What is Hedging?

Hedging is a risk management strategy used by individuals, businesses, and investors to reduce or mitigate the potential financial losses associated with adverse price movements or uncertainties in the market. It involves taking offsetting positions in assets or contracts that are negatively correlated with each other. The primary goal of hedging is to protect against potential losses while allowing for potential gains.

Table of Content

Encyclopaedia Britannica defines hedging as a method of reducing the risk of loss caused by price fluctuation. It consists of the purchase or sale of equal quantities of the same or very similar commodities, approximately simultaneously, in two different markets with the expectation that the future change in the price in one market will be offset by an opposite change in the other market. The concept of hedging refers to reducing or mitigating the risk of loss.

In the context of foreign exchange, the risk of loss arises from exchange rate volatility. The value of a foreign currency position is determined by the exchange rate.

As the exchange rate changes, the value of the position also changes. The value can go above the cost at which the position was created or it can be lower. For example, suppose a dealer in pound sterling leaves an overnight open position of GBP 10 million at the end of a day. The average rate at which he/she has purchased the amount is, say, GBP/INR 100. This means the value of the position in terms of domestic currency is INR 1000 million. Suppose the exchange rate on the next day when the market opens turns out to be GBP/INR 95.

His/Her position will then be worth only INR 950 million. He/She faces a loss of INR 50 million overnight. Unless a dealer maintains a position for speculative purposes, he/she will always try to reduce the risk of loss from his/her position arising due to exchange rate uncertainty. In this case, if the dealer wanted to eliminate exchange rate risk from his/her position, he/she would have squared up the position at the end of the day. On the other hand, he/she can also maintain the position but can reduce the risk of loss by hedging.

In this case, the dealer can undertake a hedging transaction in the forward market. Suppose he/ she sells GBP 10 million in the forward market at GBP/INR 102 for one week (note the forward rate is higher than the spot rate, implying that the rupee is expected to depreciate as per the interest rate differential). If on the next day, the rupee actually appreciates to GBP/INR 95, his/her spot position is worth INR 50 million less. However, his/her hedging position in the forward market will be worth INR 1020 million.

In the simplest case, he/she can simply keep the GBP proceeds from the spot position and deliver it for the forward contract maturing one week later. In this case, irrespective of the spot exchange rate on the next day (or even after a week), his/her GBP position will be worth INR 1020 million. Thus, through the hedging transaction in the forward market with an equal and opposite transaction, i.e., by taking a short position in the forward market against long position in the spot market by selling forward GBP 10 million, he/she has completely eliminated the exchange rate risk.

In real world, the dealer won’t be able to maintain the spot position of GBP 10 million till the maturity date of the forward contract as it implies maintenance of idle funds. The example is meant to explain the basic concept of hedging (we shall come back to this example later in the context of FX swaps). In order to avoid excessive risks from being taken by dealers, the various limits explained in the previous section are used by banks for foreign exchange operations.

These limits serve to minimise the losses due to exchange rate risks. For reducing the risk of loss from the positions already taken, which are not maintained for speculative purposes, the hedging transactions are used by banks. There are various types of hedging transactions used by banks for mitigating exchange rate risks involved in trading book positions. The simplest is the hedging in the spot market for merchant transactions. Suppose a bank customer purchases GBP 10 million; this will create a short position of GBP 10 million in the trading books of the dealer.

The dealer will immediately cover this short position with a purchase of GBP 10 million in the spot market. Similarly, the bank will hedge (or cover) all merchant transactions (either immediately or based on trading book position) in the spot market. Apart from this, banks undertake several types of hedging transactions meant for their trading book (the banks might also undertake hedging transactions for their banking book containing various assets and liabilities including foreign currency ones.

Types of Hedging Transactions for Trading Book

We will focus on trading book here. These are listed as follows:

- Hedging Through Forward Contracts

- Hedging Through FX Swaps

- GAP Risks and FX Swaps

- Hedging Through Money Market Operations

- Hedging Through Currency Derivatives

Hedging Through Forward Contracts

We discussed an example of hedging in the forward markets. In practice, hedging a spot position with an equal and opposite position in forward markets results in a maturity gap. We will discuss this later. A more straightforward example of using forward markets for hedging pertains to forward merchant transactions. Suppose an importer requires GBP 10 million payable after three months towards an import trade transaction. The current exchange rate is GBP/INR 100 while the rate could turn adverse after three months.

The importer faces exchange rate uncertainty and he/she can hedge his/her exposure by entering into a forward purchase contract with his/her bank. A forward purchase contract with the bank, at say, GBP/INR 102, implies that the bank is willing to sell GBP 10 million at the rate of 102 after three months. By this contract, the importer has shifted his/her risk to the bank. Now, the bank faces exchange rate risk of what could be the rate after three months. This is because the bank may have to purchase GBP 10 million from the market at the prevailing rate after three months in order to meet its commitment to the importer.

The bank can hedge this risk by entering into another opposite contract of an equal amount in the inter-bank forward market. For example, to hedge its commitment to sell forward GBP, it can enter into a contract with another bank to buy forward GBP after three months. As long as the rate at which the bank enters into a forward purchase contract with another bank is better than the forward rate quoted to the customer, the bank will not face any loss. This counter hedging transaction by the bank can completely eliminate the risk arising from its forward contract with the customer.

The outright forward contracts undertaken in the inter-bank market by banks are meant for hedging and they do not involve any risks. However, any stand-alone forward contract undertaken by a bank in the forward market will have to be hedged. In the example discussed previously where the spot overnight position was hedged with the forward position, the bank can squareoff the long position in the spot market the next day, if the spot exchange rate is not adverse, by selling GBP 10 million in the spot market.

However, this will leave a stand-alone one week maturity forward sale contract of GBP 10 million. The bank can hedge this forward sale contract with a forward purchase contract of GBP 10 million for the same maturity date. Whether the bank makes a profit or loss in these transactions depends on the exchange rate on the next day. If the spot rate is higher than 100, the bank will make a profit on the spot square off transaction but a loss in the forward market (assuming the same interest differential) if the forward rate is also higher. However, the bank would face a much higher loss if it keeps the GBP 10 million as an open position.

Hedging Through FX Swaps

FX swaps refer to simultaneous buying (or selling) in the spot market and selling (or buying) in the forward market for the same amount with a single counterparty. An FX swap transaction by itself does not create any risk. Let us say a dealer enters into an FX swap transaction for GBP and INR for GBP 10 million one week forward. He/She purchases GBP 10 million at 100 and forward sells GBP 10 million one week forward at 102. Through this transaction, the dealer gets a profit of 2 rupees per GBP, which is the swap point that depends on the interest differential between INR and GBP.

By itself, this FX swap transaction does not involve any exchange rate risk. Suppose the exchange rate turns adverse to GBP/INR 90 in one week. There will be neither any loss in the spot nor the forward position for the dealer. The dealer can simply deliver the GBP 10 million purchased at 100 for honouring the forward sale contract. His/Her profit remains same as that of the swap points at which he/she executed the FX swap. FX swaps are used for speculation on interest rates and also for hedging open positions.

FX swaps are generally used for hedging the merchant forward contracts instead of outright forward contracts explained in the previous section. To hedge the GBP 10 million merchant forward sale contracts, the bank can ideally enter into an outright forward as mentioned earlier. However, the bank needs to cover its forward sale transaction with the client immediately in the market before the rates turn adverse.

For example, if the bank enters into a forward sale at 102, the rate could become 104 by the time the bank covers its transaction in the inter-bank. However, the bank may not immediately find another counterparty that is willing to forward sell GBP 10 million. The bank cannot wait for a suitable counterparty in order to hedge its transaction with the customer. In this case, the easiest method to hedge the forward sale is to purchase in the spot market.

The bank can purchase GBP 10 million in the spot market, which can be delivered to the customer after three months (assuming the worst case scenario of no other transaction in the interim period) to honour the forward sale commitment. However, the bank cannot keep GBP 10 million idle for the sake of meeting the forward contract commitment. Hence, strictly speaking, this is not a feasible method of hedging the forward sale.

In the real world, the bank cannot hope to find an exact counterparty in the forward market with similar requirements for the same amount immediately. Hence, in practice, the dealer immediately hedges his/her forward sale with a spot purchase. After the spot purchase for GBP 10 million is made, the dealer enters into an FX swap to sell spot and buy forward for GBP 10 million for three months. The spot leg will square-off the spot purchase of GBP 10 million made immediately after the customer transaction while the forward leg will cover the forward contract.

Effectively, the FX swap along with the spot purchase serves the same function as an outright forward transaction as shown in Table:

| Transaction to be Hedged | Hedging Transaction in Forward Market | Hedging Transaction through FX Swap |

|---|---|---|

| Forward sale to customer amounting to GBP 10 million | Outright forward purchase for GBP 10 million | Spot purchase for GBP 10 million FX sell/buy swap for GBP 10 million |

GAP Risks and FX Swaps

Earlier, we discussed the case of a dealer having an overnight open position of GBP 10 million and hedging it with a forward sale. The forward sale covers the open long spot position, and there is no exchange rate risk involved in the overall position. However, as discussed, the open spot position will not be maintained over a period to cover the forward transaction. The position has to be closed by selling the GBP 10 million in the spot market and undertaking a hedging forward transaction to nullify the forward leg.

Since it is risky to undertake a separate spot and forward transaction on the next day, an FX swap can be used on the following day. A FX swap with spot sale of GBP 10 million and forward purchase for the same amount will square off the entire position and the dealer need not maintain his/her open spot position to cover the forward undertaken the previous day. The initial position in this example does not involve any exchange rate risk.

In fact, the net position is zero:

= (+GBP 10) + (–GBP 10)

= 0

Hence, the net position is zero for the dealer once he/she undertakes the forward cover. However, there is a maturity gap between a long position and a short position. The spot position is current while the forward position has maturity of three months. This means the position is zero over a period of three months. Alternatively, there will be no exchange rate risk only if the position is maintained for three months. In the real world, the dealer won’t be able to maintain the position for three months. He/She will undertake an FX swap as discussed, to square off the position.

The position after the FX swap transaction will be:

Net Open Position = Net Open Spot Position (Long) + Net Open Forward (Short) + FX Swap Spot + FX Swap Forward

= (+GBP 10) + (–GBP 10) + (–GBP 10) + (+GBP 10)

= 0

After the FX swap transaction, the position is squared off and there is no maturity gap involved. However, we have till now ignored the swap rate at which the position was closed. If the swap rate is not favourable, then the dealer would face loss. The swap rate is dependent on the interest rate differential between GBP and INR. If the interest rates differential change by the time the FX swap is executed, it will lead to loss.

The interest rate differential is dependent on the maturity period concerned. This risk of loss due to the movement of swap points arises out of the need to close a gap position having a maturity mismatch. Hence, the position containing spot and forward, even though the net position is zero, is considered to have gap risk. Example 1 illustrates further how a gap risk can lead to losses.

Illustrative Example 1: A dealer has the following position in GBP against INR:

Spot – GBP 10 million long

Three months forward – GBP 10 million short

The spot was executed at an average rate of 100.25 and the forward rate was 100.75.

The dealer now wants to close his/her position.

If the prevailing swap quotes are as follows, what is the profit/loss in squaring off his/her position?

GBP/INR Spot: 100.3510/100.3530

3-month Swap: 9125/9180

Solution: The spot forward position can be closed by undertaking an FX swap.

The dealer can undertake an FX swap to spot sell GBP 10 million and forward buy for the same amount.

Let the settlement rate for the spot transaction be mid-rate. The spot rate applicable will be 100.3520. The forward leg of the swap will be executed at the swap offer points of 9180. This implies an outright forward rate of (100.3520 + 0.9180 = 100.5385).

The cash flows will be as follows:

| Spot | Forward | |||

|---|---|---|---|---|

| GBP | INR | GBP | INR | |

| Original Deal | 10 | –1002.5 | 10 | +1007.5 |

| 10 | +1003.52 | 10 | –1012.7 | |

| Net Cash Flows | +1.02 | –5.2 |

The dealer would make a profit in the spot leg of INR 1.02 million and a loss of INR 5.2 million in the spot leg. The close out implies a net loss of INR 4.18 million for the dealer. Even though the spot rate has moved favourable, the swap points have turned adverse due to changes in expectations of movement of interest differentials between 3-month interest rates of GBP and INR. Hence, the dealer loses INR 4.18 million due to unfavourable movements of the swap points. In this example, even though the original position did not have any exchange rate risk, its closure implies an exchange rate risk due to the maturity mismatch.

The maturity mismatch of 3 months has resulted in a loss of INR 4.18 million for the dealer due to the unfavourable movement of the swap rates. This loss is due to the GAP risk associated with the original position. Gap risks are managed through setting up gap limits. For example, a spot long position in a currency and a one year forward short position might imply a net open position of zero. However, there is a maturity mismatch as discussed. This is not the same as the maturity mismatch applicable, if the short forward position has a maturity period of one week rather than one year.

Hedging Through Money Market Operations

Banks can also hedge through money market operations. This is an especially useful route for hedging forward positions when the dealers cannot get equivalent outright forwards or hedge through FX swaps. Consider a bank entering into a forward sale contract with its importer for GBP 10 million. After the contract is entered into, the dealer will try to cover through an FX swap or an outright forward. Suppose he/she could not use either option due to market conditions. In this case, he/she can use money market transactions. The money market hedge involves lending and borrowing in different currencies in the respective money markets.

The steps involved in a money market hedge for covering a forward sale contract with a customer involves the following steps:

- The dealer needs GBP 10 million after three months to be delivered to the customer. Hence, he/she should get this amount after three months through transactions carried out in the money market. This can be achieved by lending GBP 10 million for three months such that the maturity amount is the same as the forward sale amount.

- Lending GBP 10 million requires first purchasing the same amount in the spot market. Hence, the bank will first purchase the amount in the spot market. The amount purchased will be GBP 10 million less interest that will be earned in the lending operation.

- To purchase the GBP amount, the dealer would require an equivalent rupee amount. The customer has contracted to pay the equivalent rupee amount only after three months. Hence, the bank has to borrow the rupee amount equivalent to the amount required to purchase GBP. This will be done in the rupee money market.

- After three months, the loans will mature with the bank receiving GBP on the repayment of the money lent to the borrower while it will have a repayment obligation for the rupee loan. Also, the customer will make payment for the forward sale contract. The bank will receive the INR payment from the customer and close the rupee loan. It will receive GBP proceeds from the money lent in pound sterling money markets and deliver it to the customer.

- If the covered interest parity theorem holds good, then the forward rate quoted to the customer by the bank for the forward sale will be such that the maturity amount of the rupee loan will be the same as that of the rupee obligation of the customer. This is because the forward rate is based on the interest differential between the GBP interest rate and the INR interest rate.

Example 2 illustrates the process.

Illustrative Example 2: An export customer wants to hedge his/ her one year receivables in USD for $10 million. The bank quotes USD/INR 68.8235 for the forward sale contract (ignore commissions). The customer enters into a forward contract at this forward rate. If the bank decides to hedge this forward position through money market operations, what are the steps involved? The interest rate is 8% p.a. in the Indian money markets and 2% p.a. in the US money markets, and the spot rate is USD/INR 65.

Solution: The money market hedge will involve the following steps:

- Borrow from the US money markets.

- Convert the USD proceeds and lend in the Indian money market.

- On maturity, close the USD loan with the export proceeds delivered by the customer, and pay the maturity amount of the rupee investment to the customer.

The amount of USD to be borrowed will be based on the amount to be delivered by the customer.

The maturity amount of the USD loan = Amount to be delivered by the customer = $10 million.

Since borrowing in the US money markets will be done at 2% p.a., the amount to be borrowed so that the maturity amount is $10 million is:

USD amount to be borrowed = 10/(1 + 2%) = $9.8039 million.

This amount will be sold in the spot market at USD/INR 65 and the amount will be invested in the Indian money markets.

INR amount to be lent = $9.8039 × 65 = INR 637.2549 million.

At the interest rate of 8% p.a., the maturity amount of the rupee loan will be:

INR maturity amount = INR 637.2549 × (1 + 8%) = INR 688.2353 million.

On maturity after one year, the customer will pay $10 million. This amount will be used to close the USD loan. The amount to be paid to the customer:

INR amount to be delivered to the customer = $10 million × 68.8235 = 688.2350 million.

This is the same amount that will be received from the rupee investment. Thus, the forward contract is hedged through money market transactions and the bank does not face any exchange rate risk as the spot or forward rate prevailing after one year is immaterial. In this example, the bank will have neither any profit nor loss due to the money market hedge. This is because the forward rate quoted by the bank is based on the interest rates in the respective currencies.

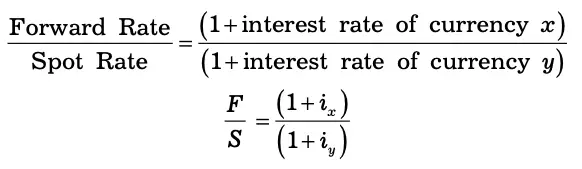

The forward rate needs to be derived from the following covered interest rate parity relationship (irrespective of the currently prevailing forward rates when the forward position is hedged through money market transactions):

Where F is the forward rate and S, the spot rate both quoted with currency Y as the base currency.

Hedging Through Currency Derivatives

Apart from outright forward contracts and FX swaps, banks can also hedge their positions using currency derivatives, such as currency futures, currency options, currency swaps and interest rate derivatives. In theory, currency futures can be used in place of forward contracts for hedging. The hedging with currency futures will be similar to hedging with outright forwards except that the currency futures are exchange traded derivatives and hence the contract terms are standardised and marked to market.

However, banks generally use forwards and FX swaps for hedging currency positions instead of currency futures. The currency options, currency swaps and interest rate derivatives are used more for hedging foreign currency assets and liabilities than foreign currency positions of the trading book. These are also used for hedging the foreign currency exposure in the assets and liabilities of the banking book.