Invoices in Import Export

Invoice is a commercial non-negotiable instrument that contains information regarding the transaction between a buyer (importer) and a seller (exporter). Invoice provides information relating to the quantity, price, date, parties involved, unique invoice number, and tax information. It helps in identifying that whether it’s a credit or cash purchase. The invoice contains the terms of the deal, and provides information on the available methods of payment. Invoice is also referred to as bill/ statement/sales invoice.

Table of Content

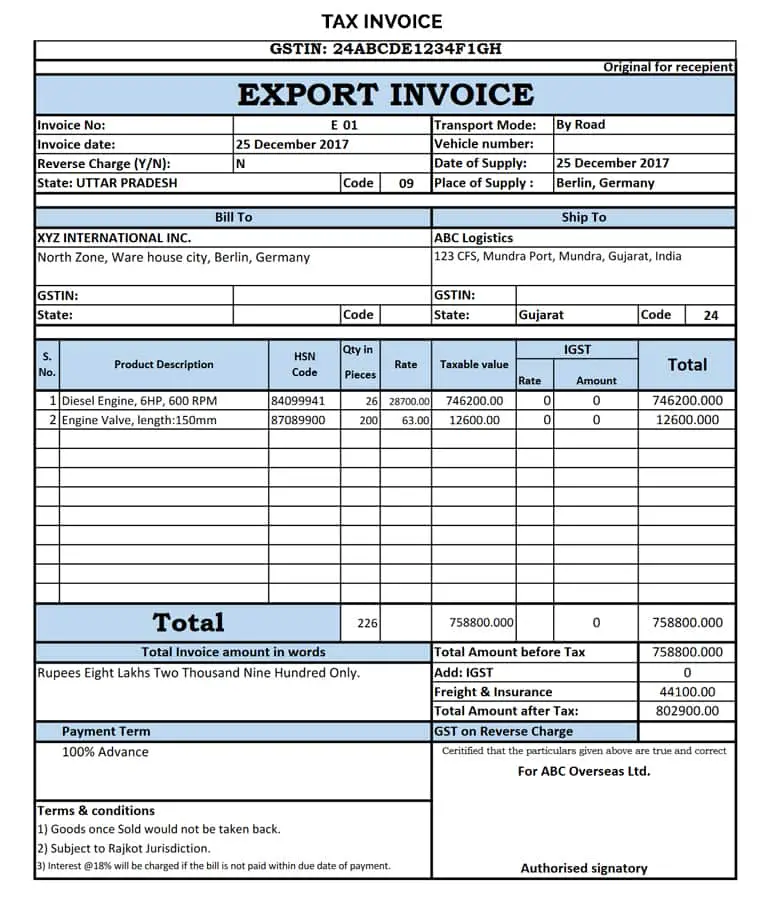

The format of an export invoice is shown in Figure:

Invoices are used for various purposes but they play a crucial role in tracking the sale of a product, managing books for accounting and tax purposes. Now-a-days many companies are relying on e-invoice in which invoices are transmitted through electronic medium rather than using conventional paper based invoice. One of the main advantage of e-invoice is that in case one of the trading party misplaces the invoice then they can request for the copy of the invoice.

In many companies, the products are shipped before getting the payment and in such cases invoice are created. When these companies ship the product without getting the payment at the same time then the total amount due becomes an account payable for the buyer and an account receivable for the seller.

When an invoice is issued for rental industry then it has to include time duration of the bill and price or discount provided on the invoicing amount. Any type of rental invoice is billed on the basis of actual hours, days, weeks, months, or years. For seller the invoice is a sales invoice (export invoice for exporter) whereas for buyer the same invoice is purchase invoice (import invoice for the importer).

An invoice typically consists of the following:

- Name, address, telephone number, fax number, and email address of the seller/exporter

- A unique reference number (for correspondence of the invoice)

- Date of the invoice

- Name and address of the buyer/importer

- Credit terms

- Purchase Order (PO) number (or similar tracking numbers requested by the buyer to be mentioned on the invoice)

- Tax payments if relevant (VAT)

- Date that the goods or service was sent or delivered

- Quantity of the goods or services delivered

- Description of the product(s)

- Unit price(s) of the product(s) (if relevant)

- Total amount charged

- Payment terms (including method of payment, date of payment, and details about charges for late payment)

Pro-forma Invoice

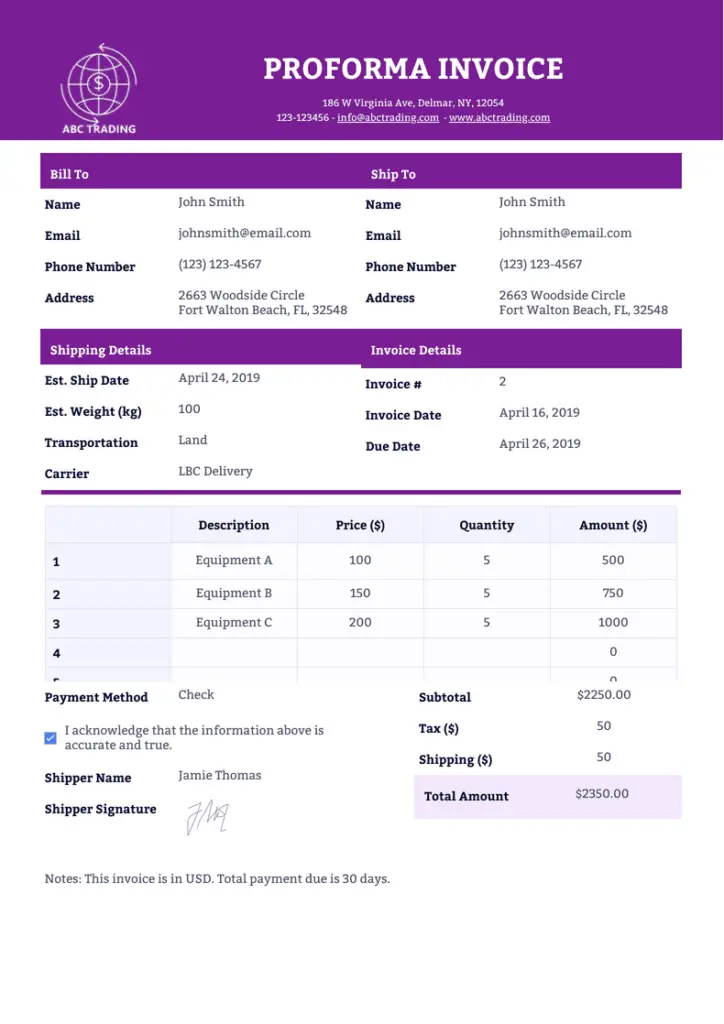

It is the first and initial step before entering the export contract. The exporter has to submit pro-forma invoice at the time of trade inquiry to the importer. It is a detailed document which consists of following information:

- Name and address of the seller or exporter

- Name and address of the buyer or importer

- Types of goods

- Shipping mode

- Rates charged as per the internationally accepted quotation

- Name of the country of origin of goods

- Name of the country of final destination

- Period required for executing the contract after receipt of confirmed order

- Signatures of the exporter

Figure shows the sample of pro-forma invoice:

Importance and significance of pro-forma invoice are two fold:

- Pro-forma invoice is the base of all trade transactions and further negotiation are carried out on the basis of this invoice.

- Importer can obtain licence through pro-forma invoice and later can request for foreign exchange after fulfilling all the requirements of the contract.

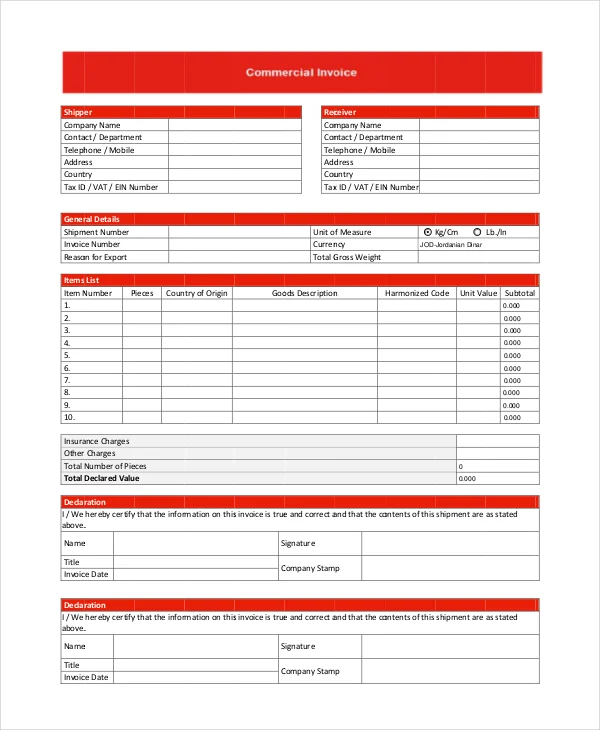

Commercial Invoice

Commercial Invoice refers to seller’s bill and it shows the information of the merchandise or goods sold by him or her. This document consists of following details:

- Name and address of seller (exporter)

- Name and address of buyer (importer)

- Date

- Exporter’s reference number

- Importer’s reference number

- Description of goods

- Price per unit at particular location

- Quantity

- Total value

- Packing specifications

- Terms of sale (FOB, CIF etc.)

- Identification marks of the package

- Total number of packages

- Place and country of destination

- Country of origin of goods

- Reference to letter of credit, if opened

- Terms of payment

- Signature of the exporter

The format of commercial invoice is shown in Figure below:

It is one of the most relevant and significant export document which is also known as ‘Document Of Contents’ as it contains all the important information needed for the preparation of other export documents. In many countries, there are no specifications regarding the invoice forms. In such cases, exporters use normal invoices for any international exports and include all the terms of the contract.

Significance of Commercial Invoice

- It is one of the most important document of sale and purchase of goods. All the other documents needed for the export are designed on the basis of the information contained in this document.

- Commercial invoice provides the basis for various export formalities such as inspection before the delivery, quality, excise and customs procedures.

- This document serves accounting purposes of both the parties that includes exporter and importer.

- Commercial invoice is needed during the time of collection or negotiation of documents through the bank.

- This document is needed for claiming incentives as well.

Consular Invoice

The invoices that are signed by the consular of the importing country who are based in the exporter’s country are known as Consular Invoices. Most of the countries that are involved in import business have the requirement for this invoice. For getting this certificate or invoice duly signed by the authority, the exporter has to pay a fee, which differs from country to country. The consular invoice ensures the authentication of information given in the invoice.

This document improves importer’s credibility in the exporting country and helps the importer in making their way into exporting country. Once the authenticity of the information is provided, it becomes easier for the importer to carry forward the business related activities. The consular invoice plays a crucial role when any issue related to the trading of goods or services arises.

In case the custom authorities doubt the authenticity of the goods arrived or there is any other issue related to consignment then custom officer has the authority to open the packages of the imported goods. However, this might cause delays. In this case, the importer needs to obtain the consular invoice for resolving all these trivial matters quickly. Mostly, three copies of consulate invoice are created. First copy is retained by the consulate office, the second copy is sent to the customs of the importing country, and the third copy is given to the exporter.

Importance to the Exporter

- Once the invoice is signed by the consulate of the importing country, the exporter can be assured that there will be no big hurdles or restrictions and it would be easy to carry forward the export and to get foreign exchange.

- This document also helps in getting clearance from the customs of exporter’s country for shipping the goods.

Importance to the Importer

- Normally custom department of the importer’s country do not open the packages. The invoice also helps importer to get speedy delivery of goods.

- The invoice also helps in eliminating lots of unnecessary hardship that could raise its head for the importer once the packages are opened.

Importance to the Customs

- This invoice helps the custom department of the exporting country to clear the goods in less time.

- This invoice also helps importing country’s customs department as it saves their time of opening the packages for calculating the import duties.

Legalised Invoice

Only a few Latin American countries such as Mexico, and a few in middle east have a requirement of legalised invoice. These invoices need to be both certified, authorised, and legalised by the consulate. In this, the invoices are to presented to the embassy for getting them stamped so that they become legal. Legalised invoices are similar to consular invoice, in this consulate or authorised mission, stationed in the exporter’s country has to give authentication or certification for the invoices.

Custom Invoice

Custom invoice is an extension of commercial invoice where the exporter has to specify the following:

- Description

- Quantity as well as the price

- Freight

- Insurance

- Packing costs

- Delivery terms

- Payment terms

- Weight or volume of the products

Commercial invoice follows the format as specified by the customs authorities of the importing country, and this format is called Customs Invoice. In international trade, certain countries namely U.S.A., Canada, and Australia require custom invoice.