What is Integrated Treasury Management in Banks?

Integrated Treasury Management in banks refers to a comprehensive approach to managing a bank’s treasury functions in a coordinated and efficient manner. The treasury department plays a crucial role in a bank by managing its financial assets and liabilities to ensure liquidity, optimize returns, and mitigate risks.

Table of Content

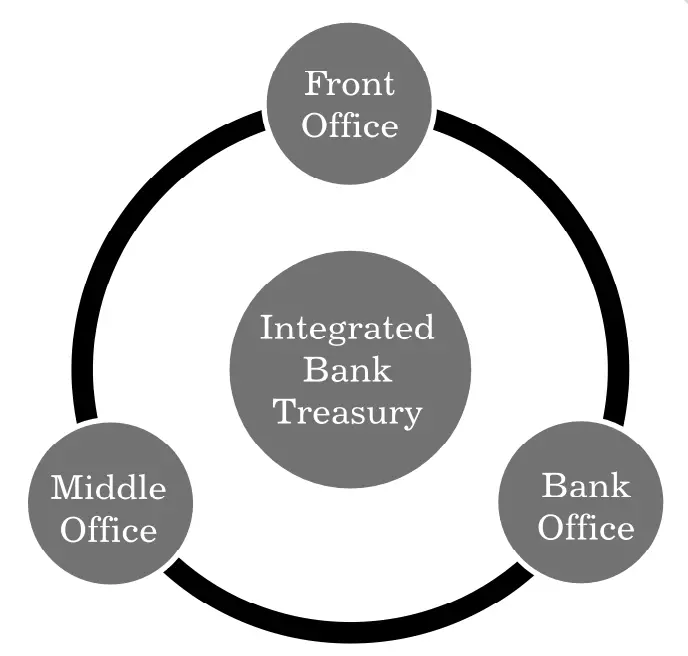

Structure of Integrated Treasury

The integrated treasury of a bank is structured such that it comprises three parts: the front office, the middle office and the back office. The front office is also known as the dealing room. The treasury may be structured in the form of a department or as a separate branch. Treasury in the form of a separate branch is the preferred structure.

The treasury head reports and works directly under the head (Chairperson/CEO) of the bank. The heads of the front, middle and back offices report to the treasury head.

Let us now discuss the functions of each office of integrated treasury, as follows:

Front office

It is headed by a chief dealer. The staff of the front office comprises dealers specialising in a particular kind of market. For example, there may be forex dealers, money market dealers, government security dealers, etc. In addition, there is a corporate dealer who looks after corporate clients. There are dealers who look after secondary market dealings. The primary market dealings are handled by the investment department of the treasury. The investment department is usually not a part of the front office but of the treasury.

Middle office

The main work of this office is to provide information to the Management Information System (MIS) and to implement the risk management system. The middle office also monitors the risk exposure limits and the stop-loss limits. In addition to acting as a support group for Asset Liability Management (ALM), the responsibility of transfer pricing may also lie with the middle office.

Back office

This office is responsible for the verification, confirmation and settlement of the deals concluded by dealers. After a deal is confirmed by a dealer in the front office, a deal slip is generated and sent to the back office, or it might be accessed by the back office through an automated process. The staff of the back office confirms the trade on the basis of the deal slips and also by confirming with its counterparties over the phone.

The job of bookkeeping of the treasury is also handled by the back office along with submission of periodic returns to the Reserve Bank of India (RBI). Other functions of the back office include maintaining nostro accounts; maintaining accounts with RBI; and maintaining the demat account with depository participants.

The integrated structure of a bank contributes in the enhanced overall efficiency of the bank. The consolidation of treasury management helps in monitoring of cash position. The bank with integrated treasury can hedge balance sheet risk more accurately. In addition the global funding cost is reduced as the aggregation of treasury result in the optimum investment decisions that is characterised by the minimisation of cost and maximisation of profit for the bank.

Advantages of Integrating Treasury Operations

The benefits of centralising treasury functions are as follows:

- A centralised treasury gives a comprehensive picture of a bank’s liquidity position. This enables the bank to control and utilise the available funds in the best possible manner.

- An important task of the treasury in banks is to manage their reserve judiciously. An integrated treasury allows efficient reserve management by enabling continuous monitoring of the bank’s reserves. This not only cautions banks against possible defaults, but also prevents accumulation of surplus cash.

- An integrated treasury keeps track on funds in transit within the banking network, for example, inter-branch fund movement, movement of funds between the RBI and non-RBI centres, etc. Often, these funds are overlooked and left idle in the banking system.

- Centralised treasury prevents unnecessary fund movements across different bank centres and minimises the number of actual transmission of funds.

- A centralised treasury allows banks to deal with large commodities in the market and benefit from the wholesale market.

- A centralised treasury helps in better management of risks. If the treasury is decentralised and divided into smaller units, one unit may be unaware of the financial exposures of the other unit. Similarly, when markets are volatile, the treasury would need to bring about rapid changes in its functioning at short notice to avoid risks. This can be done conveniently in the case of an integrated treasury.

An integrated treasury allows for comprehensive reporting and implementation of management decisions. In a decentralised treasury, a lot of time would be consumed in the collection, compilation and analysis of data. Delayed implementation may further affect the bank’s finances negatively.

However, a major limitation of having a centralised treasury in banks is that the bank may not be able to benefit from opportunities at other centres. As management of finances is centralised, other functions in the banking system may remain unaware of the importance of treasury management and reflect the same in their actions. A decentralised treasury is generally better suited for individual operating units in a bank.

Role and Function of Treasury in a Bank

One of the most important functions performed by the treasury department of a bank is to balance and manage cash flows and liquidity. In addition, this department is also responsible for handling the investments of the bank in different areas as well as forex, asset and liability management and cash management. The treasury department also acts as the main custodian of cash and other liquid assets in a bank.

The core objective of the treasury in a bank is to ensure effective management of the consolidated funds so that the bank can manage an acceptable risk-return profile. The treasury is also responsible for raising and investing funds.

Let’s discuss the main functions performed by the treasury of a bank in greater detail in the following sections.

Reserve Management and Investment

Each bank is required to follow the guidelines as prescribed by the central bank. As already mentioned in the previous chapter, it is mandatory for banks to maintain Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR), the quantum of which is decided by the central bank. In addition, these guidelines include policies that help in building a portfolio that ensures optimisation of the yield earned.

Banks usually invest in government securities and stocks of large organisations. A bank’s investment policy focuses on earning high returns on its excess cash. However, the bank needs to guarantee the safety and liquidity of its capital resources to meet the requirements of its customers.

A bank’s objective of gaining profitability often conflicts with its safe- ty and liquidity requirements. Therefore, a good investment policy would be one that strikes a judicious balance between the two. A bank needs to decide its investment policy in a way that ensures the safety and liquidity of its funds and also maximises the returns.

This requires adherence to certain investment principles, which include the following:

- Linking the investment policy with the bank’s overall economic development strategy. The investment policy should take into consideration the overall economic development strategy and combine it with the bank’s deposit and lending policy, and risk management policy. The bank’s investment policy should be consistent with its overall development strategy and not in conflict with it.

- The investment policy of a bank should focus on the investment policy of different states. In addition, these states should also ensure the development of the given policy.

- While developing an investment policy, banks should take into account the financial market conditions that have been forecast. The investment policy should reflect the financial market changes projected for a given period.

Asset-liability Management (ALM)

One of the main measures used by banks for mitigating various risks is Asset–Liability Management (ALM). The importance of ALM in Indian banks has increased because of increased volatility in interest rates as well as foreign exchange rates.

Fluctuating interest rates have put pressure on the management of banks for maintaining a good balance among spreads, profitability and long-term sustainability. In the last decade, there has been immense competition among banks. Banks need to take up strategic planning in ALM if they want to sustain themselves and grow in the risky environment.

ALM Techniques

ALM is a mechanism for banks to manage the risks they face due to a mismatch between assets and liabilities in their balance sheets. This mismatch may happen because of several factors, such as liquidity or interest rate fluctuations.

Liquidity refers to the ability of a bank to meet its obligations either by borrowing or converting its assets into cash. A bank typically tends to borrow for the short term, while lending for the long term. During this period, interest rates may go through several changes, which often leads to a mismatch in the bank’s balance sheets.

ALM attempts to mitigate liquidity risk and manage interest rate risk and trade risk. Thus, ALM is a technique for financial risk management in banks and other financial institutions. ALM mainly deals with the management of three central risks, which are interest rate risk, liquidity risk and foreign currency risk.

As we know that the bank deposits the funds on which they are obligated to pay interest (liabilities) and on the basis of that collected funds, banks make loans on which they receive interest (assets). As a result this is mandatory for the bank to manage interest rate risk that if remain unconsidered, lead to the mismatch of assets and liabilities.

The profit of the bank depends on the net interest margin that refers to the difference between the rate that it pays on deposits and the rate that it receives on its assets. The net interest margin is greatly influenced by the interest rate sensitivity and the quantum and mix of assets and liabilities of the bank. There are various derivatives that can be used by the bank to tackle the mismatch includes swaps, swaptions, options and futures.

For banks dealing in foreign exchange operations, ALM helps in managing currency risk. ALM is basically a control mechanism used by banks.

The following are the two main types of ALM techniques used in banks:

Gap analysis

One of the main techniques of ALM is the gap analysis technique. Banks and financial institutions started using this technique during the late 1990s. The gap analysis technique is used to measure the interest rate or liquidity risks faced by banks. At a given point of time, this technique assesses the gap existing between Interest Sensitive Liabilities (ISL) and Interest Sensitive Assets (ISA).

ISL are short-term deposits held by a bank that pays a variable interest rate to the customer, for example, savings accounts, money market certificates, etc. ISA are assets held by a bank that are exposed to interest rate fluctuations. Change in asset values may get reflected either when the asset matures or when it is revalued as per an index rate. The value of such assets is adjusted as per the rise or fall in an index rate.

ISL and ISA (including off-balance sheet position) are grouped into time buckets based on the residual maturity or next re-pricing period, whichever falls earlier. An asset or liability is treated as interest-sensitive if the following are true:

- Cash flow occurs in the concerned time span

- The interest rate fluctuates during the concerned time buckets for both assets and liabilities

- The administered rates are altered

- The contract related to asset or liability is such that an asset or liability is pre-payable or can be withdrawn before maturities.

Therefore, we can say that Gap = ISA – ISL and Gap ratio = ISA/ ISL

Duration gap analysis

This is another ALM technique used by banks for measuring interest rate risk. Duration gap analysis assesses the sensitivity of the market value of a bank’s net worth to the changes in interest rates. This method is based on Macaulay’s duration concept, which measures the average lifetime of a secu- rity’s cash flows.

Duration is a measure of interest rate sensitivity of assets and liabilities and takes into account the time of all cash flows received from a security until their maturity. It is calculated as the weighted average time to maturity of the present values of all anticipated cash flows. Duration can thus be referred to as the average life of an asset or a liability.

The larger the duration, the higher is the price sensitivity of the asset/ liability to changes in interest rates. Therefore, according to duration gap analysis, a bank would be protected from interest rate risk if the duration gap between the assets and liabilities is zero.

It is important to note that the gap analysis only consider the impact of changes in interest rates on the net income of a bank. It does not consider the effect of interest rate changes on the equity capital position of the bank. In addition, a single number is calculated by duration analysis that provides the overall exposure to interest rate risk of a bank.

The following formula is used to calculate the duration gap:

DURATIONGap = DURA – ( AL × DURL)

The following are the important terminologies that are used in the context of the treasury department of a bank:

Transfer pricing

Transfer pricing refers to a mechanism that helps a bank divide the net interest income among its various business units, including the treasury and credit groups. Transfer pricing makes use of the transfer rates so that the net interest income can be divided into manageable components through a proper identification.

This identification helps in separating the spread as a result of interest rate risk and other risks that are managed by different departments of the bank. It is important to note that the transfer rate for the funds is the interest rate on which the buying and selling transactions of those funds take place by the banks in the open market. In addition, the transfer rate acts as a benchmark for determining if the return earned on a loan (an asset) is sufficient to cover the associated credit risk, operating cost and cost of acquiring funds.

For instance the banking department may raise funds at 8% but the treasury department of that bank buys the deposit at market rate, after making adjustments of hedging and liquidity, say 7 %. In this case, the exceed cost would be borne by the banking department of the bank only. Once the transfer pricing is implemented, the liquidity and interest rate risk of the entire bank would be taken care of by the treasury departments. As a result the contradictions in the interest rate would be avoided and lead to the integrated and optimum results for the entire bank.

Capital Adequacy

It can be defined as a measure of the capital held by a bank. It is computed and expressed as a percentage of the bank’s risk weighted credit exposures. This percentage acts as a parameter to assess the stability and efficiency of financial systems across the globe.

Arbitrage

Arbitrage is a trading strategy that involves the simultaneous buying and selling of a certain security in two different markets in which the trader makes a profit owing to the price differential between the markets. It is a carefully thought of strategy where traders exploit the inefficiencies of the market in valuing securities. A special quality of arbitrage traders is that they do not take any market risk because they structure a set of trades in such a manner that they are able to generate riskless profit.

Investment committee

This is one of the most important committees that are formed by the board of a bank to review, approve and actively oversee the management of the investment policy run by the bank. In addition, an investment committee monitors and oversees the bank’s management pertaining to its asset/liability position.

Dealing room

The dealing room, also known as the front office, is regulated by the chief dealer who heads a team of treasury dealers. These dealers perform the purchase and sales function in the market. Each dealer specialises in different types of markets such as the forex market, the money market, the capital market, the forward markets, etc.

A function of a bank’s treasury is managing cash by ensuring availability of sufficient funds to meet the liabilities and any surplus cash that is to be invested, in order to maximise the returns. The initiation of these deals is a function of the front office. The front office dealers are responsible for devising new ways of raising funds in the most economical manner.

Marked to market trading mechanism

This refers to a process of assessing the value of an asset on the basis of the latest market prices. This approach helps in providing a realistic appraisal of the financial position of a bank. In currency futures or in the case of any futures derivative product, there is no actual delivery applicable on the maturity date.

For example, in the case of forward purchase contracts, the corporate client is expected to purchase the foreign currency on the maturity date at the agreed forward rate. But in the case of futures contracts, a settlement of the profit or loss accruing to the contract is done instead of delivery. This is done through the Mark-to-Market (MTM) margining process.