International Financial Institutions (IFIs) are organizations established to provide financial and technical assistance to countries and regions around the world. They play a crucial role in promoting economic development, stability, and poverty reduction on a global scale. These institutions are typically composed of member countries and operate under specific charters or agreements.

Table of Content

International Financial Institutions

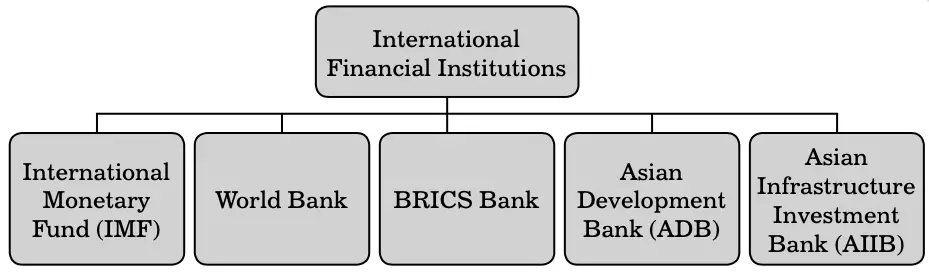

There are various international financial institutions that help countries and corporates carry out different kinds of projects. Majority of these projects are developmental in nature. Some of these international financial institutions are depicted in Figure below:

International Monetary Fund

The International Monetary Fund (IMF) is an international financial institution which was constituted after the Second World War. After the Second World War, gold standards broke down. Countries across the globe felt the need for international co-operation in trade, balance of payments and economics.

In 1943, the US came up with the idea of Exchange Stabilisation Fund (ESF), which was proposed by Harry Dexter White, and hence was named ‘White Plan’. On the other hand, the UK suggested the establishment of International Clearing Union (ICU), proposed by British economist, John Maynard Keynes, and came to be known as ‘Keynes Plan’. The experts in 1944 issued a combined plan in the form of a joint statement, announcing the establishment of IMF.

IMF came into existence on 1st March 1947, with a total strength of 44 members to promote expansion and balanced growth as well as, economic and financial cooperation among member countries. In the year 2008, the number of member countries of the IMF was 185.

The provisions under the agreement which are observed by the member countries are monitored by IMF. IMF keeps amending the agreement from time to time adjusting to the changes in the exchange rates due to various international financial events.

Some of the key roles of IMF are as follows:

- In balance of payments, it is often termed as the ‘guardian of good conduct’.

- It provides foreign currencies to members, thus acting as a lending institution.

- IMF provides the required machinery to make necessary adjustment, which are important to balance exchange rates.

- It intends to reduce the restrictions and tariff rates imposed by member nations.

- IMF gives its members advice regarding their monetary and fiscal policies.

- It provides financial assistance to member nations to overcome their balance of payment deficit.

- Short-term training courses on fiscal, balance of payments and monetary issues are conducted for the employees of member countries.

- It tries to improve the long-term balance of payment position of its member countries by offering the required techniques to alter the par value of the currency of the member nation.

World Bank

In 1944, at the Bretton Woods conference, the World Bank came into existence. The primary objective of the World Bank is financing economic development.

The purposes of the World Bank include the following:

- Assisting development of its member nations’ territories

- Promoting and supplementing private foreign investment

- Promoting long-term balance growth in international trade

The current primary focus of the World Bank is on the following strategic themes:

- The poorest countries: Poverty reduction and sustainable growth in the poorest countries, especially in Africa.

- Post-conflict and fragile states: Solutions to the special challenges of post-conflict countries and fragile states.

- Middle-income countries: Development solutions with customised services as well as financing for middle-income countries.

- Global public goods: Addressing regional and global issues that affect national borders, such as climate change, infectious diseases and trade.

- The Arab world: Greater development and opportunity in the Arab world.The Arab world: Greater development and opportunity in the Arab world.

- Knowledge and learning: Leveraging the best global knowledge to support development.

The World Bank plays a significant role in the development of the member countries by providing loans. It provides long-term loans for projects spanning 5 to 20 years duration.

Following are the various roles of the World Bank:

- It assists its member countries with various technical services. Further, the Bank has established “The Economic Development Institute” and a Staff College in Washington to support this purpose.

- It can grant loans to a member country of up to 20 per cent of its share in the paid-up capital.

- The amount of loans, interest rate and terms and conditions are determined by the bank itself.

- Generally, it grants loans for a particular project duly submitted to the bank by the member country.

- The nation that takes up the loan has to repay either in reserve currencies or in the currency in which the loan was sanctioned.

- It also provides loan to private investors belonging to member countries on its own guarantee. However, private investors have to seek prior permission from those countries where this amount will be collected.

- It assists in the reconstruction and development of territories of its members by facilitating the investment of capital for productive purposes. It also encourages the development of productive facilities and resources in developing countries.

- It promotes private foreign investment by providing guarantees on participation in loans and other investments made by private investors if capital is not available on reasonable terms. It also supplements private investment by providing finance for productive purposes out of its own resources or from borrowed funds.

- It promotes the long-range balanced growth of international trade and maintenance of equilibrium in the balance of payments of member countries.

- It also arranges loans and guarantees by it in relation to international loans through other channels in order to deal with the more useful and urgent, small and large projects.

BRICS Bank

The BRICS Bank is also called the New Development Bank (NDB). It is designed to provide both development finance and balance of payments funding on a worldwide scale. It is a clear potential rival to the IMF and the World Bank. The competition between the BRICS Bank and the IMF and the World Bank is based more on efficiency instead of being a struggle between liberal vs alternative economic philosophies.

In this context, there is a strong complementary relationship between the BRICS Bank, the IMF and the World Bank. This relation states that the West, the IMF and the World Bank should not view the BRICS Bank as a threat to their domination of the global economic order. However, one of the threats could be another development bank, The Asian Infrastructure Investment Bank (AIIB), which is backed by China AIIB Bank has more capital and members than the BRICS Bank.

Some key roles of BRICS Bank are as follows:

- All the BRICS countries the (Brazil, Russia, India, China and South Africa) agreed to set up a development bank, whose sole purpose, according to its articles, is to “mobilise resources for infrastructure and sustainable development projects” not only in BRICS countries but also in other emerging economies.

- It aims to utilise resources at its disposal to support infrastructure and sustainable development projects, which may be public or private, in the BRICS and other emerging market economies and developing countries, through the provision of loans, guarantees, equity participation and other financial instruments.

- The BRICS initiative is considered to be the most significant sign yet of developing countries’ refutation of Washington-led policies on many issues such as tough conditions on international payments and development assistance to reform the IMF’s voting structures.

- With much financial clout moving to Asian banks as European and US banks rein in their operations in areas like international trade and project finance, the BRICS Bank can have considerable influence in catalysing new areas of finance for developing nations.

- The BRICS Bank focuses on improving the living standards of BRICS countries citizens and assisting other developing countries, which are in desperate need of funding for infrastructure projects.

- It promotes equality for all developing countries to realise their development potential.

- It aims to provide technical assistance for the preparation and implementation of infrastructure and sustainable development projects to be supported by it.

- BRICS countries, especially China, have accumulated financial means and resources that can enable the BRICS Bank to fill the gap to some degree. The financial deficit in developing countries is estimated to be $1 trillion annually.

- It aims to cooperate as it may deem appropriate, within its mandate, with international organisations, as well as national entities whether public or private, in particular with international financial institutions and national development banks.

- Moreover, it is instrumental for increasing economic cooperation among BRICS countries. Therefore, it ensures efficient use of the productive resources available at their end.

Asian Development Bank (ADB)

The Asian Development Bank (ADB) was founded in 1966 with a vision to make Asia and the Pacific poverty-free and help developing member countries improve the living standards and quality of life of their people. ADB is dedicated to improve people’s lives in Asia and the Pacific—home to 1.4 billion poor people, living without access to essential goods, services, assets and opportunities.

It provides assistance to countries in these regions in the form of loans, grants, policy dialogue, technical assistance and equity investments. ADB also plays a crucial role in development thinking and practice, disseminating information through regional forums and publication of specialised papers, serials and books.

Currently, ADB has 67 countries as its members, with a subscribed capital of $153.05 billion. It is headquartered in Manila, Philippines. ADB enters into partnership with member governments, independent specialists and other financial institutions to deliver projects that create economic and development impact. Towards this objective, it had $22.93 billion in approved financing in 2014.

Some projects completed by ADB in several poorest countries during 2014 are as follows:

- Building or upgrading educational facilities for the benefit of over 17 million students.

- Building or upgrading 25,000 km of roads.

- Making clean drinking water accessible to 1 million households.

- Installing 230 megawatts of new generation capacity.

- Reducing greenhouse gas emissions by 600,000 tons of carbon dioxide equivalent per year.

Asian Infrastructure Investment Bank (AIIB)

The Asian Infrastructure Investment Bank (AIIB) was an initiative of China, which wanted to establish a multilateral development bank for Asian countries. The bank was envisaged to promote interconnectivity and economic integration in this region and work in cooperation with the existing multilateral development banks.In 2014, 22 Asian countries gathered in Beijing to sign the Memorandum of Understanding to establish AIIB.

AIIB aims to focus on developing the infrastructure and other productive sectors such as energy and power, transportation and telecommunications, rural infrastructure, agricultural development, water supply and sanitation, environmental protection, urban development, and logistics, etc., in Asia.

It also aims to complement and cooperate with the existing Multilateral Development Banks (MDBs) to jointly address the infrastructure and economic development needs in Asia. Currently, the core philosophy, principles, policies, value system and operating platform of the bank are in the development stage. The process of setting up the bank is still in progress and is expected to commence operation by 2016.