What is Interest Rate Swap (IRS)?

An Interest Rate Swap (IRS) is a financial derivative contract between two parties that involves the exchange of interest payments over a specified period of time. IRS is one of the most common and widely used financial instruments in the world of finance, and it is primarily used to manage or hedge interest rate risk.

Currency derivatives pertain to hedging a single transaction exposure. These exposures may pertain to international trade transactions like exports and imports or one-off financial transactions. Firms also face foreign exchange transaction exposures that are spread over a period of time. The risk involved in these exposures could be exchange rate risk, interest rate risk or both. You have studied earlier that a single exposure to interest rate risk could be hedged with an OTC derivative instrument like Forward Rate Agreements (FRA).

Financial swaps are derivative contracts that can be used for hedging a series of transaction exposures pertaining to exchange rates and/or interest rates. An interest rate swap is meant for hedging a series of interest cash flows and is equivalent to applying a series of FRAs for future cash flows. Interest rate swaps involve a single currency and can be used to hedge interest rate exposures.

Cross-currency swaps (to be discussed in the next section) involve loans in two different currencies and can be used for managing both currency and interest rate risks. Interest Rate Swap (IRS) can be defined as a financial derivative contract between two parties for exchanging a series of interest payments on a notional principal amount over a period of time as per the initially agreed terms.

On each payment date during the swap period, the parties exchange interest payments, which could be between ‘fixed to floating’ or ‘floating to floating’ rates of interest. IRS involves the exchange of ‘fixed to fixed’ is called coupon swap, while ‘floating to floating’ is termed as basis swap.

Interest rate swaps have two important characteristics:

- They involve the swap of interest payments denominated in the same currency.

- There is only the exchange of interest payments and not principal (being same currency).

A liability swap can also be meant for hedging interest rate risks, while assets swap can be meant for changing the asset-liability structure in tune with balance sheet cash flows. In addition, both of these might involve lower cost of borrowing due to comparative advantages.

Purpose of Interest Rate Swap (IRS)

The interest rate swaps can be used by corporates for the following purposes:

IRS for Changing the Nature of Liability Structure – Liability Swap

Consider an Indian company (Company A), which has issued a 3-year Eurobonds for $10 million at fixed interest rate of 5% p.a. The company would like to have a mix of floating and fixed rate debt and would like to convert this fixed rate loan into floating rate one. A US company (Company B) which has raised $10 million in Eurocurrency markets at LIBOR + 2% would like to convert its liability exposure to fixed interest rate. The two companies can decide to enter into an IRS contract that would change the nature of their cash flows.

IRS would involve companies swapping their interest payments. Company A will pay the interest at Six Month LIBOR + 2% to Company B, while Company B will pay interest at 5% fixed rate to Company A. In practice, instead of both companies making payments on scheduled payment dates, only the net cash flow difference between two rates will be settled. The company that pays a fixed rate is called the swap buyer, while the company that pays the floating rate is known as the swap seller.

By entering into IRS, the swap buyer converts his floating rate liability into the fixed interest rate liability (and vice versa for the swap seller). LIBOR rates applicable are fixed in advance to the actual payment date. If the contract is based on six-month USD LIBOR, and if the interest is payable every June and December, the interest payable in December is fixed as per LIBOR prevailing in June at the previously agreed reset dates.

In the above example, if the LIBOR on the reset date in June is 3.5%, then floating interest rate applicable for the June-December period is 5.5% (3.5%+2%) and the difference between fixed and floating is 0.5%. The swap buyer, i.e. Company B will receive 0.5% as the differential amount applicable for the period from Company A.

Table gives the schedule of actual interest differential payments that would have paid under IRS assuming the given LIBOR rates during the three-year period:

| Date | LIBOR % | Floating Cash Flow | Fixed Rate Cash Flow | Net Payment to the IRS buyer |

|---|---|---|---|---|

| December, 2015 | 3.00% | |||

| June, 2016 | 3.50% | 2.50 | 2.50 | 0.00 |

| December, 2016 | 3.80% | 2.75 | 2.50 | 0.25 |

| June, 2017 | 2.80% | 2.90 | 2.50 | 0.40 |

| December, 2017 | 3.10% | 2.40 | 2.50 | -0.10 |

| June, 2018 | 4.00% | 2.55 | 2.50 | 0.05 |

| December, 2018 | 4.50% | 3.00 | 2.50 | 0.50 |

In Table, the net payment to the IRS buyer, i.e. Company B for the June-December, 2017 half-year period is calculated as follows:

Net Payment to the IRS Buyer = Floating Interest – Fixed Interest

= $100 million × (LIBOR + 2%) × 180/360 – $100 million × 5% × 180/360

= 100 × (2.8% + 2%) / 2 – 100 × 5% /2

= – 0.1 million

Company B will pay 0.1 million to Company A for the above period.

The above example assumes that two companies directly enter into a swap contract. In practice, it is not possible for Company A to search for another company with equivalent swap needs. Hence, companies approach a swap dealer/bank that can structure the IRS deal. Banks act as intermediary in IRS deals. In the above example, the counterparty of IRS deal for Company A will be a bank and not another company. The bank will later structure another offsetting deal with other clients who have similar needs by running a swap book.

IRS Based on Comparative Advantage in Raising Funds

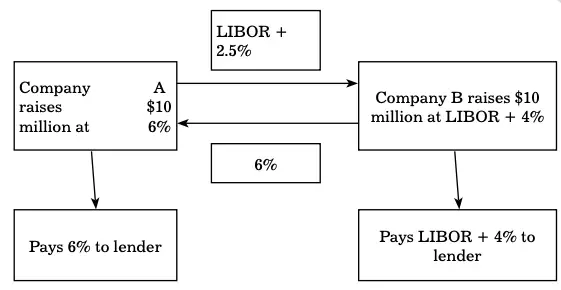

Interest rate swaps are also used for taking benefit from a comparative advantage in raising funds in different markets. Consider a US company (Company A) that can raise dollar loans at a fixed rate of 6% and a floating rate of LIBOR + 3%. Similarly, an Indian company (Company B) can raise loans denominated in USD at a fixed rate of 8% and a floating rate of LIBOR +4%.

The US Company has an absolute advantage in both markets as it could raise funds at lower interest rates in both fixed and floating interest markets. However, the Indian company has a comparative advantage in floating interest markets. Its cost of funds is higher than the US Company in fixed markets by 2%, while it is higher only by 1% in floating interest markets. Both the companies can reduce their cost of borrowing by entering into an IRS contract.

This would involve the following steps:

- Company B has a comparative advantage in floating interest rate markets. It will raise, say $10 million, at LIBOR + 4%.

- Company A will raise $10 million in fixed interest market at 6%.

- Two companies will enter into an IRS contract whereby company A will pay to Company B, interest payments at LIBOR + 2.5%. The Company B will pay 6% to Company A.

In order for the IRS to benefit Company A, its interest payments should be less than what it would pay if it has not entered into the IRS. Hence, in the above example, Company A will pay only LIBOR + 2.5% instead of LIBOR + 3%, thereby saving 0.5% by entering into an IRS, as compared to its cost, if it has to directly take a floating rate loan. Company B will also benefit from the swap because its total interest cost is lower than the fixed interest rate of 6% applicable if it has taken the loan directly:

Interest rate applicable for Company B = Floating int. received from Company A – Fixed int. to be paid to Company B – Floating int. to be paid to the lender

= (LIBOR + 2.5%) – 6% – (LIBOR + 4%)

= – 7.5%

The overall cost of the fixed rate loan is now only 7.5% instead of 8%, which would have been applicable if Company B has raised fixed rate loans directly. Thus, both companies have reduced their cost of borrowing by 0.5%. The total cost reduction of 1% is the same as the actual comparative advantage of Company B.

Figure shows the swap structure:

Table shows cost advantages owing to the swap deal:

| Company A (Floating) | Company B (Fixed) | |

|---|---|---|

| Cost if no swap undertaken | LIBOR + 3% | 8% |

| After IRS deal | LIBOR + 2.5% | 7.5% |

As before, deals will be structured by a swap bank intermediary instead of Company A and B entering into an IRS contract directly. In such cases, the bank might also partake of the benefit accruing from the swap deal.

In the above example, the bank might structure the deal as follows:

- Company A will pay LIBOR + 2.5% to the bank

- Company B will pay 6.25% to the bank

- Bank will pay Company A, 6% and Company B, LIBOR + 2.5%

In the above deal, Company B pays overall 7.75%, while the bank takes 0.25% from the deal. The comparative advantage of 1% applicable for Company B has been split between three parties through the swap deal.

Table shows interest cash inflows/outflows arising out of the deal for all the parties including the swap bank:

| Outflow due to the actual loan raised | IRS inflow | IRS outflow | Total cost after IRS | Cost before IRS | Cost benefit due to IRS | |

|---|---|---|---|---|---|---|

| Company A | 6% | 6% | LIBOR + 2.5% | LIBOR + 2.5% | LIBOR + 3% | 0.5% |

| Company B | LIBOR + 4% | LIBOR + 2.5% | 6.25% | 7.75% | 8% | 0.25% |

| Swap Bank | Nil | LIBOR + 2.5%, 6.25% | LIBOR + 2.5%, 6% | 0.25% | – | 0.25% |

Managing Interest Rate Risks – Asset Swap

As mentioned before, interest rate swaps can be used for managing interest rate risks and it is possible to achieve the same for both liability swaps and asset swaps. For example, the reason why Company A wants to take a floating rate loan instead of a fixed rate loan in the case (1) discussed above as part of the liability swap, might be because it expects interest rates to come down. It would rather prefer to have a floating rate liability instead of a high cost fixed interest loan in its book and hence might prefer a liability swap. Similarly, IRS can also be used for managing interest rate risks associated with assets.

Consider a financial institution that has invested in floating rate securities at LIBOR + 3%. In order to match its liability with assets, it would like to remove uncertainty associated with floating rate investment. It might expect interest rates to come down and would like to hedge the floating rate security with a fixed interest investment. It can enter into an IRS deal whereby it can swap the floating rate interest receipts with fixed interest receipts of, say 7%. The swap bank will pay the difference between the fixed swap rate applicable for the deal and the floating interest rate. This will act as the hedge against interest rate volatility.

Role of Banks in Swap Markets

The IRS market has grown to become one of the largest financial markets. Banks act as intermediaries in the swap market. As mentioned earlier, it is not possible for a company to find out a suitable counterparty who has an offsetting requirement. At the same time, it is also not possible for banks to find an exactly matching counterparty in the real sense. In practice, banks themselves act as the counterparty in all swap deals. Banks will later offload the IRS with an offsetting deal with counterparty, as and when, it finds one. This requires banks to warehouse swap deals and run a swap book.

Moreover, swaps have different implication for banks acting as counterparties when compared to the actual purpose of swap clients. This is because cash flows of IRS are equivalent to the following:

- Issue of bonds with fixed (or floating) rate

- Investment of the proceeds with floating (or fixed) rate instruments

For example, when banks act as an IRS buyer, it implies that they pay a fixed rate on a bond while they invest in LIBOR and roll it over. Thus, IRS cash flows are not very different from cash flows arising out of normal operations of the bank. This means banks can also use IRS deals to structure their asset-liability portfolio rather than requiring offsetting each deal with the counterparty depending on the cash flow requirements of the banking book.

Hence, banks might engage in IRS deals (including currency swaps to be discussed later) to:

- Meet the needs of their clients

- Structure or hedge asset-liability mismatches in their banking book

- Trade on their own account

Pricing and Valuation

When banks enter into an IRS deal with their clients, they need to quote the applicable swap rate. The swap rate is the fixed rate that is equivalent to a series of floating interest rate payments. For example, if a client needs to convert his LIBOR loan into a fixed rate loan, the bank has to arrive at the swap rate (or equivalent fixed rate) that is equal to the floating rate. This is termed the pricing of IRS and is done on the basis of the interest rates applicable for the period as indicated by the prevailing yield curve.

The principle behind the pricing of IRS deal is that the present value of cash flows arising out of a fixed rate loan should be equal to the present value of cash flows arising out of a floating rate loan. The discount rate that makes the present value of fixed rate coupon payments equal to the floating rate interest payment will be the swap rate quoted by the bank. This means the value of the swap is zero as the value on both the fixed and floating sides are made equal in the beginning. However, after the swap is initiated, the value of the swap can be either positive or negative depending on the interest rate movements.

Illustration 6: ABC Corp., a financial institution has an investment in 2-year floating rate securities of $20 million at six month-LIBOR with a spread of 2%. The corresponding liability in its book carries a fixed interest rate of 8% p.a. The bank decides to hedge the interest rate risk associated with the asset-liability mismatch by using an asset swap. A swap bank offers an Interest Rate Swap at a swap rate of 8% p.a. as per the detail given below.

Notional Principal – $ 20 million

Swap rate – 8%

Days Count – Actual day count and 360 days per year

- Explain how the swap will be structured.

- Show the net amount received/paid by ABC Corp. if the first interest payment was due on June 2015 and the LIBOR rate was 5.9% on December 2015. LIBOR rates that prevailed on subsequent periods were 6.1%, 5.5% and 5%.

Solution: To hedge the interest rate risk, the financial institution can swap its interest receipts from the floating rate securities with fixed interest payment from the swap bank at the swap rate of 8%. Thus, the financial institution will enter into a ‘Pay Floating, Receive Fixed’ Interest Rate Swap with the swap bank. The swap bank will be the IRS buyer and the financial institution, the seller. The financial institution can use the fixed interest payments received from the swap, to pay for the fixed interest liability, thereby removing the interest rate risk. Table 10.7 gives cash flows arising out of the swap:

| Date | LIBO | Days | Fixed Interest | Floating Interest | Net Cash Flow for ABC Corp. |

|---|---|---|---|---|---|

| December, 2015 | 5.90% | ||||

| June, 2015 | 6.10% | 182 | 808889 | 798778 | 10111 |

| December, 2016 | 5.50% | 183 | 813333 | 823500 | -10167 |

| June, 2016 | 5.00% | 182 | 808889 | 758333 | 50556 |

| December, 2017 | 183 | 813333 | 711667 | 101667 |

The interest payments are calculated as per the days count convention mentioned in the problem of “Actual/360”.

Cash flows applicable for the first interest payment schedule date of June 2015 are calculated as follows:

Interest payment due from ABC Corp:

= (LIBOR + 2%) × 182/360 × 20,000,000 = $ 798,778

Interest payment due from the swap bank:

= 8% × 182/360 × 20,000,000 = $ 808,889

The net cash flow due to ABC Corp = Fixed Interest – Floating Interest

= 808,889 – 798,778

= $ 10,111

Cash flows for other payment dates are also calculated in the same way. The settlement will not be done on a gross basis, but on the basis of net cash flow, i.e. for the first schedule, ABC will be the receiver of the differential amount. While for the second schedule, and it will be a payer since the floating rate is greater than fixed rate for June 2015 – December 2016 period.