The commercial property insurance evolved in a unique way where different types of coverages meant for protection of different types of property losses evolved parallel to each other. The industry at that time worked on monoline policies and the underwriters were attuned to that concept; hence, the commercial property coverage originated as a monoline policy.

Table of Content

If we see the history of commercial fire insurance, we will see that it traditionally provided coverage only at the premises of the insured. Thus, it created a need for developing a different type of insurance, that is, transportation insurance, which covered the belongings when they were away from the premises and were in transit. It also provided a framework for developing various other property insurances that included crime insurance, marine insurance, and boiler and machinery coverage.

In January 1986, the long awaited portfolio programme was finally launched by the Insurance Services Office. It made the procedure simpler by introducing new forms that were easy to understand and worked on the general guidelines of commercial property insurance.

During this time, the individual lines of insurance had become con- siderably standardised and streamlined, but the commercial line was still in a state of disarray as every line was based on separate language and terms. Thus, the portfolio programme was groundbreaking in this regard as it worked on phasing out all the differences and bringing standardised forms creatively that worked on the basic guidelines of commercial package policies.

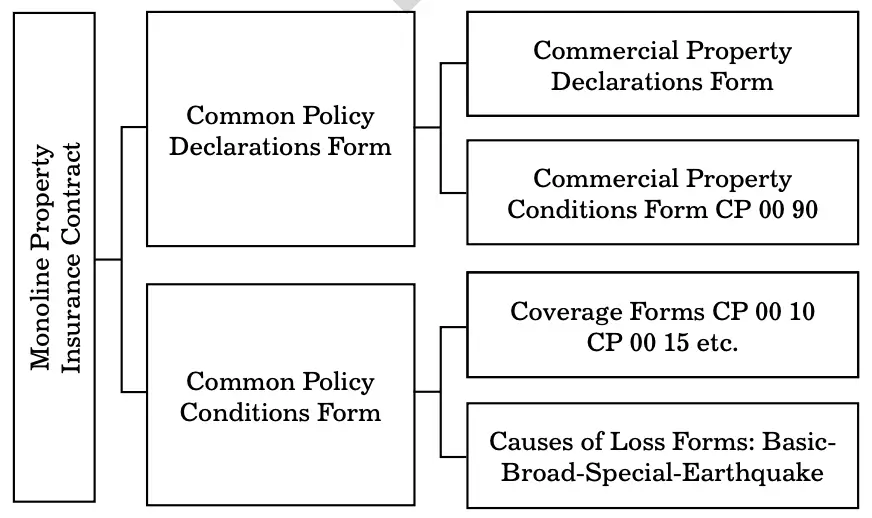

It included introduction of modular forms and standard policy conditions. Today, all commercial policies follow the basic format that works on the same structure, irrespective of the coverage. It also includes standard common declarations part and a common conditions part in addition to the forms suitable for various insurance coverages.

The common declarations part contains information about the:

- Insured

- Inception date

- Term of the policy

- Premium for the coverage

The common policy conditions form contains items common to all types of coverages, which eliminates the requirement to restate the same provisions in different policies. Thus, it reduces the burden of insurers and agents to stock and carry multiple forms. Further, each type of coverage may have a separate declaration form and a coverage form(s) for that line of insurance. The insurer-proposer can make use of portfolio forms in order to create monoline contracts or may simply combine to create package policies, using the same form in either of the cases. Insurers often offer package discounts for including both property and liability insurance.

Commercial Property Direct Loss Coverage

First, let us understand the concept of direct loss; as the name suggests, it can be defined as any property or life damage that may have been inflicted by some natural disaster, such as outbreak of fire, accidents or any other related event.

According to International Risk Management Institute (IRMI), direct loss can be defined as the loss incurred due to direct damage to property, as opposed to time element or other indirect losses.

The commercial property insurance provides coverage to the insured in case of damage to the property. The property here refers to anything that can be valued and includes both personal and real properties.

This insurance covers the following:

- Commercial buildings

- Equipment

- Furniture

- Inventories

- Accounts receivables

- Business records

It is to be noted that buildings and personal property coverage in the insurance contracts provides cover against the direct loss suffered by the policyholder. This direct loss may include physical damage or property damage caused to the policyholder.

Some of the direct losses to commercial property routinely covered by insurers are as follows:

- Accounts receivable: It can be defined as the outstanding amount that a policyholder is yet to receive from the customer. It also includes other expenses that the policyholder is bound to incur for creating accounts receivables.

- Computer property: It includes the direct loss that is inflicted on the computer property and whose occurrence is within 1000 feet of the building premises.

Examples include the following:

Computer virus – hacking event creating accounts receivable

Illegal or malicious entry - Debris removal: It involves the actual cost of removing the debris upon facing the physical damage/direct loss of the premises and the related property.

- Discharged fire protection equipment: It takes into consideration the cost of installing the discharged fire protection equipment even if the premises or the related property did not suffer from any direct loss or physical damage.

- Exhibition, fair or trade show: It calculates for any damage suffered on the items such as fine arts, which were at or being transported for any exhibition, fair or trade show.

- Extra expense: It includes all the extra expenses incurred by the insurance company to the policyholder during the restoration period after the physical loss or damages to the premises.

- Fire department service charges: It includes the expenses related to making payment to the fire department for either saving or protecting the insured building or its contents at the time of damage.

- In-transit: It includes all the necessary cost incurred for the direct loss suffered for the contents, computer property and fine arts when being transported. It also includes the cost incurred on carrying out research for restoring, producing copy or replacing valuable records and documents.

- Installation: In this, all those costs are included where direct physical loss of contents was suffered at the time of installation or testing products such as air conditioners, cameras, etc.

- Personal property of employees: It includes any direct physical damage or loss suffered by employees to their physical property within 1000 feet of the premises.

- Preservation of property: It takes into consideration all the costs incurred for moving the contents of the premises to another location for the purpose of carrying out the restoration procedure.

Commercial Property Coverage Policies

You have already understood that commercial property insurance helps clients and their business to recover from the disasters that can risk the functioning of the business. The events that are covered in this policy include protection from fire, theft, property damage, vandalism and windstorms.

The commercial property coverage policy includes the following modular parts:

Standard common policy conditions form

It includes conditions related to cancellation, coverage policy changes, audits, inspections, premiums and policy assignments. The policy lines include a declaration page that consists of general policy conditions, coverage forms and endorsements.

Commercial property conditions form

It helps in forming the provisions of the policy, which are related to fraud, property control, comprehensive insurance that is for two or more coverages, policy period, transfer of rights and so on.

Commercial property coverage part

It is the declaration form that involves general information of the policyholder, such as name of the policyholder, address of the premises covered, coverage pro- vided and optional coverage if any.

Causes of loss form

In it, the policyholder has to define the causes behind the damages on which coverage(s) will be provided. Generally, it provides coverage against fire, explosion, windstorm, hail, riot, sprinkler leakage, sinkhole collapse and so on.

Monoline Property Insurance Contract

Building and Personal Property Coverage Forms

The form used for insuring most of the business properties is called the Building and Personal Property (BPP) coverage form. Direct damage coverage on completed buildings and structures, business personal property of the policyholder or others can also be covered for direct damage by this form. It is possible to write coverage on buildings only, property only or as a combination of the two in the same contract.

Further there is also a flexibility to provide coverage on specific classes of property, such as stock, tenant’s improvements and betterments or machinery and equipment, by declaration. The insuring agreement of the form identifies three categories of covered property, which are as follows:

Building

The building coverage explains the scope and definition of a building that helps in explaining the premises, furniture and fixtures, machinery and equipment, and other property that is utilised for servicing or maintaining the building materials and any such supplies. These all are used for various purposes, such as additions or alterations within 100 feet of the building.

Personal property

Property belonging to the policyholder may include furniture and fixtures; any machinery and its related equipment; and any other property, such as stocks, which are used in business transactions. Personal property also includes the vested interest of the insured/policyholder in improving the condition of the tenant.

In the revised versions of BPP, there is also a provision for coverage of leased personal property. As per regulations, an insured may be obligated to insure such a property, unless it is insured under the personal property of others insuring agreement.

Personal property of others

This condition applies to the property of others that may be under the care or supervision of the insured. At the same time, this property shall be situated within or on the building described in the declarations. It means that any personal belonging of employees or others is also covered if it is within 100 feet of the mentioned premises.

Replacement cost option

This coverage option is available for all three classes of property, that is, buildings, personal property and personal property of others. Replacement cost coverage on the personal property of others shall be applicable only in the event when the insured is legally liable.

Additional coverages

Certain extensions of coverage are also included in the BPP; while some of these are referred to as additional coverages, others are referred to as coverage extensions.

Commercial Property Indirect Loss Coverage

Indirect loss can be explained, in simpler terms, as a loss that is the aftermath of direct loss to a property. This loss is also known as conse- quential loss, which is a result of direct damage where the policyholder incurs loss due to inability of making use of commercial property or equipment.

It is to be noted that the indirect loss incurred by the policyholder is not guaranteed cover.

According to Emmett J. Vaughan and Therese Vaughan, The com- mercial property forms do not provide coverage for the indirect loss resulting from damage to the insured property. If the policyholder so desires, such protection must be obtained under a separate form for an additional premium.

The major consequential loss coverages are:

Business interruption insurance

It helps the policyholder to carry on the restoration process. Moreover, this policy works on a framework that compensates almost 12 months of lost income of the policyholder. Under this insurance, calculation of amount to be paid is based on the profits that would have been earned during a period of interruption and the continued expenses during the period of restoration.

Extra expense insurance

In some situations, a business may be required to continue operations even after its facilities have been destroyed. For example, a bank that earns from loans and investments is not affected by destruction of the premises. However, it would certainly require other facilities to continue to service its accounts.

An alternative to business interruption insurance is the extra expense insurance where business operations are not affeced by the damage and operations can still be continued with other facilities. However, this insurance cover offers compensation for the expenses that would be incurred for continuing the business operations even after damages.

Contingent business interruption and extra expense insurance

Many a time, the damage to the property of a firm leads to interruption in business activities and the extra expenses are incurred on repairs even if the firm does not own, operate or control the property. In such cases, this insurance covers the firm and provides financial protection against the losses.

Leasehold interest coverage

According to Emmett J. Vaughan and Therese Vaughan, this coverage Protects against loss due to the termination of a favourable lease caused by fire or other insured peril. The amount of coverage under leasehold interest coverage decreases month by month.

The amount of insurance is approximately equal to the insured’s interest in the lease. In the event of a loss that terminates the rental agreement, the insured is paid a lump sum equal to the discounted value of the leasehold interest for the remaining months of the lease.

Boiler and Machinery Insurance

The term “boiler and machinery” insurance is an old term of the time when firms in industry used to own or operate boilers or pressure vessels. However, today modern insurance policies are wider in scope and are not limited to the old concept of boilers and machinery. This insurance is suitable for those businesses that deal in large range of mechanical and electrical exposures. Broadly, boiler and machinery insurance covers equipment that generate, use or transmit power. The term boiler and machinery insurance is often replaced by “equipment breakdown coverage.”

This coverage is often required by firms that own, operate or depend on some or the other type of equipment. These firms also indulge in the following common activities during business operations:

- Use electricity

- Heat, cool or refrigerate the premises

- Have communication networks, such as computer or telephone

- Manufacture or process goods

- Use equipment to sell, deliver services, or help keep track of sales

- Use a lot of hot water

Let us now understand the need for boiler and machinery insurance:

- Cost factor: The cumulative costs of equipment breakdown can go very high. The loss to a firm due to equipment breakdown doesn’t occur only because of physical damage. Indirect losses, such as business interruption, can be more widespread than direct losses, such as equipment or premises damage.

- Unique nature of hazards: The nature of electrical and mechanical equipment is such that they may inflict certain unique hazards, such as sudden power increase, short circuit and so on. Most of the times, machinery and equipment are integrated into an interdependent system; so in the event of one breakdown, it can lead to another problems.

- Electronic networks: It has been observed that, in recent years, a rush has been reported towards electronic networks that have opened the doors for automation. New trend suggests that even small firms are dependent on computer networks through which various business operations are carried out, such as inventory management or database management. However, these electronic equipments are exposed to the risks of power failures, short circuits and so on, which can cause major disruption in the functioning of the business.

Since the unique nature of hazards is present, commercial property insurance and other comprehensive policies don’t provide compensa- tion for damages associated with electrical disturbances or mechanical breakdown. Thus, it becomes mandatory to take the equipment breakdown coverage.

Transportation Coverage

One major difference between the dwelling or homeowner forms and the property forms used to insure business firms is that the latter do not generally include off-premises coverage.

According to Emmett J. Vaughan and Therese Vaughan, it is for this reason that a special provision must be made for business property which is away from the insured premises. Ocean marine and inland ma- rine forms are designed to provide this coverage.

Ocean Marine Insurance

Businesses that are involved in foreign trade face the major peril in the form of ocean disaster despite the adoption of modern technology in marine transportation. There are four types of losses that are covered by ocean marine insurance, which are listed below:

- Hull insurance: It provides coverage for a vessel against any loss to the ship itself and is underwritten on a modified open-perils basis. This insurance includes a special provision that is the run- ning-down clause, which covers the property damage liability of the third party, that is, the damages inflicted on other ships.

- Cargo insurance: Underwritten separately from the insurance on the ship, it protects cargo owner from financial losses resulting from the destruction or loss to freight.

- Freight insurance: It is a special form of business interruption insurance. In the event a vessel is lost, it indemnifies the ship owner for the loss of income that would have been earned on completion of the voyage.

- Protection and indemnity: It is a liability insurance that covers the ship owners against the perils of negligent behaviour and its further consequences. However, it is to be noted that here ship owner might not be involved directly; that is to say, his/her agent can be responsible for the whole act.

The ocean marine insuring policy is an open-perils contract, which has certain limitations. It covers damage from perils of the sea that include the following:

- Waves

- Sinking

- Stranding on reefs or rocks

- Lightning

- Collisions

Specifically listed perils of the sea are also covered, which include:

- Fire

- Pirates

- Thieves

- Jettisons

- Barratry and all other like perils

Inland Marine Insurance

Inland marine insurance is an extension of warehouse-to-warehouse clause, which provides cover to the shipping goods from the shipping destination to the final destination and also covers the transit time period. Exemption of regulation in the marine insurance industry led to underwriting policies on goods in transit not only by water route but also on land and finally underwriting coverage on fixed-location property.

In 1933, the National Association of Insurance Commissioners (NAIC) made amendments in its Nationwide Marine Insurance Definition and clearly defined the types of insurance that marine insurers were allowed to underwrite. In 1977, it was again revised, which identified six property classes that can be insured under marine contracts:

- Imports

- Exports

- Domestic shipments

- Means of transportation

- Personal property floater risks

- Commercial property floater risks

National Flood Insurance Program

Flood insurance on fixed-location property was available only on an extremely limited basis till 1968. However, in 1968, the Housing and Urban Development Act (HUDA) was enacted, which initiated the National Flood Insurance Program (NFIP) and created a federally subsidised flood insurance program. Under this program, flood insurance became available to both individuals and businesses.

NFIP aims to provide protection against losses from flooding. It is the insurance alternative for meeting the costs of repairing damage to buildings and their contents caused by floods. In other words, this program mitigates the after-effects of the flooding.

The three main components of NFIP are as follows:

- To provide flood insurance

- To provide floodplain management

- To develop the maps of flood hazard zones

There are two types of insurable property under NFIP: building and possessions. Building coverage includes the following:

- The insured building and its foundation

- The electrical and plumbing system

- Central air conditioning equipment, furnaces and water heaters

- Refrigerators, cooking stoves and built-in appliances, such as dishwashers

- Permanently installed carpeting over unfinished flooring

Contents coverage include the following:

- Clothing, furniture and electronic equipment

- Curtains

- Portable and window air conditioners

- Portable microwaves and dishwashers

- Carpeting that is not already included in property coverage

- Clothing washers and dryers

NFIP falls under the jurisdiction of the Federal Insurance and Mitigation Administration in the Federal Emergency Management Agency (FEMA).

Private insurers participating in the cooperative program referred to as the Write-Your-Own Program Flood policies can underwrite the flood insurance policies on behalf of the NFIP other than the NFIP itself. Policies issued by the private insurers are reinsured 100% against loss. Private insurers who actively participate in the Write-Your-Own Program are offered compensation by the NFIP for losses incurred. Private insurance agents who are paid a commission sell coverage written by both the private insurers and the federal government.

According to E. J. Vaughan and T. Vaughan, the National Flood Insurance Program consists of a policy jacket and a form. General Property Form: It is the flood policy used to insure commercial property. Many of the provisions of this form—such as the definition of flood, inception and cancellation, and the debris removal and property removal provisions—are similar to the Residential Flood Policy. Under the General Property Form, Replacement Cost coverage is not available.

General Property Form Flood Insurance Policy

According to E. J. Vaughan and T. Vaughan, the National Flood Insurance Program consists of a policy jacket and a form. General Property Form: It is the flood policy used to insure commercial property. Many of the provisions of this form—such as the definition of flood, inception and cancellation, and the debris removal and property removal provisions—are similar to the Residential Flood Policy. Under the General Property Form, Replacement Cost coverage is not available.

Non-residential Condominiums

According to E. J. Vaughan and T. Vaughan, non-residential condominium buildings and their commonly owned contents may be insured in the name of the association under the General Property Form. A unit owner of a non-residential condominium unit may not purchase flood insurance on his or her unit but may purchase contents coverage under the General Property Form.