What is Crossing of Cheque?

The crossing of Cheque means that the specific cheque can only be deposited straightway into a bank account and cannot be instantly cashed by a bank or any credit institution.

This ensures a level of security to the payer since it requires the funds to be handled through a collecting bank.

Crossing of a cheque means “Drawing Two Parallel Lines”

Table of Content

A cheque is either ‘open’ or ‘crossed’.

An open or uncrossed cheque is the one for which the banker has to pay cash across the counter when it is presented by the customer.

- An open cheque is risky because, if the holder of the cheque loses it, any person, who is in possession of it, can take the payment from the bank.

- The payment of such cheques can be stopped by the drawer by writing a letter to the banker regarding loss of cheque.

To make cheques secure and useful, crossing of cheques was adopted.

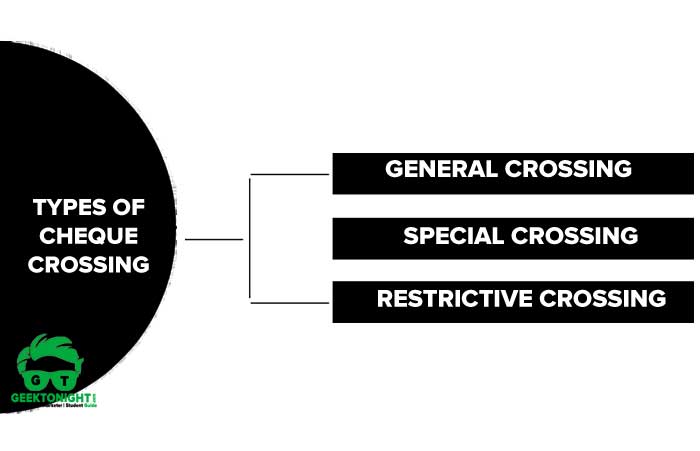

Types of Cheque Crossing

Basically, there are 3 types of cheque crossing:

General crossing

General crossing on a cheque can be made by inserting two parallel lines on the left-hand top corner of a cheque.

Between the two parallel transverse lines the options are to add certain words like – ‘and company’, ‘& company’ or ‘not negotiable’. It is one of the common types of cheque crossing.

Special Crossing

A cheque is deemed to be specially crossed when in the parallel transverse lines in a cheque the name of the banker is written with or without the words “not negotiable“.

In a special crossing, the paying banker will pay the sum only to the banker whose name is stated in the cheque or to his agent.

Restrictive crossing

Restrictive crossing involves the crossing of a cheque through two parallel lines on the left corner of a cheque. The words A/c payee are inserted inside the parallel lines.

According to this crossing, the cheque can be collected by the bank only for the person, whose name is written on the cheque.

It provides higher protection to the drawer of the cheque, in a case; a cheque is misplaced or lost.

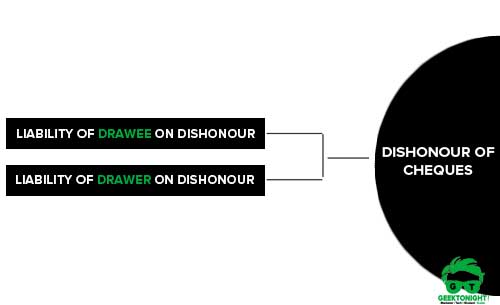

Boucing of Dishonour of Cheques

A cheque is said to be bounced or dishonoured by non-payment when the drawee of cheque makes a default in payment in when cheque is presented to him for payment.

Liability of drawee on dishonour

In case of default by the drawee (i.e. Banker), the drawee shall compensate the drawer for loss caused to him. The liability of a drawee arises by non-payment, if the following three conditions are fulfilled on the dishonour of cheque:

- The drawer has sufficient funds in the account;

- Such funds are properly applicable to payment of the cheque;

- The drawee is duly required to pay the cheque.

Liability of drawer on dishonour

On the dishonour of the cheque, the drawer is punishable with imprisonment up to two years or fine not exceeding twice the amount of cheque or both if the following conditions are satisfied:

- The cheque was issued to discharge a legally enforceable debt.

- The cheque was returned or dishonoured for insufficiency of funds.

- The cheque was presented within six months from which it was drawn or validity period of cheque.

- The payee or the holder in due course has made a demand from the drawer within 30 days of dishonour.

- The drawer of cheque has failed to make a payment within 30 days of demand made.

- A complaint can be made only by the payee or the holder within one month of expiry of 30 days of the receipt of notice by the drawer.

Business Law Notes

(Click on Topic to Read)

FAQ

Business Law is also known as Commercial law or corporate law, is the body of law that applies to the rights, relations, and conduct of persons and businesses engaged in commerce, merchandising, trade, and sales.

Also Read:

1. Business Law Definition

2. Business Law Meaning

3. Business Law of India

The Indian Contract Act is divisible into two parts.

The first part (Section 1-75) deals with the general principles of the law of contract and therefore applies to all contracts irrespective of their nature.

The second part (Sections 124-238) deals with certain special kinds of contracts, namely contracts of Indemnity and Guarantee, Bailment, Pledge, and Agency.

Also Read:

1. Essential Elements of a Valid Contract

It is the duty of the seller to deliver the goods and of the buyer to accept and pay for them, in accordance with the terms of the contract of sale.

– Sec. 31, The Sale of Goods Act, 1930

Also Read:

1. Delivery of Goods

2. Types of Delivery

3. Rules for delivery of goods

Sales of Goods Act 1930 came into force on 1st July 1930. It extends to the whole of India. It does not affect rights, interests, obligations and titles acquired before the commencement of the Act. The Act deals with the sale but not with mortgage or pledge of the goods.

Read Complete:

1. Essentials of Valid Sales

2. How the Contract of Sale Comes About

3. Difference Between Sale And Agreement To Sell

The Sale of Goods Act, identifies the terms, “Conditions and Warranties” as being of a prime significance in a contract of sale.

Read Complete:

Implied Conditions

Implied Warranties

Negotiable Instruments Act 1881 ✅

Negotiation of an instrument is the process by which the ownership of an instrument is transferred from one person to another.

Read Complete:

1. Methods of the negotiation of instrument

2. Definition of Negotiable Instrument

3. Meaning of Negotiable Instrument

4. Characteristics of a Negotiable Instrument

5. Presumptions as to Negotiable Instruments

6. Classification of Negotiable Instruments

7. Types of Negotiable Instruments

Also Read:

Types of Endorsement

1. Blank or general endorsement

2. Special or full endorsement

3. Partial endorsement

4. Restrictive endorsement

Promissory Note, on the other hand, is a promise to pay a certain amount of money within a stipulated period of time. And the promissory note is issued by the debtor.

Read Complete:

1. Characteristics of a Promissory Note

2. Bill of Exchange Parties

Bill of exchange is an instrument ordering the debtor to pay a certain amount within a stipulated period of time. Bill of exchange needs to be accepted in order to call it valid or applicable. And the bill of exchange is issued by the creditor.

Read Complete:

1. Example of Bill of Exchange

2. Features of Bill of Exchange

3. Bill of Exchange Parties

A cheque is a bill of exchange, drawn on a specified banker and it includes ‘the electronic image of truncated cheque’ and ‘a cheque in electronic form’.

Read Complete:

1. Characteristics of a Cheque

2. Parties of Cheque

3. Truncated Cheque

4. Cheque in electronic form

5. Presentment of truncated cheque

Business Law Book References

- Goel, P. K. (2006). “Business Law for Managers” Wiley

- Sheth, T. (2017). “Business Law” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “Business Legislation for Management” (2ed.) Vikas Publishing.

Go On, Share article with Friends

Did we miss something in Business Law Note? Come on! Tell us what you think about our article on Types of Cheque Crossing | Business Law in the comments section.

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

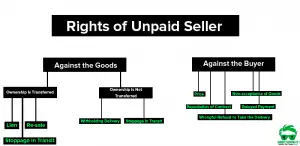

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Business Law Notes

(Click on Topic to Read)

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India