when the cut-off rate is high. One can give a thumb rule that for a cut-off rate of around 15 per cent, about a 10-year analysis will be fine if time-value based techniques are used.

- If the length of analysis is less than the approximate project life, then it is appropriate to forecast the resale value of all assets at the end of the terminal period and incorporate the terminal value in the last year’s cash flow for the project.

Financing Mix Decision

At the stage of financing mix and cost, the firm might not have raised capital for financing the project. The financing mix decision has three purposes:

- Investigating the effect of new project financing on the company’s capital structure. Sometimes, a capital-intensive project may not be feasible if it may result into a very high debt as the only possible way of financing the project.

- Approximating the cost of each type of new funds that will be raised for financing the new project.

- Approximating the weighted average cost of capital, which can be used in deriving the cut-off rate required for accepting the new project.

Cut-off Criterion

- The cut-off decision is a benchmark against which the project cash flow stream is compared to determine whether the project would attain its financial goal.

- A cut-off rate is sometimes called a go-no-go criterion, hurdle rate or required rate of return.

- If time-value-based evaluation techniques are used, the cut-off rate will be determined on the basis of cost of capital.

- For other techniques where time value concept is not used, the appropriate cut-off must be decided.

- There is a general belief that one has to use the cost of capital as the cut-off point when time-value-based techniques are used.

Evaluation of Investment Proposals

There are many techniques for the evaluation of investment proposals. Some focus on capital recovery, some measure profitability and some take into account the time value of money. For instance:

- A project for establishing a new market territory may be evaluated on the basis of accounting rate of return but replacement of machines on the basis of net present value.

- An appropriate evaluation technique is one that may be justifiably applied to a given investment proposal for the attainment of financial and non-financial goals within the constraints in which the firm operates.

Social cost Benefit Analysis (SCBA) is a systematic and cohesive economic method to survey all the impacts caused by an urban development project.

It comprises not just the financial effects (investment costs, direct benefits like tax and fees etc), but all the social effects, like pollution, safety, indirect (labour) market, legal aspects etc. The main aim of SCBA is to attach a price to as many effects as possible in order to uniformly weigh the above heterogeneous effects.

Two principal approaches for SCBA emerged towards the end of the sixties and in the early seventies of the last century,– one is UNIDO approach, and the other is L–M approach.

Some of the differences between UNIDO & L-M approach are:

- The UNIDO approach measures costs and benefits in terms of domestic rupees. The L-M approach measures costs and benefits in terms of international prices.

- The UNIDO approach measures costs and benefits in terms of consumption. The L-M approach measures costs and benefits in terms of uncommitted social income.

- The stage-by-stage analysis recommended by the UNIDO approach focuses on efficiency, savings, and redistribution considerations in different stages. The L-M approach tends to view these considerations together.

Project Report and Audit

The management information system must evolve to generate the required reports so that cost, time and work can be monitored. Different levels of management require different reports at varying frequencies. Figure gives the pictorial idea about the report requirement at various levels.

Types of Project Reports

There are many reports and information sought on a regular basis as well as on need basis. A small list of the three types of reports is given as follows:

- Cost reports

- Time and efforts reports

- Work status report

Feasibility and Detailed Project Report

The feasibility study report is prepared to support the investment proposal. Feasibilities related to technical, commercial and financial aspects are examined in detail by the experts. A feasibility study report is termed as a techno-economic feasibility study.

A detailed project report is a complete blueprint for the execution of the project. It is the project implementation guide for the project team. It describes functions, authority and activities along the line of time, cost and technical parameters. This report sets the standards for time, cost and work with which results can be later compared as and when the work progresses.

Project Completion Report

Once the project is terminated and handed over to the operations team, a project review is undertaken. The end result of the project review is the preparation of the project completion report (PCR).

A project completion report is a document that would give a comparison of the actual costs and the time with the originally budgeted ones. The reasons for deviations are recorded.

The initial scope and the level of its attainment are also documented with observations upon them. The degree of attainment of goal is also recorded in the project completion report. It is usually quite detailed and informative. The contents of a project-completion report may vary depending upon the type of project and the perceived benefits from project review activity.

The European Commission uses ‘Seven-Framework-Programme’ for technical review of a project.

Best Project Management Courses

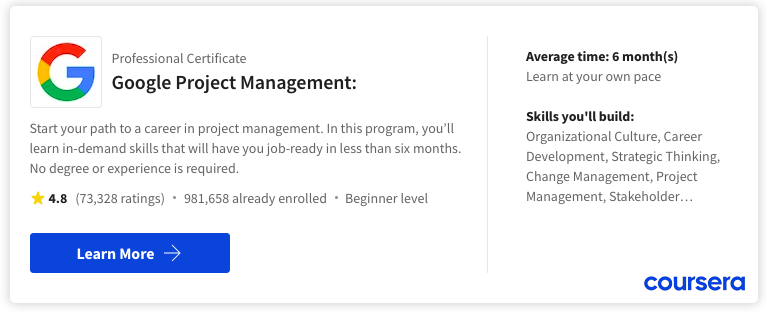

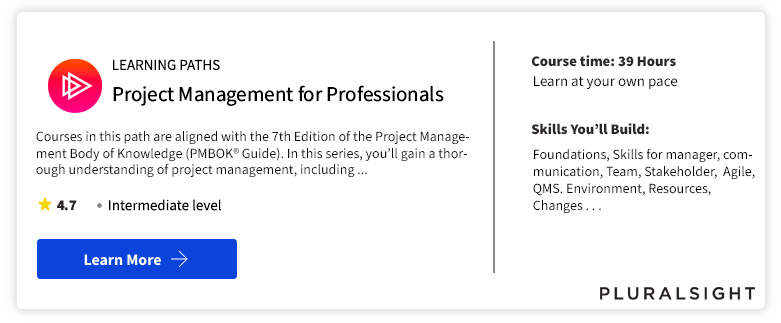

Project management skills are in demand. If you are ready to get started, consider enrolling in the Google Project Management: Professional Certificate Learn the job-ready essentials of project management in six months or less, such as initiating projects, risk management and change management. Also we have made list of best project management courses as there are a plethora of options available, and it can be challenging to identify the best one.

Best Project Management Tool

Best for:

- Mid & Large Size Team

- Higher Plan

- Standard Feature

- Flexible Database & Stability

Best for:

- Small & Growing Team

- Smaller Plan

- Standout Feature

- Try New Feature

The ideal project management tool selection will eventually rely on the particular requirements of your team. We suggest experimenting with the free versions of various tools to gauge your team’s comfort level and then proceeding accordingly.

Project Management Tutorial

(Click on Topic to Read)

- What is Project Management?

- Functions of Project Management

- What is Project?

- Project Managers

- What is Project Life Cycle?

- Project Feasibility Study

- What is Project Analysis?

- What is Project Planning?

- What is Project Selection?

- What is Project Schedule?

- What is Project Budget?

- What is Project Risk Management?

- What is Project Control?

- Project Management Body of Knowledge (PMBOK)

- Best Project Management Tools

- What is Project Organisation?

- What is Project Contract?

- Types of Cost Estimates

- What is Project Execution Plan?

- Work Breakdown Structure (WBS)

- Project Scope Management

- Project Scheduling Tools and Techniques

- Project Risk Identification

- Risk Monitoring

- Allocating Scarce Resources in IT Project

- Goldratt’s Critical Chain

- Communication in Project Management | Case Study

- Plan Monitor Control Cycle in Project Management

- Reporting in Project Management

- IT Project Quality Plan

- Project Outsourcing of Software Development

- Implementation Plan of Software Project

- What is Project Implementation?

- What is Project Closure?

- What is Project Evaluation?

- Software Project Management Challenges

- What is Project Management Office (PMO)?

- IT Project Team

- Business Case in IT Project Life Cycle

- PMP Study Guide