In branch accounting, each branch is treated as an individual unit which earns revenues (profits) and incurs costs. Each branch maintains its own books of accounts, which include a record of the branch’s assets and its day-to-day transactions.

Dependent branches follow the double-entry bookkeeping system and maintain ledgers and balance the trial balances with its debits and credits. In addition, these branches also calculate their profits or losses for the accounting period.

Table of Content

All the books of accounts are maintained at the branch level unlike departmental accounting. The books of accounts are maintained for the whole year and the accounting statements are finalised before sending them to the HO. All revenues are transferred to the HO and the branch restarts its accounts in the opening of the new accounting period.

Methods of Maintaining the Accounts of Dependent Branches

Debtors System

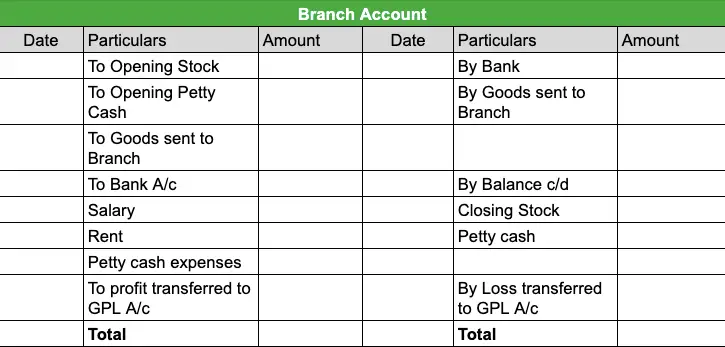

In this system of accounting, the HO opens a branch account and records all transactions done with the branch. This account is recorded similar to the Debtors Account, where revenue is receivable. For example, when goods are supplied from the HO to the branch, the branch account is debited and when the revenue generated by the branch is transferred to the HO, the branch account is credited.

When the credit is more than the debit, it means that the branch has generated profits and when the credit is less than the debit, it means that the branch has incurred losses. The profit or the loss earned is then transferred to the HO’s general profit and loss account. Branches having low-scale operations generally use the debtor’s system of accounting.

Accounting of Goods Received From Head Office

When the stocks received are at cost and the branch can sell only in cash

When stocks received are at cost and the branch can sell only in cash, then accounting of goods received from the HO is done as follows:

| 1 | Stock transferred from Head office to Branch | Branch A/c ……………………. Dr. To Goods sent to Branch A/c |

| 2 | Unsold or defective goods returned by branch to head office | Goods sent to Branch A/c Dr. To Branch A/c |

| 3 | Sale of goods in cash | Not recorded at head office |

| 4 | Remitted the sales to head office | Bank A/c …………………….. Dr. To Branch A/c |

| 5 | Petty cash issued to branch | Branch A/c …………………….. Dr. To Bank A/c |

| 6 | Closing stock of branch | Closing Stock A/c ………… Dr. To Branch A/c |

| 7 | Petty cash balance at the end of the accounting period | Branch petty cash A/c ….. Dr. To Branch A/c |

| 8 | Profit transferred to head office | Branch A/c …………………….. Dr. To General P&L A/c |

| 9 | If Loss transferred to head office | General P&L A/c ………….. Dr. To Branch A/c |

Now when these entries are posted in the ledger of the branch ac- count, they will appear as:

Branch receives goods at cost price and can sell at cash and credit

All the above entries are applicable in this situation too. Additionally, for credit sales the following journal entries are made: When credit sale is made, there is no entry in the books of the HO. Also, when cash is received against the credit sales in part or full, it is not recorded in the books of the HO. However, when cash is remitted for these sales by the branch to the HO, the entry is recorded as:

Bank Account

….. To Branch Account

There are no entries in the books of the HO for discounts given, bad debts written off and goods returned to the HO. However, the closing stock is ascertained and the journal entry is recorded as:

II. When goods are received by branch at cost plus percentage

Let us now see how accounting is done for goods received by the branch from head office at cost plus percentage. In this case, the HO supplies goods to the branch at cost plus a certain percentage which is the selling price or market price or which can be called the mark-up price. This practice is applied when the head office wants to keep the real profit confidential from the branch management.

Therefore, in such case the opening stock, closing stock, goods sent to branch and goods returned to branch will all be recorded at the invoice price, i.e., cost plus percentage.

To find the real profit, we will have to do adjustments to remove the loading on price. The Journal entries done will be:

1. Difference in Opening Stock of the Branch

Stock Reserve A/c ………………………………………..Dr

To Branch A/c

2. Goods supplied to branch

Goods sent to branch A/c …………………………………Dr

To Branch A/c

(Being loading of cost price adjusted)

3. Goods returned by branch

Branch A/c …………………………………Dr

To Goods sent to branch A/c

(Being loading of cost price adjusted)

4. Closing Stock

Branch A/c …………………………………Dr

To Stock Reserve A/c

(Being loading of cost price adjusted)

These entries are made when we use the single entry method. In the double-entry method, an adjustment entry is required.

Stock and Debtors System

In this system, the profit or loss can be calculated by preparing the branch account in the books of the HO. It is similar to a customer’s account or a personal account. The only difference lies in the naming. This method is more suitable for branch offices with small-scale operations.

In the above examples, observe when the credit sales is provided, the system was inadequate to provide detailed sales. Therefore, this system was devised to overcome the problem of accounting of credit sales.

In this system, there are several accounts related to the branch in the books of the head office.

1) When goods are supplied at cost

This transaction is recorded in the following accounts:

- Branch stock account (real account): This account records all transactions related to goods and arrives at the gross profit or loss of the branch. This gives the effective control of branch stock to the HO.

- Branch debtors account (personal account): All transactions related to branch debtors are maintained in this account.

- Branch expense account (nominal account): All expenses and losses of the branch are recorded in this account.

- Branch profit and loss account (nominal account): The gross profit from the branch stock account and expenses from branch expense account are incorporated in this ac- count. The balance of this account represents the net profit.

- Goods sent to branch account: This account shows goods received from the HO and returned back to the HO.

- Branch cash account: This account shows the movement of cash, i.e., cash inflow and outflow.

2) When goods are supplied at selling price

This transaction is recorded in the following accounts:

- Branch stock account: The transactions are recorded in the branch stock account at the selling price. From this account, the profit or loss of the branch cannot be derived but the deficit, surplus and closing stock of the goods can be derived.

- Branch adjustment account: From this account, the gross profit of the branch can be derived. All the loading on opening balance, closing balance, goods sent to branch, goods returned from the branch, deficit, surplus, etc., are all recorded in this account.

- Branch debtors account: All transactions related to branch debtors are maintained in this account.

- Branch expense account: All expenses and losses of the branch are recorded in this account.

- Goods sent to branch account: This account shows the goods received from the HO and returned back to the HO.

- Branch profit and loss account: The gross profit from the branch stock account and expenses from branch expense account are incorporated in this account. The balance of this account represents the net profit.

Wholesale Branch System

As the name suggests, the wholesale branch system means that a branch selling at wholesale rates. Customers nowadays prefer to buy directly from the manufacturer or the producer. Therefore, many businesses have opened their own wholesale branches to sell directly to the customer or to retailers thereby eliminating a lot of middle men and agents.

The branch may have different profits on a retail sale and on wholesale. In this type of accounting, the additional profit earned by a branch in retail trading is treated over the whole sale trading. This means wholesale price is always less than the retail price.

For example, Benz sells its products at a wholesale price of ₹200 and at retail price of ₹240 when its cost price is ₹150. If the sale happens through its branch, the profit earned will be ₹90. However, the actual profit earned by branch is ₹40 (₹240 – ₹200) as it is the contribution of the branch. The profit of ₹50 (₹200 – ₹150) is earned by the HO as it sells on wholesale prices to others.

In such cases, for determining the real profit of the branch, the HO always considers the wholesale price which helps it to get the retail profit of the branch.

Therefore, it can be said that the difference between the wholesale price and retail price is the retail profit.

In case there are some goods that remain unsold, they are valued at their invoice price and the unrealised profit of the HO trading account is shown in the Branch Stock Reserve Account.

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting