The success of the financial system is essential for the achievement of overarching objectives of a country. Financial institutions are an important part of the overall financial system and financial markets. These institutions play an important role in the global, national and regional transactions.

Table of Content

- 1 Commercial Bank

- 2 Central Bank

- 2.1 Acts as a currency regulator or bank of issue

- 2.2 Serves as the government’s bank

- 2.3 Functions as the custodian of cash reserves and foreign reserves

- 2.4 Acts as the lender of last resort

- 2.5 Serves as the clearing house for transfer and settlement

- 2.6 Functions as the controller of credit

- 2.7 Protects depositors’ interests

- 3 Mutual Funds

Commercial Bank

A commercial bank is a financial organisation that accepts deposits, provides checking account services, extends different types of loans and provides people and small companies with basic financial products and services such as Certificates of Deposit (CDs), fixed deposits, current accounts or savings accounts.

Commercial banks make profits by giving loans, such as mortgages, vehicle loans, company loans and personal loans, as they are given at higher rate of interest to people than the rate of interest that they pay to people who deposit their money. Therefore, banks earn interest on loans they extend to the borrower.

Importance of Commercial Banks

Commercial banks not only provide necessary services to consumers, they also assist in the creation of capital and liquidity in the market. Banks maintain their liquidity by borrowing monies from their customers’ accounts and giving them on credit to others.

The following points describe the importance of commercial banks:

Increasing the rate of capital formation

Commercial banks promote savings and mobilise people’s deposits. These funds are distributed to the final users of funds for productive investment which leads to improved productivity which eventually leads to capital formation and economic development.

Encouraging credit and financing

Commercial banks are a vital source of credit and finance for trade, commerce and industry at domestic and international levels.

Developing entrepreneurship

Banks encourage entrepreneurship by the following means:

- Offering underwriting services for stock of new and current businesses

- Assisting in the development of new ventures

- Funding promotional activities

- Providing funding to sick (loss-making) industries to ensure their revival and turning them into profitable businesses

Encouraging balanced regional development

Commercial banks open branches in areas where banking services are not readily available or are underserved. It provides loans to rural residents. The money that is deposited by the urban savers in urban areas is used to fund investments in the country’s underdeveloped or rural areas. In this way, the banks are able to achieve a more balanced regional growth.

Consumer assistance

Commercial banks assist the consumers by providing loans for purchasing consumer durable goods such as automobiles, televisions or refrigerators. Such products are usu- ally out of reach for some consumers due to non-availability of financial resources. In this way, banks also contribute in creation of demand for consumer durable items.

Emergence of Private Sector Bank After Liberalisation

After the Liberalisation-Privatisation-Globalisation (LPG) policy was implemented in the 1990s, private banks got recognition. Axis Bank and IndusInd Bank are two of India’s oldest and most well-known private banks. These were established in 1993 and 1994, respectively.

Since 1994, many foreign banks have also opened offices in India. In 2020, the total assets of all the banks in India stood at 6.57 trillion. Of this amount, the share of foreign banks in total assets was valued at US$179.35 billion (approx. Rs 13,271.9 billion).

During the last three decades, the Indian banking system has benefited from enhanced technology, specialised skills, better risk management techniques and greater portfolio diversification as a result of deregulating the entrance criteria and establishing new bank operations.

Financial Innovation in Commercial Banks

The procedure of developing new financial products, services or processes is known as financial innovation. Advances in financial instruments, technology and payment systems, all have contributed to financial innovation. The financial services business has been transformed by digital technology, which has changed the way people engage in saving, borrowing, investing and making payments.

Some of the important examples of financial innovations include:

- ATM locators

- Bill payment alerts

- Inter and intra bank payments

- Bill payments

- Use of applications

- Contactless payments and NFC

- Use of Bots

- Blockchain

- Biometric authentication

- Artificial intelligence

- Cloud

- Green banking

- Machine learning

- Crowdfunding

- Mobile banking

- Remittance technologies

Central Bank

A central bank is considered to be an apex financial institution in the banking system as it plays an integral role in the economic and financial system of a nation. The central bank acts as an independent authority in a country. It is mainly responsible for controlling, regulating and stabilising the monetary and banking structure of the country as well as maintaining the financial stability and economic sovereignty of the country.

In India, the Reserve Bank of India (RBI) is regarded as the central bank. Founded in 1935, the bank sets monetary policy for the country and is fully owned by the government of India and is run by a government-appointed board of directors.

Let us look at the functions of the RBI:

Acts as a currency regulator or bank of issue

RBI has an exclusive right to produce currency notes for circulation in an economy. This is one of the most important functions of RBI; thus, it is also known as the bank of issue.

Serves as the government’s bank

RBI accepts deposits and issues funds to the government. It is also involved in making and receiving payments for the government. It also offers short-term loans to the government in order to recover from bad phases in the economy.

Apart from that, RBI also functions as an advisor and agent of the government by providing advice to the government in areas of economic policy, capital market, money market and loans from the government. In addition, RBI is instrumental in the formulation of monetary and fiscal policies that help in regulation of money in the market and controlling inflation.

Functions as the custodian of cash reserves and foreign reserves

It is a practice of the commercial banks of a country to keep a part of their cash balances in the form of deposits with the central bank. The commercial banks can draw that balance when the requirement for cash is high and pay back the same when there are fewer requirements for cash. Thus, RBI is regarded as the banker’s bank. It should also be noted that the central bank also plays an important role in the credit creation policy of commercial banks.

Apart from that, RBI maintains a minimum balance of foreign currency. The purpose of maintaining such a balance is to manage sudden or emergency requirements of foreign reserves and also to overcome any adverse deficits of balance of payments.

Acts as the lender of last resort

RBI acts as a lender of last resort by providing money to its member banks in times of cash crunch. It performs this function by providing loans against securities, treasury bills and also by rediscounting bills; thereby protecting the financial structure of the economy from collapsing.

Serves as the clearing house for transfer and settlement

RBI acts as a clearing house of the commercial banks and helps in settling of mutual indebtedness of commercial banks. In a clearing house, the representatives of different banks meet and settle the interbank payments.

Functions as the controller of credit

Many a time, commercial banks create a lot of credit in the economy that increases the inflation. In such a case, RBI controls the way credit creation by commercial banks is done by engaging in open market operations or bringing about a change in the CRR to control the process of credit creation by commercial banks.

Protects depositors’ interests

RBI also needs to keep an eye on the functioning of commercial banks in order to protect the interests of depositors.

Mutual Funds

A mutual fund is a financial product that collects money from a number of people and invests it in stocks, bonds and other asset types. The portfolio of a mutual fund is made up of all of the fund’s holdings. Mutual funds are purchased by investors.

Mutual funds are a popular investment option because of the following benefits:

- Management expertise: For the investors, research is done by the fund managers. They choose the securities and keep a track of their performance.

- Diversification: Mutual funds usually invest in a variety of assets belonging to different businesses and industries. This process is called as diversification which leads to risk dispersion and is known as risk diversification. Diversification reduces the risks for investors.

- Affordability: The mutual fund investments can be done with a sum of amount as low as Rs 100.

- Liquidity: Investors in mutual funds can redeem their mutual fund units at the current Net Asset Value (NAV) plus any redemption costs at any time.

Types and Functions of Mutual Funds

The sort of mutual fund is determined by the goal and the underlying asset. Mutual funds are divided into the following categories:

Mutual funds that invest in stocks and bonds

The money pooled by equity mutual funds is primarily invested in stocks of various companies. As a result, equity mutual funds have a larger market risk. Earnings, revenue estimates, management changes and corporate and economic policy all have an impact on price changes and returns. The returns on equity funds fluctuate a lot. As a result, investors should have a thorough awareness of the asset class risks connected with equity.

- Equity Funds: What are they and how do they work? Equity-based funds can be categorised further on the basis of market capitalisation and sectors in which the funds invest. On the basis of market capitalisation, mutual funds are categorised as:

- Large-cap equity funds: These funds invest in shares of well-established large-cap firms with a track record of steady performance over a longer period of time. These businesses have strong fundamentals and are less influenced by market fluctuations.

- Mid-cap equity funds: These funds invest in stocks of mid-cap firms. In terms of performance, mid-sized businesses have a lesser level of consistency. However, they have a greater potential for growth than large-cap enterprises.

- Small-cap funds: These funds invest in the stocks of small-cap companies. Small-cap enterprises are prone to maximum risk and have the greatest chance of succeeding or failing. As a result, small-cap funds carry a high level of risk, but they also have the potential to yield the highest gains.

- Multi-cap funds: These funds invest in different organisations having different market caps. Multi-cap funds give different weightages to different types of funds and invest accordingly. The fund management allocates aggressively based on cues and trend analysis in order to profit from the volatility.

On the basis of sectors, mutual funds are categorised as: FMCG funds, technology funds, pharmaceutical funds, banking funds, etc. Sector funds are vulnerable to business cycle risk and sector drift.

- Large-cap equity funds: These funds invest in shares of well-established large-cap firms with a track record of steady performance over a longer period of time. These businesses have strong fundamentals and are less influenced by market fluctuations.

- Debt mutual funds: These are mutual funds that invest in debt securities such as government bonds, corporate bonds, debentures and money market products. Bond issuers issue debt instrument for a sum of money from investors. In return, the mutual funds promise stable and consistent stream of interest income.

Debt funds are less risky than equity funds. The debt fund manager guarantees that the fund is invested in assets with the best credit ratings. The highest credit rating indicates the issuer’s creditworthiness in terms of timely interest and principal repayment.

As opposed to equity funds, debt funds are characterised by lower volatility and range-bound returns. As a result, debt funds are a safer option for conservative investors who wish to grow their money while minimising risk.

As a matter of fact, the amount of interest earned and the maturity date are both known ahead of time. Therefore, debt funds are appropriate for making short-term (3 to 12 months) or medium-term (3 to 5 years) investments. There are a variety of debt funds available. Some of the debt funds available in India are as follows:

- Dynamic bond funds: The investment basket of a dynamic bond fund includes both short and long-term maturity periods. The portfolio composition of the debt fund management is aggressively tweaked in response to changing interest rates.

- Liquid funds: Liquid funds are practically risk-free due to underlying securities which have a short maturity (no more than 91 days). It is preferable to put money in savings account since it provides decent returns while also providing much-needed liquidity.

Liquid cash can be redeemed virtually instantaneously. For a short-term investment, liquid funds may be a better option because they offer returns of 6.5 to 8%. Liquid funds are useful for meeting emergency fund requirements. - Income funds: To have better consistency and consistent interest income flow, fund managers invest mostly in securities with longer maturities. The majority of income funds have an average maturity of 5 to 6 years.

- Short-term and ultra-short-term debt funds: These funds have a maturity range of 1 to 3 years. The fund manager decides on the interest rates and invests in securities with maturities that fall within that range. This is a good option for risk-averse investors who want to avoid interest rate fluctuations.

- Gilt funds: Gilt funds invest only in government assets having high credit rating. The Gilt funds have no risks because they rarely default. Investors may put your money in this instrument to get guaranteed returns over a longer period of time.

- Credit opportunities funds: Credit opportunities Funds are riskier investment and focus on higher returns by investing in low-rated bonds and accepting credit risks. To obtain larger returns, credit opportunity fund managers rely more on interest rate volatility.

- Fixed Maturity Plans (FMPs): These are closed-ended debt funds which invest in fixed-income instruments such as government and corporate bonds. Investors can invest only during the original offer period and the funds are locked in for a particular time which might be months or years.

- Dynamic bond funds: The investment basket of a dynamic bond fund includes both short and long-term maturity periods. The portfolio composition of the debt fund management is aggressively tweaked in response to changing interest rates.

Mutual fund types according to investment objectives

Because mutual funds are all about working together to achieve a common goal, mutual fund schemes are also divided into categories based on the goals of investors. Some of the popular types of mutual funds based on investor goals are:

- Growth-oriented plan: The fundamental purpose of growth-oriented mutual funds is to assure long-term capital accumulation. In line with this goal, the fund invests majority of their money (i.e., more than 65%) in equities. The fund managers actively shuffle the portfolio to reap the benefits of market changes and concentrates on better returns.

- Income-generating scheme: The fundamental purpose of income-generating mutual funds is to assure consistent generation of income. Only when the underlying assets provide a consistent return can the goal of regular income be met.

To achieve this goal, the fund managers invest a large amount of the fund’s assets in fixed-income securities such as government bonds, corporate debentures and money market instruments. It is safe for regular income due to dividends from lower risks and a guaranteed return. However, in the specified time frame, these products have a very limited potential for wealth generation. - Balanced portfolio: Balanced mutual funds invest in defined proportions in both equities and debt securities. Balanced fund’s goal is to provide fair growth and consistent income while minimising risk. These funds’ managers typically invest about 60% of their assets in equities and the rest in debt securities.

When compared to equities funds, balanced funds’ NAV is less volatile. The balanced mutual funds are appropriate for individuals who want to benefit from market movements while also maintaining the safety of the debt market. - Liquid asset management: The goal of these schemes is to provide short-term liquidity, capital protection and an acceptable return. These funds are found to be suitable for those investors who want to store money for a short period of time and receive higher returns than savings bank accounts due to their low volatility.

The majority of the pooled fund’s assets are held in short-term safe instruments such as government securities, treasury bills, certificates of deposit, commercial paper and interbank call money.

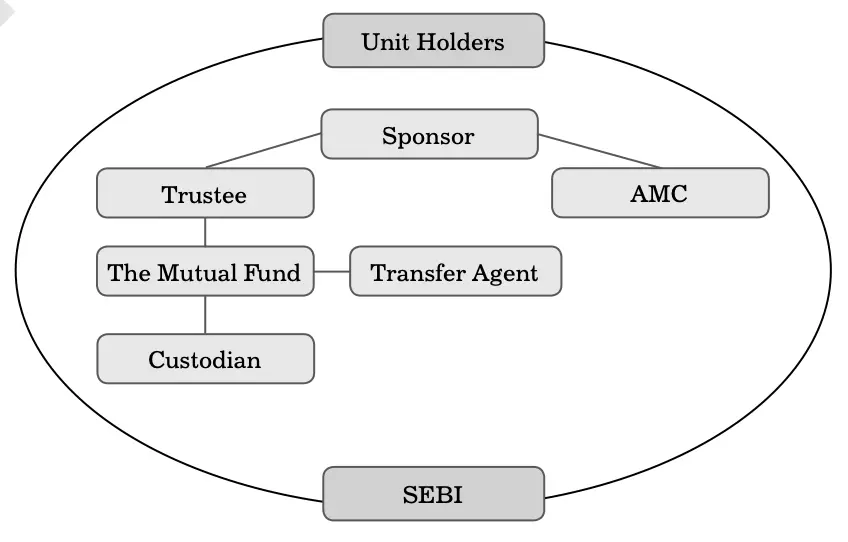

Structure of Mutual Funds

The structure of the mutual funds involves three tiers along with a few other important components and actors. In the construction of mutual funds, various banks and AMCs that originate or float different mutual fund schemes are included along with certain other actors.

Each entity is required to register with the Securities Exchange Board of India (SEBI). SEBI is the principal watchdog or regulator for mutual funds industry.

All mutual fund companies are subject to regulations by SEBI owing to the SEBI (Mutual Funds) Regulations issued in 1996.

The five essential participants in mutual funds include:

- Sponsor

- Mutual Fund Trustee

- Asset Management Company

- Custodian & Registrar

- Transfer Agent

Let us now discuss the different components of the mutual funds.

Sponsor

A sponsor is any person or institution that can set up a mutual fund scheme for generating money through fund management. It is essential that the sponsor applies to SEBI to seek approval for the mutual fund scheme. The sponsor alone can- not do everything. The sponsor should establish a Public Trust under the Indian Trust Act, 1882 and register it with SEBI.

After the Trust is established, the Trustee of the Trust is registered with the SEBI. The SEBI registers the trustee of the given mutual fund to ensure that the interest of the unit holders is upheld and that the mutual fund complies with the Mutual Fund requirements laid down by SEBI. After creating the Trust, the Sponsor establishes an Asset Management Company (AMC) under the Companies Act to handle the fund’s management.

To become a sponsor, following requirements must be met:

- The Sponsor must have made a profit in three of the previous five years, including the immediately preceding year.

- The sponsor must have at least five years of expertise in financial services.

- For the previous five years, the sponsor’s net worth must have been positive.

- Sponsor is required to participate in at least 40% of the AMC’s total net worth.

A sponsor must have a high level of trustworthiness. Strict guide- lines dictate that in the event of a financial crisis, the sponsor must have sufficient liquidity and loyalty to restore the money of an innocent investment.

Trusteeship and Trust

The second tier of the mutual fund system comprises trust and trustees. The fund sponsor employs trustees, who are also known as the fund’s protectors. As the name implies, they play a critical role in maintaining investor confidence and overseeing fund’s growth. SEBI requires the trustees to submit a report on the fund and the AMC’s operations every six months.

Trustees can be established as a Board of Trustees or as a Trust Company. The trustees are in charge of overseeing the AMC’s complete operation as well as the mutual fund schemes’ operations.

There should not be any conflict of interest between the sponsor and the AMC. SEBI has reinforced the norm of transparency. An AMC cannot launch a new mutual fund scheme without the Trust’s consent and approval. It is critical that the trustees operate independently and take proper steps to protect investors’ money. Trustees must be registered with SEBI, which supervises their registration by suspending or revoking it if they are found to be in violation of any criteria.

Asset Management Company (AMC)

An AMC is the third tier in mutual fund structure. AMCs float different types of mutual fund schemes according to the needs of investors and the nature of the market. AMCs, along with the trustee and the sponsor, create mutual funds and subsequently manage them.

They take the assistance of bankers, brokers, Registrar and Transfer agents (RTAs), auditors and others in the development of the scheme. An AMC is a corporation that is incorporated under the Companies Act must be registered with the SEBI. An AMC, must ensure that there is no conflict of interest among the AMC, sponsor and trustees.

Other participants in the structure of mutual funds

Apart from the sponsor, AMC and the trust company, some other participants in the mutual funds are:

- Custodian: A custodian is a company that is in charge of keeping securities safe with them. SEBI-registered custodians are in charge of transferring and delivery of units and securities. Custodians also help investors keep track of their investments by allowing them to update their holdings at a certain point in time. Custodians are in charge of collecting company perks such as incentive payments, interest and dividends, in addition to their core task of safekeeping.

- Registrar and Transfer agents (RTAs): RTAs serve as a vital interface between investors and fund managers. They help fund managers by keeping them up to date on investor information and they help investors by delivering the fund’s benefits to them.

RTAs are SEBI-registered firms that handle mutual fund applications, assist with investor KYC, help in management and delivering the periodic investment statements, update investor records and thereby processing investor requests. Some of the well-known RTAs in India include Link-in-Time, Karvy and they give the necessary operational support to the AMC in mutual fund activities. - Participants from other groups: Brokers, auditors and bankers are some of the additional actors in the mutual fund system. Brokers are in charge of attracting investors and assisting in the distribution of money. Brokers assist investors in the sale and acquisition of units as well as providing crucial advice.

Brokers also analyse market trends and forecast market movement in the future. Auditors act as independent internal watchdogs and audit AMCs, Trustees and Sponsors’ financials and issues reports. In the process, bankers act as collection agents for the fund managers.