What is Fundamental Analysis?

Fundamental analysis is an analytical and methodical approach to measure the future dividends and share price. In simple words, fundamental analysis can be categorised as the detailed study of the basic factors like economy, industry and the like that affects the performance of an organisation. The main task in fundamental analysis is to explore and interpret the financial statements of the organisations.

Table of Content

By analysing this, the company’s future performance can be judged by the fundamental analysts. As the term suggests, fundamental analysis is an analysis of any entity in terms of its price movement. The rationale behind the analysis is that the performance of an organisation not just depends on its own efforts, but also has a great deal to do with general industry and economic factors.

Types of Analysis in Fundamental Analysis

So, the fundamental analysis includes three types of analysis, are:

Economy Analysis

Performance of a company is directly related to the economy’s performance of the market/state/country in which it operates. When the economy is soaring high, the income rises, demands for items increases, and thus, it benefits to both industry and the company. Alternatively, if there is a downfall in the economy, it adversely affects the performance of the company. Thus, we are going to analyse the variables in the economy that has an impact on the performance of the company.

Such an analysis will give an idea about the forecast of corporate earnings and payments of dividends and interest of the investors. In macroeconomic analysis, the factors that affect the assets and their returns are business cycle, fiscal and, monetary policy of the government, inflation, unemployment level, consumption level, investment opportunities, exchange rates, etc.

Industry Analysis

In industry analysis, the nature of the industry, the regulatory control within the organisation, and the phase of the industry’s development cycle are identified and studied. It includes the study of the following factors:

Demand of Assets in the Market

While analysing the potential of industry, an investor needs to determine the demand of assets in the market. High demand for assets implies that companies have gained the stronghold in the market.

Pricing of Assets

The assets must be evaluated to find whether they overvalued or undervalued from its actual price. The valuations of assets can be done by studying company’s financial statements and evaluating its cash flow, return on assets, profit retention and capital management, etc.

Costs of the Asset for the Organisation

This implies that one needs to ascertain the value of asset for company. Costs of asset help in assessing the return on assets and comparing with profits generated by the company.

Impact of the Economics and Financial Aspects of the Market on the Assets’ Performance

The market conditions under which companies operate have a major impact on the perfromace of their assets. this helps in analysing risk umder which companies are operating and expected returns.

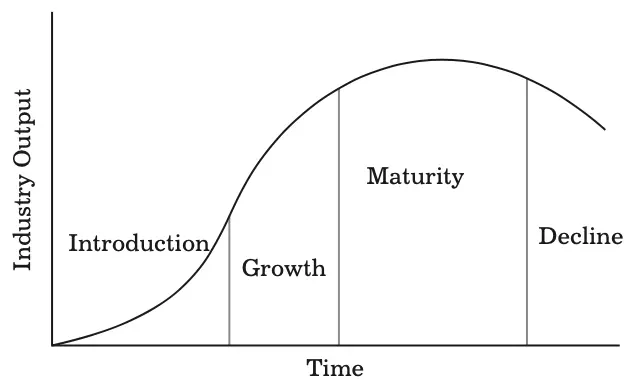

The life cycle of an industry mainly comprises four stages. These stages are shown in Figure:

Let us discuss these stages in detail, as follows:

- Introduction: At this stage, the demand for the industry’s product is low and the costs are high. The companies at this stage are often referred as start-up firms. The sales of the industry are also low at this stage.

- Growth: At this stage, the industry is established in the market with little competition and accelerated sales. At this stage, the sales of the industry grow faster than any other stage of the lifecycle.

- Maturity: Once an industry enters the maturity stage, the product of the industry gets more and more standardised. At this stage, companies compete on the basis of price. Moreover, the cash flows at this stage remain consistent and the opportunities for further growth are low.

- Decline: At this stage, the sales of companies begin to decline and the demand for the substitute or new product increases.

Company Analysis

Industry analysis assists the investor to choose an industry where the return are maximum. After identifying the industry for the investment purpose, the investor selects a company in that industry on the basis of the company analysis. Company analysis is conducted using the publicly disclosed and audited financial statements of a company for a period not less than three years.

These statements include Balance Sheet, Profit/ Loss Statement, Cash Flow Statement and Statement of Profit Distribution. In company analysis, the analyst tries to predict the future earnings of the company as the company earnings have a direct and powerful effect upon the share prices.