What is Depreciation?

Depreciation in accounting refers to the permanent loss and gradual shrinkage of the book value of noncurrent assets. Depreciation is charged on the cost of the noncurrent asset utilised or consumed in a business.

It is not charged on the asset’s market value. It is a method of financial accounting wherein the allocation of the cost of physical assets is done over the useful life or life expectancy of that asset

Table of Content

Depreciation charged on an asset shows how much value of physical assets is utilised in business. Noncurrent assets, also known as depreciable assets, lose some part of value when put into use in business. The value which is lost and cannot be recovered is called depreciation.

Depreciation Definition

The following are some popular definitions of depreciation:

According to the Institute of Cost and Management Accounting, London (ICMA) terminology The depreciation is the diminution in intrinsic value of the asset due to use and/or lapse of time.

The American Institute of Certified Public Accountants (AICPA) employed the definition as given below Depreciation Accounting is a system of accounting which aims to distribute the cost or other basic value of tangible capital assets, less salvage value (if any) over the estimated useful life of unit (which may be a group of assets) in a systematic and rational manner.

It is a process of allocation, not of valuation. Depreciation for the year is the portion of the total charge under such a system that is allocated to the year

Depreciation Example

Let us understand depreciation with the help of an example.

Aradhya Pvt. Ltd. purchased machinery worth 2,00,000 on April 01, 2018. The estimated useful life of that machinery is 10 years which means that the machine can be used by the company for next 10 years i.e. till March 31, 2028.

While making income statement (Statement of Profit and Loss) the whole amount of ₹ 2,00,000 must not be charged against the revenue generated for the accounting year 2018 19. This is because the capital expenditure incurred on the purchase of machinery will give the benefit for next 10 years.

Therefore, one tenth of ₹ 2,00,000 i.e., 20,000 will be charged against the revenue for the year 2018 19. This one tenth part shows the depreciated value of machinery because of its use or passage of time.

Need for Calculating Depreciation

There is a loss in the value of an asset due to wear and tear over a period of time, which reduces the working capacity of that asset. Thus, the need for calculating depreciation arises.

Every noncurrent asset except land becomes obsolete gradually due to the advent of new technology, innovation, etc., which reduces the worth of the asset over time. It becomes important to note the depreciated value of the asset.

Following are the needs for calculating depreciation:

- To match the revenue with expense of the same year

- To depict the true and fair financial position of the business

- To find out the true profit

- To anticipate the useful or estimated life of the asset so that it can be replaced after it becomes outdated or scrap

- To follow legislations related to companies

- To reduce the tax liability because depreciation is tax deductible expense and charged against profits.

Factors Affecting the Computation of Depreciation

The computation of depreciation relies upon various factors such as cost of the asset, estimated useful life of the asset and probable salvage or residual value of the asset.

Some factors that affect the calculation of depreciation are explained as follows:

- Cost of the Asset

- Estimated Residual or Scrap Value of the Asset

- Estimated Useful Life of the Asset

- Other Factors

Cost of the Asset

The cost of the asset, also known as original or historical cost, comprises the invoice price and other costs which are important to keep the asset in a working condition. Besides the price at which the asset is purchased (purchase price), other cost includes cost of freight and transportation, cost of transit insurance, cost of installation, registration cost, etc.

When a second hand asset is purchased, there will be an initial repair cost incurred on keeping the asset in a working condition.

Estimated Residual or Scrap Value of the Asset

The residual or scrap value of the asset is the monetary value that the company estimates or expects to get back or recover less disposal costs, from the asset scrapped, or sold. Another name for the residual or scrap value is salvage value.

The net salvage value is the estimated net realisable value determined after reducing the expenses necessary for disposing of the physical asset.

Estimated Useful Life of the Asset

The useful life of the asset is the time period that a company thinks to utilise the asset. The estimated useful life of the asset can be years, months or units produced.

The company must take into account obsolescence due to technological upgradation and change in tastes of people while estimating the useful life of the asset.

Other Factors

The other factors that must be considered while calculating depreciation are the addition to the asset, sale of the asset, legal provisions with regard to the Companies Act or Income Tax Act.

Methods of Calculating Depreciation

Depreciation is the accounting process that shows a decline in the value of noncurrent assets because of uses, passage of time or obsolescence. It should be kept in mind that depreciation does not involve any cash outflow so it is a non-cash expense which is different from any other conventional expenses of a business.

The depreciation method must be selected by a business entity according to its suitability which depends on the nature and type of noncurrent assets.

There are two important methods of computing depreciation, namely:

- Straight line method

- Written down value method

Let us study about these two methods of calculating depreciation.

Straight Line Method (SLM)

The Straight Line Method (SLM), also known as original cost method or fixed instalment method, is one of the commonly used methods for calculating depreciation.

Under the straight-line method, a fixed percentage of depreciation is charged on the original cost of the noncurrent asset in each accounting year. This equal amount of depreciation is charged year to year until that particular noncurrent asset gets reduced to nil or its salvage or residual value at the end of the noncurrent asset’s estimated useful life.

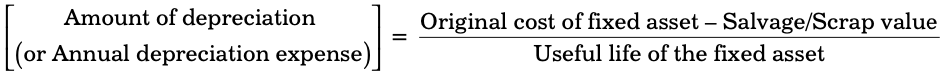

Depreciation is calculated by deducting the scrap or salvage value from the original cost of the noncurrent asset and then dividing the balance with the estimated useful life of the noncurrent asset. The depreciation calculated must be charged yearly from the cost of the asset.

The straight-line method is suitable for those companies whose noncurrent asset’s useful life can be accurately estimated. It is feasible to use this method when the noncurrent asset does not involve many renewals or repairs.

The formula for calculating the amount of annual depreciation by using the straight-line method is mentioned below:

Written Down Value Method (WDV)

In the Written Down Value (WDV) method, also known as the reducing instalment method or declining/diminishing balance method, the value of a noncurrent asset as well as depreciation goes on declining year after year.

Under this method, a fixed percentage of depreciation is charged to the net balance of the non-current asset every year. The net balance of a non-current asset is the value of non-current asset which comes after subtracting the accumulated depreciation.

Change of Depreciation Method

You have studied about the two major methods of estimating depreciation, namely straight line method and the written down value method. However, apart from these methods, there are various other methods of estimating depreciation such as depletion method, production units method, machine hour method, sinking fund method, annuity method and sum of years of digits method.

Depreciation method helps in estimating the consumption of utility in the asset. Accountants use the depreciation method to derive depreciation estimates and to align the costs and benefits related to the assets

According to the principle of consistency, businesses should apply accounting policies and principles throughout the years. However, it is a good practice to assess the depreciation method used by company every year.

At the end of each financial year, the management should review its method of charging depreciation. It is possible that the management may find certain changes in the pattern of future financial benefits from the assets and decides to change the method of calculating depreciation.

Amortisation and Impairment of Assets

Amortisation and impairment of the assets are related to the value of intangible assets such as goodwill, patents, trademarks and copyrights.

Amortisation is a term used to show deduction in the value of intangible assets over their lifespan. The term ‘impairment’ is used when the value of an intangible asset mentioned in the balance sheet is considered less than the value mentioned in the company’s balance sheet after amortisation.

To determine amortisation of an intangible asset, the company finds out the current value for the intangible asset and determines its estimated useful life similar to depreciation calculation.

The amortisation amount is deducted annually each year so that the company’s balance sheet shows the current value of the asset. The impairment of the asset is also related to the longterm intangible assets and shows the permanent deduction in the book value of the intangible asset.

Following are the reasons behind the impairment of the asset:

- Outdated or oldfashioned asset

- Noncompliance of standards

- Damaged asset

- Change in market conditions and preferences of customers

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting