What is Factoring?

Factoring is a financial technique where a specialized firm (factor) purchases from the clients accounts receivables that result from the sales of goods or services to customers. In this way, the customer of the client firm becomes the debtor of the factor and has to fulfil its obligations towards the factor directly.

The factoring agreement usually assumes that the whole credit risks as well as the collection of the accounts are taken by the factor. Factoring offers enterprises, particularly small and medium ones, a means of financing their need for working capital, but also an instrument of collection of receivables and default risk hedging.

Table of Content

In other words, factoring may also be defined as a continuous relationship between financial institution (the factor) and a business concern (the client) selling goods and/or providing service to a trade customer on an open account basis, whereby the factor purchases the client’s book debts (account receivables) with or without recourse to the client.

Characteristics of Factoring

- Factor provides finance for the supplier, including loans and advance payments.

- Usually the period for factoring is 90 to 150 days. Some factoring companies allow even more than 150 days.

- Factoring is considered to be a less costly source of finance compared to other sources of short term borrowings.

- Factoring receivables is an ideal financial solution for new and emerging firms without strong financials. This is because creditworthiness is evaluated based on the financial strength of the customer (debtor). Hence these companies can leverage on the financial strength of their customers.

- Credit rating is not mandatory for factoring. But the factoring companies usually carry out credit risk analysis before entering into the agreement.

- Factoring is a method of off balance sheet financing.

Mechanism of Factoring

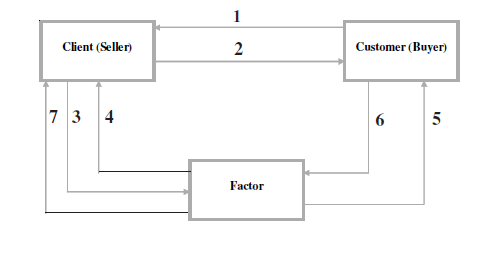

In a factoring arrangement, there are three parties directly involved namely; the one who sells the invoice (client), the debtor (customer of the seller), and the factor (financial organization).

- Seller of the product or service provider who originates the invoice is called Client and generally is a business firm.

- Debtors or customers of the client are the recipient of the invoice for the goods or services rendered. They promise to pay the balance within the agreed payment terms. They owe the money for the value of goods and services bought from the seller.

- Assignee (the factoring company) or factor is the service provider who purchases the invoice and gives advance payment to business firm.

Factor is thus an intermediary between the seller and buyer. Mechanics of Factoring shown in figure is explained below:

Steps in Factoring Service

- Firstly, the customer places an order with the Client

- Client sends goods and invoice to customer

- Client assigns invoice to factor

- Factor make pre-payment up to 80 % to client

- Factor send statement to customer

- Customer make payment to factor

- Factor makes balance 20% on realisation to client.

Advantages of Factoring

Following are some of the advantages of factoring services:

- Substitute for market credit: Factoring has an important role in working capital finance. Factoring substitutes bank borrowings and supplements the market credit or suppliers’ credit. It replaces high-cost bank loans.

- Time Savings: Factoring can save time and effort to the company that would otherwise be spent on collecting from customers. That energy can be redirected to other business-building activities, like sales, marketing and client development.

- No Collateral Required: Unlike traditional bank loans, factoring doesn’t require you to risk your home or other property as collateral.

- Reduction in operating cycle time: With factoring, the average receivables collection period is reduced substantially and as a consequence the total operating cycle time of the client is reduced. This contributes to efficient working capital.

- Liquidity: Factoring helps the company to raise cash, even up to 90% of the invoice value immediately after the sale. This builds the liquidity position of the client.

- Advisory Services: Factoring institutions offer a variety of advisory services to its clients including credit assessment for its overseas buyers.

Disadvantages of Factoring

Factoring provides a pool of benefits to a business by providing immediate cash for your account receivables. However, it also has some drawbacks that need to be considered before deciding on factoring services. Some of these drawbacks are as follows:

- High cost: Factoring provides immediate access to cash, but this will come at a higher price than loans. Factoring companies usually keep between 1% and 4% of a receivable as their fee. In addition to this, they also charge an interest on the cash advance provided.

- Adverse relationship with customers: Factoring companies are usually more aggressive while collecting debts, and this may upset the customer and lead to nil or decreased sales by the customers.

- Potential change in business practices: A Factor may insist on changing business strategies, and interfere in the working of the business and may even recommend cutting off certain customers. This highlights the necessity of ensuring that the businessman chooses to work with such a lender who understands his business and is interested in its growth.

Types of Factoring

There are a number of types of factoring in both theory and practice. Various types of factoring depend on the relation between the main parties in the factoring operation.

It also depends on the specific features in the factoring agreement. The most common feature of practically all the factoring transactions is collection of receivables and administration of sale ledger.

However, following are some of the important types of factoring arrangements

Recourse and Non-recourse Factoring

- In recourse factoring, the factor does not assume the credit risk (risk of non-payment by the debtors). In other words, if the receivables become bad, i.e. if the customer does not pay on maturity, risk of bad receivables remains with the seller, and the factor does not assume any risk associated with the receivables.

The factor provides the service of receivables collection, but does not cover the risk of the buyer failing to pay the debt. The factor can recover the funds from the seller (client) in the case of such default. The seller assumes the risks associated with the credit and the buyer’s creditworthiness.

The factor charges the seller for the management of receivables and debt collection services, while also charging interest on the amount advanced to the client (seller). - On the other hand, in non-recourse factoring, the factor assumes the risk of non-payment by the client’s customers. The factor cannot demand any outstanding amount from the client (seller).

The commission or fees charged for non-recourse factoring services are higher than for recourse factoring. The factor assumes the risk of non-payment on maturity and consequently takes an additional fee called a del credere commission.

Domestic and Export Factoring

- In domestic factoring three parties are involved (the seller, the buyer, and the factor), while in export factoring there are four (the seller, the buyer, the domestic factor, and the factor abroad). In domestic factoring, the factor mediates between the seller and the buyer. All three parties are located in the same country.

- Export factoring is similar to domestic factoring, except there are four parties involved. There are consequently two factors involved in the transaction, and it is referred to as the two-factor system of factoring.

Conventional or Full Factoring

- In full factoring, the factor performs almost all services of collection of receivables, maintenance of sales ledger, credit collection, credit control and credit insurance.

The factor also fixes up a draw limit based on the bills outstanding maturity-wise and takes the corresponding risk of default or credit risk and the factor will have claims on the debtor as also the client creditor.

Full factoring is also known as Old Line Factoring. In India, factoring agencies like SBI Factors are doing full factoring for good companies with recourse.

Financial Accounting

(Click on Topic to Read)

- What is Posting In Accounting?

- What is Trial Balance?

- What is Accounting Errors?

- What is Depreciation In Accounting?

- What is Financial Statements?

- What is Departmental Accounts?

- What is Branch Accounting?

- Accounting for Dependent Branches

- Independent Branch Accounting

- Accounting for Foreign Branches

Corporate Finance

Management Accounting