Treasury and Risks

The treasury department of a bank takes care of a range of complex tasks associated with the internal and external stakeholders, and ensures smooth functioning and value creation within the bank. One of the main tasks of the treasury department is to manage the financial risks faced by a bank.

In finance, risk can be defined as an uncertain event that can potentially cause financial loss or reduced earnings for a bank or other financial institutions and organisations. It stems from the unpredictability of future events and possibilities. Risk management is the process of identifying financial risks and devising ways of minimising them.

Table of Content

Financial risks are generally linked with the management of a bank’s holdings, which could range from money market instruments to equities. In the banking industry, the risks associated with treasury management are even higher. The primary reason for this is that the bank’s treasury is highly leveraged. Another reason for high treasury risks in banks is the large volumes of transactions they undertake. Therefore, treasury risk management is one of the core functions of banks.

The following are some of the conditions that lead to risks in banks:

- Borrowers may make late payments or fail to make the payments altogether.

- Depositors may demand the bank to return their money at a faster rate than the bank decided.

- Market interest rates may affect the value of the bank’s loans due to constant fluctuations.

- Investments made by the bank in securities or incorporates may lose value.

- Human error or computer fraud may lead to considerable losses.

Key Reasons for Treasury Risk Management as a Primary Banking Function

Let us discuss the main reasons that make treasury risk management and mitigation one of the primary banking functions. These reasons can be listed as follows:

Bank’s transformation services

Banks offer three types of transformation services while undertaking the intermediation process. The first is a transformation of liability, asset and size, which com- prise fund mobilisation and allocation. The second type involves the transformation of maturity by offering customers short-term claims on liquid deposits and offering borrowers long-term loans.

The third type includes the transformation of risk by reducing the risk involved in direct lending. In the process of transformation, banks incur risks due to market fluctuations, currency and interest rate risks, etc.

Mismatch of assets and liabilities in the balance sheet

The ideal situation where all bank liabilities are matched exactly by the same amount of assets bearing the same maturity and interest rate, does not usually exist in reality. Mismatching is an inherent feature of banks and gives rise to risks.

When the maturity of assets is greater than those of liabilities, banks are exposed to liquidity risk; when the interest rates of assets and liabilities differ, banks face interest rate risk; and when the denomination of asset and liabilities currencies are different, banks are exposed to currency risk.

Bank’s financial services

Banks offer several financial services to their customers, which include lendings and deposits, etc. Banks also invest money in channel the available funds as per specified priorities and purposes. However, banks face several risks when dealing with money in the long or short term.

Types of Risks in Treasury Management

While carrying out their operations, banks are exposed to different types of risks that may have a negative effect on their business. To manage these risks, banks have to be actively involved in risk management. Risk management in banking operations involves identification of risks, their measurement and assessment as well as mitigation of their negative effects on the operations of a bank.

In banks, risk management involves constantly measuring the risk of the bank’s portfolio of assets and other exposures, communicating the risk profile to treasurers and adopting ways either directly or in collaboration with other bank functions to mitigate the possibility of potential loss. Therefore, banks usually form a dedicated unit to take charge of the risk management function.

The three main functions of this unit are as follows:

- Risk identification: This function involves identifying the different risks associated with each transaction, product or service.

- Risk measurement: This function involves determining the scope, probability and timing of the risks identified.

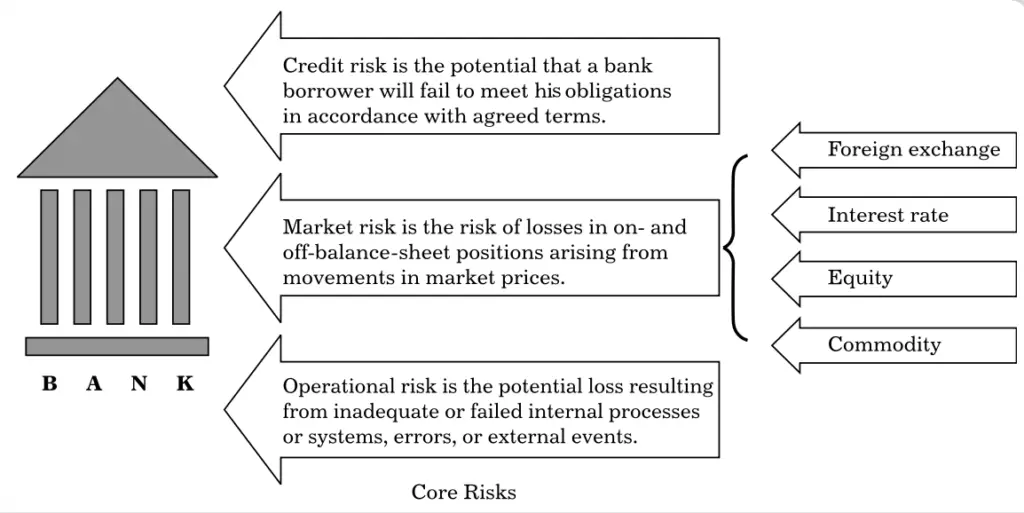

- Risk control: This function involves formulation of policies and guidelines for limiting the effects of the risks. There are several types of risks to which a bank is exposed. Of these, three types of risks that arise out of bank operations form the core risks. These include credit risk, market risk and operational risk.

The other types of risks are outcomes of the core risks and include liquidity risk, interest rate risk, foreign exchange risk, equity risk, and commodity risk. These different types of risks have been identified by the Basel Accords, the cornerstone of international risk-based banking regulation.

Figure shows the different risks that a bank is exposed to:

Market Risk

Market risk is the risk of incurring losses by banks that may arise from movements in market prices. Market prices may fluctuate due to changes in interest rates, foreign exchange rates and equity and commodity prices.

The various components of market risk are:

Interest Rate Risk

Interest rate risk can be defined as the potential loss that banks may incur due to fluctuations in interest rates. This risk arises as a bank’s assets, such as loans and bonds, generally have a longer maturity than the bank’s liabilities (like deposits). This risk may be conceptualised in two ways. If interest rates rise, the value of long-term assets would fall more than the value of short-term liabilities, thereby reducing the bank’s equity.

On the other hand, if interest rates declines, the bank would be forced to pay greater rates on deposits much before its long-term loans mature and the bank would be able to replace these loans with those that would give higher interest rates.

Let us look at an example to understand this concept better. American Savings and Loans (S&Ls) is a financial institution that offers loans in lieu of mortgages. It collects deposits and underwrites mortgages. In the 1980s and 1990s, the American S&L system faced a major crisis when several thousand deposits failed due to interest rate risk.

Many of these deposits were underwritten long-term fixed-rate mortgages backed by variable rate deposits. The variable rate deposits paid interest rates based on the market interest rates. As market interest rates increased, so did the deposit rates. As a result, the interest payments that the deposits were bound to receive exceeded the interest payments they were actually receiving on their fixed-rate mortgages.

This resulted in large losses and eventually wiped out thousands of S&Ls. The value of foreign currency assets and liabilities are affected not only by the exchange rates but also by the changes in interest rates.

For example, the interest rate differential between two currencies determines the forward rates. Similarly, the value of foreign currency assets and liabilities acquired from money market operations can change when the interest rates change leading to pricing and reinvestment risks applicable to any fixed income securities. Banks also undertake several other interest rate-dependent transactions like foreign currency swaps, interest rate swaps, forward rate agreements, etc. The changes in the interest rate affect the valuation of these instruments.

In addition, any mismatch between foreign currency assets and liabilities in terms of maturity dates can lead to potential losses when interest rates changes. For example, banks cannot always ensure exact matching of maturity of assets and liabilities as these are acquired as part of business operations. The re-financing of assets/liabilities may have to be done at different interest rates leading to losses. The maturity mismatch between assets and liabilities is termed as gaps.

These gaps are filled by banks through transaction by paying/ receiving appropriate forward differentials, which are functions of interest rates. Any adverse movement in interest rates impacts forward differentials, which affect the cash flows underlying the assets/liabilities due to gaps. Interest rate risks are managed through dealers by undertaking money market operations to match the assets and liabilities, by using swaps and through other interest rate derivative products.

Foreign Exchange Risk

The first and foremost risk involved in forex operations is due to exchange rate volatility. Changes in exchange rates can adversely affect the value of holdings of a bank in several currencies. As mentioned before, banks do not maintain exposures to foreign currencies due to the possible losses due to adverse currency movements. As soon as a client transaction is carried out, the FX dealer will immediately cover his transaction in the interbank market.

For example, if an exporter sells his proceeds in Euro to his bank as per the merchant quote applicable for Euro vs. INR, the dealer will immediately sell the EURO proceeds in the interbank market. If he does not sell the EURO proceeds, it is quite likely that the exchange rate between EURO and INR will turn adverse and he might be forced to sell at a price lower than the price at which he purchased it from his client.

In general, the dealer will not get into interbank market for every retail merchant transaction as these will be carried out from balances maintained by him. But he will be required to maintain the positional limits applicable for various currencies and transactions, and carry out the required hedging transactions in the interbank market. Hence, the dealer will be required to keep a constant watch on his currency positions and exchange rate movements.

Equity Risk

Another type of risk that arises due to market changes is the equity risk. Equity risk refers to the potential loss banks may face due to an adverse change in the price of a stock. Stock (shares or equity) represents an ownership interest by investors in a bank. Banks usually purchase ownership stakes in other banks, which expose them to the risk of change in the valuation of these shares. Let us look at an example to understand this concept better.

As the use of the Internet increased in the late 1990s, stock prices of banks in the technology sector increased rapidly. Investments in these banks increased partially due to speculation of future price increases, which pushed stock prices even higher. However, the collapse of the dot com bubble between March 2000 and October 2002 caused the stock price of many of these banks, including Amazon, Yahoo! Dell, etc., to drop drastically, resulting in huge losses to the shareholders.

Commodity Risk

Different types of commodities such as agricultural commodities (wheat, corn and soybeans), industrial commodities (metals), and energy commodities (natural gas, crude oil), etc., are traded in the market. On behalf of their customers, banks buy and sell commodities in the market. In doing so, the banks face commodity risk due to the possibility of an adverse change in the commodity prices. The value of a commodity fluctuates significantly owing to changes in demand and supply in the market.

Credit Risk

Credit risk, also referred to as counterparty risk, is the potential loss that banks may suffer if their borrowers fail to meet the obligations of repaying the loan amount and interest on the amount borrowed as per the agreed terms. Credit risk is the most prominent risk that banks face, and it stems from the possibility that loans or bonds held by a bank would not be repaid (partly or fully). Let us understand the concept of credit risk with the help of an example.

In December 2007, Swiss Bank announced a huge loss amounting to USD 10 billion due to loss in the value of loans advanced to various high-risk counterparties. Many of these high-risk borrowers failed to repay the loans and the bank suffered huge losses. This was coupled by the failure of complex models used to predict the likelihood of credit losses. Many other banks suffered similar losses due to their failure in correctly predicting the probabilities of default on loan payments. Such failure to correctly measure and predict credit risk resulted in the loss of billions of US dollars to banks and individuals around the world.

It is important to differentiate between country risk and credit risk. Country risk is different from credit risk because, in this case, the counterparty fails due to local laws and restrictions that prevent him from honoring his commitment, though he himself might be of good credit risk. Country risk can also arise due to changes in governments or government policies that invalidate contracts entered into during the tenor of the previous government, especially when the contracts are entered with state entities.

Country risks are mitigated by controlling the quantum of transactions carried out with counterparties from different countries by setting up ‘country exposure limits’. Also, suitable clauses in the contracts can be incorporated to take care of country risk. Moreover, these contracts can be subjected to a third-country jurisdiction. The risky geographies and countries are also constantly monitored in order to take advance steps in the event of possible fructification of country risk.

Operational Risk

Operational risk is also a major risk faced by banks, arising out of the failure of internal processes, systems or people. These effects are generally caused by human error caused by bank employees, inadequate internal procedures and processes, inadequate information management, inadequate systems, and unpredictable external events. Therefore, we can see that the agents responsible for operational risk can be broadly classified into four categories: people, processes, systems and external factors.

The Basel Accords Committee has identified the following types of operational risk that may cause losses to banks:

- Internal fraud: These include intentional misreporting of positions, employee theft, and insider trading on the employee’s own account.

- External fraud: These include robbery, counterfeiting cheques, and damage from information leak due to computer hacking.

- Employment practices and workplace safety: These include workers’ compensation claims, violation of employee health and safety rules, organised labour activities, discrimination claims, and general liability.

- Clients, products and business practices: These include fiduciary breaches, misuse of confidential data, malicious trading activities on the bank’s account, money laundering, and sale of unauthorised products.

- Damage to physical assets: These include loss of the bank’s assets due to terrorist activities, vandalism, earthquakes, fires, or floods.

- Business disruption and system failures: These include failure of computer hardware and software, telecommunication problems, and utility outages.

- Execution, delivery and process management: These include manual errors in data entry, collateral management failures, deficient legal documentation, unauthorised access to client accounts, etc.

Liquidity Risk

Liquidity can be defined as the ability of a bank or an individual to meet the financial obligations as per the agreed terms and undertake new transactions when they are profitable. Liquidity risk arises out of the possibility of banks incurring losses due to their inability to sell or convert their assets into cash. The financial crisis of 2007-08 exposed the inherent weaknesses in the global banking system, raising fundamental questions regarding liquidity risk.

During the crisis, the global financial system experienced urgent demands for cash from various sources like counterparties, short-term creditors and borrowers. Credit fell and banks suffered acute liquidity pressures hitting their financial status sharply.

Liquidity risks for a bank refer to situations wherein:

- The bank is unable to meet its funding requirements without incurring additional costs.

- The bank may be unable to execute a contract due to illiquid market conditions.

- The bank may be unable to exit a position or cover its position quickly at a reasonable price.

The above situations arise whenever the bank requires funding its position or executing a contract to exit a position but the market condition is not amenable for the same. In order to avoid such liquidity risks, banks enforce proper cash management practices.

Liquidity risks might arise due to:

- Chance of draining out the assets of a bank at a faster rate than its liabilities

- Mismatch between cash flows arising out of assets and liabilities

- Markets getting illiquid with higher bid-spread offers or lack of transactions

Liquidity risks are mitigated by properly forecasting fund and cash positions, maintaining appropriate balances, controlling mismatches between assets and liabilities and reducing the quantum of open positions.