What is Foreign Exchange Market?

The Foreign Exchange Market, often referred to as the Forex or FX market, is the global marketplace for trading national currencies against one another. It is the largest and most liquid financial market in the world, where participants, including banks, financial institutions, governments, corporations, and individual traders, buy and sell currencies.

Table of Content

- 1 What is Foreign Exchange Market?

- 2 History

- 3 Evolution of Indian Foreign Exchange Market

- 4 Players of Foreign Exchange Market

- 5 Interbank Foreign Exchange Market

- 6 Foreign Exchange Market

- 7 Structure of Foreign Exchange Market

- 8 Structure of Foreign Exchange Market in India

- 9 Types of Transactions

- 10 Direct/Indirect Quotations

- 11 What is Cross Rates?

- 12 Merchant Rates

- 13 TT Buying/Bill Buying

- 14 TT Selling/Bill Selling

Foreign exchange basically refers to trading between two currencies. Foreign exchange transactions operate ‘over the counter’ through a worldwide network of banks, individuals and corporations trading currencies. The foreign exchange market is the world’s largest financial market operating 24/7 where large amounts of money are traded on a daily basis.

In the financial market, an investor needs to be aware of currency fluctuations occurring due to political changes, economic conditions, social events and financial instability, etc. The financial market offers access to up-to-date news services, 24/7 help desks, charting services and electronic trading platforms for the individual trader.

History

Currency trading is not a new concept as this exchange has its origins in ancient times. According to Talmudic writing, people used to take a commission or a fee to change money for helping others. In ancient times, goldsmiths and silversmiths also acted as ‘money changers’.

Then, during the 4th century, the Byzantine government captured the entire exchange market and maintained a monopoly over it. Foreign exchange markets originally facilitated foreign trade, which is conducted in multiple currencies by multinational companies, governments and individuals.

There are many players who have captured the maximum proportion of foreign exchange transactions like speculators, arbitragers, professional dealers, etc. Traditionally, only retail investors had access to the foreign exchange market where banks transacted large volumes of multiple currencies for commercial purpose.

This trading volume increased rapidly in 1971 when exchange rates were allowed to vary freely. From 1944 to 1971, under the Bretton Woods Agreement, most of the world’s major currencies were pegged to the US dollar. Participating countries agreed to maintain the same value of the currencies against the US dollar and a corresponding rate of gold, as needed. These countries were restricted from diminishing their currencies to gain a foreign trade advantage.

Evolution of Indian Foreign Exchange Market

Due to the limited availability of foreign exchange, India was treated as a controlled commodity. Initially, foreign exchange management in the country concentrated on controlling foreign exchange by regulating demand due to its limited supply. Exchange control in India was initiated on a temporary basis on 3 September 1939.

The statutory power for exchange control was provided by the Foreign Exchange Regulation Act (FERA) of 1947, which was replaced by Foreign Exchange Regulation Act, 1973. This Act authorised the Reserve Bank of India (RBI) and the Central Government to control and regulate dealings in foreign exchange for all receipts and payments.

From time to time India witnessed drastic changes in foreign exchange rate policies. In 1971, the Bretton Woods System had broken down and opened numerous opportunities for various players in the foreign exchange market. In 1978, Indian banks were allowed intraday trading in the foreign exchange market for foreign currencies.

Officially, the exchange rate of the rupee was determined by the RBI, which also announced the buying and selling rates to authorised dealers (ADs). Driven by liberalisation measures introduced since 1991, extensive relaxations in the rules governing foreign exchange were initiated.

Thereafter, in 1993, a new foreign exchange regulation was amended. Since then, there have been significant developments in the financial sector, such as increase in exchange reserves, relaxation in tariffs, growth in foreign trade, increased proportion of external commercial borrowings by Indian businesses and active participation by Foreign Institutional Investors (FII) in the Indian stock market.

As a result of this changing dynamics in the Indian financial market, the Foreign Exchange Management Act (FEMA) was enacted in 1999 to replace FERA, and the Act became effective on June 1, 2000.

Players of Foreign Exchange Market

There are various players in the foreign exchange market who participate in all activities at the global level. These players are listed in Figure:

The role of these players is explained in detail as follows:

Banks and financial institutions

An important part of a country’s financial system, banks and non-bank financial institutions carry out inter-transactions in the foreign exchange market. They trade on behalf of their customers and the majority of the trading is done for their own account by proprietary desks. Apart from banks and non-bank financial institutions, many multinational corporations, insurance companies, asset management companies, etc., participate in the foreign exchange market.

Financial institutions include hedge fund providers and other asset management companies, regional and local banks, broker dealers and central banks. Compared to corporate customers, financial institutions trade in larger volumes and hold foreign exchange positions for a longer period of time.

Speculators, Hedgers and Arbitrageurs

Traders who trade on foreign currencies can take the role of hedgers, speculators or arbitrageurs. Hedgers are traders who undertake foreign exchange trading because they have assets or liabilities in foreign currency. Speculators are traders who buy and sell foreign currency to make profit from the expected movement of the currency. They do not hold any cash position in the currency. Arbitrageurs buy and sell the same currency from two distinct markets that have different prices in order to make profit.

Central Banks and Treasuries

Almost all central banks and treasuries participate in the forex market. Although the volume of trading in these institutions is very less, central banks play a very important role in the foreign exchange market. These banks have an official/unofficial target of the foreign exchange rate for their home currency. If the actual price deviates from the target rate, central banks intervene in the market to fix the issue. Besides central banks, other commercial banks also trade foreign exchanges.

Forex Dealers/market Makers and Brokers

All banking or non-banking financial institution act as foreign exchange dealers. Such dealers quote both the ‘bid’ and ‘ask’ price for a particular currency pair and take a different side from either buyers or sellers of the currency. Dealers try to make profit from the differences between the buying and selling prices—that is, the bid and ask rates. Brokers are simply agents who match buyers and sellers and get a brokerage fee for every transaction.

Forex Trading and SWIFT

Brokers and banks are important players in the foreign exchange market. The Society for Worldwide Interbank Financial Telecommunication (SWIFT) enables communication between brokers and banks. All transactions are executed electronically through SWIFT. Banks simply need to transfer bank deposits through SWIFT to settle a foreign exchange transaction.

SWIFT is a kind of carrier of messages. It does not hold funds or manage the accounts of customers, and it does not manage financial information on an on-going basis. It is only a data carrier that transports messages from one financial institution to another. Confidentiality and integrity of proprietary data are maintained while performing such exchange operations.

Robots and Forex Trading

The foreign exchange market provides an Internet-based online trading platform that is available 24/7 to all traders all over the world. Many companies have developed software for foreign exchange trading, which guarantee maximum profits after installation. Such software is known as forex robot, which automatically performs trading transactions given by the trader.

Corporate Customers

Corporate customers need support for their core business operations like mining, shipping and manufacturing which can be performed in the foreign exchange market. Some use these currencies as a medium of exchange for speculative trade practices, while some may use the currencies only for import-export payments.

Retail Investors

In the early days, only individuals with a high net worth could deal in the foreign exchange market. Currently this wholesale market of currencies has removed such entry barriers. Trading for the small bidder, which was restricted earlier because of high bid-ask spreads on small trades, is possible today. Further, trading below US$1 million was also restricted; however, this restriction no longer exists due to the Internet-based trading platform.

Algorithmic Trading

Algorithmic trading is a type of electronic trading in which a computer programme determines an order-submission strategy and which executes trades without human interference. Human involvement is limited to designing the algorithm, monitoring it and occasionally adjusting the trading constraints. Some algorithms simply automate existing strategies.

Interbank Foreign Exchange Market

The interbank foreign exchange market is a foreign exchange market where banks exchange in different currencies. Banks can either deal with other banks directly or through electronic brokering platforms. The Electronic Broking Services (EBS) and Thomson Reuters Dealing are two competitors in the electronic brokering platform business and together, they connect over 1000 banks.

These currencies do not have fixed values; their values fluctuate relative to other currencies. The currencies of most developed countries have floating exchange rates. For the wholesale market through which all currency transactions take place, interbank market is kept as a separate segment.

The following are some important constituents of the interbank market:

- The forward market

- The spot market

- SWIFT

The interbank market is decentralised and unregulated. There is no particular place or exchange where these kinds of currency transactions take place. However, in a number of overseas countries, these transactions are well regulated. Closing spot prices are published by the central bank in many countries on a daily basis.

Foreign Exchange Market

A foreign exchange market is defined as a market in which currencies are bought and sold. This is different from a financial market where currencies are borrowed and lent. A foreign exchange market is described as an “over the counter” market as there is no physical place where the participants meet to execute their deals.

It is more an informal arrangement among the banks and brokers operating in a financing centre, purchasing and selling currencies. They are connected to each other via telecommunications like telex, telephone and satellite communication network, SWIFT, etc. The leading foreign exchange markets in India are Mumbai, Kolkata, Chennai and Delhi.

The policy of the Reserve Bank of India (RBI) has been to decentralise exchange operations and develop broad-based exchange markets. As a result of the efforts of the RBI, Kochi, Bangalore, Ahmedabad and Goa have emerged as new centres of the Indian foreign exchange market.

Some functions of the foreign exchange market are depicted in Figure:

Transaction in a Universal Currency

International business transactions involve participants from two distinct countries with different national currencies. Both the participants wish to deal in their respective currencies but the transaction can take place in only one currency. Hence, it becomes necessary for one of the two participants to deal in a foreign currency. Therefore, the foreign exchange market provides the currency which the transaction is carried out.

Minimise Risk of Exchange Rate Changes

Since transactions take place at international level, they are affected by several factors which lead to changes in the exchange rates, thus increasing the risk for the participants. However, the foreign exchange market provides a facility called “hedging” to its participants. Using the hedging facility, the participants can transfer their risks to someone else more willing to take the risk.

Credit for international trade transactions

International trade involves transfer of goods from one country to another. The importer cannot make the necessary payment till he/she receives the goods. On the other hand, the exporter cannot export the goods till he/she receives the payment or at least the guarantee for the payment. The foreign exchange market provides instruments like bankers’ acceptances, letter of credit and letter of guarantee as sources of credit to enable these transactions.

Structure of Foreign Exchange Market

In the foreign exchange market, the major participants are commercial bankers, foreign exchange brokers, other authorised dealers and monetary authorities. In the inter-bank market, commercial banks operate at the wholesale level, whereas for individual exporters and corporations, commercial banks operate at the retail level.

Foreign exchange brokers are either individual brokers or corporations. Brokers are often used by bank dealers to deal on their behalf in the market to maintain anonymity since the identity of banks can influence short-term quotes. The central banks of different countries are the monetary authorities in the market.

These monetary authorities intervene in the market to:

- Ensure the proper execution of the orders of the government

- Maintain or influence the exchange rate of their currencies withina certain range.

The foreign exchange market is a global market where the participants may be based in individual countries and the countries themselves have their own trading centres. It primarily functions through telephone or SWIFT or Reuters Messenger.

The participants can deal in more than one market as the trading centres are in close and continuous contact with one another. Very few countries have established full convertibility of their currencies for full transactions. The countries whose currencies have limited convertibility play a very small role in the exchange market.

Structure of Foreign Exchange Market in India

In India, the foreign exchange market consists of three fragments or tiers. In the first tier, transactions take place between the RBI and the authorised dealers. The authorised dealers are mostly commercial banks. The second fragment is the interbank market in which the authorised dealers (commercial banks) deal with one another.

And thethird fragment includes transactions between authorised dealers and their corporate customers. In the retail market, the needs of the tourists are taken care of through currency notes and travellers cheques. In addition, there are moneychangers who are allowed to deal in foreign currencies.

It was around 1985, when the Indian markets started showing signs of becoming well-functioning markets, for example, active market makers prepared to quote two-way rates. Forward quotes were even in the form of near-term swaps, mainly for authorised dealers in order to adjust their positions in the inter-bank market under various currencies.

Brokers are also engaged in the business of matching sellers with buyers. They collect their commission from both the buyer and the seller in the market. Financial deals between authorised dealers in the same market centres must take place through accredited brokers, according to FEDAI guidelines.

Figure depicts the average daily turnover between inter-bank and merchant segments in the Indian foreign exchange market in recent years:

Types of Transactions

In the foreign exchange market, all transactions can be categorised in three categories:

Spot Transactions

In this type of transaction, purchase of foreign exchange along with the delivery and payment between banks takes place in two business days. It means that the settlement or value date is usually two business days ahead for European currencies or the Yen traded against the Dollar. To understand it clearly, consider an example where a London bank sells a Yen against a Dollar to a Frankfurt bank on Monday.

The London bank will transfer a Yen in Japan to the Frankfurt bank on Wednesday and the Frankfurt bank will deposit a Dollar in US to the London bank on the same day reducing the credit risk. It the following Wednesday happens to be a bank holiday in either Japan or the US, the value date is shifted to the next available business day, which is Thursday.

The settlement time is reduced to one business day for trade between currency pairs in the same time zone, such as US Dollar and Mexican Peso and US Dollar and Canadian Dollar. For the countries, having same time zone, the value date is postponed to next business day if it is a holiday in both the countries.

However, if Wednesday is a holiday only in one of the countries, the location where it is a holiday, the settlement will automatically shift to the next business day, whereas at the other location it will remain the same day. On the settlement date, most dollar transactions in the world are settled through the Computerised Clearing House Interbank Payments System (CHIPS) in New York.

Forward Transactions

The transaction that requires delivery of a specified amount of one currency for a specified amount of another currency at a future value date is referred to as forward transaction. This future value date can be one, two, three, six months, or even a year. At the time of the agreement, the exchange rate is established by the parties, whereas payment and delivery are done at the time of maturity.

In this type of transaction, sometimes actual contracts can be arranged for a period greater than one year. The payment takes place at the second business day after the month or year anniversary of the trade. For example, the value date of a six-month forward transaction, which happened on April 5, will be October 7. If October 7 is a holiday, the next business day will be considered for payment.

An agreement for buying or selling of currencies, say Yen and Dollars, between parties in three months can be described as both “buying/selling yen forward for dollars” and “selling/buying dollars forward for yen.”

Swap Transactions

It refers to all the transactions where simultaneous exchange of foreign currency takes place. There are two types of swap transactions, which are “Spot against Forward” and “Forward-Forward swap”. In the “Spot against Forward” type of swap transaction, a dealer buys a currency in the spot market and sells the same amount back to the same bank in the forward market simultaneously.

It is executed as a single transaction with one counter party and is a more common type of swap transaction. In the “Forward–Forward” type of swap transaction, swaps are more complicated than the “Spot against Forward” swaps. A dealer sells 1,000,000 Euros forward for Dollars for delivery in three months at $1.789 per Euro and at the same time buys 1,000,000 Euros forward for delivery in four months at $1.823 per Euro.

In this type of swap transaction, the difference in the buying and selling prices is equal to the interest rate differential. The interest rate differential is the interest rate parity between the currencies of two countries.

Direct/Indirect Quotations

There are basically two types of quotations, which are:

Direct Quote

A direct quote is the price of a foreign currency in domestic currency units. In simple words, it involves quoting in fixed units of foreign currency against variable amounts in domestic currency. It is the number of units of domestic currency required to purchase one unit of foreign currency.

It is also known as “price quotation”. For example, if the direct quote for Rupee/US$ is 60/1, then it implies that for buying 1 Dollar you have to pay 60 Rupees. In the foreign exchange market, USD is the base currency in a currency pair and most of the currencies are traded against it. In these cases, it is called a direct quote. This is also true for the USD/JPY currency pair, which indicates that $1 is equal to 119.50 Japanese Yen.

Indirect Quote

An indirect quote is the price of the domestic currency in foreign currency units. In simple words, the indirect quotation is the quotation that states the units of foreign currency required to buy or sell one unit of the domestic currency. It is also called “quantity quotation”. It is the reciprocal of the direct quote. In the direct quote, foreign currency is the base currency and domestic currency is the counter currency.

However, in the indirect quote, domestic currency is the base currency and the foreign currency is the counter currency. For example, if the indirect quote for $/Rupee is 0.016$, then it implies that for buying 1 Rupee one has to pay 0.016US$. Some currencies do not have the USD as the base currency. For example, the British Pound, Australian Dollar, etc. are quoted as the base currency with the USD.

The Euro, which is relatively new, is quoted the same way as well. For all these currencies, USD is the counter currency and the exchange rate falls under the indirect quote. Hence, the EUR/USD quote is given as 1.25, for example, because it means that one Euro is the equivalent to 1.25 U.S. Dollars.

Also, it is a common practice to quote the home currency as the price and the foreign currency as the unit in the retail exchange in several countries (such as currency exchanged in hotels and airports). The two quotes are understandably equivalent (at least to four decimal places). For instance, a woman walking down Madison Square in the New York City may observe the following quote in a bank window:

USD 1.2174 = EUR 1.00

The domestic currency is the Dollar (the price) and the foreign currency is the Euro (the unit). In New York, this would be a direct quote on the Euro (the home currency price of one unit of foreign currency) and an indirect quote on the Dollar (the foreign currency of one unit of home currency). Hence, she will probably say, “I will pay US$1.2174 Dollars per Euro.”

What is Cross Rates?

The cross rate is defined as the exchange rate of a common currency that enables an individual to calculate the exchange rate between two different currencies. In other words, the cross rate is the exchange rate of currencies being merchandised in a country, which does not utilise either of those currencies in the foreign exchange.

For example, consider a trader in Britain, who deals in Mexican Pesos and Euros, will trade them at the cross rate. If any person is to derive the rate at which he/she would change his/ her base currency and it does not involve USD, he/she needs to find the cross rate. For example, one can easily compute the Euro-Yen along with Yen-Euro exchange rate.

For this, let us take Yen–Dollar and Euro–Dollar rates as ¥78.56 and €0.7802, respectively. Now,

¥ / $ = 78.56

and 0.56

€ / $ = 0.7801

And now, we have to calculate the following:

¥ / €

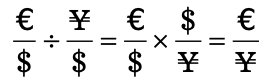

To get the Euro–Yen exchange rate, we divide the Euro–Dollar exchange rate by the Yen–Dollar exchange rate, as shown below:

Therefore, if we divide the Euro–Dollar exchange rate by the Yen–Dollar exchange rate,

€ / ¥ = 0.0099

The Euro–Yen exchange rate turns out to be €0.0099.

Merchant Rates

A bank, as part of its day-to-day business activities, purchases and sells foreign currencies to its customers. In order to generate profits, the bank, while acquiring foreign currencies from its clients, must sell to another bank the same amount, at a rate better than its purchase rate. In the same way, the bank must sell foreign currencies to its customers to make profits.

In order to do so, it must purchase foreign currencies from the inter-bank market at a rate which is less than the rate at which it will later sell the same to its customers. The bank sells foreign currency to the market at the market’s buying rate, that is, the rate at which market buys from others, which it has obtained from its customers. The bank will have to give less to the market than it takes from its clients, to make profits.

The bank adds a margin towards its operating and handling costs on the market’s buying rate and quotes the result to the clients, which is the profit margin. Similarly, the bank must buy from the market before selling foreign currency to its clients at the market’s selling rate. The bank must pay less than it receives from the market, if it has to continue earning profits.

The bank deducts a certain amount of its margins, and quotes the net figure as its sales rate to arrive at its merchant selling rate. The merchant buying and selling rates are derived with the help of the rates prevalent in the inter-bank markets. A bank decides or quotes the merchant rate on the basis of the inter-bank rate, which is also called the base rate or cover rate. In India, the FEDAI has prescribed a set of rules to determine the approach for merchant rate calculations.

These rules are:

- Base Rate

- Purchase Rate

- Sale Rate

Figure illustrates determination of market selling and buying rates from the inter-bank market:

Computing Merchant Rates

The customers, who do not have direct access to the inter-bank markets, must necessarily route all their transactions through an authorised dealer in foreign exchange in order to deal with banks.Inter-bank rates are used as base rates, which are the starting points in the computation of merchant rates (for customers of banks or authorised dealers).

It the inter-bank rate quoted for Euro is 1 US$ = 0.8020 Euro, the bank purchases Euro from the inter-bank market at 0.8020 Euro per US$. In this transaction, the Euro gained by the bank can be used to fulfil client’s requirements such as payment of import bills.

However, if the bank provides Euro to the customer at the inter-bank market rates, it would not be able to recover its operating costs, nor would it be able to earn any profits. The margin added to the inter-bank rate helps in determining the final merchant rates.

The formula is:

Inter-bank Rate + Operating Costs + Exchange Profit = Merchant Rate

Higher Merchant Business Means Greater Profits

A bank can obtain higher reach if it continues buying and selling from merchant customers. In this way, it can earn higher profits than it would if it would have restricted itself to the inter-bank market and doing the same amount of business. An equal mix of customers, for example, an even mix of inward and outward remittances, exporters and importers as well as sale and purchase are of great help to the bank as it does not require going to the inter-bank market to square off its merchant business.

Another important benefit of having an equal mix between bank and the merchant is that, it is the merchant that always faces the ‘quote’. Therefore, the bank is no longer required to go to the inter-bank market to correct its position. A strong and large merchant customer base allows the bank to handle its exchange position effectively.

It also helps the bank to minimise its exposure to the risk in the inter-bank market. The bank may have customers who do not satisfy the objectives of the bank. In that case, the bank through active marketing efforts should emphasise on achieving balance in its exchange position as well as fulfil its long-term objectives.

Inter-bank Vs Merchant Deals

The profit margin added by the bank to its cost of operations varies from time to time, with the type of transactions. However, certain facts remain unchanged, which are as follows:

- The bank that has a larger merchant base has a greater risk taking ability compared to the bank which does not have a huge merchant base.

- In the inter-bank market, the reach of the bank is limited and much less compared to the distribution network of merchant transactions. In order to increase profits from trading activities, banks must increase their turnover in the inter-bank market significantly.

However, it will require larger dealing rooms, adequate infrastructure and technology to cater to high volume trading activities and to create back-up. A team of intelligent and efficient exchange dealers along with an effective support staff needs to be formed. All this leads to huge operating costs as well as higher risks. - A bank with a large or high-value merchant customer base have the advantage of choosing to simply cover their merchant transactions. By covering its merchant transactions, the bank may minimise the prospects of increasing its profit margin but at the same time it is able to reduce the risk it faces in the inter-bank market.

Some banks may try to boost their turnover by influencing their huge merchant customer base. If they are able to increase their trading volumes in the inter-bank market, they are in a position to offer their select customers more competitive rates, as they are able to generate additional profits. - The Central Bank restricts the banks which do not have a large merchant customer base from entering into disproportionate levels of pure trading. The size of a bank’s balance sheet, its track record and risk management policies as well as the technical skills and experience level of the bank’s personnel are some of the factors affecting the decision of the Central Bank.

TT Buying/Bill Buying

TT stands for ‘Telegraphic Transfer’. It is one of the modes for inward or outward remittance. It is the quickest mode of transfer where the buyer pays the bank a certain amount in home currency and the bank pays the equivalent in the required foreign currency to the seller’s bank through a telegraphic code.

Some examples of transactions where TT rate is applied include payment or receipt of demand draft, telegraphic transfers, mail transfers, etc. drawn on the bank. TT rate is applied for all transactions, which do not involve handling of documents by the bank.

TT buying rate is defined as the rate at which a forward inward remittance received by telegraphic transfer is converted into rupees. This rate is applied for purchase of foreign currency by banks. It is applied to a transaction which does not involve any delay in realisation of foreign exchange by the bank. The TT buying rate is determined from the inter-bank buying rate of the exchange margin.

Therefore, all forward inward remittances that are made payable in India are converted by applying this rate. Bill buying or selling by a bank involves handling of documents by the bank and this rate is worse than the TT rate. Further, the bank recovers interest for the duration for which the bank has lent the funds.

The bill buying rate is defined as the rate that is applied when a foreign bill is purchased or discounted or negotiated. When a bill is purchased, the bank realises the proceeds after the bill is presented to the person involved in withdrawals at the foreign branch. In the case of a usance bill, the bank realises the proceeds on the due date of the bill that includes both the transit duration and usance duration of the bill.

TT Selling/Bill Selling

The TT selling rate is the rate applicable when a customer sends an outward remittance via telegraphic transfer. This rate is applied for selling foreign currency to the customer by the bank for effecting remittances outside India. The TT selling rate is determined by adding exchange margin to the inter-bank selling rate.

The bill selling rate is defined as the rate that is applied for transactions involving transfer of proceeds of import bills. Even if the proceeds of import bills are remitted in foreign currency by way of Demand Draft (DD), Mail Transfer (MT), Telegraphic Transfer (TT), etc. the rate to be applied is the bill selling rate and not the TT selling rate.