What is Treasury Management?

Treasury management includes activities associated with cash management, in-house banking, payment and collection factories, corporate finance, financial risk and transaction management. In larger organisations, the definition is often expanded to include pension fund management, risk management and insurance, investor/creditor relations, transfer pricing, and risk-based performance measurement.

Table of Content

- 1 What is Treasury Management?

- 2 Need for Treasury Management

- 3 Benefits of Treasury Management

- 4 Functions of Treasury Management

- 5 Treasury Exposures

- 6 Organisational Structure of Treasury

- 7 Members of a Treasury Community

- 8 Role of Treasurer and Controller in Treasury Department

- 9 Careers in Treasury Management

Treasury refers to the funds or revenues of an organisation. In our case, it refers to bank treasury. Treasury management refers to the management of a bank’s holdings (assets and liabilities). It is done in order to maintain the liquidity position of the bank as per the regulatory requirements and internal policies of the bank. In case of banks, treasury management involves management of its deposits, loans and advances and investments.

It is known that the banks help their customers in managing their funds, but who helps a bank manage its funds? The bank needs to decide how much it should invest to gain profit and how much it needs to maintain as a reserve. There are various business areas that banks deal in such as housing finance business, securities trading business, insurance business, pension business, wholesale banking, financial services and wealth management business.

The bank has to maintain sufficient liquidity to ensure that each business area has sufficient cash to serve its clients. The bank also has to plan for any unexpected developments in the market. All these activities that require a bank to maintain sufficient liquidity and at the same time generate profits along with various activities of the treasury are done by the treasury department of the bank.

Most banks, financial institutions and businesses are expanding their operations globally. In such a scenario, managing the financial functions of these entities is proving to be a challenging task for those in control of finances. This is because when businesses enter global territories, they are exposed to a highly volatile global market. The decision to move from domestic markets to global markets needs careful thinking and a great understanding of how things operate across borders.

The decision to invest globally is not a spontaneous decision but is followed by considering multiple risks such as exchange risk, business risk, etc. In light of all these and other issues, businesses these days are focusing on a department that works solely for management of all such risks. Treasury management involves the policies and procedures that ensure that a bank, financial institution or business is capable of managing its financial risks effectively.

The primary role of treasury management is to optimise cash or cash equivalents in a way that a bank is able to meet its financial obligations. Therefore, treasury management is alternatively referred to as cash management also. You will study the functions of treasury management in the subsequent sections in detail.

Need for Treasury Management

As mentioned above, the treasury department handles all the treasury management activities of a bank. However, the need to manage the treasury assets and liabilities and to create an altogether new department for the same can be described in the following points:

Regulatory and compliance requirements

Constant and rapid changes are taking place in the regulatory and compliance requirements and the technology related to the financial sector. Treasury management is increasingly assuming a strategic role in the banking sector to add value to these organisations.

For example, whether it the constant influx of changing regulations or the considerations required to manage financial risk, organisations depend on the treasury management system. This dependence on treasury management is due to the fact that treasury management ensures that an organisation has sufficient cash available at all times to fulfil the needs of its primary business operations.

Managing liquidity

Organisations need to constantly monitor the internal processes and decisions that bring about changes in the working capital and liquidity and maintain key relationships with investors. The treasury department monitors the current and the expected cash flows and any special funding requirements.

The department also has to plan for investing excess funds of the bank and should also be prepared for borrowing additional money in case of requirements. This is accomplished with the help of an effective treasury management system.

Miscellaneous benefits offered by treasury management

Treasury management offers a wide range of benefits to a business, including improvement in cash visibility, financial risk management and enhancement of cash management and accuracy. It safeguards an organisation’s existing assets, which involves the careful investment of funds while avoiding any loss on interest rates and foreign exchange at the same time.

Benefits of Treasury Management

In the previous section, you studied why treasury management is important for a bank. However, the treasury management function also offers certain benefits to the bank, which are as follows:

- Treasury management ensures that banks are capable of withstanding future market fluctuations.

- Treasury management ensures that all the departments or business areas of the bank can readily access the cash required for business activities.

- Treasury management helps in maintaining the overall financial stability of the bank.

- Treasury management implements all the risk management policies and strategies and also manages forex risks.

- Proactive and thoughtful treasury management practices serve as a competitive advantage for a bank.

- Treasury management helps in managing inflation and growing excess liquidity of a bank.

- Treasury management helps in making specific and targeted investments that support the overall business strategy of the bank.

- Treasury management helps in selecting an optimum mix of appropriate investments and timing their maturities in order to coincide with the future needs of the bank.

- Treasury management helps in develops strategies for current and future tax planning.

Functions of Treasury Management

The primary function of treasury management is to manage the liquidity of an organisation. In order to accomplish this, all existing and future cash inflows and outflows are monitored to ensure that the organisation has sufficient cash for routine operations at all times. It also ensures that excess cash, if any, is suitably invested.

The treasury department of an organisation should have adequate control over all financial activities to ensure that current assets are safeguarded through appropriate investment and hedging activities.

Forecasting cash

The treasury department collects information from other departments of the organisation for forecasting projected cash and its equivalents based on the current cash positions. This data may be derived from accounting records, the organisation’s budget, board minutes and top management (for details such as dividend pay-outs, mergers and acquisitions in the pipeline, etc.)

Monitoring working capital

The treasury department is responsible for reviewing the organisation’s policies related to its working capital management and analyses the impact of these policies on the organisation’s cash flows. For example, loose credit generally results in making a significant investment in accounts receivable, which uses up large amounts of cash.

Concentrating cash

Treasury management helps in developing a system for funnelling cash into a centralised investment account. This helps in utilising and investing cash in the most effective manner. This may involve a hypothetical estimation of cash pooling.

Investing excess cash

The treasury department makes use of an organisation’s investment policy for allocating excess cash to different investments depending on the expected rates of return and the ease of liquidity of these investments.

Granting credit

The treasury department issues credit to the clients of an organisation. This involves following the organisation’s policies that determine the terms and conditions under which credit is granted.

Raising funds

When additional capital is required, the treasury department raises funds through the acquisition of debt, stock sales, or changes in organisational policies that affect the amount of working capital required for routine operations.

Managing risks

Treasury management involves the use of different hedging strategies for minimising risks related to changes in asset values, interest rates and foreign exchange.

Maintaining relationships with credit rating agencies and banks

The treasury department informs credit rating agencies about the financial status of an organisation regularly to assist these agencies in rating the organisation based on its marketable debt issuances.

In addition to these functions, the treasury department also informs the organisation’s bankers about its financial status and any projected changes in its requirement for borrowed funds.

Maintaining IT systems

The treasury department maintains technical systems, which provide information related to an organisation’s cash holdings, investment projections, market conditions, etc.

Reporting

The treasury department provides the senior management with reports having information about market conditions, issues in capital funding, investment returns, financial risks, etc.

Advising on mergers and acquisitions

The treasury department often advises an organisation on matters related to mergers and acquisitions. It is also involved in the integration of the treasury functions of the targeted acquiree.

The essence of treasury management functions includes cash monitoring, cash utilisation and raising more cash for an organisation.

Treasury Exposures

The treasury function in banks need to manage several risks that banks are exposed to, such as interest rate risk, commodity price risk, regulatory risk and business continuity risk, etc. While most banks face all these risk exposures to some extent, the most common risk exposures that pose the greatest challenge include foreign exchange risk, counterparty risk and operational risk.

Managing foreign exchange is a key concern for treasurers in banks and financial institutions. Banks are usually exposed to three different foreign exchange exposures, which are as follows:

Transaction exposure

This occurs due to transactions conducted in foreign currencies. In case the exchange rate is unfavourable, banks may receive less cash than expected. For example, a bank grants a loan to a company, Co. A, which requires dollars. The conditions of the loan state that bank will issue loan in INR and Co. A will convert it into dollars at the existing exchange rate for its use. In addition, Co. A would make the repayment to the bank in dollar. The bank charges 10% interest and will receive the principal amount along with the interest after one year at the then existing or prevailing exchange rates.

Assume that the company requires a loan of $100 and the exchange rate at this point is $1 = Rs65. Therefore, the bank gives Rs 6500 as loan. Now, the interest plus principal amount after a year equals $110. The existing exchange rate has changed to $1 = 60. Therefore, the bank will receive Rs 60 × 110 = Rs 6600. However, we see that the bank could have received Rs 7150 if the exchange rate was fixed at $1 = `Rs 65.

Translation exposure

A bank may have multiple subsidiaries operating in different foreign countries. These foreign subsidiaries prepare their respective financial statements in local currencies. Banks face translation exposure while consolidating financial statements of its foreign subsidiaries as the value of a bank’s equities, assets or liabilities change with fluctuation in the exchange rate. Translation exposure is also called accounting exposure. Let us take an example to better understand the concept of translation exposure.

Suppose an Indian bank has a number of foreign subsidiaries operation in Europe and US. The subsidiaries in the US prepare their financial statements in dollar, whereas the subsidiaries in Europe prepare their financial statements in euro. In such a case, when the bank consolidates its financial reports in rupee, the bank faces translation exposure because of the fluctuations in USD/INR and EUR/INR exchange rate.

Economic exposure

This arises in case the value of the bank’s cash flow is affected by exchange rate movements. It is also known as operating exposure. Transaction exposure is a part of economic exposure. For example, a bank can face economic exposure due to change in business competitiveness in different economies because of exchange rate fluctuations.

For example, a bank may have operations in different countries. The exchange rate of the currency of a particular country has significant impact on the economic prospect of the country. Therefore, fluctuations in the exchange rate affect the business prospect of a country, which, in turn, may have adverse effect on the cash flow of the bank.

Another major risk that banks usually face is counterparty risk. Banks face this risk in case the counterparty fails to meet its contractual obligations. To manage this risk, bank treasurers analyse the risks associated with the bank’s borrowers before lending funds.

The third major exposure that the bank treasury is concerned with is operational risk. This risk may arise out of losses due to manual errors or unauthorised actions originating from within the bank. The treasurers ensure that banks have adequate controls to monitor cash flows to prevent errors and fraudulent activities.

Organisational Structure of Treasury

The treasury function in banks is either organised as a separate bank department or as a specialised branch of the bank, which would remain under the control of the bank’s head office. Treasury is generally supervised by a member of the senior management, general manager, deputy general manager, vice president, etc.

Treasury is a key function in a bank; therefore, the treasury head reports directly to the chief executive of the bank. The frequency of reporting data and delegating powers among the employees, however, depends on the size of the bank and the level of importance imparted to the treasury activities within the bank set up.

The treasury department of a bank is divided into the front, middle and back offices. The dealing room of a bank refers to the place where the bank dealers carry out the trading activities and it is a part of the front office of the treasury. The back office handles the settlement and confirmation processes, whereas the middle office is responsible for the risk management. The bank has to maintain its exchange position and cash position and it must adhere to the open position limits for daytime and overnight while dealing in foreign currencies.

The operations of different desks or sub-departments of the treasury department are interdependent and therefore, the operations of the treasury department are integrated in nature. The trading of various securities takes place either through direct dealing between two counterparties or through anonymous dealing. In both cases, the dealing requires the use of a common trading platform, such as Reuters 3000, FX-Clear, etc.

The main divisions of the treasury department of a bank are:

Front Office

The front office, also referred to as the dealing room, is regulated by the chief dealer who heads a team of treasury dealers. These dealers perform the purchase and sales function in the market. Each dealer specialises in either of the following markets: forex market, money market, capital market, forward markets or derivatives.

A general function of bank treasury is management of cash by ensuring there are sufficient funds to meet the liabilities and any surplus cash is duly invested, in order to maximise returns. Initiation of these deals is a function of the front office. It is the responsibility of front office dealers to devise new ways of raising funds in the most economical manner.

Middle Office

The middle office in the treasury department provides market information to the management and implements the risk management system. It monitors and informs the management about issues like risk exposures and treasury performance.

It also generates risk management reports and ensures compliance with internal limits to risk exposures. The fund dealings initiated by the front office are transferred to the back office through the middle office. Manual dealing slips are collected to be transmitted to the treasury back office. The middle office staff ensures that dealing slips are complete with proper settlement instructions.

Back Office

The final verification and settlement of deals is conducted at the treasury’s back office. The deals are verified through deal slips prepared by the front office. The back office also verifies deals based on the confirmation received from the counterparties.

In addition, the back office staff approves the deals independently with the counterparties (banks and other institutions) and verifies the validity of documents. The back office maintains books of records for submitting periodical returns to the RBI. The basic function of the back office is the settlement of deals and ensuring timely payment and receipt of cash. Any delay in a deal settlement may result in financial loss to a bank, which would also negatively affect the bank‘s reputation.

Members of a Treasury Community

The treasury department of any organisation (and in our case, banks) is dependent on a number of supporting members. These ancillary members form the treasury community of the organisation. Generally, the treasury relies on accounting professionals, legal professionals, in addition to financial institutions, service providers and investors. Therefore, we can say that the treasury community of an organisation generally includes ancillary members are:

Financial Institutions

Financial institutions function as financial intermediaries (banks and non-banking financial organisations) and offer several financial services. They also facilitate non-financial activities as well as help in buying/selling currencies, debt and investments for or from their accounts. Often, they act as brokers and charge a commission in return for either buying or selling.

These financial institutions also provide treasury management services to their clients. It must be noted that banks usually handle their treasury management functions themselves. Therefore, they do not seek help of financial institutions in most cases. However, they themselves offer treasury services to their corporate clients.

Financial institutions mainly offer the following services:

- Processing receipts or disbursements

- Issuing debt

- Making investments

- Buying/selling foreign exchange services or products

- Hedging products

- Providing custodial and trustee services

Financial institutions offer services by associating with in-house experts managed by an accountant or a relationship manager. For example, if a financial institution requires a special service seeking assistance for a particular interest rate swap, it would contact the relationship manager, who in turn would direct the treasury to an appropriate person.

Service Providers

The treasury community also includes service providers, who offer key products and services to the treasury department. These service providers are actually consultants, who work on specific projects or offer ongoing advisory services, real-time information, information related to treasury software vendors, payment facilitators, etc. In exchange of the services they offer to the treasury management department, these service providers charge a certain payment.

Investors

Another important component of the treasury community is the external investor. External investors are particularly important for the treasury if the organisation issues marketable debt to investors directly or through dealers. External investors include rating agencies, which are extremely significant for investment mechanisms.

Credit rating refers to the analysis of the credit risks linked to a financial instrument or an entity. Credit rating agencies assign credit ratings to financial institutions that issue debt obligations, such as mortgage-backed securities. These credit rating agencies help treasuries by proving information about borrowers, financial institutions, governments and debt issuers. Some of the major credit rating agencies include Standard & Poor’s Rating Services, Fitch, Moody’s Investors Service, etc.

Role of Treasurer and Controller in Treasury Department

The basic role of treasurers and controllers in an organisation is to act as financial risk managers responsible for safeguarding the organisation’s finances from the financial risks it faces. As discussed above, these risks can arise from different sources; the role of treasurers and controllers requires an understanding of business functions and communicating with different financial professionals within the organisation.

The key roles of treasurers and controllers in the treasury department are:

Managing risk

Treasurers manage several risks faced by banks and financial institutions, such as interest rate risk, credit risk, currency risk, commodities risk and operations risks. Banks and financial institutions face these risks at varying degrees all the time.

Formulating risk policies

Treasurers and controllers are responsible for formulating treasury policies approved by the company’s board of directors. These policies and procedures serve as a set of guide elements and methods to be used for minimising various risks. Treasury policies are different for each organisation depending on long-term strategies. For example, not every organisation permits treasurers to use derivatives as a hedging technique in the capital market.

Maintaining relationships with banks and credit rating agencies

Treasurers and controllers regularly inform credit rating agencies about the organisation’s financial status. This helps agencies in rating the organisation based on its marketable debt issuances. In addition to this, treasurers inform the organisation’s bankers about the organisation’s financial status and any projected changes in its borrowed funds.

Forecasting cash position

The treasurers and controllers within the treasury department liaison with other departments of the organisation for forecasting projected cash and its equivalents based on the organisation’s current cash position. This information is usually collected from accounting records, the organisation’s budget, board minutes and the top management.

Managing organisation’s liquidity

The treasurers and controllers periodically review the organisation’s policies related to working capital management and analyse their impact on the organisation’s cash flows.

Careers in Treasury Management

In large-scale organisations and banks, the treasury department is very big and many people work in it. Treasury management as a function has various roles fulfilled by different employees. Each role in the treasury management can be considered a career option for the appropriate people.

There are numerous career opportunities for treasury professionals as it has been observed that there was a great increase in treasury position recruitments in 2014–2015. The number of opportunities for treasury positions has increased. More and more organisations recruit fresh graduates directly from the campuses. One who aspires to make his career in the treasury field can expect that he will be rewarded for his expertise.

The real satisfaction for any individual in a treasury-based job is that he can feel that his efforts can be very useful in achieving the success of any organisation. Treasury roles exist in all organisations including multinational organisations, NGOs and banks. The treasury department like any other department comprises various roles and job designations starting from the entry level to the senior-most level. Some of the designations and career options include the following:

- Treasury analysts

- Treasury dealers

- Treasury accountants

- Risk managers

- Cash managers

- Credit risk analysts

- Financial analysts

- Group treasurers

- Head of treasury operations

- Tax directors

- Relationship managers

- Transaction services analysts

- Finance directors

- Financial controllers

- Managing directors

- Company secretaries

- Non-executive directors

- Chief financial officers (CFOs) and Chief executive officers (CEOs)

Those people who want to make a career in treasury should possess a combination of financial, technical and social skills, such as:

- Curiosity

- Interest in financial markets

- Technical skills

- Problem-solving attitude

- Working with different people

- Can play with numbers

- Ability to plan and think strategically

- Attention to detail

- Hard-working and self-motivated

- Good communication skills

- Maintain and build personal relationships

The salaries given to treasury management employees depend on the size, location and nature of the business. In addition, the level in organisational hierarchy, experience level of the employee and educational qualifications impact the salary given to a treasury employee. In the UK, salaries for graduates and assistant-level treasury posts start from £25,000 per annum. The senior positions easily fetch around £100,000 per annum.

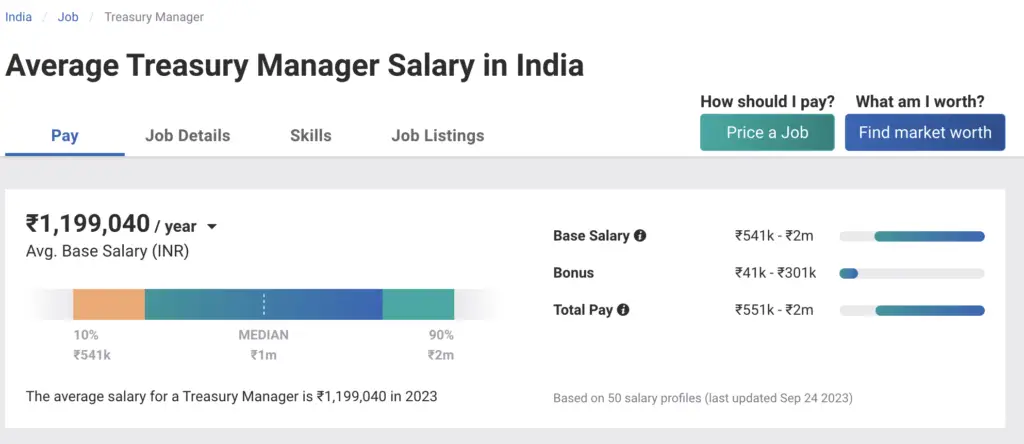

According to PayScale.com, a leading online salary, benefits and compensation information company, the average salary of a treasury manager in India is Rs 1,19,9040. The average salary statistics related to treasury job are shown in Figure: