Certificate of Inspection

An inspection agency issues the Certificate of Inspection, which verifies that the goods have been inspected before shipment as per the requirements of the Exports (Quality Control and Inspection) Act, 1963. It satisfies the conditions associated with quality control and inspection as applicable to it and is certified export worthy This certificate confirms that the goods have been inspected before shipment.

Table of Content

- 1 Certificate of Inspection

- 2 What is Certificates?

- 2.1 Certificate of Free Sale

- 2.2 Certificate of Authentication (Apostille)

- 2.3 Phytosanitary Certificate

- 2.4 Black List Certificate

- 2.5 Weight Note

- 2.6 Manufacturer’s Certificate

- 2.7 Certificate of Chemical Analysis

- 2.8 Certificate of Shipment

- 2.9 Health/ Veterinary/ Sanitary Certification

- 2.10 Certificate of Conditioning

- 2.11 Antiquity Measurement

- 3 Special Documents

Some customers require a pre-shipment inspection, which is done mainly to satisfy their own requirements, according to the standards set by industry, government, or carrier. Many private organisations and agencies specialise in inspecting and issuing a certificate of inspection. In this, the goods are checked by the inspector before shipping them and a certificate of inspection is issued afterwards. There are two methods for inspecting the goods, in the first one inspector checks the sample and the in the other one inspection is done while packing the consignment.

The certificate of inspection is mostly demanded while shipping high-valued products. The certificate confirms that the shipment carry all the goods ordered by the customer, ensuring the quality and quantity of the goods. The inspection certificate can be directly sent to the buyer, importer’s government, or directly to the importer’s bank.

Inspection can be done by inspection agency appointed by the Government of India that includes Export Inspection Agency, Textile Committee, Central Silk Board, and so on. Inspection agency can also be nominated by the government of importing country and sometimes the buyer hires independent private inspector who inspects the goods. Exporter is expected to arrange the necessary inspection, if it forms a part of transaction.

Figure shows the format of the Certificate of Inspection:

What is Certificates?

A certificate can be defined as written and legal document, which is an official representation of some action that has or has not been taken, some incidence that took place, or some legal formality that has to be complied with. There are various types of certificates that an exporter may need while dealing with the importer or buyer that are explained further.

Certificate of Free Sale

The Certificate of Free Sale is mostly obtained by exporter dealing in agriculture, medicinal, and cosmetic products. This certificate ensures that the exporter adheres to the domestic requirements for sale in the United States. The certificate is issued by the Virginia Economic Development Partnership (VEDP) or United States Food and Drug Administration (USFDA).

Figure shows a specimen of the certificate of free sale:

Certificate of Authentication (Apostille)

For certifying the authenticity of the original document, it is necessary to ensure that the original document has been notarised by the Secretary of the Commonwealth.

Figure shows the specimen of Certificate of Authentication:

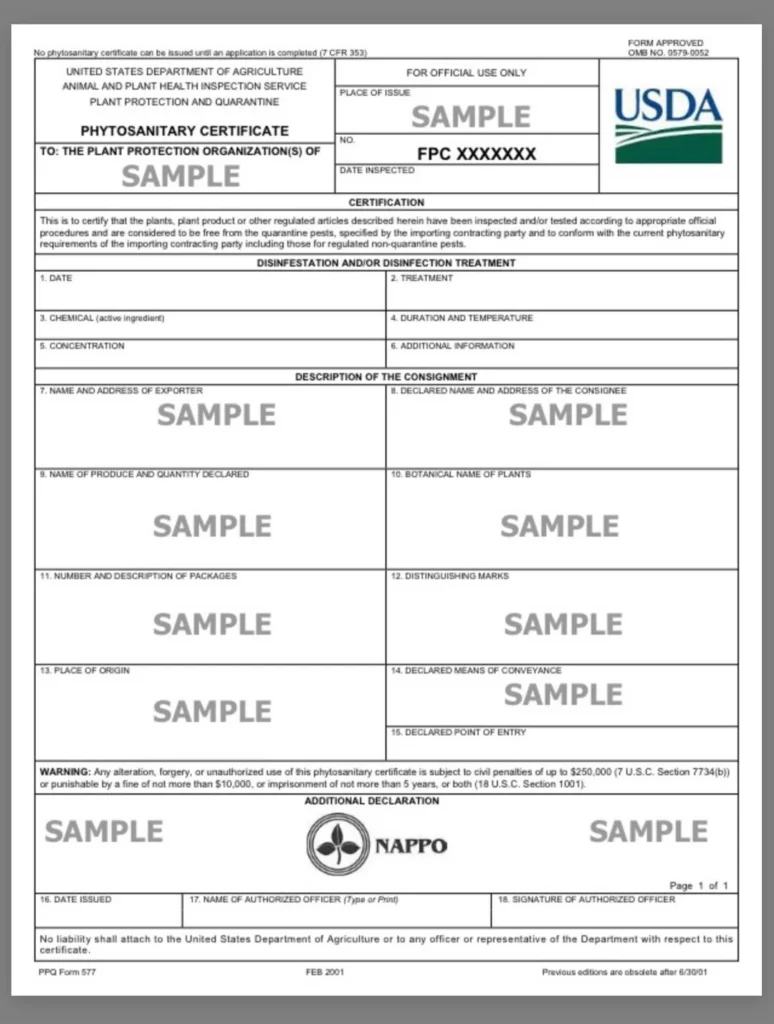

Phytosanitary Certificate

For importing goods to the US, Phytosanitary Certificate is required. Phytosanitary certificates are issued to indicate that consignments of plants, plant products or other regulated articles meet specified phytosanitary import requirements and are in conformity with the certifying statement of the appropriate model certificate. Phytosanitary certificates should only be issued for this purpose.

Figure is a sample of Phytosanitary Certificate:

Black List Certificate

A Black List Certificate ensures that goods do not reach or touch the boundary of country(s) with whom they have strained relationship. This affect overall foreign trade transaction with those blacklisted countries by the home country.

Weight Note

A weight note confirms that the packets/bales or other forms weigh to the specified weight. It is also known as a certificate of weight and it is a document that the customs department of the exporting country issues for certifying or attesting the exact gross weight of the goods being shipped.

Manufacturer’s Certificate

Manufacturer’s Certificate is also known as Manufacturer’s Statement of Origin (MSO), which is a particular document that confirms the country of origin of the manufacturer. This certificate is required in a few countries, which is an extension to the Certificate of Originfor a few countries to show that the goods shipped has actually been manufactured and are available.

Certificate of Chemical Analysis

The main purpose of the certificate of chemical analysis is to confirm that the quality of specific items, such as metallic ores and pigments, should correspond with its actual standard.

Certificate of Shipment

A Certificate of Shipment is also known as Authority to Load Endorsement, which is written document with official stamp. This states all the details of products that are shipped. When shipping hazardous goods, such as chemically reactive goods, it is very important to provide certain details that include the name, adherence to packaging and labelling requirements, which vary in different countries.

Health/ Veterinary/ Sanitary Certification

This certificate is issued by the exporting country that export foodstuffs, hides, livestock, and marine products. This certificate ensures that the goods are inspected before shipping and are suitable for human consumption.

Certificate of Conditioning

It is issued by the competent office who is responsible for inspecting the goods and certifying the compliance of humidity factor, dry weight, and so on.

Antiquity Measurement

It is issued by the Archaeological Survey of India in the case of antiques being exported. This certificate state all the details such as value, weight, and types of antiques.

Special Documents

Exporter may need special documents depending on the type of product or destination they are dealing with. Some products require quality control inspection certificate from the Export Inspection Agency, whereas some food and pharmaceutical products may require a health or sanitary certificate for export.

Dangerous Goods Regulations (DGR)

A Declaration of Dangerous Goods certificate is needed to declare the quality and quantity of hazardous materials. The certificate has the proper classification for each item.

ATA Carnet

ATA Carnet is also known as merchandise passport, which allows countries to ship duty-free goods only on temporary basis.

Shipping Bill

Shipping Bill, which is also known as Bill of Export is the main document that needs to be submitted to the Customs Department for shipment of products. Shipping Bill is of four types and it can be differentiated on the basis of goods being subject to certain conditions, which are mentioned below:

- Export duty/cess

- Free of duty/cess

- Entitlement of duty drawback

- Re-export of imported goods

The following are the export documents required for the processing of the shipping bill:

- Guaranteed Remittance (GR) forms (in duplicate)

- Four copies of the packing list

- Four copies of invoices

- Contract, Letter of Credit, Purchase Order of the overseas buyer

- AR4 (both original and duplicate) and invoice

- Inspection/ Examination Certificate

The formats presented for the Shipping Bill are as given below:

- White Shipping Bill in Triplicate: This format is followed for exporting duty free of goods.

- Green Shipping Bill in Quadruplicate: This format is adhered for exporting goods that can be claimed for duty drawback.

- Yellow Shipping Bill in Triplicate: This arrangement is used for the export of dutiable goods.

Documents Required for Post Parcel Customs Clearance

There is no requirement of shipping bill when considering the case of Post Parcel. The documents required in this are mentioned below:

- Customs Declaration Form: This is recommended by the Universal Postal Union (UPU) and international apex body and its main aim is to coordinate and integrate all the activities of the National Postal Administration. It is also known by its code number that is CP2/CP3 and it is mostly prepared in quadruplicate, which is finally signed by the sender.

- Dispatch Note: This is also known as CP2 and is filled by the sender specifying the action performed by the postal department at the destination, in case the address is non-traceable or the parcel is refused to be accepted.

- Commercial Invoice: It is issued by the seller for the full reliable amount of goods as per the trade terms.

- Consular Invoice: In this type of invoice, the counsel located in exporting country signs and certifies the invoice.

- Customs Invoice: This invoice is made in adherence with the requirements set by the customs department and this helps in entry of goods in the importing country at the preferential tariff rate.

- Legalised Invoice: This invoice confirms and certifies the credit and trustworthiness of the seller before the appropriate consulate, Chamber of Commerce, and embassy.

- Certified Invoice: This certificate confirms that goods were manufactured and packed at a certain place and in accordance with a specific contract.

- Packing List: This includes the itemised detail of goods packed in each parcel/ shipment.

- Certificate of Inspection: This certifies that goods have been properly inspected for their quality and quantity before shipment.

- Transhipment Bill: This bill is for goods imported into a customs port/ airport that are intended for transhipment.

- Shipping Order: It is issued by the Shipping (Conference) Line to inform the exporter of the reservation of space of shipment of cargo through the specific vessel from a specified port and on a specified date.

- Cart/Lorry Ticket: The lorry ticket is an entry pass of the cargo through the port gate and it has information namely shipper’s name, cart/ lorry numbers, marks on packages, quantity, and so on.

- Short Shipment Form: It is a claiming application which is submitted to the customs authorities at the port seeking short shipment of goods. This is required for claiming the return.

- Shipping Advice: This aligned document is prepared to inform the overseas customer about the shipment of goods.