Which customers should companies cultivate and expand a business with? Companies do not have to give up earnings in order to achieve growth. Companies can have it both ways. Marketing, operations, and financial requirements are all met in a balanced manner.

The moment an organisation is aligned cross-functionally to the point where everyone talks in the common language of profit, they have achieved success and when the expectations of the customer regarding value are established.

Table of Content

- 1 Customer Profitability Segmentation Methods

- 1.1 Customer Satisfaction Research

- 1.2 Net Promoter Score

- 1.3 Recency, Frequency, Monetary (RFM) Transactional Analysis

- 1.4 Customer Lifetime Value (CLV)

- 1.5 CLV to contribution to profit to date matrix

- 1.6 Profitable Customer to Profitable Product Relationship

- 1.7 Activity Based Costing to balanced scorecard matrix

A number of thought leaders, including Robert Kaplan, Martha Rogers, Frederick Reichheld, and our very own Bob Sabath and George Fruehan, have put forth a number of approaches to profitability segmentation that can assist organisations in focusing their efforts and identifying the most promising opportunities. It is possible to achieve different levels of sophistication and integration of marketing, operations, and financial systems.

Customer Profitability Segmentation Methods

Although any of these methods will assist companies in getting started with aligning an organisation for profit, using any of them will assist them in getting started with aligning an organisation for profit—from senior executives to middle managers, and then from middle managers and their group leaders to the people on the front lines with customers.

The following summarises seven leading approaches and what’s next:

Customer Satisfaction Research

Determine which customers are the most satisfied. For example; Online shopping stores like Nyka after the delivery of product ask their customer to give rating to Nyka’s app and delivery person. These rating depicts the satisfaction level of the customers.

What’s Next: After that, incorporate Voice of the Customer research into the customer relationship development process so that companies can track not only what individuals say, but also what they DO. Compare and contrast what they DO with what they SAY.

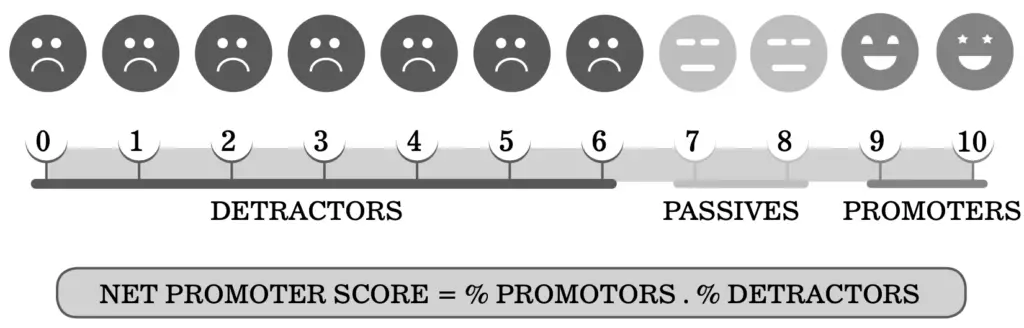

Net Promoter Score

Identify those who support or suggest an organisation using the Net Promoter Score (NPS). For example, ebay uses NPS and ask customers, “On a scale from 0 to 10, how likely are they to recommend this product/company to a friend or colleague?”

What’s Next: Keep track of recommendations and results, and compare them to profit patterns to see where companies stand. Incorporate Voice of the Customer research into the customer relationship development process so that they can track what customers DO, rather than just what they SAY, about their experiences. Compare and contrast what they DO with what they SAY. Refer figure.

Recency, Frequency, Monetary (RFM) Transactional Analysis

Data mining for those who have purchased most recently, who have purchased most frequently, and who have purchased the most expensive items. For example, Amaira is a customer who spent $1,000 three times in the last month and is a lot more valuable than Veronica who spent $100 once in February of last year.

What’s Next: After that, by incorporating real-time operational data into historical data sets, predictive modelling can be improved.

Customer Lifetime Value (CLV)

Calculate the CLV, which represents the possible future income that can be expected from a customer. Associated with either attitude and perception research or cash flow analysis. For example, a typical restaurant customer Mr. Deewan visits once per month and spends 2000 per visit over an average lifetime of 10 years. The customer lifetime value would be calculated as: 2000 x 12 x 10 = 2,40,000/-

What’s Next: When planning, link CLV to profit rather than just cash flow. In strategy execution, link customer lifetime value (CLV) to the customer relationship-building process and what people DO, rather than just what they SAY.

CLV to contribution to profit to date matrix

Customers’ projected CLV or contribution to profit is compared to their actual contribution in real time to determine which is higher.

What’s Next: Track customer relationship metrics and trends to determine whether customer contacts result in success or failure, and then iteratively improve the process as a result of the findings.

Profitable Customer to Profitable Product Relationship

With the help of Activity-Based Costing (ABC), companies may discover the customers who are the most profitable in terms of total contribution to profit, and then identify the customers who have the most potential for high-profit growth.

What’s Next: After that, make ABC even more resilient by extending the use of variable costs from cost-to-serve to include cost-to-acquire and cost-to-retain as well as the cost-to-serve. As the approach is implemented, update variable expenses that are connected to specific consumers.

Activity Based Costing to balanced scorecard matrix

In the ABC to Balanced Scorecard Matrix, companies can compare successful and unprofitable consumers as well as those who have been targeted and those who haven’t been targeted.

What’s next: After that, make ABC even more resilient by extending the use of variable costs from cost-to-serve to include cost-to-acquire and cost-to-retain as well as the cost-to-serve. As the approach is implemented, update variable expenses that are connected to specific consumers.